Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations Completed Form Examples and Samples

Explore our Form 7203 example for S Corporation Shareholder Stock and Debt Basis Limitations. This sample showcases how to accurately fill the form to report stock and debt basis as an S Corporation shareholder, ensuring compliance with IRS requirements.

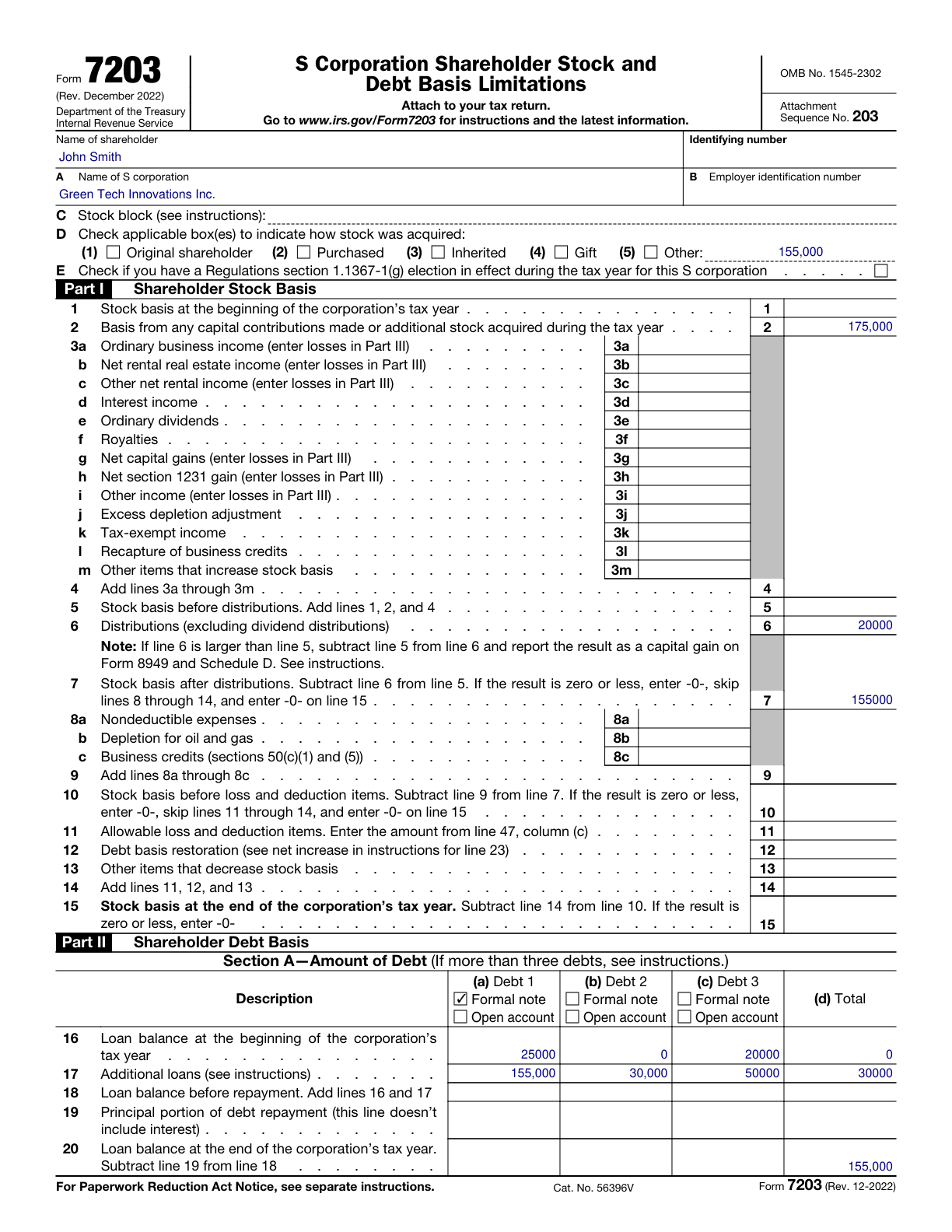

Form 7203 Example – S Corporation Shareholder Stock and Debt Basis Limitations

How this form was filled:

This example demonstrates how a shareholder in an S Corporation should fill out Form 7203 to report stock and debt basis limitations. John Smith, a shareholder in Green Tech Innovations Inc., provides accurate information regarding his stock and debt basis, ensuring compliance with IRS requirements.

Information used to fill out the document:

- Shareholder Name: John Smith

- Corporation Name: Green Tech Innovations Inc.

- Tax Year: 2025

- Stock Acquired: 150,000

- Loan Provided: 50,000

- Additional Contributions: 25,000

- Distributions: 20,000

- Year-End Stock Basis: 155,000

- Year-End Loan Basis: 30,000

- Signature: John Smith

- Date: 02/20/2025

What this filled form sample shows:

- Complete shareholder name and corporation details

- Accurate stock and loan basis calculations

- Detailed purchases, contributions, and distributions

- Properly signed and dated for IRS compliance

Form specifications and details:

| Use Case: | S Corporation Shareholder Basis Calculation |

| Tax Year: | 2025 |

| Includes: | Stock and Loan Basis |