Yes! You can use AI to fill out Form 8288, U.S. Withholding Tax Return

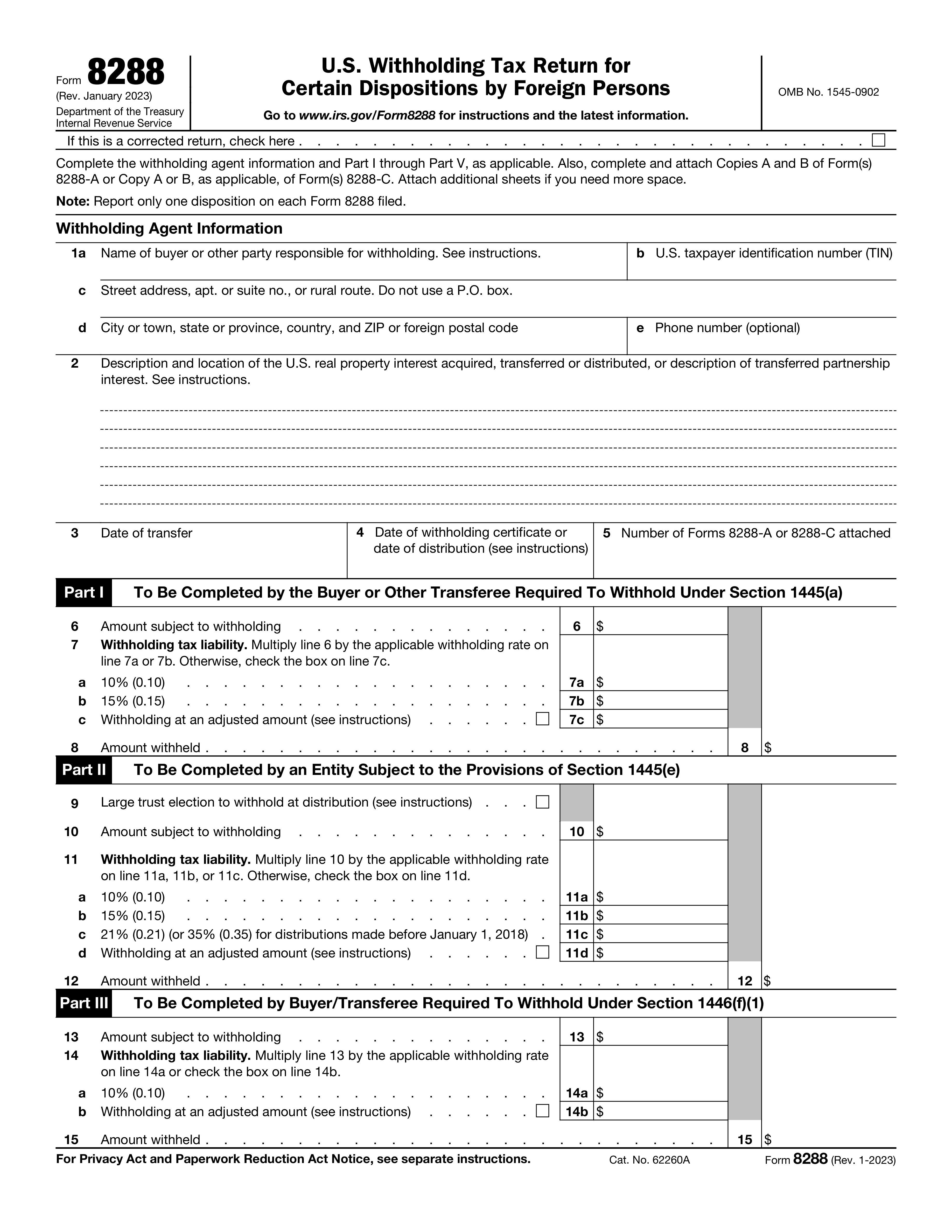

Form 8288, U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons, is used to report and pay withholding tax on the sale or transfer of U.S. real property interests by foreign individuals or entities. This form is crucial for ensuring that the appropriate taxes are withheld and reported to the IRS.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8288 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8288, U.S. Withholding Tax Return |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 54 |

| Number of pages: | 2 |

| Version: | 2023 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i8288.pdf |

| Language: | English |

| Categories: | tax forms, tax withholding forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8288 Online for Free in 2026

Are you looking to fill out a FORM 8288 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8288 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8288 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8288.

