Yes! You can use AI to fill out Form SSA-1-BK, Application for Retirement Benefits

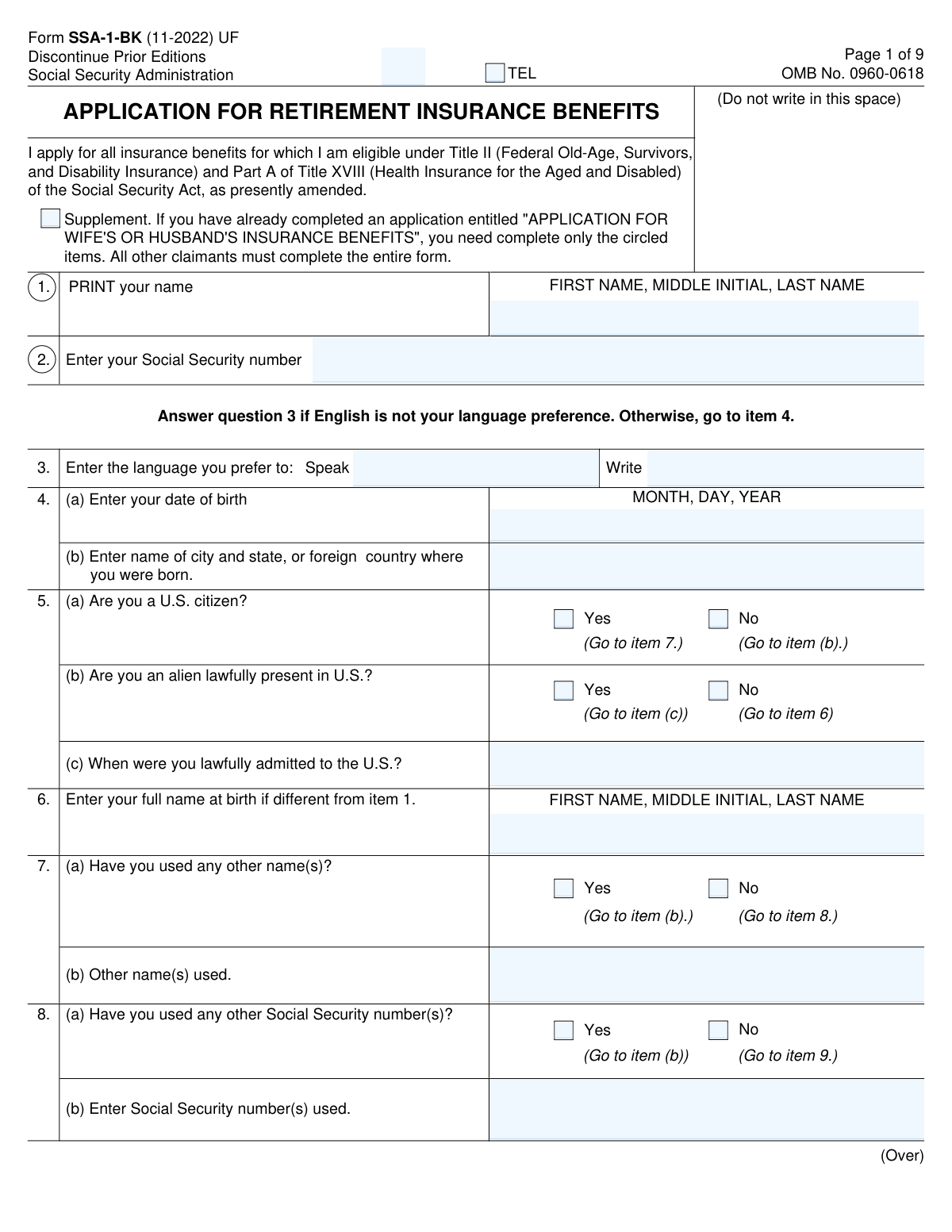

Form SSA-1-BK, Application for Retirement Benefits, is used to apply for Social Security retirement insurance benefits. This form is essential for individuals seeking to receive benefits under the Social Security Act, ensuring they provide necessary personal and financial information for eligibility assessment.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SSA-1-BK using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SSA-1-BK, Application for Retirement Benefits |

| Form issued by: | Social Security Administration |

| Number of fields: | 223 |

| Number of pages: | 9 |

| Version: | 2022 |

| Language: | English |

| Categories: | benefit forms, retirement forms, SSA forms |

Instafill Demo: How to fill out PDF forms in seconds with AI

How to Fill Out SSA-1-BK Online for Free in 2026

Are you looking to fill out a SSA-1-BK form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SSA-1-BK form in just 37 seconds or less.

