Yes! You can use AI to fill out Form 8889, Health Savings Accounts

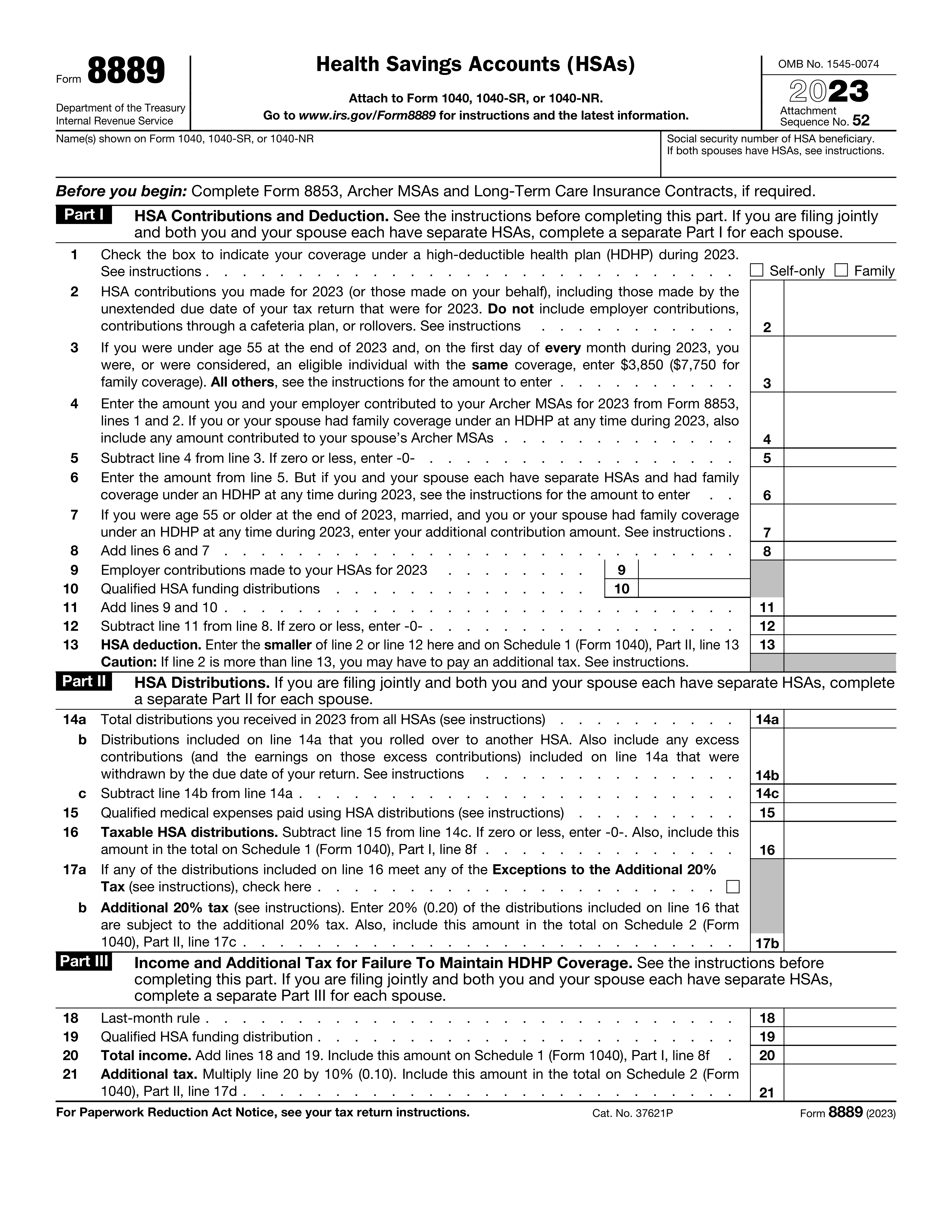

Form 8889, Health Savings Accounts, is used to report contributions to and distributions from Health Savings Accounts (HSAs). This form is important for taxpayers to accurately report their HSA activity to the IRS, ensuring they receive the correct tax benefits associated with HSAs.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8889 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8889, Health Savings Accounts |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 27 |

| Number of pages: | 1 |

| Version: | 2023 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-8889 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i8889.pdf |

| Filled form examples: | Form Form 8889 Examples |

| Language: | English |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out Form 8889 Online for Free in 2026

Are you looking to fill out a FORM 8889 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8889 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8889 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8889.