- 2 Complete withholding agent information.

- 3 Fill out Parts I through V as needed.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8288 Form?

Speed

Complete your Form 8288 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8288 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8288

Form 8288, Withholding Tax Return, is used by U.S. persons or entities (withholding agents) to report and pay withholding tax on income paid to nonresident alien individuals or foreign entities. This form is also used to claim a reduction or exemption from withholding based on a tax treaty or other applicable law.

U.S. persons or entities (withholding agents) that are required to withhold taxes under the Internal Revenue Code (IRC) on income paid to nonresident alien individuals or foreign entities must complete Form 8288. This includes, but is not limited to, payments for services, rents, royalties, and interest.

The Withholding Agent Information section requires the name, address, and taxpayer identification number (TIN) of the withholding agent. It also asks for the withholding agent's contact information and the type of income being paid. This information is used to identify the withholding agent and ensure proper reporting and payment of withholding tax.

Part I of Form 8288 is used to report withholding tax on payments made to nonresident alien individuals. Part II is used to report withholding tax on payments made to foreign entities, including trusts and estates. Part III is used to report withholding tax on payments made to foreign persons under the backup withholding rules. Each part requires different information based on the type of payment and the payee.

The Large trust election in Part II of Form 8288 allows a withholding agent to treat a foreign trust as a domestic trust for withholding tax purposes. This election can simplify the withholding process and reduce the reporting requirements for the withholding agent. However, it may also result in higher withholding tax rates for the trust. The election must be made by the withholding agent and must be based on the trust meeting certain requirements, including having a U.S. trustee or a U.S. agent.

Form 8288, U.S. Withholding Tax Return, is used to report withheld taxes on payments to nonresident alien individuals and foreign corporations. The tax liability is calculated differently in each part:

Part I: Withholding tax on fixed and determinable income (FDI), such as interest, dividends, rents, and royalties. The tax is calculated at a flat rate based on the type of income and the payee's tax treaty status, if applicable.

Part II: Withholding tax on wages paid to nonresident alien individuals. The tax is calculated based on the wages paid and the applicable tax treaty rate, if any.

Part III: Withholding tax on other types of income, such as commissions, fees, and annuities. The tax is calculated based on the type of income and the payee's tax treaty status, if applicable.

It is important to note that the tax rates and rules can change, so it is essential to refer to the current IRS instructions for Form 8288.

The regular withholding rate is the rate specified in the IRS tax tables or rates published in tax treaties. Withholding at an adjusted amount refers to withholding at a rate different from the regular rate due to a tax treaty provision or a request from the payee. For example, a tax treaty may provide for a reduced rate of withholding on certain types of income. In such cases, the payer must withhold at the adjusted rate and report it on Form 8288.

Another situation where withholding at an adjusted amount may apply is when the payee requests a lower rate of withholding based on their income and tax filing status. The payer must obtain a valid withholding certificate, such as Form W-8BEN or W-8BEN-E, from the payee before withholding at the adjusted rate. The payer must then report the adjusted rate on Form 8288.

The deadline for filing Form 8288 depends on the payment type and the payment date. Generally, Form 8288 must be filed quarterly, by the 20th day of the month following the end of the quarter. For example, for payments made between January 1 and March 31, Form 8288 must be filed by April 20.

However, there are some exceptions to this rule. For example, if the total withholding for the calendar year is less than $5,000, the form need not be filed. Additionally, if the payer is a U.S. government agency or a tax-exempt organization, they may have different filing requirements.

It is important to note that failure to file Form 8288 on time can result in penalties, so it is essential to check the current IRS instructions for Form 8288 and any applicable tax laws.

