Yes! You can use AI to fill out Form SF 1199A, Direct Deposit Sign-Up

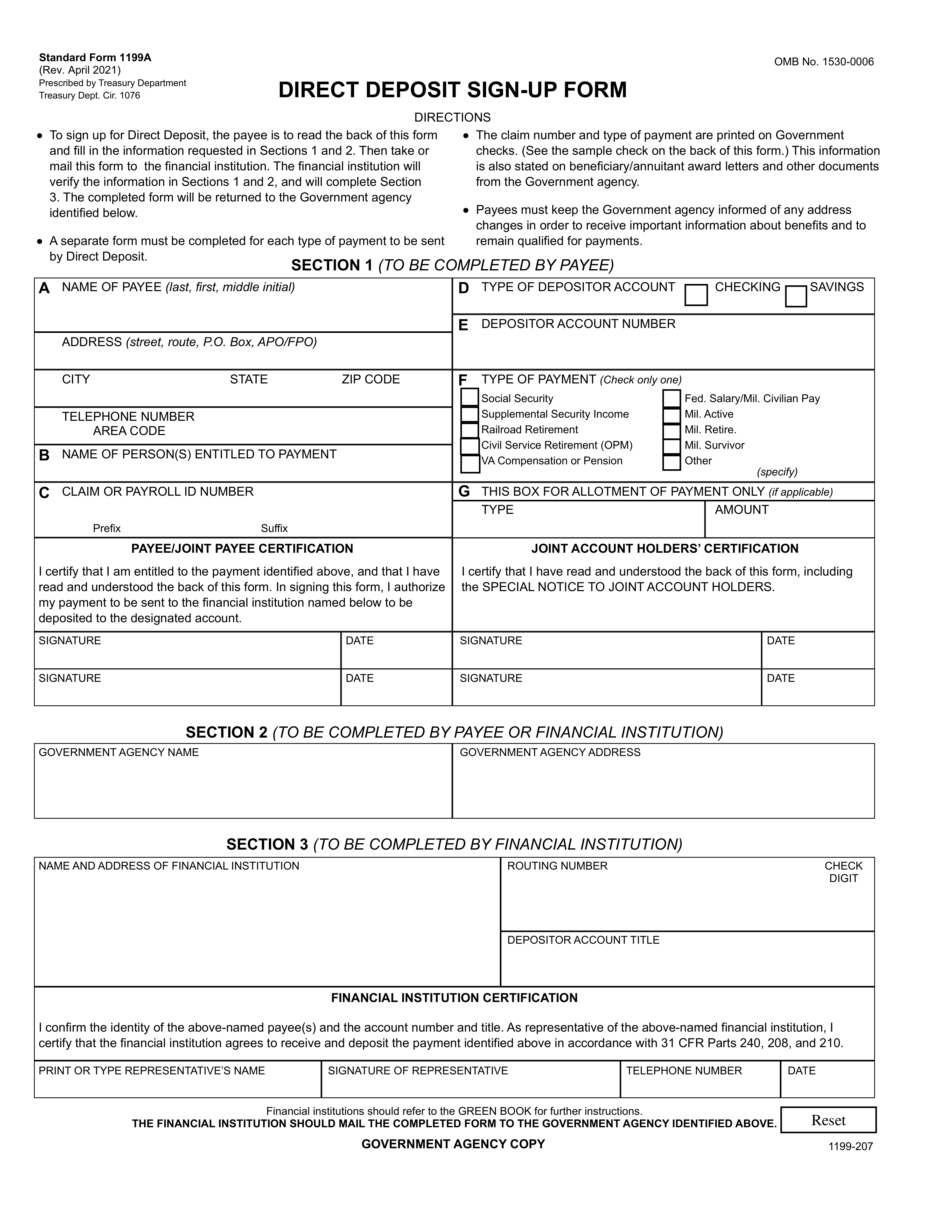

Form SF 1199A, also known as the Direct Deposit Sign-Up Form, is used by individuals to enroll in Direct Deposit to receive federal payments electronically, instead of by paper check. This ensures faster and more secure access to funds.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SF 1199A using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SF 1199A, Direct Deposit Sign-Up |

| Form issued by: | Treasury Department |

| Number of fields: | 216 |

| Version: | 2021 |

| Filled form examples: | Form SF 1199A Examples |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out SF 1199A Online for Free in 2026

Are you looking to fill out a SF 1199A form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SF 1199A form in just 37 seconds or less.

