Yes! You can use AI to fill out Form 945, Annual Return of Withheld Federal Income Tax

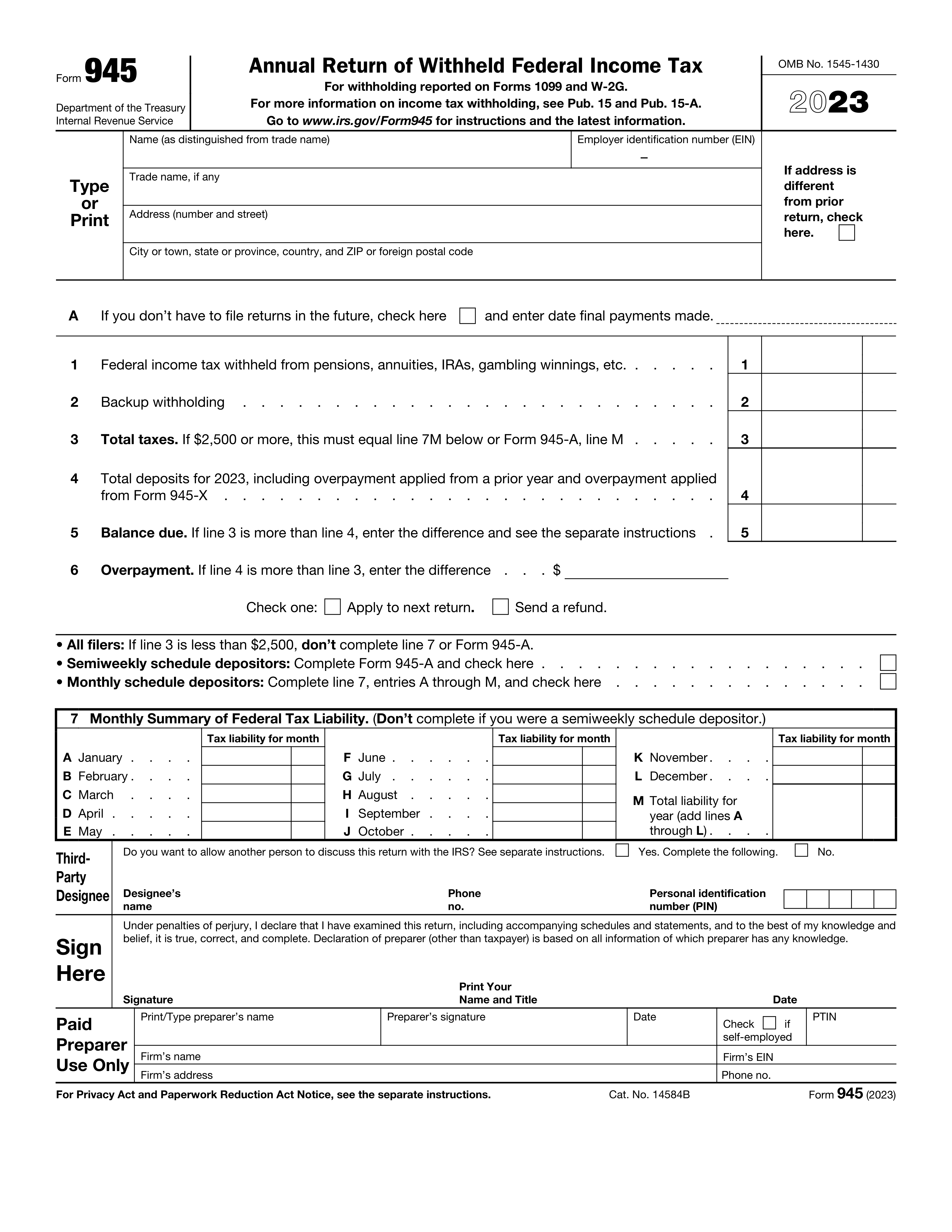

Form 945, Annual Return of Withheld Federal Income Tax, is used to report federal income tax withheld from pensions, annuities, IRAs, and gambling winnings. It is important for ensuring that the correct amount of tax is reported and paid to the IRS.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 945 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 945, Annual Return of Withheld Federal Income Tax |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 70 |

| Number of pages: | 2 |

| Version: | 2023 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i945.pdf |

| Filled form examples: | Form Form 945 Examples |

| Language: | English |

| Categories: | tax forms, federal forms, income forms, income tax forms, federal tax forms |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out Form 945 Online for Free in 2026

