Yes! You can use AI to fill out Form 8283, Noncash Charitable Contributions

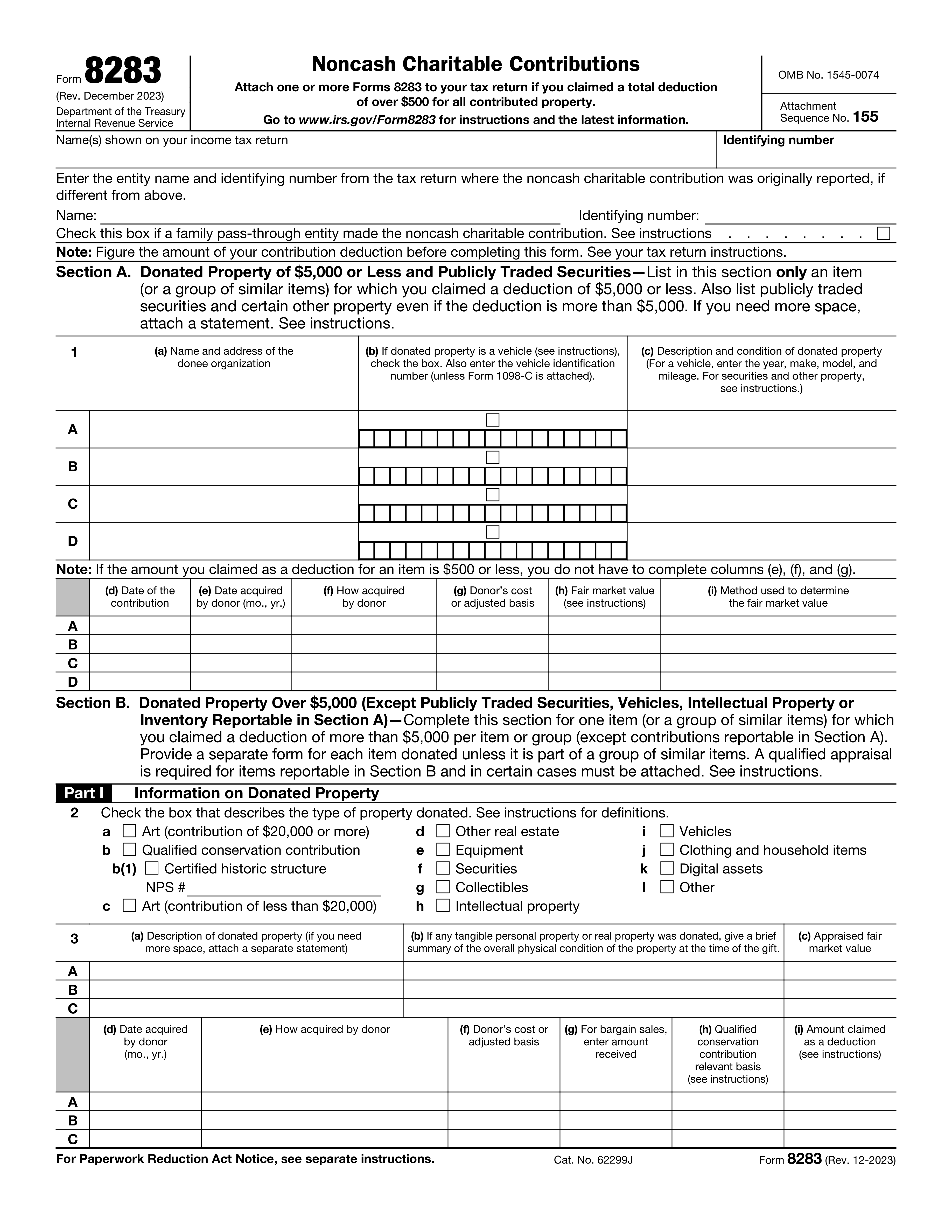

Form 8283, Noncash Charitable Contributions, is used by taxpayers to report noncash charitable contributions exceeding $500. This form is essential for claiming tax deductions for donated property, ensuring proper documentation and compliance with IRS regulations.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8283 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8283, Noncash Charitable Contributions |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 117 |

| Number of pages: | 2 |

| Version: | 2023 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i8283.pdf |

| Filled form examples: | Form Form 8283 Examples |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8283 Online for Free in 2026

Are you looking to fill out a FORM 8283 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8283 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8283 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8283.

- 2 Enter your name and identifying number.

- 3 List donated property details in sections A and B.

- 4 Provide appraiser information if necessary.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8283 Form?