Follow these steps to fill out your SF 1199A form online using Instafill.ai:

- 1 Visit instafill.ai site and select SF 1199A

- 2 Enter payee's name and address

- 3 Provide claim or payroll ID number

- 4 Select type of payment and account

- 5 Enter financial institution details

- 6 Sign and date the form electronically

- 7 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SF 1199A Form?

Speed

Complete your SF 1199A in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SF 1199A form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SF 1199A

Form SF 1199A, also known as the Direct Deposit Sign-Up Form, is used by individuals to establish direct deposit for receiving federal payments. It is a standardized form that allows payees to provide their financial institution information to federal agencies so that payments can be made electronically to the payee's bank account. This form is used to start, change, or stop direct deposit for various types of federal payments, such as Social Security benefits, veterans' benefits, federal retirement, and other government payments.

Section 1 of Form SF 1199A must be completed by the payee, which is the individual or entity entitled to receive the federal payment. The payee provides their personal and payment information in this section, including their name, address, telephone number, and the type of payment they are receiving. This section is crucial for identifying the payee and ensuring that the direct deposit is set up correctly for their account.

In Section 1 of Form SF 1199A, the payee is required to provide the following information: their full legal name, address, telephone number, the name of the federal agency from which they are receiving payments, the type of payment (e.g., Social Security, veterans' benefits), and any additional information or claim numbers associated with the payment. This information helps to accurately identify the payee and the specific payment to be deposited.

A payee certifies their entitlement to the payment on Form SF 1199A by providing accurate personal and payment information in Section 1, and by signing and dating the form in the designated certification area. The signature serves as an attestation that the information provided is correct and that the payee is authorized to receive the federal payment. In some cases, additional documentation may be required to prove entitlement, depending on the agency's requirements.

Through Direct Deposit using Form SF 1199A, a payee can receive a variety of federal payments, including but not limited to Social Security benefits, veterans' benefits, federal retirement annuities, federal salary and wages, tax refunds, and other government assistance payments. The form facilitates the electronic transfer of these payments directly into the payee's bank account, providing a secure and efficient method of payment delivery.

The role of the financial institution in the Direct Deposit sign-up process is to verify the identity and account information of the individual or entity wishing to receive payments by direct deposit. The financial institution is responsible for ensuring the accuracy of the account number and routing number provided on Form SF 1199A. Additionally, the institution may need to certify that the account is eligible for direct deposits and may assist the payee in completing the form. Once the form is completed and verified, the financial institution will forward it to the appropriate government agency for processing.

Once Form SF 1199A is completed and signed by the payee and the financial institution, it should be sent to the federal agency that makes the payments the payee is set to receive. The agency will use the information provided on the form to set up the direct deposit of funds into the payee's account. It is important to follow the specific submission instructions provided by the agency, as procedures may vary.

Yes, a separate Form SF 1199A is typically required for each type of payment a payee is to receive. This is because different government agencies handle different types of payments, and each agency needs a completed form to set up the direct deposit for their specific payments. Payees should complete and submit a Form SF 1199A for each agency from which they are receiving funds.

A payee can find their claim number and type of payment by referring to the documentation provided by the government agency that issues the payments. This information may be found on award letters, benefit statements, or other correspondence from the agency. If the payee is unable to locate this information, they should contact the agency directly for assistance. The claim number and type of payment are essential for accurately completing Form SF 1199A and ensuring that the direct deposit is set up correctly.

Payees must keep the government agency informed of any address changes because the agency may need to send important correspondence regarding the payments, such as notifications of changes to payment amounts, tax documents, or other critical information. An up-to-date address ensures that the payee receives all necessary information in a timely manner and helps prevent potential issues with their payments. Additionally, some agencies may use the address on file as a means of verifying the payee's identity and to maintain accurate records.

