Yes! You can use AI to fill out Form 6198, At-Risk Limitations

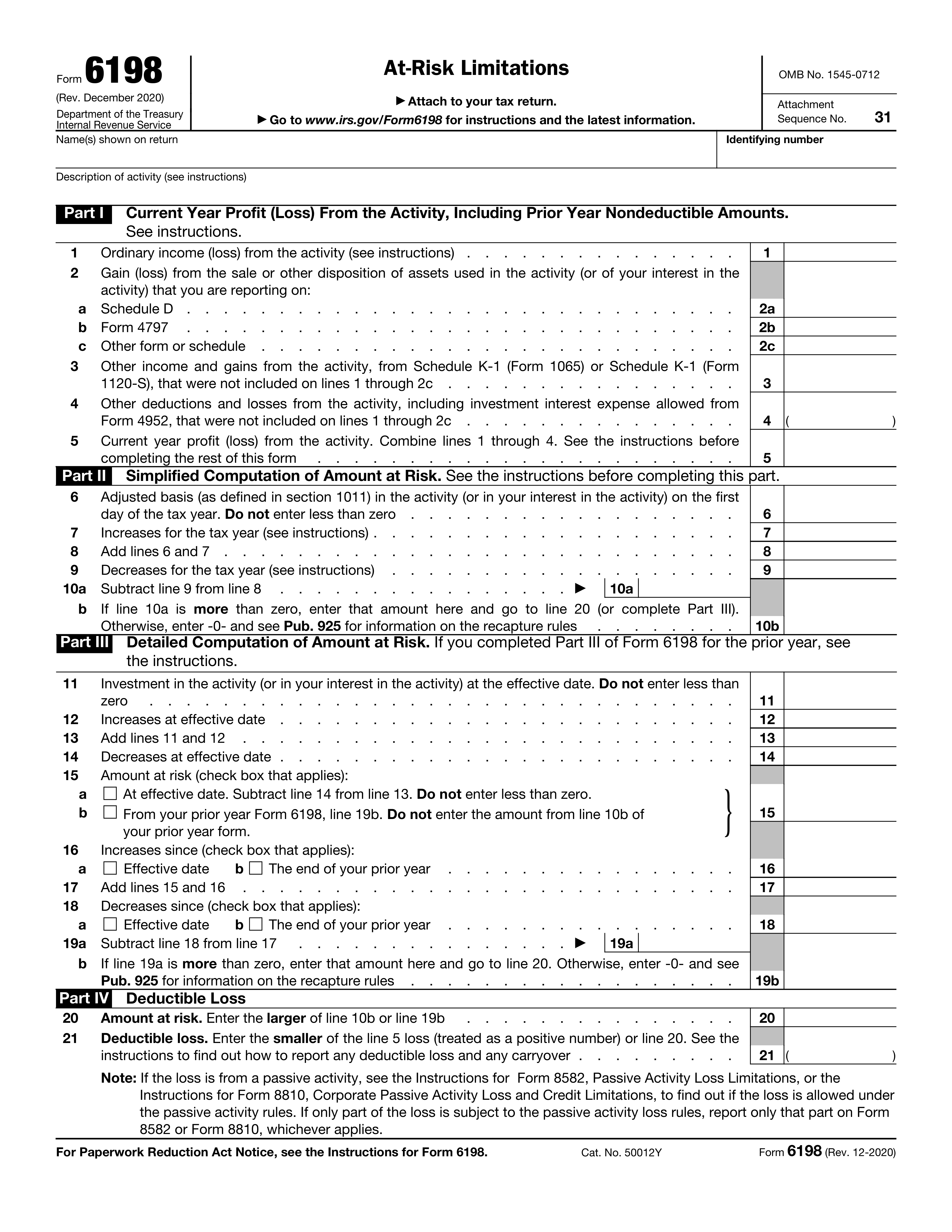

Form 6198, At-Risk Limitations, is used to calculate the amount at risk in an activity for tax purposes. This form is important for determining how much of a loss can be deducted on your tax return, ensuring compliance with IRS regulations.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 6198 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 6198, At-Risk Limitations |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 34 |

| Number of pages: | 1 |

| Version: | 2020 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i6198.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 6198 Online for Free in 2026

Are you looking to fill out a FORM 6198 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 6198 form in just 37 seconds or less.

Follow these steps to fill out your FORM 6198 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 6198.

- 2 Enter your name and identifying number.

- 3 Provide details of the activity and income/loss.

- 4 Complete the sections for adjustments and computations.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 6198 Form?