Are you looking to fill out a FORM 945 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 945 form in just 37 seconds or less.

Follow these steps to fill out your FORM 945 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 945.

- 2 Enter your name and EIN in the fields.

- 3 Fill in your address and tax withheld amounts.

- 4 Complete the monthly summary of federal tax liability.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 945 Form?

Speed

Complete your Form 945 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 945 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 945

Form 945 is an annual return used by employers to report and pay withheld federal income taxes. It is used to reconcile the taxes withheld during the year with the deposits made throughout the year.

Employers who withhold federal income taxes from their employees' wages, pensions, annuities, IRAs, gambling winnings, and other types of income are required to file Form 945.

Form 945 requires the employer's name, EIN, address, and other contact information. It also requires the total taxes withheld during the year, the total deposits made throughout the year, and the balance due or overpayment.

Form 945 is typically due on January 31 of the following year for calendar year employers. However, there are special filing deadlines for certain types of employers, such as those with fiscal year ends.

If your total taxes for the year are less than $2,500 and you're paying in full with a timely filed return, or if you're a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule, you can make a payment with Form 945. Otherwise, you must make deposits by electronic funds transfer.

Form 945-V is a payment voucher that accompanies Form 945 when making a payment to the Internal Revenue Service (IRS). It helps the IRS credit your payment more promptly and accurately.

There are penalties for not making timely deposits or payments. The deposit penalties range from 2% to 15% per month, depending on the severity of the violation. The failure-to-file penalty is generally 5% per month, up to a maximum of 25%.

Yes, you can designate a third-party designee to discuss the return with the IRS on your behalf. You must complete the appropriate section on Form 945 and provide their name, phone number, and personal identification number.

Semiweekly schedule depositors make deposits every other business day, while monthly schedule depositors make deposits monthly. The form instructions specify which schedule to use based on the amount of taxes withheld.

The Third-Party Designee section on Form 945 allows you to designate an individual or organization to discuss the return with the IRS on your behalf. This can be useful if you want to grant power of attorney or if you want to ensure that someone specific can handle any IRS inquiries related to the return.

Compliance Form 945

Validation Checks by Instafill.ai

1

Ensures the Employer Identification Number (EIN) is correctly provided in the Identifying Information section.

The software ensures that the Employer Identification Number (EIN) is entered correctly in the Identifying Information section of the form. It checks for the proper format and length of the EIN, which is a nine-digit number. The validation includes verifying that the EIN matches the IRS records for the entity filing the form. If the EIN is missing or incorrect, the software prompts for a correction to prevent filing errors.

2

Confirms that the name and address of the entity filing the form are accurately entered in the Identifying Information section.

The software confirms that the name and address of the entity filing the form are accurately entered in the Identifying Information section. It cross-references the provided information with official databases to ensure accuracy and completeness. The software also checks for any formatting issues or typos in the name and address fields, and it may suggest corrections based on standardized postal address formats.

3

Verifies that the General Information section includes the User ID and CPM Schema if applicable, along with the date and any required initialing.

The software verifies that the General Information section of the form includes all necessary details such as the User ID and CPM Schema, if applicable. It ensures that the date is current and correctly formatted. Additionally, the software checks for any required initialing by the person preparing the form, ensuring that all mandatory fields are completed to maintain compliance with filing requirements.