- 2 Enter your name and social security number.

- 3 Fill in HSA contributions and deductions.

- 4 Complete HSA distributions section.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8889 Form?

Speed

Complete your Form 8889 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8889 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8889

A Health Savings Account (HSA) is a tax-exempt savings account that allows individuals with high-deductible health plans (HDHPs) to save money for out-of-pocket healthcare expenses. To be eligible, you must be covered under an HDHP and not have other disqualifying health coverage. HSAs can be used by individuals or families.

The maximum contribution limit for an individual with self-only coverage is $3,850, while the limit for families is $7,750. If you were under age 55 at the end of 2023, these limits apply. If you were age 55 or older, there is an additional catch-up contribution limit of $1,000.

Distributions from an HSA can be used to pay for qualified medical expenses, including deductibles, copayments, and coinsurance. They can also be used to pay for certain long-term care expenses. Distributions for non-qualified expenses are subject to income tax and an additional 20% tax.

Contributions to an HSA for the current tax year can be made up until the extended due date of your tax return. For most taxpayers, this deadline is October 15 of the following year.

Excess contributions to an HSA are subject to a 6% excise tax per month (up to a maximum of 60% of the excess contribution) until the excess amount is removed from the account. The account holder must also include the excess contribution and the related earnings in their taxable income.

The last-month rule allows individuals to maintain HDHP (High Deductible Health Plan) coverage and HSA (Health Savings Account) eligibility for the entire month, even if they enroll in or change their coverage during the last month of the year. This rule applies to both open enrollment periods and special enrollment periods.

If you fail to maintain HDHP coverage for any month during the tax year, you may be subject to a monthly penalty of $35 per month ($420 per year) for each month that you are not eligible. This penalty applies to the total amount of contributions made to your HSA for that year, including employer contributions.

There are several exceptions to the additional 20% tax on HSA distributions. These include distributions made after age 65, distributions for certain disability expenses, and distributions for certain medical expenses that are not covered by insurance. Consult the IRS instructions for a complete list of exceptions.

Yes, HSA funds can be rolled over from one HSA to another HSA, as long as the rollover is completed within 60 days of the distribution from the original account. This can be done to avoid the 20% additional tax on distributions for non-qualified expenses.

No, HSA funds cannot be used to pay for health insurance premiums, except in certain circumstances, such as for COBRA continuation coverage, long-term care insurance premiums, and certain types of health insurance for disabled individuals. Consult the IRS instructions for a complete list of exceptions.

Compliance Form 8889

Validation Checks by Instafill.ai

1

Ensures that all personal information provided matches the individual's tax records and identification documents.

The AI ensures that the personal information filled out on the Health Savings Accounts (HSAs) form aligns with the individual's official tax records and identification documents. This includes verifying the accuracy of the name, Social Security Number (SSN), and address. The AI cross-references this data with government databases to prevent discrepancies that could lead to processing delays or rejections. It also checks for any typographical errors that might have been made during the form completion process.

2

Confirms that HSA contribution details are accurately reported and do not exceed the annual contribution limits set by the IRS.

The AI confirms that the contribution details entered for the HSA are accurate and within the legal limits established by the Internal Revenue Service (IRS). It checks the reported amounts against the current year's contribution limits for both individual and family coverage. The AI also takes into account catch-up contributions for individuals aged 55 and older, ensuring that the total contributions do not surpass the maximum allowed. This validation is crucial to avoid excess contributions that could result in penalties.

3

Verifies that HSA distribution information is complete and correctly identifies the type of expenses covered.

The AI verifies that the distribution information provided for the HSA is complete and that it correctly specifies the types of medical expenses covered. It checks that the distributions are for qualified medical expenses as defined by the IRS and that all necessary details, such as dates and amounts, are accurately reported. The AI also ensures that the form includes proper documentation or references for the expenses, which is essential for tax purposes and for maintaining the tax-advantaged status of the HSA.

4

Checks eligibility criteria to ensure the individual is qualified to contribute to an HSA, including having a High Deductible Health Plan (HDHP).

The AI checks the eligibility criteria to ensure that the individual is qualified to make contributions to an HSA. This includes verifying that the individual is covered under a High Deductible Health Plan (HDHP) as required by the IRS. The AI examines insurance coverage details to confirm that the plan meets the minimum deductible and out-of-pocket expense thresholds for HDHPs. Additionally, it ensures that the individual has no other health coverage that disqualifies them from contributing to an HSA, such as being enrolled in Medicare.

