Yes! You can use AI to fill out Form FL-150, Income and Expense Declaration

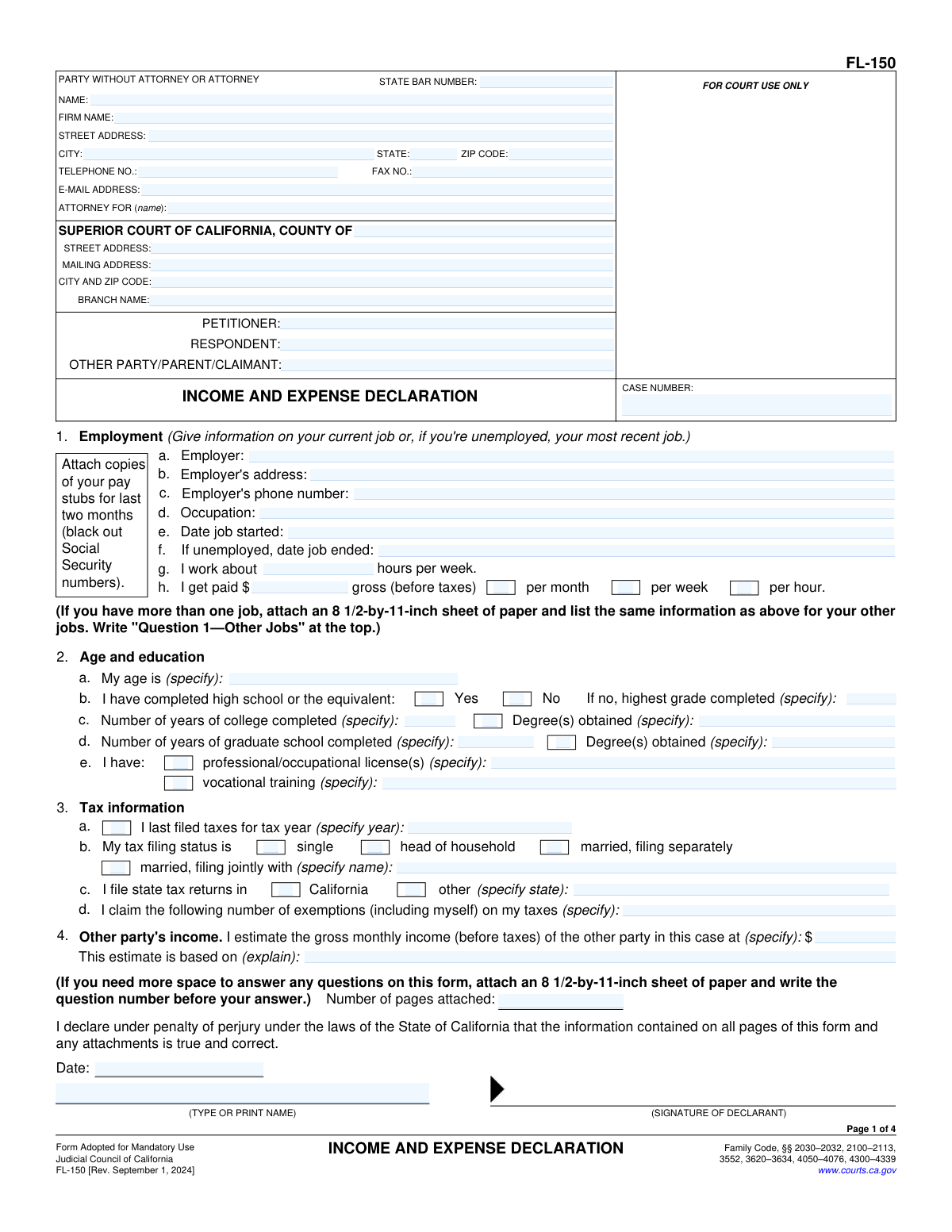

Form FL-150, officially known as the Income and Expense Declaration, is a document required by the Judicial Council of California for use in family law cases. It is used to declare one's income, expenses, assets, and liabilities to the court, particularly in matters involving child support, spousal support, and attorney fees. Filling out this form accurately is crucial as it helps the court make fair and informed decisions regarding financial support and obligations.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out FL-150 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form FL-150, Income and Expense Declaration |

| Form issued by: | Judicial Council of California |

| Number of fields: | 266 |

| Number of pages: | 4 |

| Version: | 2024 |

| Language: | English |

| Categories: | court forms, income forms, income and expense forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out FL-150 Online for Free in 2026

Are you looking to fill out a FL-150 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FL-150 form in just 37 seconds or less.

