Yes! You can use AI to fill out Form CMS L564, Request for Employment Info

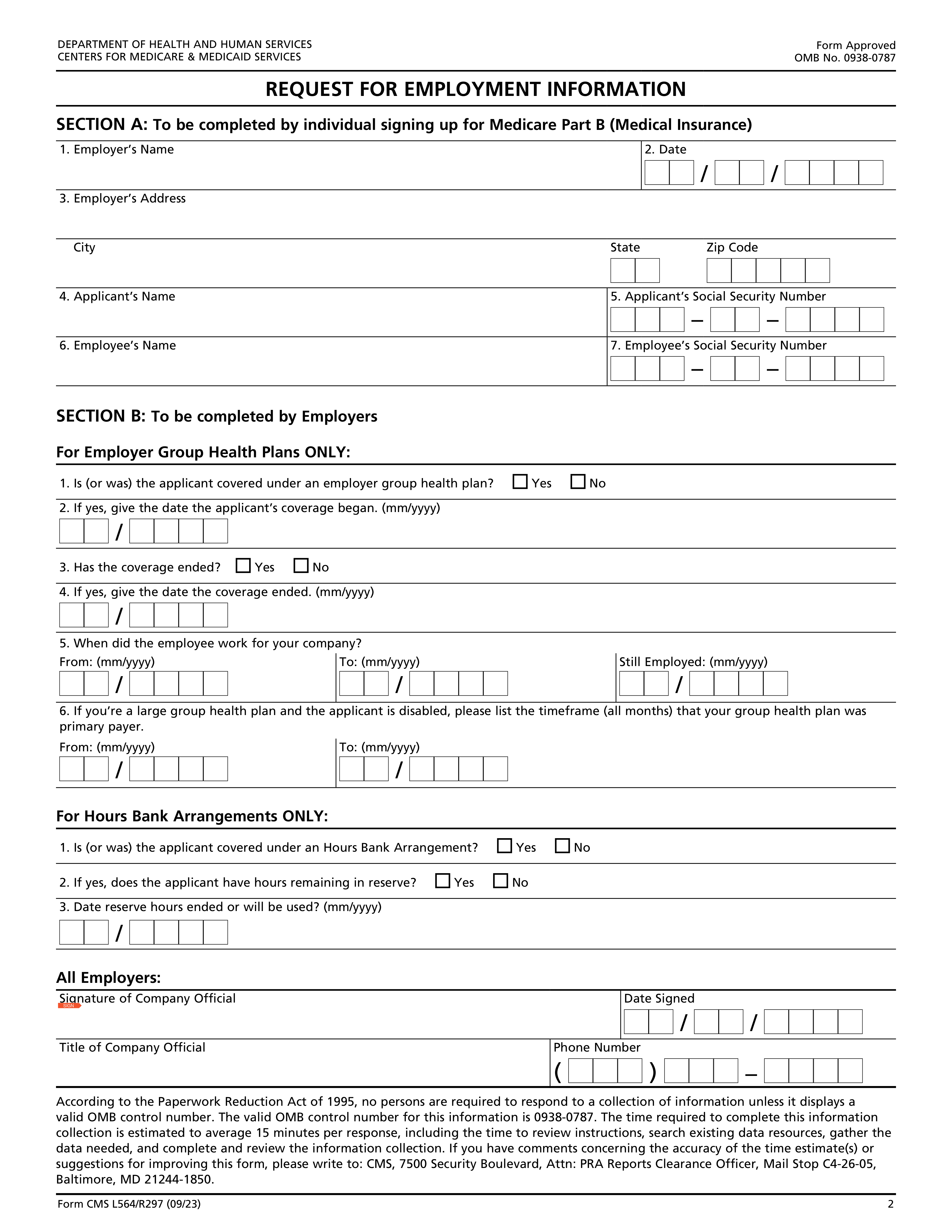

Form CMS L564 is a Request for Employment Information used to verify group health plan coverage for Medicare enrollment. It is crucial for applicants to provide proof of their health coverage to ensure proper processing of their Medicare application.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out CMS L564/R297 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form CMS L564, Request for Employment Info |

| Form issued by: | Centers for Medicare & Medicaid Services |

| Number of fields: | 48 |

| Number of pages: | 3 |

| Version: | 09/23 |

| Language: | English |

| Categories: | employment forms, CMS forms |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out CMS L564/R297 Online for Free in 2026

Are you looking to fill out a CMS L564/R297 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your CMS L564/R297 form in just 37 seconds or less.

Follow these steps to fill out your CMS L564/R297 form online using Instafill.ai:

- 1 Visit instafill.ai site and select CMS L564.

- 2 Complete Section A with your details.

- 3 Provide the form to your employer for Section B.

- 4 Ensure your employer fills out and signs Section B.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable CMS L564/R297 Form?