Speed

Complete your Form 8283 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8283 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8283

Form 8283, Noncash Charitable Contributions, is a tax form used by individuals, trusts, and estates to report noncash charitable contributions to the Internal Revenue Service (IRS). It is required when the donor's total noncash contributions for the tax year exceed $500. For contributions of vehicles, boats, or airplanes, Form 8283 is required regardless of the value.

Noncash charitable contributions that should be reported on Form 8283 include: clothing and household items; vehicles, boats, and airplanes; real property; publicly traded securities; and other property such as artwork, jewelry, and collectibles. It is essential to note that certain types of contributions, like inventory or services, have specific reporting requirements and may not be reported on Form 8283.

Section A of Form 8283 requires the following information: the name and address of the donee organization; a description of the noncash contribution, including the quantity and condition; the fair market value of the contribution; and the taxpayer's name, address, and taxpayer identification number.

Section A of Form 8283 is used to report contributions of property with a value of $500 or less for which a qualified appraisal is not required. Section B is used to report contributions of property with a value over $500 for which a qualified appraisal is required. In Section B, the taxpayer must provide the name, address, and taxpayer identification number of the appraiser, as well as the appraisal date and the value determined by the appraisal.

A qualified appraisal is required for noncash charitable contributions with a value over $500. The appraisal must be completed by a qualified appraiser, who is an individual or organization that has expertise in valuing the type of property being donated. The appraisal must be completed no earlier than 60 days before the contribution date and must be attached to the taxpayer's tax return when filed.

Part II and Part III of Form 8283 are used to report noncash charitable contributions of property other than publicly traded securities. Part II is for reporting contributions of property with a value of $500 or more per contribution, but less than $5,000. Part III is for reporting contributions of property with a value of $5,000 or more per contribution. These sections require detailed descriptions of the property, including its condition, date acquired, cost basis, and fair market value.

The Taxpayer (Donor) Statement in Part IV of Form 8283 is a certification made by the donor regarding the property being donated. The donor must provide their name, taxpayer identification number, and acknowledge that they have not received any consideration for the donation. This statement is important because it helps ensure that the donor is eligible for the charitable contribution deduction and that the value reported on the form is accurate.

An appraiser is required for reporting noncash charitable contributions of property with a value of $5,000 or more. The appraiser is responsible for determining the fair market value of the property being donated. The appraiser must complete and sign Section B of Form 8283, providing a detailed description of the property and the method used to determine its fair market value. The appraiser's statement is crucial in ensuring that the value reported on the form is accurate and supported by a qualified expert.

Part V of Form 8283 is for the donee organization to acknowledge receipt of the noncash charitable contribution. The donee organization must complete and sign this section, confirming that they have received the property and that no goods or services were provided in exchange for the donation. This acknowledgment is important because it helps ensure that the donor can claim the charitable contribution deduction on their tax return.

The penalty for false or fraudulent overstatement of property value in Form 8283 can be severe. The IRS may assess a penalty equal to 40% of the overvalued amount for contributions of property other than publicly traded securities. In addition, the donor may be subject to criminal prosecution for tax fraud. It is essential that donors and appraisers provide accurate and truthful information on Form 8283 to avoid potential penalties and legal consequences.

A qualified conservation contribution is a type of charitable donation that involves the transfer of a real property interest for conservation purposes. This type of donation is different from other types of charitable donations, such as donations of cash, stocks, or other property, because it requires the property to be used for conservation purposes, which are defined as the preservation of land areas, waters, or easements that will provide for the protection of scenic, historic, or scientific value, or the preservation of open space (including farmland and forests) where such preservation is necessary to prevent densely populated urban development. The donor may be eligible for a tax deduction for the full fair market value of the donated property if certain requirements are met.

Publicly traded securities are stocks, bonds, or other securities that are traded on a public exchange, such as the New York Stock Exchange or the NASDAQ. These securities are different from non-publicly traded securities, which are not traded on a public exchange and may include closely held corporations, partnership interests, and other types of property. The definition of publicly traded securities is important in the context of Form 8283 because the reporting requirements for donations of publicly traded securities are different from those for donations of non-publicly traded securities. For donations of publicly traded securities, the donor generally reports the name of the security, the number of shares donated, and the date of the transfer. The donor may also be required to provide information about the cost basis of the securities, depending on the value of the donation.

