Form 8949, Sales and Other Dispositions of Capital Assets Completed Form Examples and Samples

Explore a detailed example of a filled Form 8949, showcasing the reporting of cryptocurrency transactions. This guide provides step-by-step instructions for accurately completing Form 8949 with real-world data on Bitcoin and Ethereum transactions. Essential for anyone looking to correctly manage crypto taxes, this example covers key elements such as transaction dates, proceeds, cost basis, and gain or loss calculations.

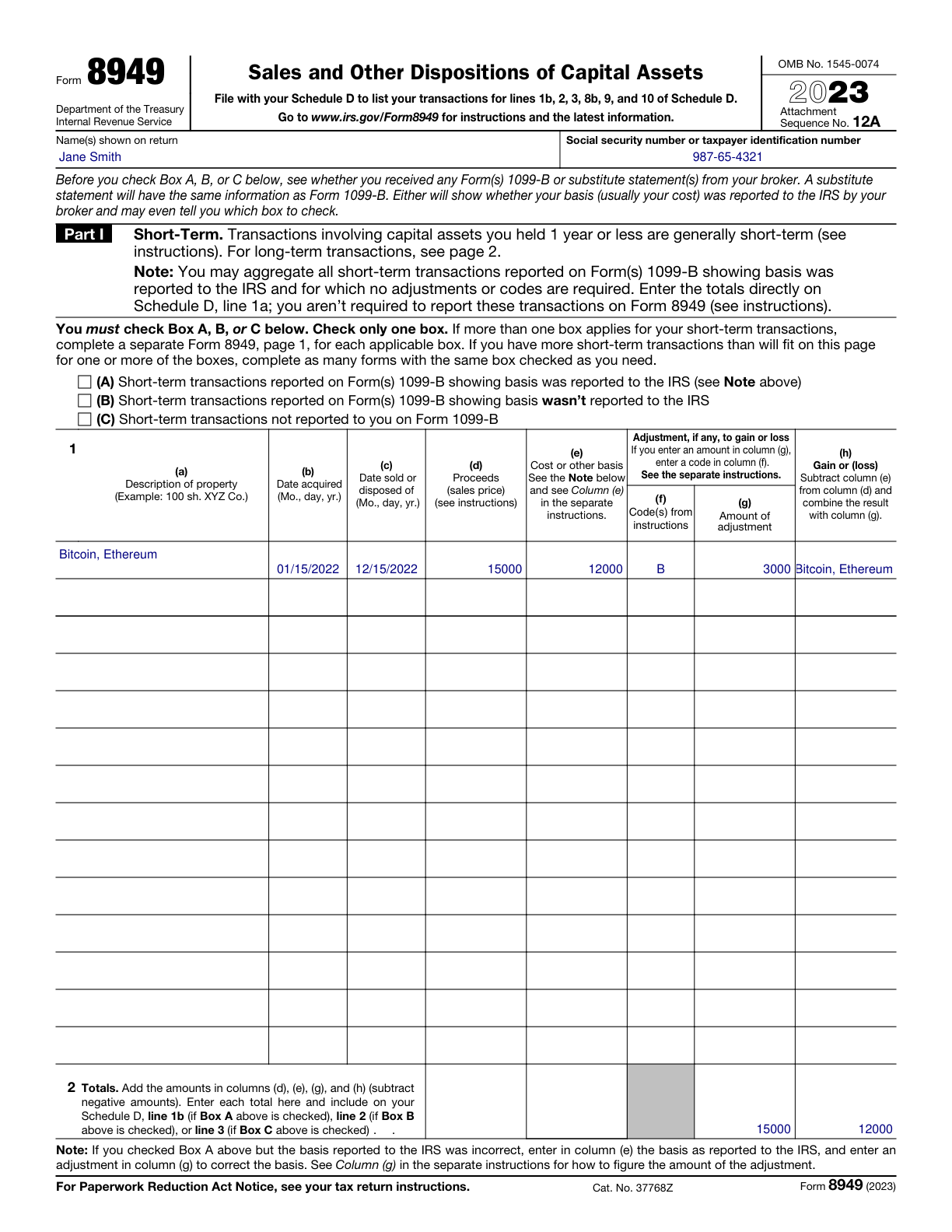

Form 8949 Example – Reporting Cryptocurrency Transactions

How this form was filled:

This example demonstrates how to fill out Form 8949 to report cryptocurrency transactions, using specific transaction data, cost basis, and adjusted gain or loss values.

Information used to fill out the document:

- Taxpayer's Name: Jane Smith

- ID Number: 987-65-4321

- Description of Property: Bitcoin, Ethereum

- Date Acquired: 01/15/2022

- Date Sold: 12/15/2022

- Proceeds: 15000

- Cost Basis: 12000

- Adjustment Code: B

- Gain or Loss: 3000

- Signature: Jane Smith

- Date: 04/15/2023

What this filled form sample shows:

- Detailed reporting of cryptocurrency sales using acquisition and selling dates

- Accurate calculation of proceeds, cost basis, and adjusted gain or loss

- Use of adjustment codes to specify necessary corrections

- Properly formatted signature and date on the form

Form specifications and details:

| Use Case: | Reporting cryptocurrency transactions |

| Asset Type: | Cryptocurrency |

| Tax Year: | 2022 |