Follow these steps to fill out your FL-150 form online using Instafill.ai:

- 1 Visit instafill.ai site and select FL-150

- 2 Enter personal and employment details

- 3 Provide tax and income information

- 4 List monthly expenses and assets

- 5 Add child support details if applicable

- 6 Sign and date the form electronically

- 7 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable FL-150 Form?

Speed

Complete your FL-150 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 FL-150 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form FL-150

Form FL-150, Income and Expense Declaration, is used in family law cases to provide the court with detailed information about a party's income, expenses, assets, and debts. This information helps the court make informed decisions regarding child support, spousal support, and other financial matters.

Parties involved in family law cases, such as divorce, child support, or spousal support proceedings, are typically required to fill out Form FL-150. This includes both the petitioner and the respondent, as the court needs a complete financial picture from both parties to make fair decisions.

Form FL-150 requires detailed information about your employment, including your employer's name and address, your job title, how long you have been employed, your gross and net income, and any benefits you receive. If you are self-employed, you must provide information about your business income and expenses.

If you have more than one job, you should report each source of income separately on Form FL-150. Provide details for each employer, including name, address, your position, and the income you receive from each job. This ensures the court has a complete understanding of your total income.

You should attach recent pay stubs, tax returns, W-2 forms, or 1099 forms to Form FL-150 to verify your income. If you are self-employed, you may need to attach profit and loss statements or other financial documents that accurately reflect your income and expenses.

On Form FL-150, you should report your education and professional licenses in the section designated for 'Employment Information.' This includes listing any degrees, certifications, or licenses that may affect your income or employment status. Be sure to provide detailed information as it may be relevant to the court's assessment of your financial situation.

Form FL-150 requires you to provide detailed tax information, including your most recent tax returns, W-2 forms, 1099 forms, and any other documents that report your income. This information helps the court understand your financial situation accurately. It's important to attach copies of these documents to your form.

Estimating the other party's income on Form FL-150 should be based on the best information available to you. This can include pay stubs, tax returns, or any other financial documents that provide insight into their earnings. If exact figures are not available, you may need to make a reasonable estimate based on their occupation, employment status, and any known financial commitments.

The 'Income' section of Form FL-150 considers all sources of income, including wages, salaries, bonuses, commissions, self-employment income, rental income, dividends, interest, pensions, social security benefits, and any other form of regular income. It's important to report all income sources to provide a complete picture of your financial situation.

Income from self-employment should be reported in the 'Income' section of Form FL-150. You will need to provide details about your business, including gross receipts, business expenses, and net income. Attaching a copy of your most recent tax return or profit and loss statement can help substantiate your self-employment income.

In the 'Additional income' section of Form FL-150, you should include any income not already listed elsewhere on the form. This can include bonuses, commissions, dividends, interest, rental income, royalties, pensions, social security benefits, unemployment benefits, disability benefits, and any other sources of income. Be sure to provide detailed information and attach any necessary documentation to support your claims.

To report a significant change in your financial situation on Form FL-150, you should detail the change in the appropriate sections of the form. If the change affects your income, list the new income amounts and provide an explanation in the 'Additional income' or 'Changes in Income' section. For changes in expenses or assets, update the relevant sections accordingly. It's also advisable to attach a separate sheet if additional space is needed to explain the changes thoroughly.

On Form FL-150, you can list deductions such as taxes (federal, state, and local), social security, mandatory retirement contributions, health insurance premiums, union dues, and other mandatory deductions from your income. Additionally, you may include child support or spousal support payments you are legally obligated to pay. Ensure you provide accurate amounts and, if possible, attach proof of these deductions.

To report your assets on Form FL-150, list all your significant assets in the designated section. This includes real estate, vehicles, bank accounts, investments, retirement accounts, and any other valuable property. For each asset, provide a description, the current market value, and any outstanding loans or liens against it. Accurate and complete information is crucial for a fair assessment of your financial situation.