Speed

Complete your Form 6198 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 6198 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 6198

Form 6198 is used to report your at-risk investments, which are investments where you have a greater potential for loss or reward than a regular investment. The IRS uses this information to determine your at-risk basis in the activity, which is used to calculate your taxable income or loss from the activity.

You are required to file Form 6198 if you are a partner in a partnership or a S corporation shareholder and you have at-risk investments in the activity. You may also be required to file if you are a nonresident alien or if you are engaged in a trade or business in a foreign country.

Part I of Form 6198 requires you to provide information about the at-risk activity, including the name and address of the activity, your percentage of interest in the activity, and the total at-risk investment in the activity. You will also need to provide the name and taxpayer identification number (TIN) of each partner or shareholder who has an at-risk investment in the activity.

Forms or schedules that should be attached to lines 1a and 1b in Part I include Form 1065 (Partnership Return) or Form 1120S (S Corporation Return), as well as any relevant K-1 forms. These forms will provide the necessary information about the partnership or S corporation and the at-risk investments of the partners or shareholders.

Line 1 of Part I reports the total amount of your at-risk investment in the activity, while line 2 reports the amount of your at-risk investment that is subject to the at-risk rules. The at-risk rules limit your losses to the amount of your at-risk investment, so it is important to accurately report the amount of investment that is at risk.

Line 2a in Part I of Form At-Risk Limitations is for reporting the name of the person or entity that is at risk. This could be an individual, partnership, corporation, or estate.

Line 2b in Part I of Form At-Risk Limitations is for reporting the taxpayer identification number (TIN) of the person or entity reported on line 2a. If the person or entity does not have a TIN, enter 'N/A'.

Part II of Form 6198 (At-Risk Limitations) is used to report the at-risk basis and at-risk losses for each activity reported in Part I. This information is necessary to determine the amount of at-risk loss that can be deducted on the taxpayer's income tax return.

Lines 6 and 7 in Part II of Form 6198 (At-Risk Limitations) are for reporting the total at-risk basis and total at-risk losses for each activity reported in Part I. At-risk basis is the taxpayer's total investment in the activity, while at-risk losses are the losses that the taxpayer can deduct from their income.

Lines 8 and 10a in Part II of Form 6198 (At-Risk Limitations) both report the amount of at-risk loss for a specific activity. However, line 8 is for reporting the total at-risk loss for the tax year, while line 10a is for reporting the at-risk loss that exceeds the taxpayer's at-risk basis in the activity. This excess loss may be subject to the at-risk rules and may be limited or disallowed as a deduction.

If the amount on line 10a is less than zero, enter a zero (0) and write 'N/A' in the box next to it. This indicates that the amount reported on line 10 is a loss, which cannot be entered as a negative number.

Part III of Form 6198 is used to report any additional at-risk activities and related losses. This section is optional and should only be completed if you have additional at-risk activities to report.

On line 11, enter the name or description of the activity. On line 12, enter the total at-risk basis in the activity. This is the cost or other basis of the property used in the activity.

Line 13 is used to report any gains from the activity, while line 15 is used to report any losses. If the amount is a loss and less than zero, follow the instructions provided in the answer to question 1 for entering negative amounts.

If the amount on line 15 is a loss and less than zero, follow the instructions provided in the answer to question 1 for entering negative amounts.

Part IV of Form 6198, At-Risk Limitations, is used to report certain transactions involving at-risk activities. At-risk activities include any trade or business activity where the taxpayer does not control the outcome of the activity, such as investments in partnerships, S corporations, or real property. The purpose of reporting these transactions is to determine the taxpayer's at-risk basis in the activity, which is used to calculate potential losses and gains.

Part IV, line 20 of Form 6198 requires the taxpayer to report the total amount of cash and other property contributed to the at-risk activity during the tax year. This includes any amounts paid for services, as well as any loans made to the activity. It is important to note that only contributions made during the tax year should be reported on line 20.

Lines 20 and 21 in Part IV of Form 6198 both relate to contributions to at-risk activities, but they report different types of contributions. Line 20 reports the total amount of cash and other property contributed during the tax year, while line 21 reports the total amount of cash and other property contributed during the tax year that is considered at-risk. The difference between the two amounts is any contribution that is not considered at-risk, such as loans that are not repayable or services rendered. These contributions are not included in the calculation of the taxpayer's at-risk basis.

Part IV, line 21 of Form 6198 requires the taxpayer to report the total amount of cash and other property contributed during the tax year that is considered at-risk. This includes any contributions that the taxpayer has control over, such as capital contributions, and any loans that are repayable. The at-risk basis is calculated by subtracting any non-at-risk contributions reported on line 20 from the total at-risk contributions reported on line 21.