If a Form 8288 is not filed on time, the payer may be subject to penalties. The penalty for late filing is generally 5% of the unpaid tax for each month or part of a month that the form is late, up to a maximum of 25%. However, the IRS may waive the penalty if the payer can demonstrate reasonable cause for the late filing.

It is important to note that failure to file Form 8288 on time can also result in the withheld taxes not being credited to the payee's account, which can delay their tax refund or result in additional taxes owed.

Therefore, it is essential to ensure that Form 8288 is filed on time to avoid penalties and ensure that the withheld taxes are properly credited to the payee's account.

If a nonresident alien individual or foreign corporation has overpaid withheld taxes, they may be able to request a refund by filing Form 843, Claim for Refund and Request for Abatement. The form must be filed within three years from the due date of the return for the tax year in which the overpayment occurred.

To request a refund of withheld taxes reported on Form 8288, the payee must provide the following information:

- Their name, address, and taxpayer identification number (TIN)

- The name and address of the payer

- The tax year and quarter(s) involved

- The amount of overpayment and the reason for the overpayment

The payee should also attach a copy of Form 8288 to their Form 843.

It is important to note that the IRS may deny a refund request if the payee fails to provide sufficient documentation or if the overpayment was due to a mathematical error or clerical mistake.

Therefore, it is essential to ensure that all required information is provided and that the form is filed within the specified time frame to maximize the chances of receiving a refund.

The preparer is responsible for completing and signing Form 8288, Withholding Tax Return, on behalf of the withholding agent. The preparer must ensure that all required information is accurately reported and that the form is submitted timely to the IRS. The preparer should have a valid Taxpayer Identification Number (TIN) and sign the form in the designated area. If the preparer is an entity, it must also provide its name and address.

The penalty for false or misleading statements on Form 8288 can be severe. The IRS may impose penalties on the withholding agent, the preparer, and any other responsible party for failing to collect, withhold, report, and pay over the required withholding tax. Penalties can include fines, interest, and even criminal charges. It is essential to ensure the accuracy of the information reported on Form 8288 to avoid potential penalties.

Forms 8288-A and 8288-C are both related to withholding tax reporting but serve different purposes. Form 8288-A, Statement for Agents, is used by withholding agents to report withheld taxes for the current quarter. Form 8288-C, Annual Withholding Statement for Individuals, is used by individuals to report their total withholding for the calendar year. Form 8288 is the primary form used by withholding agents to report and pay over withheld taxes to the IRS.

The instructions and separate instructions sections in Form 8288 are essential for correctly completing and filing the form. The instructions provide guidance on how to fill out the form, what information is required, and when the form must be filed. The separate instructions sections contain detailed explanations of specific parts of the form, such as the calculation of withholding tax or the reporting of backup withholding. It is important to read and follow the instructions carefully to ensure the accuracy and completeness of the form.

The OMB No. (Office of Management and Budget) for Form 8288 is 1545-0047. This number is used to identify the form for statistical and reporting purposes. It is important to include this number on any correspondence or submissions related to Form 8288 to ensure proper processing by the IRS.

The U.S. Taxpayer Identification Number (TIN) is a tax processing number issued by the Internal Revenue Service (IRS). It consists of nine digits: nine for individuals, institutions, and entities, and the last digit is a check digit. The TIN is required in Part I, Section A, Line 1 of Form 8288, 'Withholding Tax Return on Payment to a Foreign Person.' It is also required in Part II, Section A, Line 1 for each payment made to a foreign person.

The U.S. real property interest section in Part II of Form 8288 is used to report withholding tax on payments related to the disposition of U.S. real property interests. This includes sales, exchanges, and certain other transactions. The section requires the reporting person to provide the name and TIN of the foreign person, the description of the property, the date of the transaction, and the amount of the payment. This information is necessary for the IRS to ensure proper reporting and withholding of taxes on income derived from U.S. real property.

A corrected return on Form 8288 is a submission of previously reported withholding tax information that has been amended due to errors or omissions. It is filed to correct any inaccuracies in the original return. The corrected return should be filed as soon as possible to minimize any potential penalties or interest charges. An original return, on the other hand, is the initial submission of withholding tax information for a given tax year. It should be filed accurately and timely to ensure compliance with U.S. tax laws and regulations.