To report a donation of a vehicle on Form 8283, the donor must complete Section A of the form, which includes providing information about the donor, the donee organization, and the vehicle being donated. The donor must also complete Section B, which includes providing a description of the vehicle, including the make, model, vehicle identification number (VIN), and odometer reading at the time of the donation. If the vehicle is valued at more than $500, the donor may be required to complete Section C, which includes providing information about the cost basis of the vehicle. The donee organization will complete Section D, which includes certifying the sale or significant intervention or material improvement of the vehicle. The form must be signed by both the donor and the donee organization and attached to the donor's tax return.

To report a donation of art on Form 8283, the donor must complete Section A of the form, which includes providing information about the donor, the donee organization, and the artwork being donated. The donor must also complete Section B-1, which includes providing a description of the artwork, including the title, artist, medium, and date of creation. If the artwork is valued at more than $20,000, the donor must also complete Section B-2, which includes providing information about the provenance of the artwork, including the previous ownership history and any appraisals or expert opinions. The donee organization will complete Section D, which includes certifying the receipt of the artwork and the value of the donation. The form must be signed by both the donor and the donee organization and attached to the donor's tax return.

To report a donation of intellectual property on Form 8283, the donor must complete Section A of the form, which includes providing information about the donor, the donee organization, and the intellectual property being donated. The donor must also complete Section B, which includes providing a description of the intellectual property, including the type of property, the date of creation, and any relevant registration or application information. If the intellectual property is valued at more than $5,000, the donor may be required to complete Section C, which includes providing information about the cost basis of the property and any related expenses. The donee organization will complete Section D, which includes certifying the receipt of the intellectual property and the value of the donation. The form must be signed by both the donor and the donee organization and attached to the donor's tax return.

To report donations of digital assets on Form 8283, you must provide a valuation statement from a qualified appraiser. The statement should include the date of the contribution, a description of each digital asset, the fair market value on the date of contribution, and the cost or other basis of each asset. You must also attach a copy of the appraiser's credentials and a signed and dated section of the appraiser's statement to the form. If the total value of your noncash contributions, including digital assets, is over $500, you must also file Form 8282, Donee Information Return, with the donee organization.

To report donations of clothing and household items on Form 8283, you must complete Sections A and B of the form. Section A requires you to provide a description of each item, including the condition, the date of acquisition, and the cost or other basis. Section B requires you to estimate the fair market value of each item on the date of contribution. If the total value of your noncash contributions, including clothing and household items, is over $500, you must also file Form 8282 with the donee organization.

To report donations of other types of property on Form 8283, you must complete Sections A and B of the form, just as you would for clothing and household items. Section A requires you to provide a description of the property, including its condition, the date of acquisition, and the cost or other basis. Section B requires you to estimate the fair market value of the property on the date of contribution. If the total value of your noncash contributions is over $500, you must also file Form 8282 with the donee organization.

To report partial interests and restricted use property on Form 8283, you must complete Part II of the form. Part II requires you to provide a description of the property, including its fair market value, the percentage of the interest donated, and any restrictions on the use of the property. You must also attach a copy of the appraisal report for the property and obtain a signature from the appraiser. If the total value of your noncash contributions is over $500, you must also file Form 8282 with the donee organization.

Compliance Form 8283

Validation Checks by Instafill.ai

1

Attachment of IRS Form 8283

Ensures that IRS Form 8283 is properly attached to the taxpayer's return for the year in which the noncash charitable contribution was made. This check is crucial as it confirms the taxpayer's compliance with the IRS requirements for documenting such contributions. It also helps to prevent any delays in processing the taxpayer's return due to missing documentation. Additionally, this validation ensures that the form is filled out correctly and completely, providing all the necessary details about the noncash contributions.

2

Inclusion of Qualified Appraisal

Confirms that a qualified appraisal is included for items valued over $5,000, as required in Section B of the form. This validation is important to substantiate the claimed value of the donated items and to meet the IRS regulations for donations of high-value items. It also verifies that the appraisal meets the specific standards set by the IRS, including the qualifications of the appraiser and the appraisal date. This check helps to ensure that the taxpayer's claim is supported by a legitimate and compliant appraisal document.

3

Copy of Previous Year's Form 8283 for Deduction Carryover

Verifies that the form includes a copy of the Form 8283 from the previous year if there is a carryover of a deduction. This validation is essential for tracking the continuity of the taxpayer's noncash charitable contributions and ensuring that the carryover amount is accurately reported. It also assists in preventing any discrepancies between the current and previous years' tax filings. By confirming the presence of the previous year's Form 8283, this check upholds the integrity of the deduction carryover process.

4

Documentation and Appraisals Attachment

Checks that all necessary documentation, including appraisals and photographs for certain items, is attached as per the form's instructions. This validation is key to providing a complete and thorough record of the noncash charitable contributions. It ensures that the taxpayer has adhered to the detailed requirements for documenting donations, which may include photographs or other evidence for specific types of property. This check is instrumental in facilitating a smooth review process by the IRS.