Form FL-150 requires you to provide information about people living with you, including their names, relationships to you, and whether they contribute to household expenses. This information helps the court understand your living situation and financial responsibilities. Be sure to include all individuals living in your household, even if they are not dependents, and detail any financial contributions they make towards household expenses.

On Form FL-150, you should list all your monthly expenses in detail under the appropriate categories such as housing, utilities, food, transportation, health care, and other necessary expenses. Be sure to provide accurate amounts for each expense to give a clear picture of your financial situation.

In the 'Installment payments and debts' section of Form FL-150, you should include all your ongoing financial obligations such as car loans, credit card payments, student loans, and any other debts that require regular payments. List the creditor's name, the total amount owed, the monthly payment amount, and the remaining number of payments.

Attorney fees should be reported in the 'Other Expenses' section of Form FL-150. Specify the amount paid or owed to your attorney and indicate whether these fees are one-time or ongoing. If the fees are related to the case for which you are filing this form, it's important to provide details to justify the expense.

Form FL-150 requires you to provide detailed information about any child support you are currently paying or receiving. This includes the amount of support, the frequency of payments, and the name of the child for whom support is being paid or received. If you are requesting child support, you should also include the amount you are requesting and the basis for that request.

Special financial circumstances or hardships should be clearly described in the 'Additional Information' section of Form FL-150. Provide a detailed explanation of the circumstances, such as unexpected medical expenses, job loss, or other significant financial challenges, and how they impact your ability to meet your financial obligations. Supporting documentation may be required to substantiate your claims.

Compliance FL-150

Validation Checks by Instafill.ai

1

Verifies that the party information section is fully completed, including name, address, and contact details, or attorney details if applicable.

Ensures that all personal or legal representative details are accurately filled out to avoid any discrepancies. Confirms the presence of a valid address and contact information for communication purposes. Verifies the inclusion of attorney details if the party is represented, ensuring legal compliance. Checks for completeness to facilitate smooth processing of the declaration.

2

Confirms that all court information is accurately provided, including the Superior Court of California details, county, and case number.

Validates the accuracy of court-related information to ensure the declaration is filed correctly. Ensures the Superior Court of California, county, and specific case number are clearly stated. Checks for any potential errors in court details that could delay proceedings. Confirms the relevance and correctness of the information to the current legal matter.

3

Ensures that employment details are complete, with current or most recent job information and attached pay stubs for the last two months.

Verifies the completeness of employment information to assess financial status accurately. Confirms the inclusion of current or most recent job details for income verification. Checks for attached pay stubs from the last two months to validate income claims. Ensures all employment data is up-to-date and correctly reflects the declarant's financial situation.

4

Validates that age and education information is specified, including high school completion, college years, degrees, and any vocational training.

Ensures the declarant's age and educational background are accurately reported. Confirms the completion of high school and any higher education or vocational training. Checks for the inclusion of degrees and years attended to understand the declarant's qualifications. Validates the information to assist in any necessary evaluations or considerations.

5

Checks that tax information is correctly indicated, including the last year taxes were filed, filing status, state, and number of exemptions.

Verifies the accuracy of tax-related information to ensure compliance with legal requirements. Confirms the last year taxes were filed, along with the correct filing status and state. Checks the number of exemptions claimed to assess financial obligations accurately. Ensures all tax details are correctly specified to avoid any discrepancies in financial declarations.

6

Verifies that income and expenses are detailed with all sources of income and attached proof of income and latest federal tax return.

Ensures that all sources of income are thoroughly detailed, including wages, bonuses, and any other earnings. Confirms that proof of income, such as pay stubs or bank statements, is attached to substantiate the declared amounts. Verifies the inclusion of the latest federal tax return to provide a comprehensive financial overview. Checks for completeness and accuracy in the reporting of income and expenses to avoid discrepancies.

7

Confirms that investment and self-employment income is listed with attached relevant schedules or profit and loss statements.

Validates the declaration of investment income, including dividends, interest, and capital gains, with supporting documentation. Ensures self-employment income is accurately reported, accompanied by profit and loss statements or relevant schedules. Checks for the attachment of any necessary forms, such as Schedule C or Schedule E, to verify the income sources. Confirms that all details are complete to provide a clear picture of the declarant's financial situation.