Follow these steps to fill out your SSA-1-BK form online using Instafill.ai:

- 1 Visit instafill.ai site and select SSA-1-BK.

- 2 Enter your full name and Social Security number.

- 3 Provide your date of birth and citizenship status.

- 4 Fill in your employment history and earnings.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SSA-1-BK Form?

Speed

Complete your SSA-1-BK in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SSA-1-BK form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SSA-1-BK

You should provide your current spouse's name, date of birth, and Social Security number or Individual Taxpayer Identification Number (ITIN). If you are not currently married, you should indicate 'None' or 'Single'.

You should provide the name, date of birth, and Social Security number or ITIN for any former spouses, as well as the start and end dates of each marriage. If you were married more than once and are currently married, you should also provide information for your current spouse.

You should report any changes in your living situation, income, or work status to Social Security as soon as possible. This can be done online, by phone, or in person at your local Social Security office. Failure to report changes may result in overpayments or underpayments of benefits.

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. It is generally premium-free for most people who are age 65 or older and have worked and paid Medicare taxes for a certain number of quarters. Medicare Part B covers outpatient services, such as doctor visits, preventive services, and some home health care. It has a monthly premium and a deductible.

If you do not enroll in Medicare Part B when you are first eligible (during your initial enrollment period, which is generally the 3 months before and the 3 months after your 65th birthday), you may have to pay a late enrollment penalty. The penalty amount is 10% of the Part B premium for each 12-month period that you could have had Part B but did not enroll, but did not have other creditable coverage. The penalty will be added to your monthly premium for as long as you have Part B.

To enroll in a Medicare prescription drug plan (Part D), you can follow these steps: 1. Go to the Medicare website (www.medicare.gov) or call 1-800-MEDICARE (1-800-633-4227) to find out which plans are available in your area. 2. Compare plans based on cost, coverage, and prescription drugs you take. 3. Enroll in a plan during the Annual Enrollment Period (October 15 - December 7) or during a Special Enrollment Period if you have a qualifying life event. 4. Provide your Medicare number and other required information to the plan. Once enrolled, your prescription drug coverage will begin on the first day of the month in which you enrolled.

The Extra Help program, also known as the Low-Income Subsidy (LIS), is a program that helps eligible Medicare beneficiaries pay for their prescription drug costs. To qualify for Extra Help, you must meet certain income and resource limits. If you are approved for Extra Help, you will pay little to nothing for your monthly premiums, annual deductible, and prescription copayments or coinsurance. To apply for Extra Help, you can fill out an application online (www.socialsecurity.gov/i1020), by mail, or in person at your local Social Security office.

To apply for Supplemental Security Income (SSI), you can follow these steps: 1. Gather the required documents, including proof of identity, Social Security number, income and resources, and disability or age documentation. 2. Apply online (www.socialsecurity.gov), by mail, or in person at your local Social Security office. 3. Attend an interview with a Social Security representative to discuss your application and provide any additional information needed. 4. Wait for a decision on your application. If approved, your SSI payments will begin the following month. If denied, you can appeal the decision.

The Privacy Act of 1974 is a federal law that protects the privacy of individuals' personally identifiable information (PII) held by the federal government. When you apply for retirement benefits, Social Security collects and maintains your PII for the administration and protection of your benefits. Social Security only discloses your PII to authorized individuals, agencies, or organizations with a need to know. You have the right to access and correct any errors in your PII. For more information, you can review the Privacy Act Statement provided with your application materials or on the Social Security website (www.socialsecurity.gov).

For Social Security purposes, wages are the earnings you receive from working for someone else as an employee. Self-employment income, on the other hand, is the income you earn from operating your own business or being an independent contractor. Self-employment income includes profits from your business, as well as any wages you pay to employees. Social Security taxes are paid differently on wages and self-employment income. Employees have Social Security taxes withheld from their paychecks by their employers, while self-employed individuals must pay both the employer and employee share of Social Security taxes (self-employment tax) directly to the IRS.