5

Completion of Donee Acknowledgment

Validates that the Donee Acknowledgment in Part V of Section B is completed by the donee organization. This check is critical as it serves as proof that the donee organization has received the noncash contribution and acknowledges the donation. It also confirms that the acknowledgment is filled out in accordance with the IRS guidelines, which is necessary for the taxpayer to claim a deduction. This validation helps to prevent any disputes or questions regarding the legitimacy of the contribution.

6

Vehicle Contribution Information

Ensures that for contributions of vehicles, the software confirms the inclusion of all required information. It verifies that Form 1098-C or a similar acknowledgment is attached to the form. The AI checks for details such as the make, model, and condition of the vehicle, as well as the charity's name and the date of the contribution. It also ensures that the fair market value is appropriately documented.

7

Qualified Conservation Contribution Details

Confirms that for qualified conservation contributions, the software ensures detailed information about the easement is provided. It verifies that any relevant basis for the contribution is clearly stated. The AI checks for a complete description of the conservation purpose served by the donation and confirms that all necessary documentation is attached and properly filled out.

8

Artwork Appraisal Attachment

Verifies that for art valued at $20,000 or more, the software checks that a complete copy of the signed appraisal is attached. It ensures that the appraisal includes necessary details such as the artist's name, a description of the artwork, and the basis for the valuation. The AI also confirms that the appraisal is conducted by a qualified appraiser and that it adheres to the relevant IRS guidelines.

9

Clothing and Household Items Valuation

Checks that for clothing and household items not in good used condition and valued at more than $500, the software ensures that the qualified appraisal is attached. It confirms that the appraisal includes a thorough description of the item, the condition that justifies the valuation, and the valuation method used. The AI also verifies that the appraisal meets the IRS standards for noncash charitable contributions.

10

Historic Structure Easement Documentation

Ensures that for easements on certified historic structures, the software confirms that the qualified appraisal, photographs, and other required information are included. It checks for a detailed description of the historic structure, the terms of the easement, and any restrictions on the use of the property. The AI also verifies that all documentation supports the claimed deduction and complies with IRS requirements.

11

Attachment of Qualified Appraisal for High-Value Items

Ensures that if a deduction of more than $500,000 for an item is claimed on the Noncash Charitable Contributions form, the taxpayer has attached the qualified appraisal as required, unless an applicable exception is met. This check is crucial to comply with IRS regulations and to substantiate the claimed value of the donated property. It also prevents any delays or issues with the processing of the form due to missing documentation.

12

Appraiser Qualifications and Standards Compliance

Verifies that the appraiser who conducted the appraisal of the donated items is indeed qualified according to IRS standards, and that the appraisal itself adheres to the necessary requirements. This validation is important to ensure the credibility and acceptability of the appraisal, which supports the claimed value of the noncash charitable contributions.

13

Record Keeping for IRS Inquiry

Checks that the taxpayer maintains proper records of all appraisals and other relevant documentation related to the noncash charitable contributions. This is essential for substantiating the contributions in case of an IRS inquiry and demonstrates the taxpayer's due diligence in record-keeping.

14

Correct Form Completion According to Value

Validates that the Noncash Charitable Contributions form is filled out correctly in accordance with the instructions, ensuring that Section A is used for items valued at $5,000 or less and Section B for items valued at more than $5,000. This check is vital for the accurate categorization and reporting of donated items based on their value.

15

Attachment of Forms for Pass-Through Entity Members

Ensures that if the taxpayer is a member of a pass-through entity, all necessary Forms 8283 from the donating entity and any intermediate pass-through entities, as well as the taxpayer's own separate Form 8283, are attached. This validation is important for tracing and substantiating the flow of contributions through multiple entities.

Common Mistakes in Completing Form 8283

One of the most common errors made on the Noncash Charitable Contributions form involves failing to provide the necessary documentation for donations valued over $500. This documentation may include a qualified appraisal or Form 1098-C. The failure to attach these documents can result in the contribution being disallowed or delayed. To avoid this mistake, ensure that all required documentation is gathered and attached to the form before submitting it to the IRS. It is recommended to keep copies of these documents for your records as well.

Another common mistake made on the Noncash Charitable Contributions form is incorrect completion of either Section A or Section B, depending on the value of the donated item. Section A is used for donations valued under $500, while Section B is used for donations valued over $500. Failing to complete the correct section can result in incorrect reporting of the contribution. To avoid this mistake, carefully review the instructions for completing the form and ensure that the correct section is used based on the value of the donated item. It is also recommended to double-check all entries in the form for accuracy.

