Yes! You can use AI to fill out Form 5695, Residential Energy Credits

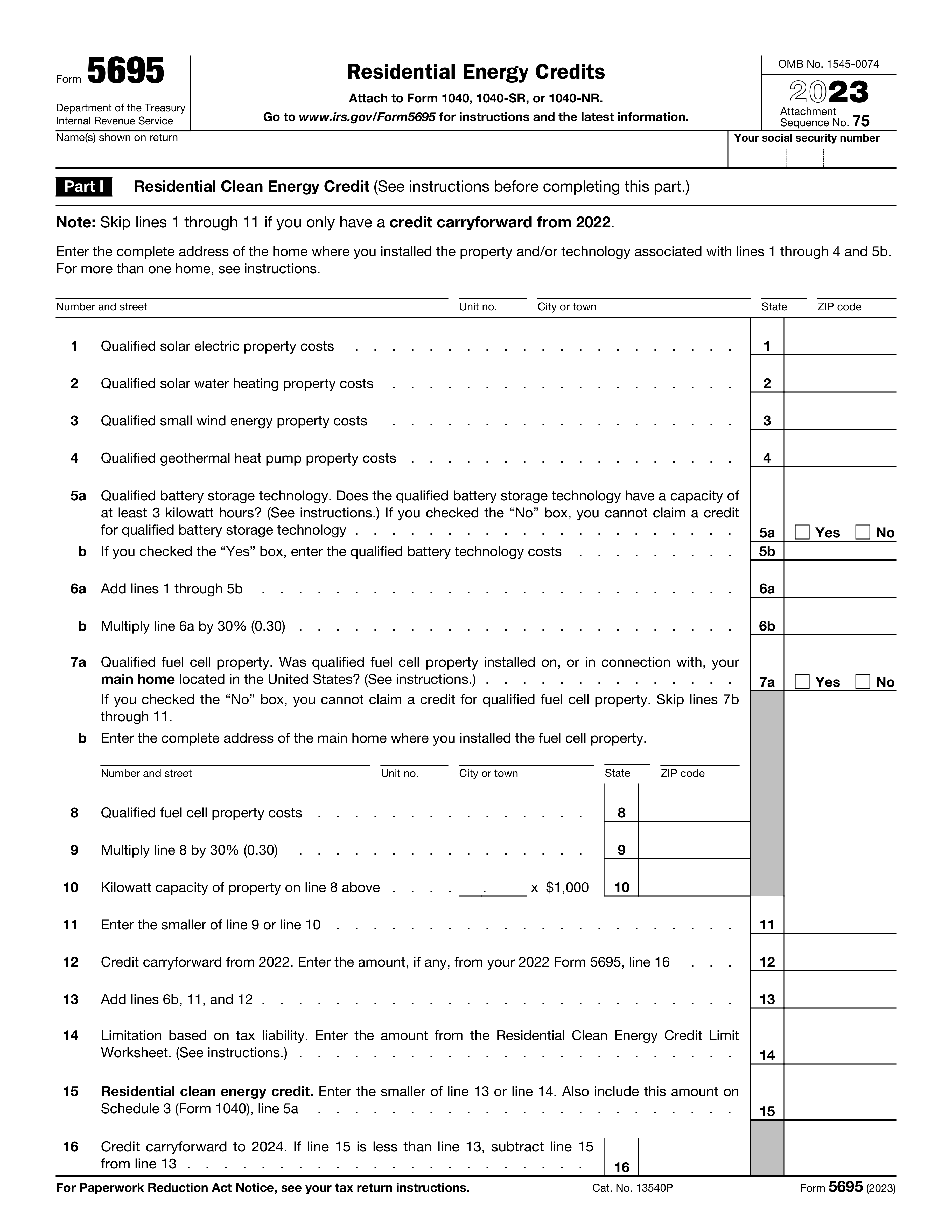

Form 5695, Residential Energy Credits, is used to claim tax credits for residential energy efficiency improvements and renewable energy installations. This form is important for taxpayers looking to reduce their tax burden while investing in energy-saving technologies.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 5695 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 5695, Residential Energy Credits |

| Form issued by: | Department of the Treasury, Internal Revenue Service |

| Number of fields: | 102 |

| Number of pages: | 3 |

| Version: | 2023 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-5695 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i5695.pdf |

| Filled form examples: | Form Form 5695 Examples |

| Language: | English |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out Form 5695 Online for Free in 2026

Are you looking to fill out a FORM 5695 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 5695 form in just 37 seconds or less.

Follow these steps to fill out your FORM 5695 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 5695.

- 2 Enter your name and social security number.