Compliance Form 8288

Validation Checks by Instafill.ai

1

Form Identification

Ensures that the U.S. Withholding Tax Return (Form 8288) and associated forms (Form 8288-A and Form 8288-C) are correctly identified and separated for processing. The system checks for the presence of each form and verifies that they are not mixed with unrelated documents. It also ensures that each form is the latest version required by the IRS and that they are properly labeled for easy identification during the tax processing workflow.

2

Completion of Form 8288

Confirms that all sections of Form 8288 are completed according to the transaction type requirements. This includes validating the completeness and accuracy of the name, address, and Taxpayer Identification Number (TIN) of the withholding agent. The system also checks for any mandatory fields that are left blank and prompts for the necessary information to ensure compliance with IRS regulations.

3

Property Description Accuracy

Verifies that the location and description of the property on Form 8288 are accurately provided. The system cross-references the property details with public records or other provided documents to ensure that the description matches the actual property involved in the transaction. It also checks for any discrepancies in the property identification and alerts for potential errors.

4

Transfer Date Verification

Checks that the date of the transfer is clearly stated and corresponds to the transaction requiring withholding. The system compares the transfer date with the dates on associated legal documents to ensure consistency. It also verifies that the date format follows IRS standards and that the date is within the tax year being reported.

5

Withholding Amount Calculation

Calculates the amount subject to withholding and confirms that the actual amount withheld is correctly entered on Form 8288. The system uses the provided information to compute the withholding tax based on current IRS rates and regulations. It then compares the calculated amount with the amount entered on the form to ensure that the withholding is accurate and complies with the tax obligations.

6

Validates that a copy of the withholding certificate for reduced rate withholding, if applicable, is attached to Form 8288.

The system ensures that if a reduced rate of withholding is applicable, a copy of the withholding certificate is attached to Form 8288. It checks for the presence of this document and alerts the user if it is missing. This validation is crucial to comply with tax regulations and to prevent any delays in processing the form. The system also assists in identifying the correct attachment based on the information provided within the form.

7

Ensures that Form 8288-A is completed separately for each person subject to withholding and that copies A and B are attached to Form 8288.

The system verifies that a separate Form 8288-A is completed for each individual subject to withholding. It ensures that both copies A and B of Form 8288-A are properly attached to Form 8288. This check is important for maintaining accurate records and for the IRS to correctly allocate withholding to the appropriate individuals. The system also helps to organize the forms to ensure that each is complete and correctly attached.

8

Verifies that the IRS will stamp Copy B of Form 8288-A and that it is forwarded to the foreign person subject to withholding.

The system confirms that Copy B of Form 8288-A, once stamped by the IRS, is forwarded to the foreign person who is subject to withholding. This verification is essential for the foreign person to receive proof of withholding and for their own tax records. The system tracks the status of the form to ensure that it is processed and handled correctly after IRS intervention.

9

Confirms that for Form 8288-C, only one form per distribution per transferee partner is attached and that Copy A is included with Form 8288.

The system checks that for each distribution, only one Form 8288-C is attached per transferee partner and that Copy A of this form is included with Form 8288. This confirmation helps prevent duplicate submissions and ensures that the IRS receives the necessary documentation for each transaction. The system's role is to maintain order and accuracy in the submission process.

10

Checks that Copy B of Form 8288-C is sent to the transferee(s) as required.

The system reviews that Copy B of Form 8288-C is sent to the transferee(s) in accordance with the requirements. This check is important to ensure that all parties involved have the necessary documentation for their records. The system aids in tracking the distribution of forms to guarantee compliance with the procedural requirements.

11

Filing Deadline Compliance

Ensures that the U.S. Withholding Tax Return is filed by the 20th day following the transaction that necessitates withholding. This check is crucial to avoid penalties for late submission. It also confirms that the date of the transaction is clearly indicated on the form to establish the deadline. Additionally, it alerts the filer if the due date is approaching or has passed, and provides guidance on next steps if the deadline cannot be met.