If you did not earn enough wages or self-employment income to meet the earnings test for Social Security retirement benefits, you may still be able to receive benefits based on your spouse's or ex-spouse's earnings record. You can also apply for spousal or ex-spousal benefits if you are age 62 or older and have been married for a certain length of time. Additionally, you may be able to receive benefits based on your own earnings record at a reduced rate if you apply before your full retirement age. It is recommended that you contact the Social Security Administration for further information and guidance.

If you are currently receiving Social Security retirement benefits and you return to work or have a change in your work situation, you are required to report this to the Social Security Administration. You should report any changes in your employment status, wages, or self-employment income as soon as possible. You can report changes online through your my Social Security account, or by calling the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778). Failure to report changes in a timely manner may result in overpayments or underpayments of benefits.

If you are receiving Social Security retirement benefits and you go outside the United States for 30 consecutive days or longer, your benefits will be suspended. However, you can apply for a benefit payment for any month you were outside the U.S. once you return and are back in the U.S. for 30 consecutive days. If you are living abroad permanently, you may be eligible for benefits under the Totalization Agreement between the United States and the country where you now reside. It is recommended that you contact the Social Security Administration for further information and guidance.

If your citizenship or immigration status changes, it may affect your eligibility for Social Security retirement benefits. If you become a U.S. citizen after age 62, you may be able to apply for retirement benefits based on your own earnings record. If you are no longer a U.S. citizen, but you were entitled to benefits before you left the U.S., you may be able to continue receiving benefits under certain circumstances. It is recommended that you contact the Social Security Administration for further information and guidance.

If you are confined to a jail, prison, penal institution, or correctional facility for more than 30 continuous days, your Social Security retirement benefits will be suspended. However, you may be able to apply for a benefit payment for any month you were confined once you are released and are back in the U.S. for 30 consecutive days. It is recommended that you contact the Social Security Administration for further information and guidance.

If you have an unsatisfied warrant for more than 30 continuous days for a crime or attempted crime, you should contact your local law enforcement agency or the court that issued the warrant as soon as possible. Failure to address the warrant may result in additional legal consequences. It is recommended that you consult with a legal professional for advice specific to your situation.

If you have an unsatisfied warrant for more than 30 continuous days for a violation of probation or parole, you should contact your probation or parole officer as soon as possible. Failure to address the warrant may result in additional legal consequences. It is recommended that you consult with a legal professional for advice specific to your situation.

If a person for whom you are filing or who is in your care dies, leaves your care, or changes address, you should promptly report this change to the Social Security Administration. Failure to report such changes may result in overpayments or underpayments of benefits. You can report these changes online at ssa.gov or by calling the Social Security Administration at 1-800-772-1213.

If your stepchild is entitled to benefits on your record and you divorce, the benefits may continue if the child is still eligible. However, the Social Security Administration may need to review the situation and make a determination based on the specific circumstances. It is recommended that you contact the Social Security Administration for guidance and to provide any necessary documentation.

If you become the parent of a child (including an adopted child) after you have filed your claim for retirement benefits, you should report this change to the Social Security Administration as soon as possible. The Social Security Administration may need to review your situation and make a determination based on the specific circumstances. You can report this change online at ssa.gov or by calling the Social Security Administration at 1-800-772-1213.

Compliance SSA-1-BK

Validation Checks by Instafill.ai

1

Ensures the full legal name matches the name on the Social Security card

The AI ensures that the full legal name provided on the Application for Retirement Benefits matches exactly with the name as it appears on the applicant's Social Security card. This includes checking for any discrepancies in spelling, middle initials, and suffixes such as Jr., Sr., or III. The AI cross-references the name with official records to prevent any errors that could lead to delays in processing the application. It also alerts the user to any mismatches and requests confirmation or correction to ensure the integrity of the application.

2

Confirms the Social Security number is valid and correctly formatted

The AI confirms that the Social Security number (SSN) entered on the Application for Retirement Benefits is both valid and correctly formatted. It checks the SSN against established patterns to ensure it consists of nine digits, formatted as XXX-XX-XXXX. The AI also references the Social Security Administration's records to verify that the SSN is legitimate and has not been issued in error or compromised. Any anomalies detected prompt the AI to request verification or correction to maintain the accuracy of the application.

3

Verifies that all other names used are listed

The AI verifies that all other names the applicant may have used in the past are listed on the Application for Retirement Benefits. This is crucial for identifying any employment records, earnings, or contributions under different names that should be accounted for in the retirement benefits. The AI checks for common variations, aliases, maiden names, and any legal name changes. It ensures that the application is comprehensive and reflects the complete history of the applicant's identity.