Speed

Complete your CMS L564/R297 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 CMS L564/R297 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form CMS L564/R297

The Request for Employment Information form (CMS L564/R297) is used to provide proof of group health care coverage based on current employment for Medicare enrollment applications. The employer completes the information about the coverage and employment of the person through which the health coverage is obtained.

Section A of the form is completed by the individual signing up for Medicare Part B. Section B is completed by the employer. The employer provides information about the coverage and employment of the person through which the health coverage is obtained.

Once Section A is completed by the individual, give the form to your employer to complete Section B. After the employer completes Section B, return the form along with your Application for Enrollment in Medicare (CMS-40B) to your local Social Security office.

The person applying for Medicare Part B completes Section A of the form.

The employer completes Section B of the form.

The employer provides information about the coverage and employment of the person through which the health coverage is obtained.

The valid OMB control number for this information collection is 0938-0787.

The time required to complete this information collection is estimated to average 15 minutes per response.

For people with disabilities, the Request for Employment Information form is used to provide proof of large group health plan coverage based on current employment for Medicare enrollment applications.

The employer needs to provide the date the applicant’s coverage began, the date the coverage ended (if applicable), and the timeframe (all months) that the group health plan was primary payer.

An hours bank arrangement is a type of employment arrangement where an employee can accrue hours, which can be used to pay for health insurance premiums in the future.

The employer is required to indicate the following for hours bank arrangements: whether the applicant was covered under such an arrangement, the number of hours the applicant had in reserve, and the date the reserve hours ended or will be used.

If you have any questions about the form or the information collection process, you can contact the Centers for Medicare & Medicaid Services at 1-800-772-1213 or visit their website at www.ssa.gov for assistance.

Compliance CMS L564/R297

Validation Checks by Instafill.ai

1

Ensures the Employer’s Name in Section A is the full legal name and not abbreviated or incomplete.

This validation check ensures that the Employer's Name field in Section A is filled out with the full legal name of the employer. It confirms that no abbreviations or incomplete names are entered, which could lead to confusion or incorrect identification of the employer. The check is crucial for maintaining the integrity of the employment information and for subsequent verification processes.

2

Verifies the Date in Section A is entered in the correct MM/DD/YYYY format and reflects the current date.

This validation check verifies that the date entered in Section A adheres to the standard MM/DD/YYYY format. It also ensures that the date provided is the current date, which is necessary for the timeliness and relevance of the employment information request. This check helps prevent errors related to outdated or improperly formatted date entries.

3

Confirms the Employer’s Address in Section A includes a complete address with city, state, and zip code.

This validation check confirms that the Employer's Address in Section A contains all the necessary components, including the street address, city, state, and zip code. It ensures that the address is complete and can be used for accurate location identification and correspondence. The check is essential for any communications or documentation that may need to be sent to the employer.

4

Checks that the Applicant’s Name in Section A is the full name and matches the name on the Medicare application.

This validation check ensures that the Applicant's Name in Section A is provided in full and corresponds exactly to the name as it appears on the Medicare application. It is crucial for the consistency of the applicant's identity across different documents and for the avoidance of any discrepancies that could arise from name mismatches.

5

Validates the Applicant’s Social Security Number in Section A is in the proper XXX-XX-XXXX format.

This validation check validates that the Social Security Number (SSN) of the applicant in Section A is entered in the standard XXX-XX-XXXX format. It ensures that all nine digits of the SSN are present and correctly segmented, which is vital for the accurate processing and handling of the applicant's personal information.

6

Ensures the Employee’s Name in Section A is correctly entered

The system ensures that the Employee’s Name field in Section A is filled out accurately. It checks whether the name provided matches the standard naming conventions and contains appropriate characters. The validation also confirms that the name corresponds to the applicant or another individual as specified. This check is crucial to maintain the integrity of the employment information.

7

Verifies the Employee’s Social Security Number in Section A matches the Employee’s Name provided

The system verifies that the Social Security Number (SSN) entered in Section A is valid and corresponds to the Employee’s Name provided. It checks the format of the SSN to ensure it follows the standard 9-digit format without any alphabetic characters. The validation process also cross-references the SSN with official databases, if available, to confirm the match with the employee's name.

8

Confirms in Section B that the 'Yes' or 'No' indication for employer group health plan coverage is selected

The system confirms that a selection is made in Section B regarding the employer group health plan coverage. It ensures that either 'Yes' or 'No' is clearly indicated, and that no field is left unanswered. This validation is important to determine the status of the employee's health plan coverage and to proceed with the correct processing of the form.

9

Checks if the coverage began date in Section B is entered in MM/YYYY format when 'Yes' is selected

The system checks that the date when coverage began, as entered in Section B, adheres to the MM/YYYY format, but only when 'Yes' is selected for current coverage. This validation ensures that the date is not only present but also correctly formatted, which is essential for accurate record-keeping and compliance with date format standards.