- 3 Fill in the address of the property.

- 4 Complete the sections for energy credits.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 5695 Form?

Speed

Complete your Form 5695 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 5695 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 5695

The Residential Energy Credits Form (Form 5695) is used to calculate and claim tax credits for qualified energy-efficient improvements and renewable energy property installed on or in connection with a taxpayer's main home located in the United States.

Form 5695 should be attached to Form 1040, 1040-SR, or 1040-NR when filing an individual income tax return.

The OMB No. for Form 5695 is 1545-0074.

Complete lines 1 through 5b in Part I of Form 5695 for each qualified solar electric property, solar water heating property, small wind energy property, geothermal heat pump property, and battery storage technology installed on or in connection with your main home.

The Residential Clean Energy Credit is a federal tax credit for qualified energy-efficient improvements and renewable energy property installed on or in connection with a taxpayer's main home located in the United States.

The Energy Efficient Home Improvement Credit is a federal tax credit for qualified energy-efficient improvements made to a taxpayer's main home located in the United States. This credit is also known as Form 5695 or Residential Energy Efficient Property Credit.

Form 5695 should be filed with your individual income tax return (Form 1040, 1040-SR, or 1040-NR) by the annual tax filing deadline. The deadline is typically April 15, but may vary depending on the taxpayer's filing status and other factors.

The maximum credit amount for the Residential Clean Energy Credit is 30% of the qualified costs for each eligible technology. There is no maximum limit for solar water heating property and geothermal heat pump property.

The maximum credit amount for the Energy Efficient Home Improvement Credit is $500 per year for all qualifying improvements combined.

Taxpayers should retain documentation, such as receipts, invoices, and manufacturer certifications, to support the costs claimed on Form 5695. It is important to keep these records for future tax filings and potential audits.

Qualifying improvements include insulation, roofing, windows, doors, skylights, water heaters, and heating and cooling equipment. The improvements must meet certain energy efficiency requirements and be installed in the taxpayer's main home located in the United States.

To be eligible for the Residential Clean Energy Credit, the energy property must be located in the United States and be used primarily for residential purposes. The property must also meet certain energy efficiency requirements and be installed by a qualified person or contractor.

To claim the Energy Efficient Home Improvement Credit and Residential Clean Energy Credit, taxpayers must complete Form 5695 and attach it to their individual income tax return (Form 1040, 1040-SR, or 1040-NR). They should also retain documentation to support the costs claimed on the form.

Compliance Form 5695

Validation Checks by Instafill.ai

1

Ensures that the address of the home with installed qualified residential clean energy property is entered in Part I.

The AI ensures that the address field for the home with installed qualified residential clean energy property is accurately filled in Part I of the form. It checks for completeness and proper formatting of the address, including street name, city, state, and ZIP code. The AI also verifies that the address corresponds to a residential property and not a commercial establishment. Additionally, it cross-references the provided address with installation records to confirm the presence of qualified energy property.

2

Verifies that costs for qualified solar electric, solar water heating, small wind energy, geothermal heat pump property, and battery storage technology are correctly entered on lines 1 through 4, and 5b in Part I, including labor costs.

The AI verifies that the costs entered for qualified solar electric, solar water heating, small wind energy, geothermal heat pump property, and battery storage technology are accurate and reflect the actual expenses incurred. It checks lines 1 through 4, and 5b in Part I for correct figures and includes labor costs associated with the installation. The AI also ensures that the costs are within the typical range for such installations and flags any outliers for review. It may also validate that the expenses are supported by appropriate documentation such as invoices or receipts.

3

Confirms that the qualified fuel cell property costs entered are for the main home and that the credit limit of $500 per each half kilowatt of capacity is not exceeded.

The AI confirms that the costs entered for the qualified fuel cell property are associated with the main home of the filer. It ensures that the credit claimed does not exceed the limit of $500 per each half kilowatt of capacity, as stipulated by the tax regulations. The AI checks the capacity of the installed fuel cell property against the claimed credit and alerts the user if the credit limit is surpassed. It also reviews the documentation to ensure that the installation qualifies for the credit.

4

Completes the Residential Clean Energy Credit Limit Worksheet to determine the allowable credit amount in Part I.

The AI completes the Residential Clean Energy Credit Limit Worksheet to accurately determine the allowable credit amount that can be claimed in Part I of the form. It performs the necessary calculations based on the costs entered for the qualified energy property and applies the relevant limits and thresholds. The AI ensures that the final credit amount is correctly computed and entered into the form. It also checks for any updates to the tax code that might affect the credit calculation.

5

Confirms that the energy efficiency improvements in Section A of Part II were made to the main home and that the filer is the original user of the components.

