Form 8801, Credit for Prior Year Minimum Tax Completed Form Examples and Samples

Discover a detailed example of Form 8801, demonstrating how to fill out the Credit for Prior Year Minimum Tax correctly. This example showcases a completed form for an individual, providing insights into sections like income, tax calculations, and credits.

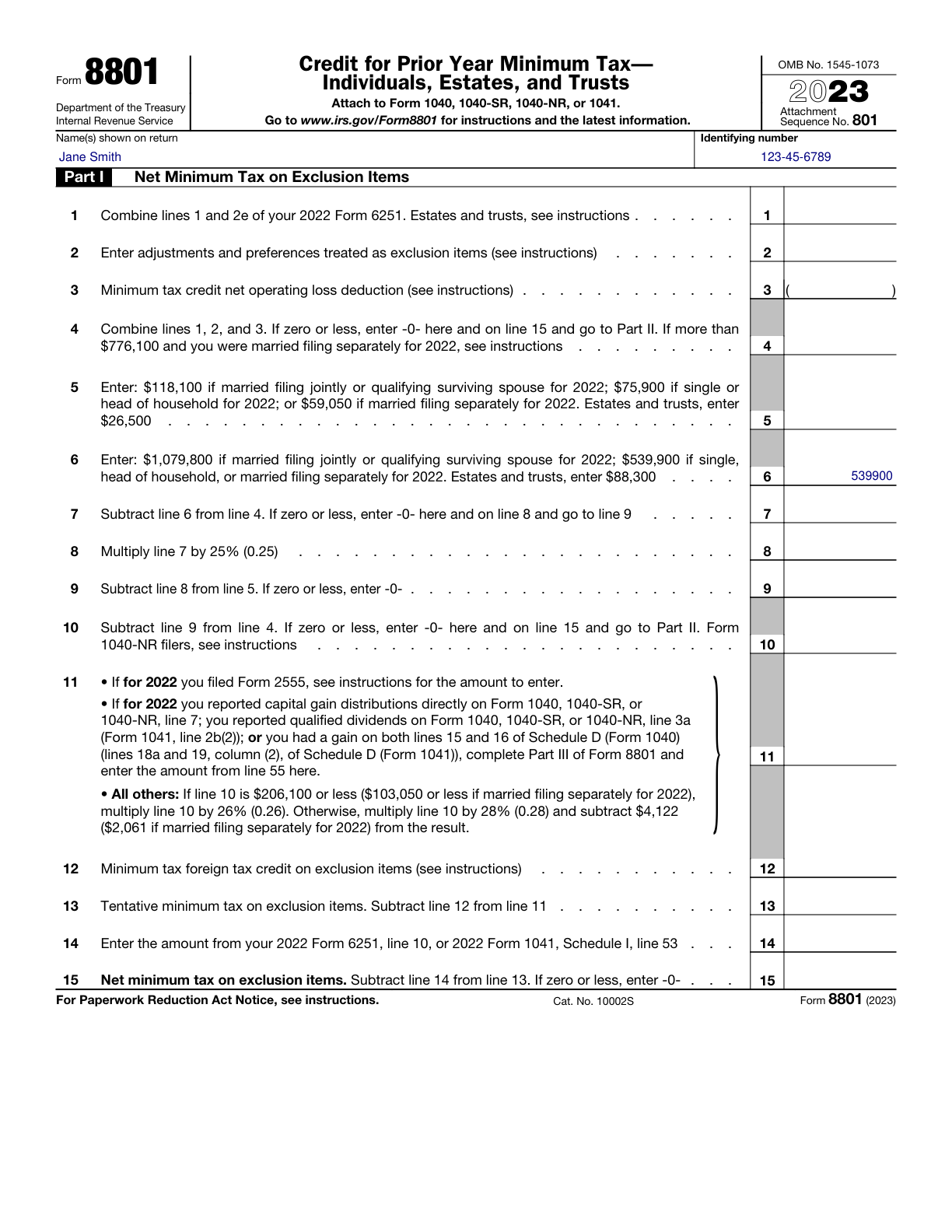

Form 8801 Example – Credit for Prior Year Minimum Tax

How this form was filled:

This example details the completion of Form 8801 for an individual who is calculating credit for prior year minimum tax. It includes sections for figuring out current year's minimum tax credit and allowable credit with necessary taxpayer details.

Information used to fill out the document:

- Taxpayer's Name: Jane Smith

- Taxpayer Identification Number: 123-45-6789

- Filing Status: Single

- Prior Year Minimum Tax: 1500

- Current Year Taxable Income: 50000

- Regular Tax Liability: 7500

- Computed Minimum Tax: 2000

- Credit Allowed: 1000

- Address: 456 Elm Street, Anytown, USA

- Date: 03/01/2025

What this filled form sample shows:

- Accurate taxpayer information including name, TIN, and address

- Detailed calculations for prior year minimum tax and current year liability

- Completed sections for credit calculations and allowable credit

- Clear entry of filing status and other financial figures

Form specifications and details:

| Use Case: | Individual claiming credit for prior year minimum tax |

| Form Year: | 2024 |

| Filing Year: | 2025 |

| Submission: | Filed with 2025 Federal Tax Return |