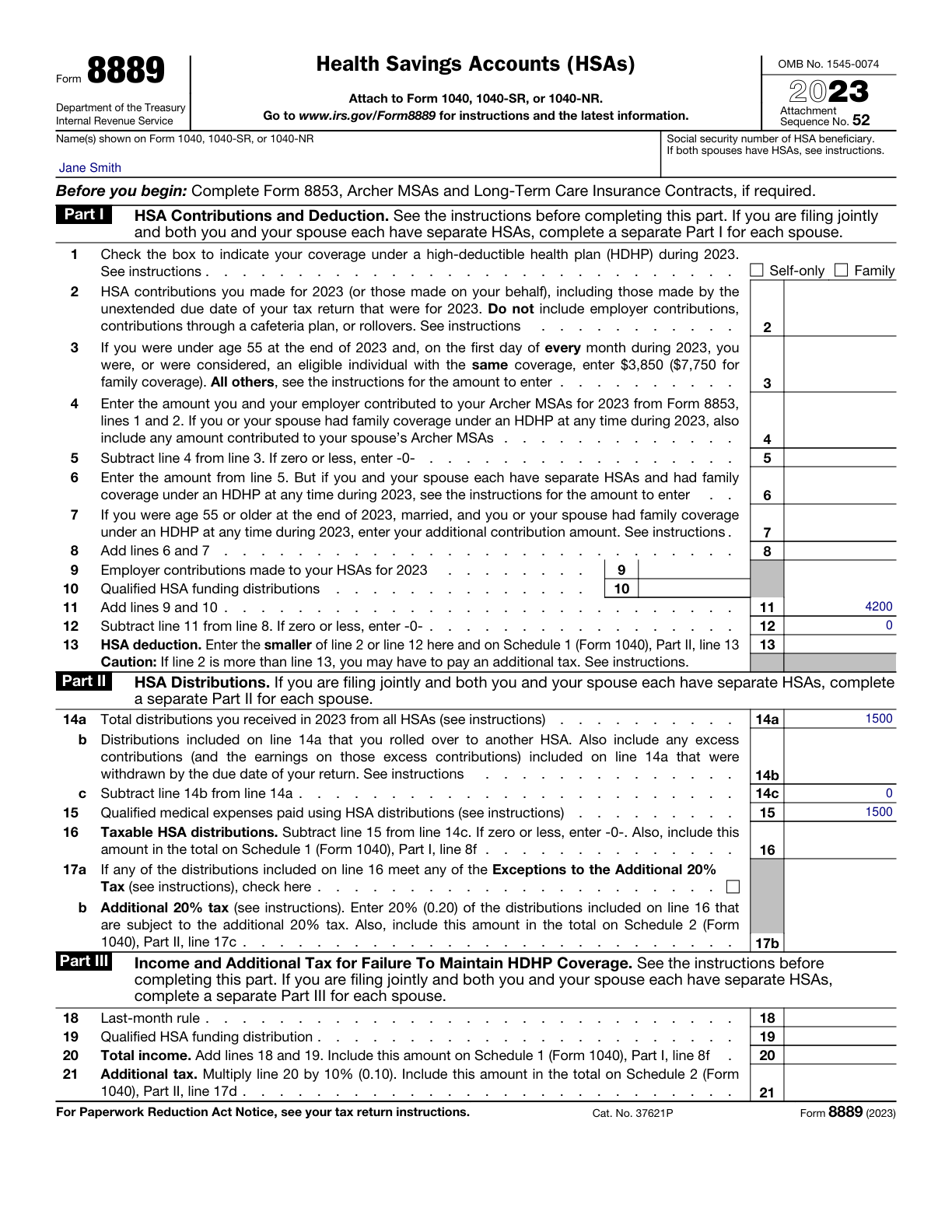

Form 8889, Health Savings Accounts Completed Form Examples and Samples

Explore a detailed example of Form 8889 illustrating family health savings account (HSA) contributions and withdrawals. Learn how to complete the form accurately with information on contributions by both the account holder and the employer, distribution amounts, and year-end balances.

Form 8889 Example – Family HSA Contribution and Withdrawal

How this form was filled:

This example demonstrates how a family with an HSA completes Form 8889, detailing contributions, withdrawals, and applicable tax sections. It includes contributions made both by the account holder and the employer, along with year-end HSA balance and distributions used for qualified medical expenses.

Information used to fill out the document:

- Account Holder's Name: Jane Smith

- Year: 2023

- Type of Coverage: Family

- Total Contributions: $7,200

- Employer Contributions: $3,000

- Distribution Amount: $1,500

- Amount Used for Qualified Medical Expenses: $1,500

- Year-End HSA Balance: $6,700

- Taxable Income from Distributions: $0

- Signature: Jane Smith

- Date: 04/15/2024

What this filled form sample shows:

- Demonstrates correct family coverage selection and contribution limits.

- Details both account holder and employer contributions.

- Accurately records qualified withdrawals and year-end balance.

- Features a taxable income evaluation from distributions.

Form specifications and details:

| Use Case: | Family HSA with contributions and qualified medical expense withdrawals |

| IRS Form: | Form 8889 |

| Relevant Tax Year: | 2023 |