Yes! You can use AI to fill out Form 940, Employer’s Annual FUTA Tax Return

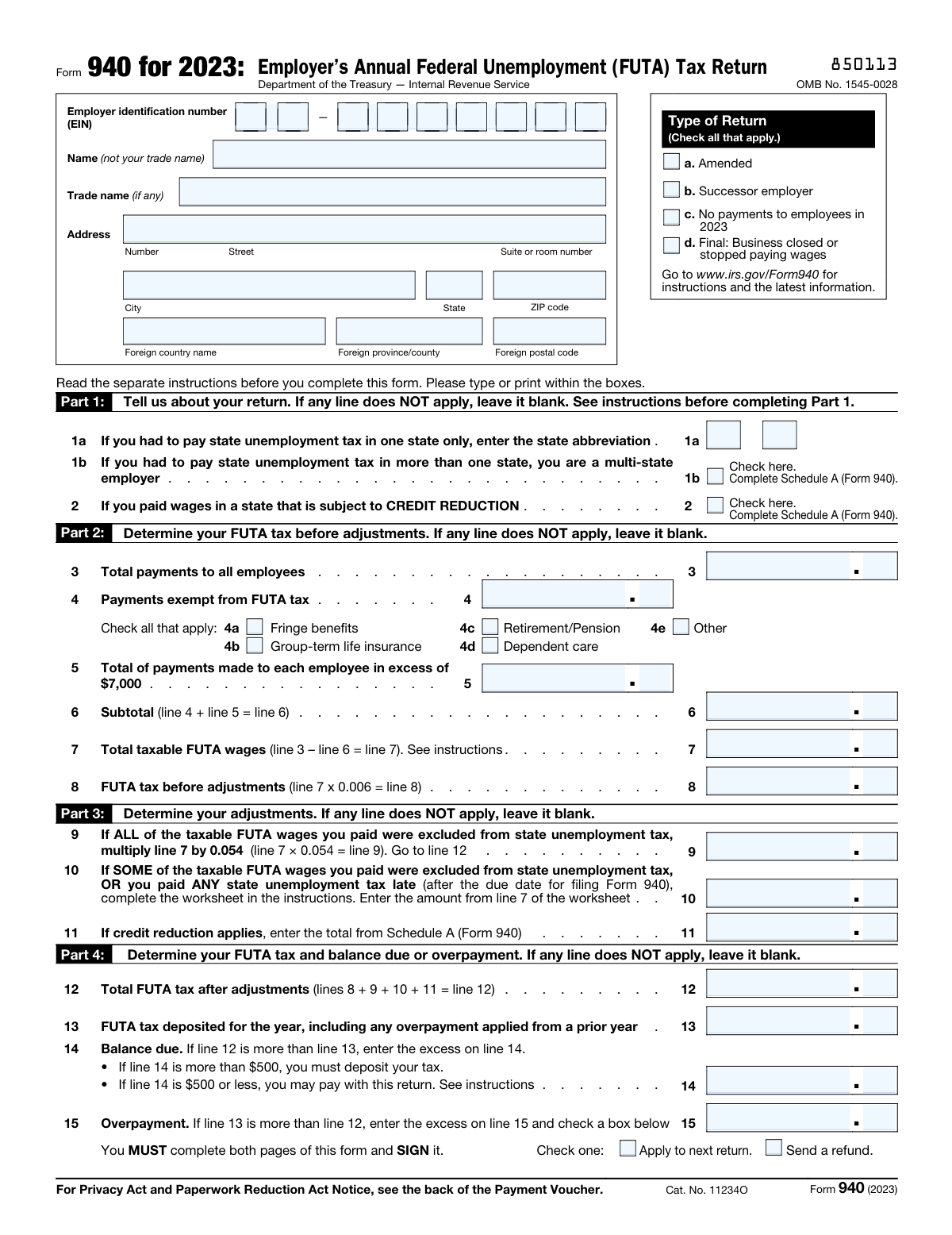

Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, is used by employers to report their annual FUTA tax liability. This form is crucial for ensuring that employers meet their federal unemployment tax obligations, which fund unemployment benefits for workers.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 940 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 940, Employer’s Annual FUTA Tax Return |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 90 |

| Number of pages: | 4 |

| Version: | 2023 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i940.pdf |

| Filled form examples: | Form Form 940 Examples |

| Language: | English |

| Categories: | employer forms, tax forms, employer tax forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 940 Online for Free in 2026

Are you looking to fill out a FORM 940 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 940 form in just 37 seconds or less.

Follow these steps to fill out your FORM 940 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 940.

- 2 Enter your employer identification number (EIN).

- 3 Fill in your business name and address.