4

Checks if the 'Final Return' box is marked on line A when applicable, and that the date of the final nonpayroll payments is entered, with an attached statement for record keeping.

The software checks if the 'Final Return' box on line A is appropriately marked when applicable. It ensures that the date of the final nonpayroll payments is entered and prompts the user to attach any required statement for record keeping. This validation is crucial for entities that have ceased paying wages or making nonpayroll payments and are filing their final return, as it affects the processing of the form by the IRS.

5

Validates the total federal income tax withheld from nonpayroll payments entered on line 1 of the Tax Information section.

The software validates the total federal income tax withheld from nonpayroll payments that is entered on line 1 of the Tax Information section. It performs calculations to ensure that the amount entered is within a plausible range based on the reported payments. The software also checks for mathematical accuracy and consistency with other reported figures on the form to prevent any discrepancies that could lead to issues with the IRS.

6

Ensures the total backup withholding is correctly entered on line 2 of the Tax Information section.

The AI performs a meticulous check to ensure that the total backup withholding, which is a critical tax figure, is accurately entered on line 2 of the Tax Information section. It cross-references this amount with relevant documentation and calculations to confirm its correctness. Any discrepancies are flagged for review to prevent errors in tax reporting. This validation is crucial for maintaining compliance with federal tax withholding requirements.

7

Calculates the sum of lines 1 and 2 and verifies the correct amount is entered on line 3 of the Tax Information section.

The AI system calculates the sum of the amounts reported on lines 1 and 2, which represent the total taxes withheld and the total backup withholding, respectively. It then verifies that the resulting sum is correctly entered on line 3 of the Tax Information section. This step is essential to ensure the accuracy of the cumulative withholding reported, which impacts the overall tax liability or refund due for the year.

8

Confirms that the total deposits made for the year, including any overpayment from the previous year, are accurately reported on line 4 of the Tax Information section.

The AI confirms that the total deposits made for the year, as well as any overpayment from the previous year that is carried forward, are accurately reported on line 4 of the Tax Information section. It checks against deposit records and prior year balances to ensure that the reported figures match the actual amounts. This validation is key to determining the correct tax position for the year.

9

Calculates any balance due and ensures it is correctly entered on line 5 of the Tax Information section, if applicable.

The AI calculates any balance due by comparing the total tax liability with the total deposits made throughout the year. It ensures that this balance, if applicable, is correctly entered on line 5 of the Tax Information section. This step is vital for identifying any outstanding amounts that need to be settled with the tax authorities, thereby avoiding potential penalties for underpayment.

10

Verifies the overpayment amount on line 6 and checks whether it is to be refunded or applied to the next return, as indicated by the filer.

The AI verifies the overpayment amount reported on line 6, ensuring that it is calculated correctly based on the total deposits and the tax liability. It also checks the filer's indication of whether this overpayment should be refunded or applied to the next tax return. This validation ensures that the taxpayer's intentions regarding any overpayment are clearly understood and processed accordingly.

11

Monthly Summary of Federal Tax Liability accuracy

Ensures that the Monthly Summary of Federal Tax Liability section is accurately completed for those who are monthly schedule depositors. It checks that all relevant lines are filled out correctly and that the total tax liability reported for the year aligns with the monthly breakdown provided. Additionally, it verifies that line 7M, which represents the total tax liability for the year, matches the amount reported on line 3, ensuring consistency across the form.

12

Form 945-A filing requirement

Confirms that Form 945-A is filed in lieu of completing line 7 for filers who were semiweekly schedule depositors or who became semiweekly schedule depositors during the year. It checks the depositor's schedule status and ensures that the correct procedure is followed, either by completing line 7 for monthly depositors or by filing Form 945-A for semiweekly depositors, to maintain compliance with IRS requirements.

13

Third-Party Designee section completion

Verifies that the Third-Party Designee section is properly filled out when the 'Yes' box is checked. It checks for the inclusion of the designee's name, phone number, and the required five-digit Personal Identification Number (PIN). This validation ensures that the IRS has the necessary information to discuss the return with the designated third party, should the need arise.