Compliance Form 6198

Validation Checks by Instafill.ai

1

Ensures that Form 6198 is used if there are amounts not at risk in an at-risk activity with a loss during the tax year.

The system ensures that Form 6198 is utilized when necessary, specifically if there are amounts not at risk in an at-risk activity that has incurred a loss in the given tax year. It checks for the presence of nonrecourse financing, stop-loss agreements, or other forms of protection against loss that would necessitate the use of Form 6198. The system also verifies that the form is correctly filled out to reflect these amounts, thereby maintaining compliance with IRS regulations. Lastly, it prompts the user to complete Form 6198 if such conditions are met to ensure proper reporting of at-risk limitations.

2

Confirms that all at-risk activities, such as farming, film production, and oil and gas exploration, are properly identified.

The system confirms that all at-risk activities are properly identified on the form. It includes a validation check to ensure that activities such as farming, film production, and oil and gas exploration, which are subject to at-risk rules, are clearly marked and reported. The system cross-references the reported activities with a database of known at-risk activities to ensure accuracy. It also alerts the user to any discrepancies or omissions in the identification of at-risk activities to prevent errors in reporting.

3

Verifies that amounts not at risk, including nonrecourse loans and amounts protected against loss by guarantees, are correctly identified.

The system verifies that any amounts not at risk are correctly identified on the form. It checks for nonrecourse loans, guarantees, and other financial arrangements that may protect the taxpayer from loss, ensuring these are accurately reported. The system also reviews the structure of the financing to confirm that it qualifies as not at risk. Additionally, it ensures that these amounts are properly reflected in the calculations of the at-risk limitations, maintaining the integrity of the form.

4

Checks that the profit or loss from the at-risk activity for the current year is accurately included in Part I.

The system checks that the profit or loss from the at-risk activity for the current tax year is accurately reported in Part I of the form. It performs calculations to verify that the amounts entered are consistent with the financial data provided for the at-risk activity. The system also ensures that any carryover losses or profits from previous years are correctly factored into the current year's calculations. It alerts the user to any inconsistencies or errors in the reported profit or loss figures.

5

Confirms that any prior year nondeductible amounts due to at-risk limitations are included on the appropriate form or schedule before starting Part I.

The system confirms that any prior year nondeductible amounts due to at-risk limitations are properly included on the appropriate form or schedule before the user begins filling out Part I. It checks historical data to ensure that any amounts that were not deductible in previous years due to at-risk limitations are carried forward accurately. The system also verifies that these amounts are considered when calculating the current year's at-risk limitations. It provides guidance to the user on how to properly include these amounts in the current year's tax forms.

6

Adjusted Basis Verification

Ensures that the adjusted basis of the property at the beginning of the tax year is accurately reported in Part II of the At-Risk Limitations form. It verifies that any increases or decreases to the basis that occurred during the tax year are correctly calculated and entered. This check is crucial for maintaining the integrity of the form as it affects subsequent calculations related to the taxpayer's at-risk amount.

7

Part III Usage Check

Confirms that Part III of the form is utilized appropriately. It ensures that Part III is only used if Part II was not applicable or if using Part III results in a larger amount at risk for the taxpayer. This validation check is important to ensure that the taxpayer maximizes their eligible at-risk amount while complying with the form's requirements.

8

Part III Line Skipping Check

Checks that lines 11 through 14 in Part III are correctly skipped when the activity in question began on or after the effective date specified by the form's instructions. This validation is essential to prevent the entry of unnecessary or incorrect information, which could potentially lead to miscalculations of the at-risk amount.

9

Part III Increases and Decreases Verification

Confirms that lines 15 and 16 in Part III are completed accurately, reflecting any increases or decreases to the at-risk amount since the end of the prior tax year or since the effective date. This check ensures that the taxpayer's at-risk amount is up to date and includes all relevant financial changes.

10

Deductible Loss Limitation Check

Verifies that the deductible loss reported in Part IV does not exceed the amount on line 20 if the loss on line 5 is greater than that amount. This validation check is critical to ensure that the loss claimed by the taxpayer does not surpass the allowable at-risk limitation, maintaining compliance with tax regulations.

11

Ensures that the correct portion of each deduction or loss item is determined if the amount on line 21 is made up of more than one item.

The software ensures that when the amount on line 21 of the At-Risk Limitations form consists of multiple items, each item's deduction or loss is accurately calculated. It cross-references the details of each item to confirm that the sum corresponds to the total on line 21. The system also checks for common errors in arithmetic and alerts the user to discrepancies. This validation is crucial for maintaining the integrity of the form and ensuring compliance with tax regulations.

