W-9, Request for Taxpayer Identification Number and Certification Completed Form Examples and Samples

See completed W-9 form examples and samples for single-member LLCs and C Corporations. Learn how to fill out each section correctly with downloadable PDF examples.

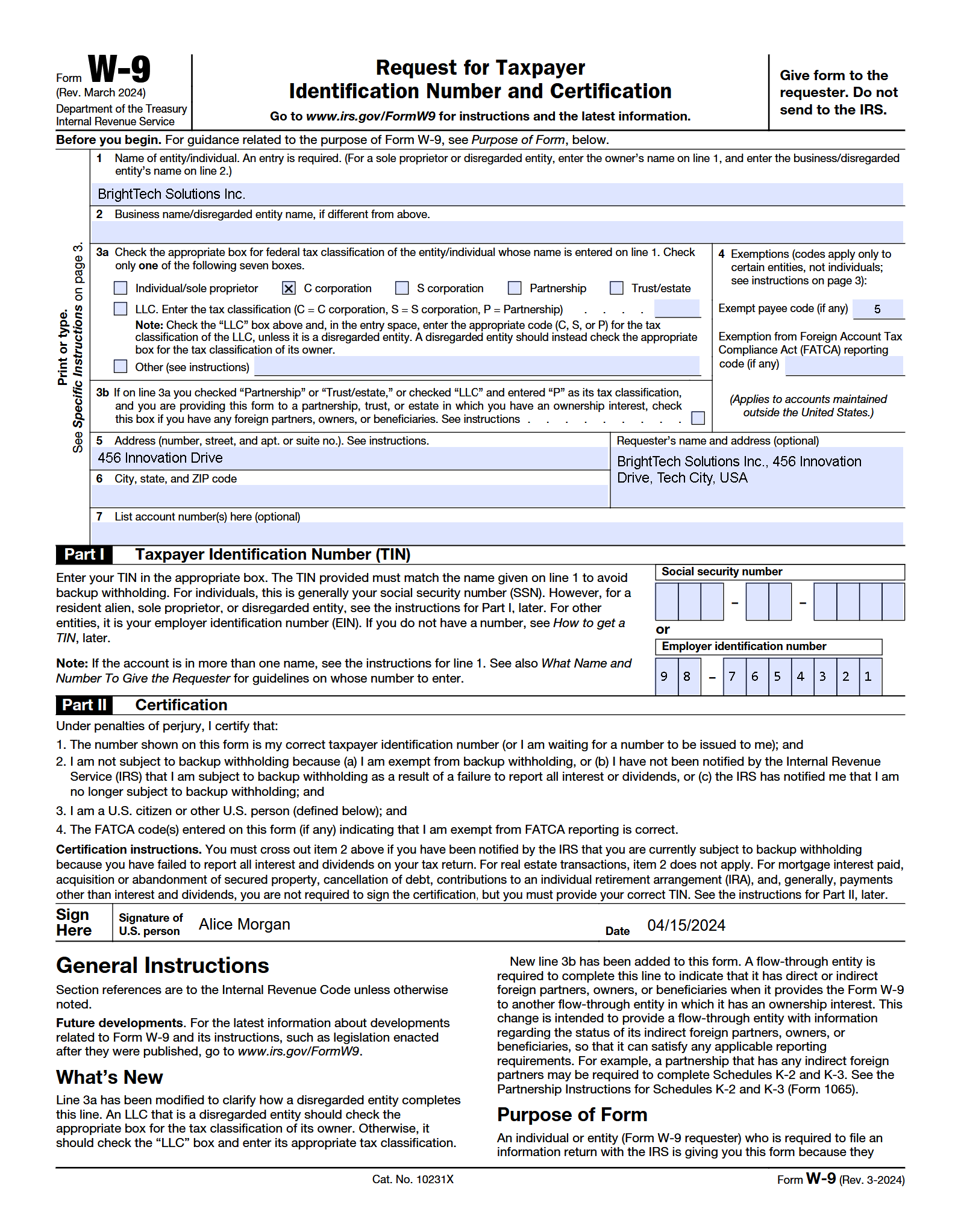

W-9 Example – Single-Member LLC (2024)

How this form was filled:

The owner's name appears on the first line, with the LLC’s business name on the second line. The tax classification selected is "Individual/sole proprietor or single-member LLC." A properly formatted EIN is provided, no exemption codes were necessary, and the form is signed and dated.