- 4 Complete the required payment and tax information.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 940 Form?

Speed

Complete your Form 940 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 940 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 940

The Employer's Annual Federal Unemployment (FUTA) Tax Return, Form 940, is used to report total wages paid to employees and the amount of unemployment tax that is due. The tax is used to fund state unemployment programs.

The Form 940 is typically due annually by January 31st if the employer's tax liability is less than $500. If the employer's tax liability is $500 or more, the Form 940 is due quarterly. The due dates for quarterly filers are: January 31 (for wages paid in the preceding calendar year's fourth quarter), April 30 (for wages paid in the first three months of the current calendar year), July 31 (for wages paid in the second and third quarters of the current calendar year), and October 31 (for wages paid in the fourth quarter of the current calendar year).

Employers who paid wages of $1,500 or more in any calendar quarter or had one or more employees for at least some part of a day in 20 or more different weeks in a calendar year are required to file Form 940. Employers in certain industries may have different filing requirements.

Part 1 of Form 940 requires the employer to report total wages paid to employees during the tax year, the total tax due, and the total tax paid. The employer must also report any state unemployment tax offsets, any tax adjustments, and any contributions to the Federal Unemployment Tax Act (FUTA) reserve fund.

A multi-state employer is an employer who has employees in more than one state. These employers must file a separate Form 940 for each state where they have employees, in addition to filing a single Form 940 for their total federal unemployment tax liability. The employer must also report total wages paid to employees in each state on the corresponding state Form 940.

Schedule A in Part 2 of Form 940 is used to report contributions to state unemployment funds and reemployment tax. Employers who have paid unemployment compensation to their employees under state or federal law during the tax year must complete this schedule.

Payments exempt from FUTA tax include: wages paid to employees under the age of 20 during their first year of employment, wages paid for services performed in a week in which the employee's total wages were less than $1,500, and wages paid for services performed in a week in which the employee was not employed for 30 or more days during the tax year.

Line 6 represents the total wages paid to employees subject to FUTA tax during the tax year. Line 7 represents the total wages paid to employees on which FUTA tax was paid or credited during the tax year. The difference between the two is the amount of FUTA tax paid or credited during the tax year, which is reported on line 8.

Adjustments may be necessary in Part 3 of Form 940 for various reasons, such as correcting errors on previous returns, reporting late payments or reimbursements, or claiming tax credits. Employers should carefully review the instructions for Part 3 and make any necessary adjustments to ensure the accuracy of their return.

Line 12 represents the total amount of FUTA tax paid or credited during the tax year, while line 13 represents the total amount of FUTA tax that is required to be paid based on the wages reported on line 6 of Part 2. The difference between the two is the amount of FUTA tax that has been deposited or paid during the tax year, which should be the same as the amount reported on line 8 of Part 2.

Form 940-V, Payment Voucher, is used to make payments of the Federal Unemployment Tax Act (FUTA) tax liability. It is important to note that while Form 940 is used to report and calculate the FUTA tax liability, Form 940-V is used to make the actual payment to the IRS.

Box 1 of Form 940-V requires the employer identification number (EIN), the name and address of the employer, and the total amount of FUTA tax being paid. This information is necessary for the IRS to properly process and apply the payment to the correct employer account.

When an employer's FUTA tax liability exceeds $500, they are required to make electronic fund transfers (EFTs) to pay the tax. This can be done through the Electronic Federal Tax Payment System (EFTPS) or by using a credit or debit card. Employers should refer to the instructions on Form 940-V for detailed information on setting up an EFT account or making a payment with a credit or debit card.

Employers who fail to deposit FUTA tax on time may be subject to penalties. The penalty for failing to deposit on time is generally 2% per month or part of a month that the tax is not deposited, up to a maximum of 15%. Employers should refer to the instructions on Form 940 and IRS Publication 960 for more information on penalty calculations and exceptions.

A third-party designee is an individual or entity authorized by an employer to receive and pay FUTA taxes on their behalf. This can be useful for employers who may not have the time or resources to handle the tax payments themselves. To designate a third-party designee, the employer must complete Part 10 of Form 940 and provide the designee's name and contact information. The designee will then be responsible for making the FUTA tax payments and receiving any corresponding penalties or interest.

The Privacy Act and Paperwork Reduction Act (PRA) notices on Form 940 serve important functions in protecting individual privacy and reducing the burden of government paperwork. The Privacy Act notice informs taxpayers that the Internal Revenue Service (IRS) is collecting, using, and disclosing personal information on the form for tax administration purposes. It also explains individuals' rights under the Privacy Act, including the right to access and correct their personal information. The Paperwork Reduction Act notice advises taxpayers that the IRS has obtained approval from the Office of Management and Budget (OMB) for the collection and use of information on the form. This notice includes the OMB control number and the expiration date of the approval. The PRA aims to minimize the burden on taxpayers by ensuring that forms are necessary, efficient, and effective. By including these notices on Form 940, the IRS demonstrates its commitment to transparency, accountability, and compliance with federal laws and regulations.