4

Checks for the listing of any other Social Security numbers used

The AI checks the Application for Retirement Benefits for the listing of any other Social Security numbers the applicant may have used. This is important to uncover any records that may be associated with different SSNs due to clerical errors, name changes, or other reasons. The AI ensures that no additional SSNs are overlooked, which could impact the applicant's retirement benefits. It prompts the user to add any missing information to ensure a complete and accurate application.

5

Validates the date of birth for correct formatting and logical accuracy

The AI validates the date of birth on the Application for Retirement Benefits for both correct formatting and logical accuracy. It ensures that the date is in a recognized format, typically MM/DD/YYYY, and that it represents a plausible date prior to the current date. The AI also calculates the age of the applicant to confirm eligibility for retirement benefits and to ensure that the date of birth aligns with other records. Any inconsistencies trigger a request for the user to verify or correct the information.

6

Confirms the city, state, or foreign country of birth is provided

The AI ensures that the applicant's place of birth is accurately captured by confirming the presence of the city, state, or foreign country in the designated field. It checks for completeness and proper formatting to ensure that the location details are clear and unambiguous. This information is crucial for identity verification and must be consistent with other official documents provided by the applicant.

7

Ensures the full name at birth is entered if different from the current legal name

The AI verifies that the applicant's full birth name is provided in the event it differs from their current legal name. This check is essential for cross-referencing identity across various legal documents and historical records. The AI also ensures that the name is entered in the correct format and sequence, and prompts the user to correct any discrepancies or omissions.

8

Verifies the language preference is indicated if English is not preferred

The AI checks that the applicant's language preference is clearly indicated on the form, especially if English is not the preferred language. This validation is important to ensure that all future communications are conducted in the applicant's language of choice, facilitating better understanding and response. The AI also confirms that the language indicated is one of the supported languages for communication.

9

Confirms U.S. citizenship status or lawful presence, and admission date if applicable

The AI confirms the applicant's U.S. citizenship status or, if not a citizen, their lawful presence in the country, including the admission date if applicable. This step is crucial for determining eligibility for retirement benefits. The AI checks for the appropriate documentation and ensures that all relevant fields related to citizenship or immigration status are completed accurately.

10

Validates current marital status and spouse's details, or indicates 'None' if not married

The AI validates the applicant's current marital status by ensuring that the marital status field is completed and, if married, that the spouse's details are provided accurately. If the applicant is not married, the AI ensures that the 'None' option is selected. This information is important for assessing potential spousal benefits and ensuring the accuracy of the application.

11

Checks for information on any previous marriages and their statuses

Ensures that all previous marriages are disclosed, including the dates of marriage and, if applicable, dissolution. Confirms the accuracy of the marital status information, which is crucial for determining potential spousal benefits. Verifies that any changes in marital status are consistently reported throughout the application to prevent discrepancies. Cross-references applicant's statements with supporting documents when available to uphold the integrity of the application process.

12

Verifies information about railroad work, international Social Security credits, and foreign benefits

Scrutinizes the applicant's work history to identify any railroad employment, which may affect the calculation of benefits. Checks for international Social Security agreements that might influence the applicant's eligibility for benefits or the benefit amount. Assesses any foreign benefits the applicant may be receiving to ensure accurate coordination with domestic benefits. Validates the completeness and accuracy of all international employment and benefit information provided by the applicant.

13

Confirms whether the applicant is entitled to a non-covered pension or annuity

Examines the applicant's entitlement to any pension or annuity from employment not covered by Social Security. Determines how a non-covered pension or annuity may affect the applicant's Social Security benefits. Ensures that all necessary information regarding non-covered pensions or annuities is provided and accurate. Evaluates the impact of the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO) on the applicant's benefits, if applicable.

14

Lists all eligible children as per the form's requirements

Checks that all children who may be eligible for benefits are listed, including biological, adopted, or stepchildren. Verifies the accuracy of each child's personal information, such as name, date of birth, and Social Security number. Confirms the dependency status of each child to ensure they meet the eligibility criteria for receiving benefits. Ensures that the application includes all necessary details to facilitate the potential benefits for each eligible child.