10

Verifies if the coverage ended date in Section B is entered in MM/YYYY format when 'Yes' is selected for coverage having ended

The system verifies that the coverage ended date in Section B is provided in the MM/YYYY format when 'Yes' is selected, indicating that the coverage has ended. This check is crucial for maintaining consistency in date reporting and ensuring that historical data regarding the employee's health plan coverage is accurately captured and formatted.

11

Validates the employment period dates in Section B are in the correct MM/YYYY format and logically consistent.

This validation check ensures that the employment period dates entered in Section B adhere to the required MM/YYYY format. It also verifies that the start date precedes the end date, maintaining logical consistency. The check prevents the entry of impossible dates, such as those in the future or dates that conflict with known employment timelines. This ensures the accuracy and reliability of the employment period information provided.

12

Ensures for Hours Bank Arrangements in Section B that 'Yes' or 'No' is indicated and details are provided if 'Yes'.

This validation check confirms that a clear indication of 'Yes' or 'No' is provided for the Hours Bank Arrangements question in Section B. If 'Yes' is selected, it further ensures that the necessary details are furnished. This check is crucial for maintaining the completeness of the form and for capturing the specifics of any Hours Bank Arrangements that may exist. It helps in avoiding any ambiguity regarding the employee's benefits and entitlements.

13

Confirms the signature of the Company Official in Section B is present and belongs to an authorized individual.

This validation check verifies that the signature of the Company Official is present in Section B and that it corresponds to an individual who is authorized to sign on behalf of the company. It involves cross-referencing the signature with a database of authorized signatories, if available. This check is essential for validating the authenticity of the form and ensuring that the information is officially endorsed by the company.

14

Verifies the Date Signed in Section B is in the correct MM/DD/YYYY format and is the actual date of signing.

This validation check ensures that the Date Signed field in Section B is filled out in the correct MM/DD/YYYY format. It also verifies that the date provided is plausible, such as not being a future date or a date that predates the creation of the document. This check is important for establishing the timeline of the form's completion and for legal and record-keeping purposes.

15

Checks the Title of Company Official and Phone Number in Section B are provided and accurate.

This validation check ensures that the Title of the Company Official and their Phone Number are both provided in Section B. It also verifies the accuracy of the phone number format and, if possible, the appropriateness of the title for the individual signing the form. This check is crucial for ensuring that there is a reliable point of contact for any follow-up or verification regarding the information on the form.

Common Mistakes in Completing CMS L564/R297

Failure to provide the full and accurate name of the employer may result in processing delays or potential rejection of the form. To avoid this mistake, ensure that the employer's name is entered exactly as it appears on the official business documents, including any abbreviations or special characters. If the employer has multiple locations, use the name and address of the specific location where the employee works.

Incorrect date formats may lead to processing errors or delays. It is essential to enter the date in the specified format (MM/DD/YYYY) to ensure accurate processing. If the date format is unclear, consult the instructions provided on the form or contact the issuing agency for clarification.

An incorrect or incomplete address for the employer may cause processing delays or potential rejection of the form. Ensure that the address includes the street address, city, state, and zip code. If the employer has multiple locations, use the address of the specific location where the employee works.

Failure to provide the full and accurate name of the applicant or employee may result in processing delays or potential rejection of the form. Ensure that the name is entered exactly as it appears on the official identification documents, including any middle initials or suffixes. If the name has changed, provide the previous name and the current name, along with supporting documentation.

An incorrect or incomplete Social Security Number may cause processing delays or potential rejection of the form. Ensure that the number is entered correctly, including any hyphens or spaces. If the Social Security Number is unknown or unavailable, consult the instructions provided on the form or contact the issuing agency for guidance.

When completing the Request for Employment Information form, it is essential to accurately select the applicable employer group health plan coverage or hours bank arrangement. Failing to do so may result in incorrect tax calculations. To avoid this mistake, carefully review the instructions and select the option that applies to your situation. If you are unsure, consult with your employer or tax professional.

Another common mistake is entering an incorrect or incomplete date for the start or end of coverage. This error can lead to discrepancies in tax calculations. To prevent this mistake, double-check the dates provided and ensure they are consistent with your employment records. If you are unsure, contact your employer or tax professional for clarification.

Leaving employment periods blank or providing incorrect dates can result in inaccurate tax calculations. It is crucial to provide complete and accurate information regarding your employment history. To avoid this mistake, carefully review your employment records and enter the correct start and end dates for each period of employment. If you are unsure, contact your employer or tax professional for assistance.

Failing to sign the form and provide the required information for the company official can delay the processing of your tax return. To prevent this mistake, ensure that all required signatures and information are provided before submitting the form. If you are unable to obtain the necessary information, contact your employer or tax professional for assistance.

Providing an incorrect or incomplete phone number for the company official can make it difficult for the IRS to contact your employer for verification of employment information. To avoid this mistake, double-check the phone number provided and ensure it is complete and accurate. If you need to make a change, contact your employer to update the information.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out CMS L564/R297 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills cms-l564 forms, ensuring each field is accurate.