12

Confirms that Form 6198 is attached to the tax return and that a copy is kept for records.

The software confirms that Form 6198, which details At-Risk Limitations, is properly attached to the taxpayer's return. It checks for the presence of the form within the tax return file and ensures that it is filled out correctly. Additionally, the system prompts the user to save a copy of the form for their records, as required by tax law. This validation helps prevent processing delays and potential penalties for missing documentation.

13

Checks that a separate Form 6198 is filed for each at-risk activity if there is more than one.

The software checks to ensure that if a taxpayer is involved in multiple at-risk activities, a separate Form 6198 is completed and filed for each one. It verifies the number of activities and the corresponding forms, ensuring that each form is accurately linked to its respective activity. This validation is important for proper reporting and to avoid confusion or errors that could arise from combining information from different activities.

14

Verifies that recapture income is accounted for if there is a distribution or transaction that reduced the amount at risk to less than zero.

The software verifies that any recapture income is properly accounted for in situations where a distribution or transaction has reduced the taxpayer's amount at risk below zero. It checks for the correct reporting of such income on the form and ensures that it aligns with the tax code requirements. This validation is essential to prevent underreporting of income and to ensure that the taxpayer's obligations are met.

15

Ensures that all records needed to complete Form 6198 are kept for as long as they may become material in the administration of any Internal Revenue law.

The software ensures that all necessary records for completing Form 6198 are retained for the period required by law. It prompts the user to confirm the retention of these records and may provide reminders or guidelines on the duration for which these records should be kept. This validation is critical for compliance with record-keeping requirements and aids in the preparation for any future audits or reviews by tax authorities.

Common Mistakes in Completing Form 6198

Taxpayers may overlook reporting certain activities as at-risk, leading to underreported income and potential penalties. To avoid this mistake, carefully review all activities and consult tax advisors if uncertain. Properly documenting and reporting all at-risk activities is crucial for accurate tax filings and compliance.

Determining whether an activity is at-risk can be complex, and taxpayers may make errors due to misunderstanding the rules or misapplying the facts. To minimize this risk, consult tax advisors, review the instructions and regulations carefully, and maintain thorough documentation of the activity's income and expenses.

Calculating the adjusted basis in an at-risk activity or interest in a partnership or S corporation can be intricate, and errors may lead to incorrect at-risk limitations. To prevent this mistake, double-check calculations, consult tax advisors, and ensure all relevant information is accurately reported.

Taxpayers may overlook reporting prior year nondeductible losses or income related to at-risk activities, leading to potential penalties and incorrect tax filings. To avoid this mistake, maintain thorough records of all at-risk activities and consult tax advisors if uncertain.

The At-Risk Limitations form contains complex calculations in Part II and Part III, and errors in completing these sections can result in incorrect at-risk limitations. To minimize this risk, consult tax advisors, review instructions carefully, and double-check calculations to ensure accuracy.

One of the most common mistakes made when completing the At-Risk Limitations form is failing to limit the deductible loss to the amount at risk. This means that taxpayers may claim losses that exceed their actual at-risk investment. To avoid this mistake, carefully review the instructions for calculating the at-risk basis and ensure that all losses are limited to this amount. Proper record keeping and documentation of all investments and related expenses can help ensure accuracy in this calculation.

Another mistake made when completing the At-Risk Limitations form is failing to attach Form 6198, Capital Losses - Farming, to the tax return. This form is required to report any losses that are subject to the at-risk rules. Failure to attach Form 6198 can result in penalties and delays in processing the tax return. To avoid this mistake, make sure to complete and attach Form 6198 to the tax return along with the At-Risk Limitations form.

Inadequate record keeping is a common mistake that can lead to errors when completing the At-Risk Limitations form. Proper record keeping is essential for accurately calculating the at-risk basis and tracking losses. This includes maintaining detailed records of all investments, expenses, and related transactions. To avoid this mistake, establish a system for organizing and maintaining records throughout the year, and consider using accounting software or other tools to help keep track of financial information.

Another mistake made when completing the At-Risk Limitations form is failing to consider the recapture income rules. These rules apply when a taxpayer disposes of property that has appreciated in value, and can affect the amount of losses that are deductible. To avoid this mistake, carefully review the instructions for calculating recapture income and ensure that all gains and losses are properly accounted for. Proper record keeping and documentation of all transactions can help ensure accuracy in this calculation.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 6198 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 6198 forms, ensuring each field is accurate.