The estimated average time burden for completing Form SF 1199A, Direct Deposit Sign-Up, can vary depending on individual circumstances. However, the form is designed to be straightforward and typically takes a short amount of time to complete. The form requires basic information such as the payee's name, address, type of depositor account, and financial institution details. It is advisable to have all necessary information and bank details on hand before starting the form to minimize the time required. For a specific estimate, one would need to refer to the instructions provided with the form or contact the issuing agency.

In the event of the death of a beneficiary, joint account holders should notify the federal agency that issues the payments as soon as possible. The surviving joint account holder may need to provide a copy of the death certificate and complete any required forms or procedures to update the account information or to stop the payments. It is important to follow the specific instructions provided by the issuing agency to ensure proper handling of the deceased beneficiary's payments.

A recipient can cancel the Direct Deposit authorization on Form SF 1199A by contacting the federal agency that issues the payments and requesting the cancellation. The recipient may need to complete additional forms or provide written notice to officially cancel the Direct Deposit service. It is important to follow the agency's procedures to ensure that the cancellation is processed correctly and to avoid any potential issues with future payments.

A financial institution generally does not have the authority to cancel the Direct Deposit authorization on Form SF 1199A without the consent of the account holder. However, if there are issues with the account or if the financial institution is required to close the account for any reason, they may contact the federal agency to inform them of the situation. The account holder would then need to take action to either update the Direct Deposit information or cancel the service.

If a payee wants to change the financial institution receiving the Direct Deposit, they must complete a new Form SF 1199A with the information of the new financial institution and submit it to the federal agency that issues the payments. The payee should ensure that the new account is active and capable of receiving Direct Deposits before making the change. It is also important to coordinate the timing of the change to avoid any missed payments during the transition period.

Presenting a false statement or making a fraudulent claim on Form SF 1199A can result in serious legal consequences. These may include criminal charges such as fraud or forgery, civil penalties, fines, and imprisonment. Additionally, the individual may be subject to administrative actions, such as disqualification from receiving future payments or benefits, and the recovery of any funds obtained through false statements or claims. It is important to provide accurate and truthful information when completing this form to avoid such repercussions.

Financial institutions can find further instructions for completing Form SF 1199A in the guidelines provided by the government agency issuing the payments. These instructions are often included with the form itself or can be found on the agency's official website. Additionally, financial institutions may refer to the Treasury Department's Green Book, which provides federal agencies and financial institutions with guidance on federal government ACH payments and collections.

To complete boxes A, C, and F in Section 1 of Form SF 1199A, the following information from a government check is needed: Box A requires the payee's name as it appears on the government check. Box C needs the payee's address, including the city, state, and ZIP code. Box F should include the claim or payroll ID number, which is often found on the government check or accompanying documentation. This information ensures that the direct deposit is set up correctly and that the funds are deposited into the correct account.

The purpose of the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS on Form SF 1199A is to inform individuals who are opening or using a joint account for direct deposit of government payments about their rights and responsibilities. It highlights that all funds deposited into the joint account are available to all account holders and that the government may recover overpayments from any account holder. The notice serves to protect the government's interests and to ensure that all parties involved are aware of the implications of using a joint account for direct deposit purposes.

If the financial institution cancels the Direct Deposit authorization, the payee should immediately contact the agency that issues the payments to report the cancellation and make alternative arrangements for receiving their payments. The payee may need to complete a new Form SF 1199A or provide other payment instructions to the agency. It is important to address the cancellation promptly to avoid delays or interruptions in receiving payments.

Compliance SF 1199A

Validation Checks by Instafill.ai

1

Ensures that the NAME OF PAYEE is entered with last name, first name, and middle initial in Section 1A

The AI ensures that the NAME OF PAYEE field in Section 1A of Form SF 1199A is filled out correctly, following the format of last name, first name, and middle initial. It checks for the presence of all three components and verifies that they are entered in the specified order. The AI also confirms that the name matches the payee's legal name to prevent any discrepancies with the financial institution's records.