Compliance Form 940

Validation Checks by Instafill.ai

1

Ensures that all required business information is accurately filled out, including the employer's name, address, and Employer Identification Number (EIN).

The AI ensures that the Employer's Annual Federal Unemployment Tax Return form contains all the necessary business details. It checks for the accuracy and completeness of the employer's name, address, and Employer Identification Number (EIN). The AI cross-references this information with official records to prevent any discrepancies. It also alerts the user if any of these critical fields are left blank or are incorrectly filled.

2

Verifies that FUTA tax calculations are correctly performed based on the first $7,000 paid to each employee after subtracting exempt payments.

The AI verifies the accuracy of the Federal Unemployment Tax Act (FUTA) tax calculations. It ensures that the calculations are based on the first $7,000 of income paid to each employee, as mandated by law, after accounting for any exempt payments. The AI checks the arithmetic operations and the application of the correct tax rate to ensure that the total tax liability is calculated correctly. It also flags any discrepancies in the calculation for user review.

3

Confirms that all sections of the form are completed, including adjustments for state unemployment tax contributions and total tax liability.

The AI confirms that every section of the Employer's Annual Federal Unemployment Tax Return form is thoroughly completed. This includes the careful review of adjustments for state unemployment tax contributions, which may affect the total tax liability. The AI ensures that these adjustments are entered correctly and that the final tax liability reflects these changes. It also ensures that no relevant sections are overlooked, which could result in an inaccurate filing.

4

Checks if the 'Amended' box is marked and an explanation is attached in cases where the form is an amendment to a previously filed Form 940.

The AI checks if the 'Amended' box is marked on the Employer's Annual Federal Unemployment Tax Return form when it is intended to amend a previously filed Form 940. It ensures that an explanation for the amendment is attached, as required by the IRS. The AI reviews the documentation for completeness and relevance to the amendments made on the form, and it prompts the user to provide any missing information or clarification.

5

Validates that the overpayment option is correctly indicated, whether to apply it to the next return or to request a refund.

The AI validates the selection made regarding any overpayment of FUTA taxes. It ensures that the employer has correctly indicated whether the overpayment should be applied to the next tax return or if a refund is requested. The AI checks for consistency in the selection made and the information provided on the form. It also alerts the user if the overpayment option is not clearly specified, which could delay processing or result in errors in future tax liabilities.

6

FUTA Tax Liability Reporting

Ensures that the FUTA tax liability by quarter is accurately reported in Part 5 of the Employer's Annual Federal Unemployment Tax Return. This validation check is crucial when the employer's tax liability exceeds $500 for the year. It verifies the correctness of the amounts entered for each quarter, ensuring they sum up to the total tax liability reported. This check is essential for maintaining compliance with federal tax regulations and avoiding potential penalties for underpayment or incorrect reporting.

7

Employer and Preparer Signature Verification

Confirms that the signature of the employer is present in Part 7 of the Employer's Annual Federal Unemployment Tax Return. Additionally, if a paid preparer is involved, this validation check ensures that their signature and information are also included. The presence of these signatures is mandatory for the form's validity and is a key step in the authentication process. This check helps prevent the submission of unsigned forms, which could result in the return being rejected or delayed.

8

Schedule A (Form 940) Completion

Verifies that Schedule A (Form 940) is completed and attached for employers who operate in multiple states or have paid wages in credit reduction states. This validation check is essential for employers to claim their full FUTA credit. It ensures that the additional form is properly filled out and submitted along with the main form, which is necessary for accurate tax calculation and compliance with multi-state unemployment tax regulations.

9

Successor Employer Status Indication

Checks for the correct indication of successor employer status on the Employer's Annual Federal Unemployment Tax Return. This validation check includes verifying that relevant wages and taxes from the predecessor are properly reported if applicable. It is crucial for ensuring that the transfer of business ownership is reflected accurately in the tax records and that all FUTA obligations are met by the new employer.

10

No Payments to Employees or Final Return

Ensures that the appropriate box is checked if no payments to employees were made in 2023 or if the form is a final return due to business closure or cessation of wage payments. This validation check is important for clarifying the employer's status and for the IRS to understand the reason for the absence of wage payments or the termination of the business. It helps maintain accurate employment tax records and streamlines the processing of the tax return.