The AI confirms that the energy efficiency improvements listed in Section A of Part II were made to the filer's main home. It verifies that the filer is the original user of the components, meaning that the components were new when installed and not previously used. The AI checks the installation dates and the purchase records to ensure compliance with the tax credit requirements. It also reviews the specifications of the installed components to confirm that they meet the energy efficiency criteria for the credit.

6

Verifies that the costs for insulation, exterior doors, windows, and skylights meeting energy standards are correctly entered in Section A of Part II.

The AI ensures that the expenses related to insulation, exterior doors, windows, and skylights, which meet specific energy efficiency standards, are accurately recorded in Section A of Part II of the Residential Energy Credits Form. It cross-references the entered costs against the actual invoices or receipts provided by the taxpayer to confirm their validity. The AI also checks that these improvements qualify under the current energy standards set by the IRS for the tax year in question. Additionally, it ensures that the costs are itemized and calculated correctly to prevent any discrepancies that may arise during the tax filing process.

7

Ensures that the costs for energy-efficient improvements such as central air conditioners, water heaters, furnaces, boilers, and biomass stoves are correctly entered in Section B of Part II, including labor costs.

The AI meticulously verifies that the costs incurred for the installation of energy-efficient products like central air conditioners, water heaters, furnaces, boilers, and biomass stoves are accurately inputted in Section B of Part II. It includes the validation of both the purchase price and the labor costs associated with the installation of these items. The AI checks against the provided documentation to ensure that the costs align with the actual expenses and that they meet the energy efficiency requirements for the tax credit. Furthermore, it confirms that the labor costs are eligible for the credit as per the IRS guidelines and that they are properly documented.

8

Completes the Energy Efficient Home Improvement Credit Limit Worksheet to determine the allowable credit amount in Part II.

The AI completes the Energy Efficient Home Improvement Credit Limit Worksheet with precision to ascertain the maximum credit amount that the taxpayer is entitled to claim in Part II of the Residential Energy Credits Form. It calculates the total of all qualifying energy-efficient improvements and applies the relevant limits and caps as per the tax code. The AI ensures that the worksheet is filled out correctly, taking into account all the necessary information to avoid any errors that could impact the credit amount. It also verifies that the final credit amount does not exceed the statutory limits for the tax year.

9

Checks that all manufacturer certifications for qualifying products are retained for records but not attached to the return.

The AI checks to confirm that the taxpayer has retained all necessary manufacturer certifications for the qualifying energy-efficient products, as these documents are essential for substantiating the eligibility of the expenses claimed. It reminds the taxpayer that while these certifications must be kept for their records, they should not be attached to the tax return when filed. The AI also advises on the proper storage of these documents to ensure they are readily available in case of an IRS audit or inquiry.

10

Verifies that the credit is correctly adjusted if there is a tax liability limit and calculates the carryover of the unused portion of the credit to the next year if applicable.

The AI verifies the correct adjustment of the energy credit in the event that the taxpayer's tax liability imposes a limit on the credit that can be claimed in the current year. It calculates any unused portion of the credit that may be eligible for carryover to the subsequent tax year, ensuring compliance with the IRS rules regarding the carryforward of unused energy credits. The AI also ensures that the carryover amount is accurately documented and that the taxpayer is informed of the potential to claim this amount on next year's tax return.

11

Ensures that the specified limits for each type of qualifying property are not exceeded when claiming credits.

The validation process ensures that the credit amounts claimed for each type of qualifying property do not exceed the established limits. It checks the specified maximums for each energy-efficient improvement or installation to prevent any excess claims. This includes cross-referencing the costs of the qualifying properties with the allowable credit caps. The system also alerts the user if the claimed credits surpass the allowable amount for any category of energy-efficient property.

12

Confirms that for joint occupancy, each occupant has completed their own Form 5695 and calculated their portion of the credit based on the amount they paid.

The validation ensures that in cases of joint occupancy, each occupant has independently completed their own Form 5695. It confirms that the credit calculation is based on the actual amount paid by each occupant for the qualifying energy-efficient improvements. The system checks for the proper allocation of costs and credits among the occupants. Additionally, it verifies that each occupant's claim does not exceed their share of the total expenses.

13

Verifies that any subsidy received from a public utility for the purchase or installation of an energy conservation product is subtracted from the product cost before calculating the credit.

The validation verifies that if a subsidy has been received from a public utility for the purchase or installation of an energy conservation product, this amount is deducted from the total product cost before the credit is calculated. It ensures that the net cost after the subsidy is used for the credit calculation to comply with IRS regulations. The system also checks for proper documentation of the subsidy and the adjusted product cost in the form.