A third mistake made on the Noncash Charitable Contributions form is the failure to obtain a qualified appraisal for donated items valued over $5,000. This documentation is required by the IRS to determine the tax-deductible value of the donation. Failing to provide a qualified appraisal can result in the contribution being disallowed or the taxpayer being required to pay a penalty. To avoid this mistake, ensure that a qualified appraisal is obtained and attached to the form before submitting it to the IRS. It is recommended to obtain the appraisal from a qualified appraiser and to keep a copy of the appraisal for your records.

Another common mistake made on the Noncash Charitable Contributions form is incomplete or inaccurate information in Part I, which includes the name and address of the donee organization and the date of the contribution. Failing to provide complete and accurate information in this section can result in the contribution being disallowed or delayed. To avoid this mistake, ensure that all required information is provided in full and that it is accurate. It is recommended to double-check all entries in Part I for accuracy and to keep records of the donation, including the date and a description of the donated item, for your records.

A final mistake made on the Noncash Charitable Contributions form is the failure to sign and date the form in the appropriate places. This mistake can result in the form being rejected by the IRS. To avoid this mistake, ensure that all required signatures and dates are provided in the appropriate places on the form. It is recommended to sign and date the form as soon as possible after making the donation and to keep a copy of the signed and dated form for your records.

One crucial mistake when completing the Noncash Charitable Contributions form is failing to provide detailed information about the donated item. This includes the condition of the item and any necessary serial numbers. Providing incomplete or vague information may lead to complications during the verification process and potential IRS audits. To avoid this mistake, ensure that all required information is accurately documented and included with the form submission. This may involve taking photographs or videos of the item, recording its condition in detail, and obtaining any relevant serial numbers or identification codes.

Another common mistake is failing to keep proper records of appraisals and other documentation related to the donated property. The IRS requires that taxpayers maintain adequate records to support their charitable contributions, including written records of the appraisal or valuation of the donated property. Failing to provide this documentation may result in the IRS denying the deduction or requiring the taxpayer to pay back the claimed amount. To avoid this mistake, ensure that all appraisals and documentation are kept in a safe and accessible location and are readily available for submission to the IRS upon request.

Another mistake is neglecting to consult IRS publications 526 and 561 for additional guidance on charitable contributions and determining the value of donated property. These publications provide valuable information on the rules and regulations governing charitable contributions, including specific instructions on how to determine the value of donated property. Failing to consult these publications may result in incorrect valuations and potential IRS audits. To avoid this mistake, ensure that you have a copy of these publications and refer to them regularly when making charitable contributions.

For pass-through contributions, it is essential to attach Form 8283 from all necessary entities. Failure to do so may result in the IRS denying the deduction or requiring the taxpayer to pay back the claimed amount. Form 8283 is used to report contributions of noncash property made to certain organizations, including religious organizations, schools, and hospitals. To avoid this mistake, ensure that all required entities complete and attach Form 8283 to the Noncash Charitable Contributions form before submission.

For vehicle donations, it is essential to provide the required information, including the vehicle identification number (VIN) and sale price. Failing to provide this information may result in the IRS denying the deduction or requiring the taxpayer to pay back the claimed amount. To avoid this mistake, ensure that all required information is accurately documented and included with the form submission. This may involve obtaining a copy of the vehicle's title or registration, which typically includes the VIN, and obtaining a written statement from the charitable organization regarding the sale price of the vehicle.

One of the most common mistakes made when completing the Noncash Charitable Contributions form for conservation contributions is the failure to provide all required information. This includes the name and address of the conservation organization that holds the conservation easement, as well as a detailed description of the easement. It is essential to ensure that this information is accurately and completely reported to avoid potential issues with the IRS. To avoid this mistake, double-check the form instructions and consult with the conservation organization to ensure all necessary information is provided.

Another common mistake made when completing the Noncash Charitable Contributions form is the failure to ensure that the appraiser is qualified and that the appraisal meets the required standards. The IRS has specific rules regarding who can perform appraisals for non-cash contributions and what the appraisal must include. Failing to adhere to these rules can result in the contribution being disallowed or even subjecting the donor to penalties. To avoid this mistake, it is recommended that donors consult with a qualified appraiser who is familiar with the IRS rules and regulations for non-cash contributions. Additionally, donors should ensure that the appraisal is completed in accordance with the IRS requirements and includes all necessary information.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8283 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8283 forms, ensuring each field is accurate.