14

Signature section authorization

Checks that the form is signed by an individual authorized to do so and that the signer's title and the date are provided in the Signature section. This validation confirms the authenticity and validity of the form, ensuring that it is legally binding and that the IRS can hold the appropriate individual accountable for the information provided.

15

Paid Preparer Use Only section completion

Ensures that the Paid Preparer Use Only section is completed with all the necessary information if a paid preparer was used. This includes the preparer's signature, Preparer Tax Identification Number (PTIN), and other relevant details. This validation helps maintain the integrity of the tax filing process by clearly identifying the preparer responsible for the form.

Common Mistakes in Completing Form 945

The User ID and CPM Schema are essential identifiers for the filer in the Annual Return of Withheld Federal Income Tax form. Failing to provide the correct information in this section may lead to processing delays or rejections. To avoid this mistake, ensure you double-check the User ID and CPM Schema provided against your records before submitting the form. If you are unsure of these details, contact the IRS Business and Specialty Tax Line for assistance.

The Employer Identification Number (EIN) is a unique identifier for your business or organization. Incorrect or incomplete EINs may result in processing errors or delays. To ensure accuracy, double-check the EIN provided against your records before submitting the form. If you need to make corrections, file an amended return with the correct information.

Filing a final return without checking the appropriate box may result in unnecessary follow-up from the IRS. To avoid this mistake, carefully review the instructions and check the box indicating that the return is a final return if it applies. If you are unsure, consult the IRS Business and Specialty Tax Line for guidance.

Failure to accurately calculate or enter the total federal income tax withheld from nonpayroll payments on line 1 may result in underpayment or overpayment of taxes. To avoid this mistake, double-check your calculations and ensure that all nonpayroll payments have been accounted for. If you need assistance with calculations, consult a tax professional or the IRS Business and Specialty Tax Line.

Failing to attach the required statement with the name and address of the person keeping payment records may result in processing delays or rejections. To avoid this mistake, ensure that you have completed and attached the statement to the final return before submitting it. If you need assistance with completing the statement, consult the IRS instructions or contact the IRS Business and Specialty Tax Line.

The Annual Return of Withheld Federal Income Tax form, also known as Form 941, requires employers to report their monthly federal income tax liability. Failure to complete this section accurately and on time can result in penalties and interest. To avoid this mistake, employers should ensure they have accurate records of their withholding and deposits throughout the year and complete this section carefully. It is recommended to double-check calculations and consult the instructions provided with the form if needed.

Proper signing and providing the title and date of the signer is essential to ensure the validity of the form. Failure to sign the form or provide the required information can result in processing delays or even rejection of the form. To avoid this mistake, employers should ensure they sign the form and provide their correct title and date. It is recommended to review the instructions provided with the form carefully to understand the signing requirements.

Providing an incorrect IRS filing address based on location and payment method can result in delayed or lost forms. Employers should ensure they use the correct address based on their location and payment method to avoid this mistake. To avoid this mistake, employers should consult the instructions provided with the form or contact the IRS for clarification if needed. It is recommended to double-check the address before mailing the form.

Missing or late filing deadlines can result in penalties and interest. Employers should be aware of the filing deadlines and ensure they file the form on time. To avoid this mistake, employers should mark their calendars with the filing deadlines and set reminders to file the form before the deadline. It is recommended to consult the instructions provided with the form or contact the IRS for clarification if needed.

Employers who have previously filed Form 945 and identified errors should correct them using Form 945-X. Failure to correct errors can result in penalties and interest. To avoid this mistake, employers should review their previously filed Form 945 carefully and correct any errors using Form 945-X as soon as possible. It is recommended to consult the instructions provided with Form 945-X carefully and seek professional advice if needed.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 945 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 945 forms, ensuring each field is accurate.