5

Calculates the maximum contribution limit based on age, coverage type (individual or family), and the number of months eligible.

The AI calculates the maximum HSA contribution limit for the individual based on several factors, including age, coverage type (individual or family), and the number of months the individual was eligible for an HSA during the tax year. It prorates the contribution limit for individuals who were not eligible for the entire year and applies additional catch-up contributions for those aged 55 and older. This calculation ensures that the individual does not exceed the legal contribution limits, which could result in tax penalties.

6

Assesses whether employer contributions to the HSA are properly reported

The AI ensures that all employer contributions to the Health Savings Account (HSA) are accurately reported on the individual's tax forms. It verifies that these contributions are included in the individual's income if necessary, according to the Internal Revenue Service (IRS) guidelines. The AI cross-references the reported amounts with the employer's records to maintain accuracy. It also checks for adherence to the contribution limits set for the tax year in question.

7

Determines if any additional taxes are applicable

The AI determines if there are any additional taxes due on excess contributions to the HSA or on distributions that were not used for qualified medical expenses. It calculates the excise tax that may apply to these excess contributions and non-qualified distributions. The AI also reviews the individual's withdrawal history to ensure that the funds were spent on eligible healthcare costs. If discrepancies are found, the AI flags these for further review and correction.

8

Identifies if the individual has maintained HDHP coverage

The AI identifies whether the individual has maintained High Deductible Health Plan (HDHP) coverage throughout the year, which is a prerequisite for HSA eligibility. It calculates any additional tax liability for months where HDHP coverage was not in place. The AI also checks for any changes in the individual's insurance coverage that could affect HSA eligibility and ensures compliance with the 'last-month rule' and testing period requirements.

9

Evaluates the necessity to file an amended return

The AI evaluates the necessity for the individual to file an amended tax return in the event that excess contributions to the HSA are withdrawn after the original tax return was filed. It ensures that the amended return reflects the corrected contribution amounts and any associated tax implications. The AI also provides guidance on the process for filing an amended return and assists in recalculating the individual's tax liability if necessary.

10

Confirms that Form 8889 is filed

The AI confirms that Form 8889 is filed with the individual's tax return if they have received distributions from their HSA, regardless of the individual's taxable income. It ensures that all necessary information is accurately reported on Form 8889, including contributions, distributions, and the type of HDHP coverage. The AI also checks that the form is properly attached to the individual's tax return and that it complies with the IRS filing requirements.

11

Checks for the accurate calculation of the deduction for HSA contributions on Part I of Form 8889.

The AI ensures that the calculations for HSA contributions on Part I of Form 8889 are accurate and comply with the current tax laws and limits. It cross-references the individual's contribution amounts with the annual contribution limits set by the IRS. The AI also checks for any catch-up contributions for individuals aged 55 and older, ensuring they are calculated correctly. Additionally, it verifies that the contributions reported do not exceed the prorated limits in cases where the HSA was not maintained for the entire year.

12

Verifies the correct reporting of distributions on Part II of Form 8889 and whether they are used for qualified medical expenses.

The AI verifies that distributions reported on Part II of Form 8889 are accurate and used for qualified medical expenses as defined by the IRS. It checks the individual's records and receipts to confirm that the expenses match the distributions reported. The AI also ensures that the form reflects if distributions were used for non-qualified expenses, which may be subject to taxes and penalties. Furthermore, it validates that the distribution amounts do not exceed the individual's actual medical expenses.

13

Ensures that the form includes any required supporting documentation or explanations for distributions or contributions.

The AI ensures that all necessary supporting documentation and explanations for HSA contributions and distributions are included with Form 8889. It checks for receipts, statements, and other relevant documents that substantiate the amounts entered on the form. The AI also prompts the individual to provide any additional explanations required for specific situations, such as excess contributions or distributions. Moreover, it verifies that the documentation is complete and satisfies IRS requirements for record-keeping.

14

Validates that the form is signed and dated, indicating that the information provided is accurate to the best of the individual's knowledge.