2

Confirms that the NAME OF PERSON(S) ENTITLED TO PAYMENT is provided if different from the payee in Section 1B

The AI confirms that if the NAME OF PERSON(S) ENTITLED TO PAYMENT is different from the payee, it is provided in Section 1B of the form. It checks for the completeness and accuracy of this information, ensuring that it aligns with the legal entitlement to the payment. The AI also validates that this section is not left blank if there is a different entitlement.

3

Verifies that the CLAIM OR PAYROLL ID NUMBER is correctly provided as it appears on government checks or award letters in Section 1C

The AI verifies that the CLAIM OR PAYROLL ID NUMBER entered in Section 1C matches exactly as it appears on government checks or award letters. It checks for the correct sequence of numbers and/or letters, ensuring that there are no transpositions or omissions. The AI also ensures that this identifier is necessary for the accurate processing of the direct deposit.

4

Checks that both the PAYEE and JOINT PAYEE (if applicable) have signed Section 1D and 1E to certify entitlement to the payment and authorize the deposit

The AI checks that Section 1D and 1E of Form SF 1199A are signed by both the PAYEE and the JOINT PAYEE, if applicable. It ensures that the signatures are present and valid to certify entitlement to the payment and to authorize the direct deposit. The AI also confirms that the date of signing is provided and that it is a recent date to reflect current authorization.

5

Validates the GOVERNMENT AGENCY NAME is entered correctly in Section 1F

The AI validates that the GOVERNMENT AGENCY NAME is correctly entered in Section 1F of the form. It checks for the proper spelling and official designation of the agency to ensure that the direct deposit is routed to the correct government entity. The AI also confirms that this information is consistent with other official documents or records.

6

Confirms the NAME AND ADDRESS OF FINANCIAL INSTITUTION are provided accurately in Section 1G

The AI ensures that the name and address of the financial institution are captured correctly in Section 1G of Form SF 1199A. It cross-references the provided information with official databases to confirm accuracy. The AI also checks for any typographical errors and corrects them to prevent any issues with the direct deposit setup. Additionally, it validates the format of the address to ensure it adheres to postal standards.

7

Ensures the PAYEE'S ADDRESS, CITY, STATE, ZIP CODE, and TELEPHONE NUMBER with AREA CODE are correctly entered

The AI verifies that the payee's address, including the city, state, and ZIP code, is entered correctly on the form. It also ensures that the telephone number is provided with the correct area code. The AI performs validation checks against address and telephone number databases to ensure the information is current and accurate. It also formats the data according to the required standards for direct deposit processing.

8

Verifies the TYPE OF DEPOSITOR ACCOUNT is indicated as either CHECKING or SAVINGS and the DEPOSITOR ACCOUNT NUMBER is provided

The AI checks that the depositor has indicated the type of account as either 'CHECKING' or 'SAVINGS' on the form. It also confirms that the depositor account number is provided and is in the correct format. The AI performs a series of checks to ensure that the account number corresponds with the selected account type and that it is a valid number for the financial institution listed.

9

Checks the TYPE OF PAYMENT is selected and specifies if it's an ALLOTMENT OF PAYMENT

The AI reviews the form to ensure that the type of payment is clearly selected and identifies if it is an allotment of payment. It checks for the appropriate selection to be made, ensuring that the form is not processed with incomplete or ambiguous information regarding the payment type. The AI also confirms that the selection aligns with the payee's instructions and the purpose of the direct deposit.

10

Ensures the financial institution's REPRESENTATIVE has PRINTED OR TYPED their NAME, SIGNED, and provided the TELEPHONE NUMBER and DATE in Section 2

The AI ensures that the financial institution's representative has properly printed or typed their name in Section 2 of the form. It also verifies that the representative's signature is present and that a telephone number and date are provided. The AI checks the legibility and completeness of this information to facilitate clear communication and to validate the authorization of the direct deposit setup.