12

Submission to Ogden Service Center

Validates that the completed Form 8288, along with the required amount withheld and any necessary attachments, is sent to the Ogden Service Center at the correct address. This check ensures that the form is directed to the proper IRS office for processing. It also verifies the completeness of the submission, including attachments, and checks that the address provided on the form matches the latest IRS guidelines.

13

Preparer Information Verification

Confirms that if a paid preparer is utilized, they have duly signed the form and included their Preparer Tax Identification Number (PTIN). This validation is essential for IRS tracking and accountability purposes. It also ensures that the preparer's information is current and valid, and that the signature is present where required.

14

Documentation Retention

Verifies that copies of all forms and supporting documentation are retained for records in accordance with the instructions provided with Form 8288. This check is important for audit purposes and future reference. It also ensures that the filer is aware of the retention period and the types of documents that must be kept.

15

Regulatory Compliance Update

Checks for the latest information and updates related to Form 8288 and its instructions on the IRS website to ensure compliance with current regulations. This validation helps to keep the filer informed about any changes in the law or filing procedures. It also assists in identifying any new requirements or revisions to the form that may affect the filing process.

Common Mistakes in Completing Form 8288

The U.S. Withholding Tax Return (Form 8288) must be filed by the withholding agent within 20 days after the date of the transaction. Neglecting to meet this deadline can result in penalties and interest charges. To avoid this mistake, ensure that you are aware of the transaction date and mark your calendar to file Form 8288 promptly. Additionally, consider setting up automated reminders or using tax software to help manage your filing deadlines.

It is crucial to provide accurate and complete information for the withholding agent on Form 8288. Incorrect reporting of the name, address, or Taxpayer Identification Number (TIN) can lead to processing delays and potential penalties. To prevent this mistake, double-check all information provided and consider using the IRS's Business Master File or the SSN validation tool to ensure the accuracy of the TIN. Additionally, maintain a record of the correct information for future filings.

Providing incomplete or inaccurate information about the property and its location on Form 8288 can lead to processing delays and potential penalties. Ensure that you provide a detailed description of the property, including its type, location, and value. To avoid this mistake, gather all necessary information before filing and double-check all entries for accuracy. Consider using tax software or seeking professional advice to help ensure that you are providing complete and accurate information.

Calculating the amount subject to withholding or the actual amount withheld incorrectly can result in penalties and interest charges. Ensure that you are using the correct rates and methods to calculate these amounts. To prevent this mistake, double-check all calculations and consider using tax software or seeking professional advice to help ensure accuracy. Additionally, maintain a record of all calculations for future reference.

Failing to attach all necessary forms and attachments, such as Forms 8288-A and 8288-C, and withholding certificates, can result in processing delays and potential penalties. To avoid this mistake, ensure that you have all required forms and attachments before filing and attach them to the return. Additionally, maintain a record of all forms and attachments for future filings.

The U.S. Withholding Tax Return, also known as Form 8288, requires the completion of Form 8288-A for reporting withholding on payments to foreign persons. Neglecting to provide complete and accurate information on Form 8288-A, such as the name, address, and Taxpayer Identification Number (TIN) of the foreign person subject to withholding, can lead to processing delays or potential penalties. To avoid this mistake, ensure that all required information is provided accurately and completely on Form 8288-A.

Form 8288 must be signed by the person responsible for withholding, and if a paid preparer prepares and files the form on behalf of the withholder, their Preparer Tax Identification Number (PTIN) must be included. Neglecting to sign the form or provide the PTIN of a paid preparer can result in processing delays or potential penalties. To prevent this mistake, make sure to sign the form and, if applicable, include the PTIN of the paid preparer.

Proper record-keeping is essential for withholding tax compliance. Failing to keep copies of all forms and documentation, including Forms 8288 and 8288-A, can make it difficult to provide evidence of withholding and potentially result in penalties. To avoid this mistake, maintain accurate and complete records of all withholding tax forms and related documentation.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8288 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8288 forms, ensuring each field is accurate.