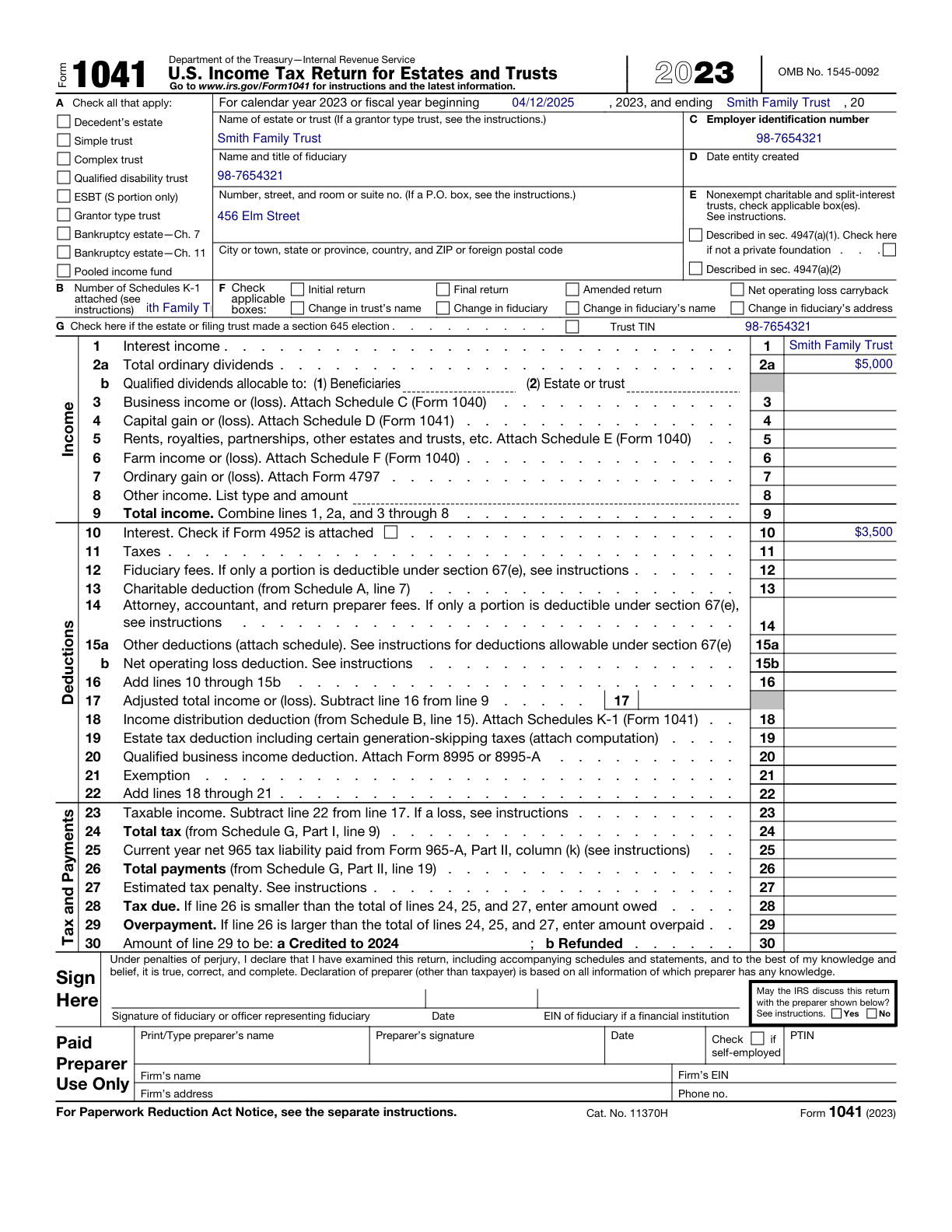

Form 1041, U.S. Income Tax Return for Estates and Trusts Completed Form Examples and Samples

Explore a detailed example of a completed Form 1041 for a Family Trust. This page provides insights on filling out this U.S. Income Tax Return for Estates and Trusts, including trustee information, income breakdown, deductions, and beneficiary details, optimized for learning and filing accuracy.

Form 1041 Example – Family Trust

How this form was filled:

This example is for a Family Trust established by the Smith family. It includes detailed information on income distribution, deductions, and beneficiaries.

Information used to fill out the document:

- Trust Name: Smith Family Trust

- Trustee Name: Jane Smith

- Trust EIN: 98-7654321

- Tax Year: 2025

- Address: 456 Elm Street, Somewhere, USA

- Dividends Income: $5,000

- Rental Income: $10,000

- Total Deductions: $3,500

- Beneficiary Name: John Smith

- Beneficiary SSN: 123-45-6789

- Signature: Jane Smith

- Date: 04/12/2025

What this filled form sample shows:

- Accurate completion of trustee information and trust EIN

- Detailed breakdown of income including dividends and rental property

- Calculation of total deductions

- Presentation of beneficiary details with SSN

- Properly formatted signature and date

Form specifications and details:

| Use Case: | Family Trust with multiple income sources |