8

Ensures that additional income and changes are reported, including one-time money received and explanations of significant financial changes.

Verifies the reporting of any additional income, such as gifts, inheritances, or one-time payments, with appropriate explanations. Confirms that significant financial changes, like job loss or major purchases, are detailed to understand their impact. Checks for the inclusion of any relevant documentation to support these declarations. Ensures transparency in financial disclosures to facilitate accurate assessment.

9

Validates that deductions and assets are listed, including union dues, retirement payments, health insurance premiums, and other necessary expenses.

Ensures all deductible expenses, such as union dues and health insurance premiums, are accurately listed. Confirms the declaration of retirement payments and other mandatory deductions to assess net income accurately. Checks for the inclusion of assets, providing a complete financial profile. Validates that all listed deductions and assets are supported by relevant documentation.

10

Checks that household information is provided, detailing people living with the declarant, their relationship, income, and contribution to expenses.

Verifies the completeness of household information, including names and relationships of all residents. Confirms the reporting of each household member's income and their contribution to shared expenses. Ensures that the information provided offers a clear understanding of the household's financial dynamics. Checks for accuracy and completeness to support the declarant's financial declarations.

11

Verifies that monthly expenses are estimated and listed, covering housing, health care, child care, groceries, utilities, and transportation.

Ensures that all monthly expenses are accurately estimated and comprehensively listed, including but not limited to housing, health care, child care, groceries, utilities, and transportation. Confirms that the form captures a complete picture of the declarant's financial obligations. Validates that no significant expense categories are omitted, providing a thorough basis for financial assessment. Checks that the estimates are realistic and reflect the declarant's actual living costs.

12

Confirms that installment payments and debts are listed, including amounts, balances, and dates of last payment.

Verifies that all installment payments and outstanding debts are detailed, including the current amounts, remaining balances, and the dates of the last payments made. Ensures that the form provides a clear and up-to-date snapshot of the declarant's debt obligations. Confirms that the information is complete, allowing for an accurate evaluation of the declarant's financial health. Checks that the details are consistent with other financial documents provided.

13

Ensures that attorney fees details are provided if applicable, including fees paid, owed, and the attorney's hourly rate.

Validates that, if attorney fees are relevant to the case, all pertinent details are included, such as fees already paid, amounts still owed, and the attorney's hourly rate. Confirms that the form captures the financial impact of legal representation on the declarant's overall expenses. Ensures that the information is transparent, facilitating a fair assessment of the declarant's financial situation. Checks that the details are accurate and verifiable against any supporting documentation.

14

Validates that child support information is completed if the case involves child support, detailing health-care expenses and time spent with each parent.

Ensures that, in cases involving child support, the form includes comprehensive details about health-care expenses and the allocation of time spent with each parent. Confirms that the information provided supports a fair and informed determination of child support obligations. Validates that all relevant expenses and time-sharing arrangements are accurately reported. Checks that the details are consistent with any court orders or agreements in place.

15

Checks that the declaration is signed and dated, confirming under penalty of perjury that the information is true and correct.

Verifies that the declaration is properly signed and dated, affirming under penalty of perjury that all provided information is true and correct. Ensures that the form meets legal requirements for submission, including the declarant's acknowledgment of the consequences of providing false information. Confirms that the signature and date are present, validating the document's authenticity. Checks that the declaration is executed in accordance with applicable laws and regulations.

Common Mistakes in Completing FL-150

Failing to provide complete and accurate party information can lead to delays in processing the form. Ensure all names, addresses, and contact details are correctly filled out. Double-check the spelling of names and the accuracy of addresses. Omitting any required party details can result in the form being returned or rejected.

Court information is crucial for the proper filing and processing of Form FL-150. Always verify the correct court name, case number, and judicial officer details before submission. Inaccurate court information can cause the form to be misfiled or delayed. Cross-referencing with court documents can help ensure accuracy.

Attaching pay stubs is a requirement for Form FL-150, but it's essential to black out Social Security numbers to protect sensitive information. Forgetting to attach pay stubs or failing to redact Social Security numbers can compromise personal security and lead to form rejection. Always review pay stubs before submission to ensure compliance with privacy requirements.