Information used to fill out the document:

- Owner’s Name: John Doe

- Business Name: Acme Consulting LLC

- Entity Type: Single-member LLC

- Tax Classification: Individual/sole proprietor or single-member LLC

- Employer Identification Number (EIN): 12-3456789

- Address: 123 Main Street, Springfield, USA

- Signature: John Doe

- Date: 04/15/2024

What this filled form sample shows:

- Properly completed business name and tax classification fields

- Appropriate exemption codes for a typical small business

- Correct EIN format with proper spacing

- Properly formatted signature and date

Form specifications and details:

| Form Version: | 2024 (Rev. January 2024) |

| Use Case: | Single-member LLC taxed as sole proprietorship |

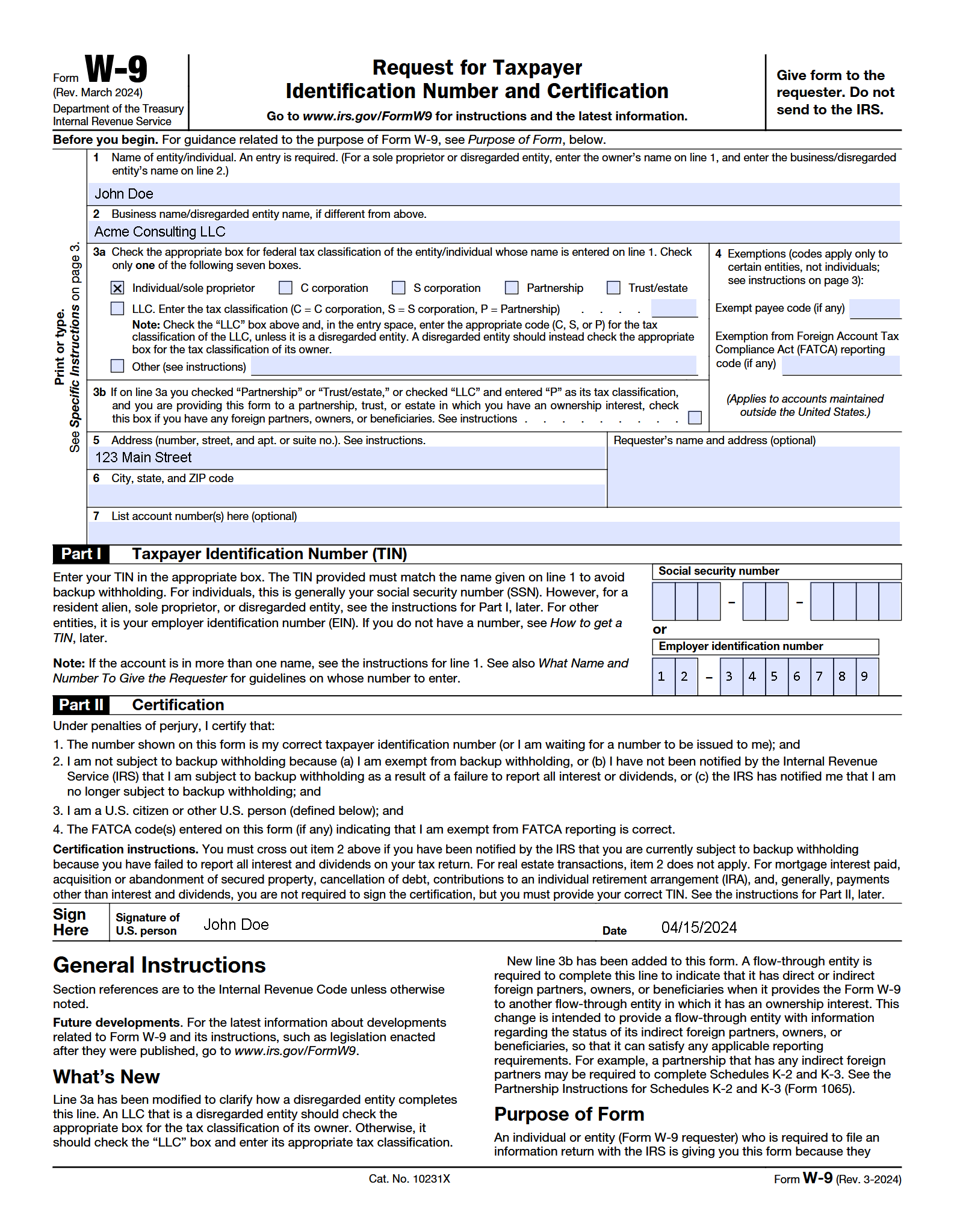

W-9 Example – C Corporation (2024)

How this form was filled:

The corporation’s legal name appears on the first line, with no entry on the second line. The tax classification selected is "C Corporation." A valid EIN is listed, with no exemption codes needed. The form is signed and dated by an authorized officer.

Information used to fill out the document:

- Owner’s Name: BrightTech Solutions Inc.

- Entity Type: C Corporation

- Tax Classification: C Corporation

- Employer Identification Number (EIN): 98-7654321

- Address: 456 Innovation Drive, Tech City, USA

- Signature: Alice Morgan

- Date: 04/15/2024

What this filled form sample shows:

- Only the legal business name is entered, as there is no DBA

- The C Corporation tax classification box is correctly selected

- A valid EIN is provided in standard format

- No exemption codes are needed for this corporation

- Authorized signature and accurate date included

Form specifications and details:

| Form Version: | 2024 (Rev. January 2024) |

| Use Case: | C Corporation providing services to a client |