The AI validates that Form 8889 is properly signed and dated by the individual, confirming the accuracy and completeness of the information provided. It ensures that the signature field is not left blank and that the date is current and corresponds with the tax year for which the form is being filed. The AI also checks for the presence of an electronic signature if the form is being filed electronically. Additionally, it reminds the individual that by signing the form, they are attesting to the truthfulness of the information under penalty of perjury.

15

Confirms compliance with IRS Publication 969 regarding HSAs and cross-references the form's instructions for specific line items.

The AI confirms that the entries on Form 8889 comply with the guidelines set forth in IRS Publication 969 regarding Health Savings Accounts. It cross-references each line item on the form with the corresponding instructions to ensure accuracy and completeness. The AI also checks for any updates or changes to the tax code that may affect HSA contributions or distributions. Furthermore, it assists in identifying any discrepancies between the form and the publication's requirements, prompting corrective actions when necessary.

Common Mistakes in Completing Form 8889

One crucial aspect of completing the Health Savings Accounts (HSAs) form involves accurately reporting employer contributions in Part I. Failure to do so may result in underreported or incorrect total contributions, which could lead to penalties or discrepancies. To avoid this mistake, ensure that all employer contributions are documented and reported in the designated fields. It is essential to maintain clear communication with your employer's HR department or payroll provider to obtain the necessary information. Keeping detailed records of contributions throughout the year can help prevent errors and ensure compliance with IRS regulations.

Another common mistake when filling out the HSAs form is exceeding the contribution limit in Part I. The IRS sets annual contribution limits for HSAs, and exceeding these limits may result in penalties. To prevent this mistake, familiarize yourself with the current contribution limits and ensure that your contributions do not exceed these amounts. Keep track of your contributions throughout the year to avoid inadvertently exceeding the limit. If you are unsure about the contribution limit or have questions regarding your eligibility, consult with a tax professional or the IRS website for the most up-to-date information.

Reporting all distributions from your HSA is essential to ensure accurate record-keeping and compliance with IRS regulations. Neglecting to report distributions in Part II of the HSAs form can lead to underreported income and potential penalties. To avoid this mistake, keep detailed records of all distributions and report them in the appropriate fields on the form. If you are unsure about the taxability of a distribution or have questions regarding reporting requirements, consult with a tax professional or the IRS website for guidance.

Reporting incorrect distribution amounts in Part II of the HSAs form can lead to discrepancies and potential penalties. Incorrect reporting may result from misunderstanding the taxability of distributions or failing to account for all distributions made during the year. To prevent this mistake, ensure that you have accurate records of all distributions and report them in the correct fields on the form. If you are unsure about the taxability of a distribution or have questions regarding reporting requirements, consult with a tax professional or the IRS website for guidance.

If you exceed the contribution limit for your HSA, you may be subject to an excess contribution penalty. Failing to calculate and report this penalty in Part III of the HSAs form can result in underreported income and potential penalties. To avoid this mistake, calculate the excess contribution penalty using the IRS formula and report it in the designated fields on the form. If you are unsure about the calculation or have questions regarding the penalty, consult with a tax professional or the IRS website for guidance.

One of the most critical requirements for contributing to and benefiting from an HSA is maintaining qualifying high-deductible health plan (HDHP) coverage. Failing to maintain this coverage can result in disqualification of HSA contributions and potential tax penalties. To avoid this mistake, ensure that you or your dependents are covered under an HDHP for the entire year and report any changes in coverage status in Part III of Form 8889. It is essential to understand that even a brief lapse in HDHP coverage can negate the tax advantages of your HSA contributions.

Form 8889, which is used to report contributions to an HSA, requires supporting documentation, such as evidence of qualifying HDHP coverage and proof of contributions. Failing to provide this documentation can lead to IRS scrutiny and potential penalties. To prevent this mistake, keep detailed records of your HDHP coverage and HSA contributions throughout the year. Make sure to attach all required documentation to your Form 8889 when filing your tax return.

HSAs come with specific rules and eligibility requirements that can be complex and confusing for some taxpayers. For instance, contributions to an HSA can only be made by the account holder or their employer, and there are annual contribution limits. Additionally, HSA funds can only be used for qualified medical expenses. Failing to understand these rules can result in incorrect contributions, missed deductions, or even penalties. To avoid this mistake, familiarize yourself with the HSA rules and eligibility requirements before contributing to or using your HSA. Consult the IRS website, your tax advisor, or your HSA administrator for guidance if needed.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8889 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8889 forms, ensuring each field is accurate.