Providing incomplete employment details can hinder the assessment of income and expenses. Include all relevant employment information, such as employer names, addresses, and job titles. Missing details may require additional documentation or clarification, delaying the process. Verify all employment information for completeness and accuracy before submission.

Accurate tax information is vital for the correct evaluation of financial declarations. Ensure all tax-related details, including filing status and dependents, are accurately reported. Incorrect tax information can lead to discrepancies and potential legal issues. Reviewing tax documents before filling out the form can help avoid errors.

A frequent oversight is not listing all income and expense sources, which can lead to inaccurate financial assessments. It's crucial to include every stream of income, no matter how minor, and all monthly expenses to ensure a comprehensive financial picture. Omitting details can result in unfair rulings or delays in the legal process. To avoid this, review bank statements, bills, and other financial documents thoroughly before completing the form.

Submitting the form without the required documentation, such as proof of income or the latest federal tax return, is a common error. This documentation is essential for verifying the accuracy of the declared income and expenses. Without it, the court may question the credibility of the information provided. Always gather and attach all necessary documents to support your declarations to prevent unnecessary complications.

Many individuals fail to fully disclose investment earnings or self-employment income, leading to incomplete financial disclosures. This includes dividends, interest, rental income, and any profits from business activities. Detailed reporting is necessary for a fair evaluation of one's financial situation. Ensure all such incomes are accurately reported by keeping detailed records and consulting financial statements.

Significant changes in financial circumstances, such as a sudden increase or decrease in income, often go unexplained. These changes can raise questions about the accuracy or completeness of the financial declaration. Providing a clear and concise explanation for any notable fluctuations is essential. This transparency helps in understanding the context behind the numbers and supports the integrity of the declaration.

An incomplete listing of deductions and assets is another common mistake that can affect the outcome of financial evaluations. All assets, including real estate, vehicles, and personal property, should be listed along with any applicable deductions. Overlooking these details can lead to an inaccurate portrayal of one's financial health. Take the time to compile a comprehensive list, ensuring nothing is omitted for a truthful and complete declaration.

Failing to provide complete household information can lead to misunderstandings about the financial situation. This includes not listing all household members or their sources of income. To avoid this, ensure all household members are listed along with their income details. Accurate household information is crucial for a fair assessment of financial obligations and rights.

Underestimating or overestimating monthly expenses can significantly affect the outcome of financial declarations. It's essential to review past bills and receipts to provide an accurate estimate. Avoid rounding numbers too much, as precision is key. Regularly updating expense records can help maintain accuracy in declarations.

Omitting details about installment payments and debts can lead to an incomplete financial picture. All debts, including credit cards, loans, and other obligations, must be disclosed. Include the creditor's name, total amount owed, and monthly payment. Transparency in this area ensures all financial responsibilities are considered.

Not fully disclosing attorney fees can affect the court's understanding of your financial burden. Include all payments made or owed to your attorney, even if payments are pending. Detailed records of these expenses should be maintained and presented. This ensures the court has a complete view of your financial commitments.

Neglecting to fill out child support information can delay proceedings and affect support calculations. All relevant details about current or pending child support obligations must be provided. This includes amounts paid, received, or any agreements in place. Ensuring this section is complete helps in accurately assessing financial responsibilities towards children.

Failing to sign or date the Income and Expense Declaration (Form FL-150) renders the document invalid. This oversight can delay legal proceedings or result in the court rejecting the form. Always ensure that the form is signed and dated before submission to avoid unnecessary delays. It's advisable to double-check the form for signatures and dates as part of the final review process.

Omitting necessary attachments, such as pay stubs or tax returns, can lead to the court's refusal to process the Income and Expense Declaration. Required documents provide evidence to support the declarations made on the form. Before submission, review the form's instructions to confirm all necessary documents are included. Organizing and labeling attachments can help ensure nothing is overlooked.

Submitting Form FL-150 without redacting sensitive information, like Social Security numbers or bank account details, poses a risk to personal privacy. Courts require such information to be protected to prevent identity theft or fraud. Carefully review the form to identify and redact any sensitive information before filing. Utilizing a checklist of sensitive data points can aid in thorough redaction.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out FL-150 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills fl-150 forms, ensuring each field is accurate.