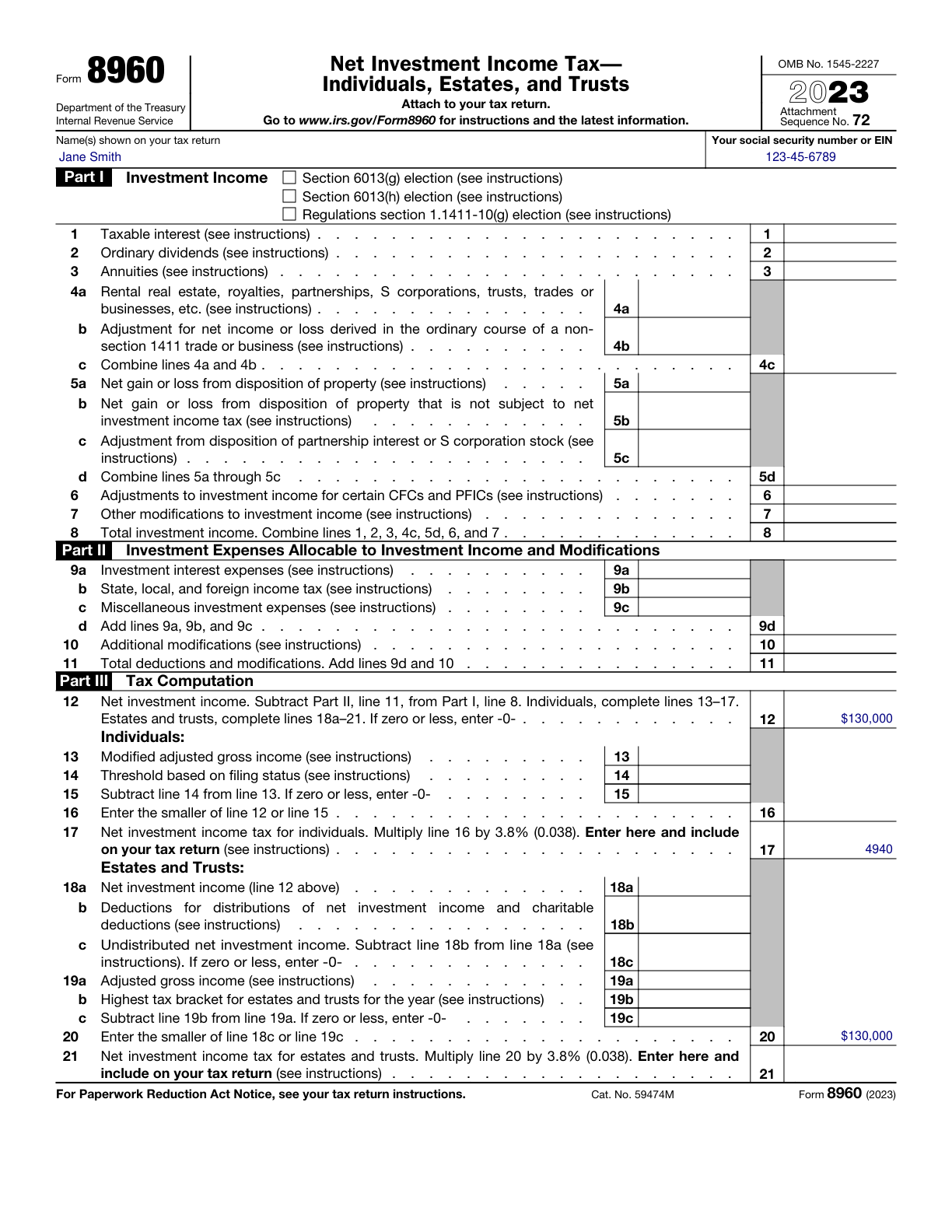

Form 8960, Net Investment Income Tax Completed Form Examples and Samples

Explore a practical example of a filled Form 8960 for an individual with net investment income. This sample demonstrates accurate reporting of investment income, deductions, and net investment income tax calculations for the tax year 2025. Ideal for taxpayers seeking guidance on completing Form 8960.

Form 8960 Example – Individual with Investment Income

How this form was filled:

This example demonstrates Form 8960 filled out by an individual reporting net investment income. The form captures vital information such as total investment income, deductions, and net investment income tax due. All monetary values are accurately reported for the tax year 2025.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Social Security Number: 123-45-6789

- Total Investment Income: $150,000

- Deductions: $20,000

- Net Investment Income: $130,000

- Tax Rate: 3.8%

- Tax Year: 2025

- Date: 03/15/2025

What this filled form sample shows:

- Accurate reporting of total investment income including interest, dividends, and capital gains

- Proper calculation of deductions related to investment income

- Correct application of the net investment income tax rate of 3.8%

- Clear demonstration of filling out social security number and taxpayer details

Form specifications and details:

| Use Case: | Individual with Net Investment Income |

| Form Type: | Form 8960 - Net Investment Income Tax |

| Year: | 2025 |