11

Verifies the ROUTING NUMBER, DEPOSITOR ACCOUNT TITLE, and CHECK DIGIT

The AI ensures that the ROUTING NUMBER provided in Section 2 of Form SF 1199A is accurate and corresponds to a valid financial institution. It also confirms that the DEPOSITOR ACCOUNT TITLE matches the account holder's information and that the CHECK DIGIT is correct, which is a crucial component for the verification of the routing number. This validation is essential to prevent any errors in the direct deposit process and to ensure that funds are directed to the correct account.

12

Confirms FINANCIAL INSTITUTION CERTIFICATION

The AI confirms that the FINANCIAL INSTITUTION CERTIFICATION in Section 3 of Form SF 1199A is duly completed and signed by the authorized representative of the financial institution. This certification is a formal acknowledgment by the financial institution that it has verified the identity of the payee(s), their account number, and the account title. This step is critical to ensure the legitimacy and authorization of the direct deposit setup.

13

Checks that the financial institution agrees to receive and deposit the payment

The AI checks that the financial institution has agreed to receive and deposit the payment in accordance with federal regulations, as stated in Section 3 of Form SF 1199A. This includes verifying that the institution's agreement is clearly indicated and that all necessary acknowledgments are in place. This validation is important to ensure compliance with federal guidelines and to confirm the institution's commitment to handling government payments appropriately.

14

Ensures the COMPLETED FORM is mailed to the GOVERNMENT AGENCY IDENTIFIED

The AI ensures that the COMPLETED FORM is correctly mailed to the GOVERNMENT AGENCY IDENTIFIED in Section 1F of Form SF 1199A by the financial institution. This step is crucial for the form to reach the appropriate government agency for processing and to avoid any delays in the establishment of the direct deposit service. The AI's validation includes checking the accuracy of the mailing address and the completeness of the form.

15

Validates that all additional instructions on the back of the form have been read and understood

The AI validates that all additional instructions provided on the back of Form SF 1199A have been thoroughly read and understood by the payee and the financial institution. This includes ensuring that the process for changing receiving financial institutions is clear and that the payee is aware of the penalties for making false statements or fraudulent claims. This comprehensive validation is essential for maintaining the integrity of the direct deposit system and for preventing any misuse or misunderstanding.

Common Mistakes in Completing SF 1199A

Failing to include the name of the government agency responsible for issuing the payment can lead to processing delays or misdirected funds. To ensure accurate and timely payments, it is crucial to provide the full and correct name of the issuing agency in the designated section of Form SF 1199A. Double-check the agency name for accuracy before submitting the form, and consult with the issuing agency if there is any uncertainty regarding the correct name to include.

Inputting an incorrect claim or payroll ID number can result in the misallocation of funds or a failure to deposit the payment altogether. It is essential to verify the accuracy of the claim or payroll ID number by cross-referencing it with official documents or correspondence from the issuing agency. Carefully enter the number in the appropriate field, and review it for any transposition errors or typos before finalizing the form.

The absence of the required signature(s) from the payee or joint payee can invalidate the direct deposit sign-up process. Ensure that all individuals listed on the form provide their signatures in the designated areas. Before submitting Form SF 1199A, perform a final check to confirm that no signature fields have been overlooked. If the form is being completed on behalf of someone else, make sure that individual is present to sign or that you have the legal authority to sign on their behalf.

Excluding the middle initial in the payee's name can lead to confusion, especially if there are multiple individuals with similar names. To prevent any issues with the identification of the payee, include the middle initial along with the first and last name as it appears on banking and government records. This attention to detail helps ensure that the direct deposit is attributed to the correct individual without delay.

Neglecting to provide a full address and telephone number can hinder communication between the payee and the issuing agency, potentially causing delays in the direct deposit setup. It is important to fill in all address fields, including street, city, state, and ZIP code, as well as a current telephone number where the payee can be reached. Double-check the information for completeness and accuracy to facilitate smooth communication and prompt resolution of any issues that may arise.

Selecting the incorrect type of depositor account can lead to funds being routed incorrectly, causing delays in payment. It is crucial to verify whether the account is a checking or savings account before marking the appropriate box on the form. Double-checking with your financial institution if you are unsure of the account type can prevent this error. Always cross-reference your bank documents or online banking information to ensure accuracy.