11

Filing Deadline Compliance

Ensures that the Employer's Annual Federal Unemployment Tax Return is submitted by the appropriate due date. The software confirms whether the form is filed by January 31, 2024, or by the extended due date of February 12, 2024, if all FUTA tax obligations have been timely deposited. It alerts the user of impending deadlines and provides reminders to prevent late submissions, which could result in penalties.

12

Correct Mailing Address Verification

Verifies that the Employer's Annual Federal Unemployment Tax Return is mailed to the correct Internal Revenue Service (IRS) address. The software checks the employer's location against the IRS's provided addresses to determine the appropriate mailing destination. It takes into account whether a payment is included with the form, as this can alter the required mailing address.

13

Inclusion of Worksheets and Recordkeeping

Checks for the inclusion of any necessary worksheets that are used for calculations on the Employer's Annual Federal Unemployment Tax Return. The software ensures that these supplemental documents are attached and that records of Form 940 are maintained according to IRS guidelines. It assists in organizing and storing these records for the required period, facilitating easy access for future reference or audits.

14

Electronic Filing and Payment Compliance

Validates that if the Employer's Annual Federal Unemployment Tax Return is not submitted by mail, the electronic filing options and payment methods conform to IRS guidelines. The software reviews the available e-file options and verifies that the chosen method is authorized. It also checks that electronic payments are processed through approved channels, ensuring compliance with federal requirements.

15

Numerical Entry and Calculation Accuracy

Ensures that all numerical entries on the Employer's Annual Federal Unemployment Tax Return are within valid ranges and that the calculations performed are mathematically correct. The software automatically reviews the figures entered, cross-references them with the applicable tax rates and thresholds, and performs the necessary arithmetic checks to prevent errors that could lead to discrepancies or IRS inquiries.

Common Mistakes in Completing Form 940

Providing incorrect business name, Employer Identification Number (EIN), or address on the Employer's Annual Federal Unemployment Tax Return (Form 940) can lead to significant issues. This mistake may result in delayed processing of the return, potential penalties, and miscalculations of tax liabilities. To avoid this error, ensure that all business information is up-to-date and accurate before submitting the form. Double-check all entries for typos and inconsistencies.

Calculating FUTA tax liability incorrectly by reporting inaccurate wages or exempt payments can lead to underpayment or overpayment of taxes. This mistake may result in penalties and interest charges. To prevent this error, carefully review the instructions for calculating FUTA tax liability and ensure that all wage and exempt payment amounts are reported accurately. Consider using payroll software or a tax professional to assist with calculations.

Failing to sign the form and provide preparer information, if applicable, can result in processing delays and potential penalties. To avoid this mistake, ensure that the form is signed by an authorized person and that any required preparer information is provided. This information may include the preparer's name, EIN, and signature. Review the instructions carefully to determine if preparer information is required.

Missing the due date for filing the Employer's Annual Federal Unemployment Tax Return (Form 940) can result in penalties and interest charges. To prevent this mistake, familiarize yourself with the due date for filing the form and ensure that it is submitted on time. Consider setting reminders or using payroll software to help manage filing deadlines.

For multi-state employers or those who paid wages in credit reduction states, failing to attach Schedule A (Form 940) can result in processing delays and potential penalties. Schedule A is used to report wages paid in other states and to calculate the tax liability for those wages. To avoid this mistake, ensure that Schedule A is completed accurately and attached to the Form 940 before submitting it for processing.

When filing the Employer's Annual Federal Unemployment Tax Return (Form 940), it is essential to accurately identify the type of return being filed. This includes checking the appropriate box for amended returns, successor employers, or final returns. Failure to do so can result in incorrect tax calculations and potential penalties. To avoid this mistake, carefully review the instructions provided on the form and ensure that the correct box is checked based on the specific circumstances of your business. It is also recommended to maintain clear records of any changes to your business status and the corresponding Form 940 filings.

Another common mistake when filing Form 940 is incorrectly reporting Federal Unemployment Tax Act (FUTA) tax deposits or overpayments. This can lead to significant penalties and interest charges. To prevent this error, it is crucial to maintain accurate records of all FUTA tax deposits and ensure that they are reported correctly on the form. It is also recommended to double-check all calculations and consult the instructions provided on the form to ensure that any overpayments are reported appropriately.

Proper record-keeping is essential when filing the Employer's Annual Federal Unemployment Tax Return. Failing to maintain accurate records of Form 940 and related worksheets can make it difficult to accurately complete future filings and may result in penalties. To avoid this mistake, it is recommended to establish a system for organizing and storing all relevant records, including copies of filed Forms 940, supporting documentation, and worksheets. Additionally, it is essential to regularly review these records to ensure that they are complete and up-to-date.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 940 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 940 forms, ensuring each field is accurate.