14

Ensures that the form is correctly attached to the tax return before submission to the IRS.

The validation process ensures that Form 5695, Residential Energy Credits, is correctly attached to the taxpayer's return before it is submitted to the IRS. It checks for the proper inclusion and placement of the form within the tax return package. The system also verifies that all necessary sections of the form are completed and that the form is signed, if required. This step is crucial to prevent processing delays or rejections by the IRS.

15

Confirms compliance with standard filing procedures when submitting Form 5695 to the IRS.

The validation confirms that the submission of Form 5695 adheres to the standard filing procedures set by the IRS. It checks that the form is filled out accurately, with all required information provided, and that it is submitted by the appropriate tax filing deadline. The system also ensures that the form is sent to the correct IRS address or electronically filed according to the IRS guidelines. This helps to ensure the taxpayer's compliance with tax laws and regulations.

Common Mistakes in Completing Form 5695

When filling out the Residential Energy Credits Form, it is essential to provide a complete and accurate address for the home where the energy improvements were made. This information is necessary for the IRS to process your claim correctly. Incomplete addresses can lead to processing delays or even rejection of your form. To avoid this mistake, double-check that you have entered your full address, including street number, name, and zip code. Additionally, ensure that all fields related to the home's location are filled out completely.

Another common mistake on the Residential Energy Credits Form is entering incorrect costs for qualified energy improvements or labor. It is crucial to ensure that the costs you claim are accurate and directly related to the energy improvements you have made. Incorrect costs can lead to over or underclaiming of the credit, which may result in an audit or even penalties. To avoid this mistake, carefully review the instructions for calculating the costs of eligible improvements and labor. Make sure to keep all receipts and invoices related to the improvements and consult with a tax professional if necessary.

The Residential Clean Energy Credit Limit Worksheet is an essential component of the Residential Energy Credits Form. This worksheet helps you determine the maximum amount of credit you can claim based on the type of energy property and the year it was placed in service. Neglecting to complete this worksheet can result in an incorrect credit amount being claimed, which may lead to processing delays or even an audit. To avoid this mistake, make sure to complete the Residential Clean Energy Credit Limit Worksheet carefully and accurately, following the instructions provided in the form.

When claiming credits for qualifying energy property, it is essential to keep manufacturer certifications as proof of purchase and eligibility. Failing to keep these certifications can result in the rejection of your claim or even an audit. To avoid this mistake, make sure to keep all manufacturer certifications and product documentation in a safe place. Consider scanning and storing digital copies in case originals are lost or damaged.

Finally, it is essential to be aware of the limits for each type of qualifying property when filling out the Residential Energy Credits Form. Exceeding these limits can result in an incorrect credit amount being claimed, which may lead to processing delays or even penalties. To avoid this mistake, carefully review the instructions for calculating the credit amount for each type of qualifying property and ensure that you do not claim more than the specified limit. If you are unsure about the limits or have complex energy improvement projects, consider consulting with a tax professional.

When filing the Residential Energy Credits Form in joint occupancy, it is essential to calculate the credit for each occupant separately. Neglecting to do so may result in underestimating the total potential credit. To avoid this mistake, ensure each taxpayer completes their respective sections of the form accurately and consistently. This will ensure that the total credit is correctly calculated and maximized.

Homeowners may forget to subtract any energy efficiency subsidies they have received from their public utility company when calculating their total energy-related expenses. This oversight can lead to an overestimation of expenses and, consequently, a smaller credit. To prevent this mistake, carefully review any utility bills or correspondence related to energy efficiency subsidies and deduct the appropriate amounts from the total energy-related expenses before calculating the credit.

It is crucial to ensure that all energy efficiency improvements were made to the taxpayer's main home to qualify for the Residential Energy Credits. Failure to do so may result in disqualification of the credit. To avoid this mistake, maintain detailed records of all energy efficiency improvements made to the main home, including dates, costs, and documentation from contractors or vendors.

Homeowners must confirm that they were the original users of energy efficiency components to qualify for the Residential Energy Credits. Installing used or second-hand components may disqualify the taxpayer from receiving the credit. To prevent this mistake, maintain records of the purchase date and original installation of energy efficiency components, and ensure that these records are included with the tax filing.

The Energy Efficient Home Improvement Credit Limit Worksheet requires complete and accurate information to calculate the maximum credit amount. Failure to provide this information may result in an incorrect credit calculation. To prevent this mistake, ensure that all required information, including the taxpayer's name, address, Social Security number, and energy efficiency improvement details, is entered correctly and completely.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 5695 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 5695 forms, ensuring each field is accurate.