Failing to provide the depositor account number results in an incomplete form and can prevent the direct deposit from being set up. It is essential to fill in this field with the correct account number as it appears on your checks or bank statements. To avoid this mistake, have your bank documentation on hand when filling out the form and take the time to double-check the account number you've entered for accuracy.

Omitting the type of payment can lead to confusion and improper processing of the direct deposit. It is important to clearly indicate the nature of the payment, such as retirement benefits, vendor payments, or other federal payments. Review the list of payment types provided in the form instructions and ensure you select the correct category that applies to your situation. This will facilitate the correct handling of your direct deposit by the agency.

When a financial institution fails to verify the routing number, there is a risk of the direct deposit being sent to the wrong bank. It is the responsibility of the financial institution to ensure that the routing number provided is correct and corresponds to their institution. As a depositor, you can prevent this error by verifying the routing number with your bank before submitting the form. Additionally, ensure that the financial institution's representative reviews and confirms the routing number upon form completion.

A missing signature or date from the financial representative can invalidate the entire form, leading to delays in the setup of direct deposit. It is imperative that the financial representative reviews the form thoroughly and completes these fields. As the account holder, you should check that these sections are filled out before leaving the bank or financial institution. A quick review of the form before submission can save time and prevent the need for resubmission.

Failing to obtain complete certification from the financial institution can lead to processing delays or rejection of the form. It is crucial that all required fields in the certification section are filled out accurately. Financial institutions must ensure that their routing number, account number, and other pertinent details are provided. Applicants should double-check this section with their bank representative to confirm that all information is correct and complete before submission.

Submitting Form SF 1199A to an incorrect government agency can result in significant delays in the direct deposit setup process. It is essential to verify the correct agency address before mailing the form. Applicants should consult with the government agency that will be making the payments to confirm the proper submission address. Keeping a record of the agency's contact information and the submission address can help prevent this mistake.

Neglecting to read the additional instructions on the back of Form SF 1199A can lead to errors in completion and submission. These instructions often contain important information about the form's requirements and the direct deposit process. Applicants should thoroughly review all instructions provided on the form to ensure compliance with all guidelines. Taking the time to read and understand the entire form can help avoid common errors and ensure accurate processing.

Not updating the government agency with new address information can disrupt communication and potentially delay payments. It is the responsibility of the recipient to promptly inform the agency of any changes to their address. This can usually be done by contacting the agency directly or through an online portal if available. Keeping personal information up to date with the agency ensures that all correspondence and payments are received without interruption.

Attempting to use a single Form SF 1199A for different types of payments is a common error that can cause confusion and processing issues. Each type of payment, such as retirement benefits, vendor payments, or social security, typically requires a separate form. Applicants should complete a distinct Form SF 1199A for each payment stream to ensure proper handling. Clarifying with the paying agency about the need for separate forms for different payments can help avoid this mistake.

When changing direct deposit accounts, it is crucial to maintain active accounts at both the old and new financial institutions until the transition is complete. This ensures that payments are not interrupted. To avoid this mistake, do not close the old account until you have confirmed that the direct deposit has been successfully rerouted to the new account. It is advisable to monitor both accounts closely during the transition period to ensure all deposits are accounted for.

Providing inaccurate information or making false claims on Form SF 1199A can lead to serious legal consequences, including penalties and potential criminal charges. To prevent this, ensure that all information provided on the form is accurate and truthful. Double-check all entries for correctness before submission. If you are unsure about any information, seek clarification from your financial institution or the agency that will be making the deposits before completing the form.

Financial institutions are expected to refer to the GREEN BOOK for guidance on federal payments and collections. Failure to do so can result in errors in processing direct deposits. To avoid this mistake, financial institutions should regularly consult the GREEN BOOK to stay updated on the latest procedures and requirements for handling federal government transactions. Training staff on the GREEN BOOK's guidelines can also help prevent errors and ensure compliance with federal regulations.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SF 1199A with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 1199-a forms, ensuring each field is accurate.