15

Checks for complete employment history for the specified years

Reviews the applicant's employment history to ensure it is comprehensive and covers the specified years required by the form. Confirms that all employers, dates of employment, and earnings are accurately reported. Verifies that the employment history aligns with the applicant's Social Security earnings record. Detects any gaps or inconsistencies in the employment timeline that may need further clarification or documentation.

16

Validates total earnings from the last year, this year, and estimates for next year

The AI ensures that the total earnings reported for the last year, the current year, and the estimated earnings for the next year are accurately captured and validated. It cross-references the provided figures with any attached documentation to confirm their veracity. The AI also checks for common input errors, such as misplaced decimals or commas, to prevent any discrepancies in the reported amounts. Additionally, it alerts the user if the earnings data appears inconsistent or if any mandatory fields are left blank.

17

Confirms the answers about expected earnings and exempt months are provided

The AI confirms that the applicant has provided complete information regarding their expected earnings and any months they are exempt from earnings limits. It verifies that all questions in this section are answered to ensure compliance with the requirements for retirement benefits. The AI also checks for logical consistency in the responses, such as ensuring that exempt months align with the applicant's retirement plans. If any information is missing or contradictory, the AI prompts the user to review and correct the entries.

18

Ensures the desired start date for benefits is indicated

The AI ensures that the applicant has indicated a desired start date for their retirement benefits. It checks that the date is properly formatted and falls within a valid range based on the applicant's age and retirement eligibility criteria. The AI also verifies that the start date is not in the past and is a feasible date for the administration to process the application. If the start date is missing or invalid, the AI requests the user to provide a correct date.

19

Completes the Medicare Information section if the applicant is of eligible age

The AI completes the Medicare Information section by verifying if the applicant is of eligible age for Medicare. It ensures that all required fields are filled out accurately, including whether the applicant is already enrolled in Medicare Part A and wishes to enroll in Medicare Part B. The AI checks for any inconsistencies in the applicant's age and the information provided, and it prompts for clarification or additional documentation if necessary.

20

Indicates whether the applicant wants to enroll in Medicare Part B

The AI indicates whether the applicant has opted to enroll in Medicare Part B by checking the appropriate section of the application. It ensures that the applicant's choice is clearly marked and that any necessary supplementary information or questions related to Medicare Part B enrollment are addressed. The AI also reminds the applicant of the implications of their choice and the deadlines associated with Medicare Part B enrollment to ensure informed decision-making.

21

Verifies if the applicant wants to file for Supplemental Security Income, if applicable

The AI ensures that the section pertaining to the filing for Supplemental Security Income (SSI) is reviewed and accurately reflects the applicant's intentions. It verifies whether the applicant has indicated a desire to apply for SSI benefits, which is a separate process from other retirement benefits. The AI checks for consistency in the applicant's responses throughout the form to ensure that the decision to apply or not apply for SSI is clear and intentional. If the applicant is eligible and wishes to apply for SSI, the AI confirms that all necessary fields related to SSI are completed.

22

Uses the 'Remarks' section for additional information as necessary

The AI utilizes the 'Remarks' section of the application to include any additional information that may be relevant to the applicant's retirement benefits claim. It ensures that any details that do not fit within the standard fields of the form are clearly and concisely noted in this section. The AI also checks that the information provided in the 'Remarks' section is pertinent to the application and does not contain irrelevant or redundant data. It assists in organizing the information in a manner that is easily understandable for the reviewers of the application.

23

Ensures the form is signed and dated, with witness signatures if signed by mark (X)

The AI confirms that the application for retirement benefits is properly signed and dated by the applicant, as this is a critical step in validating the form. In cases where the applicant is unable to sign and uses a mark (X) instead, the AI ensures that there are witness signatures present as required. It checks the date for accuracy and relevance, making sure it is current and falls within acceptable timeframes for processing. The AI also verifies that the witness signatures meet the necessary criteria and are properly documented.

24

Confirms the mailing address, telephone number(s), and direct deposit information are provided

The AI systematically confirms that the application includes the applicant's complete mailing address and telephone number(s) to ensure reliable communication regarding the retirement benefits. It also verifies that direct deposit information is provided if the applicant wishes to receive benefits electronically. The AI checks for the accuracy of the banking details, including the bank name, account number, and routing number, to prevent any delays or issues with benefit payments. It highlights any missing or incomplete information for correction before submission.

25

Reviews the Privacy Act Statement and the Paperwork Reduction Act Statement acknowledgment

The AI reviews the application to ensure that the applicant has acknowledged the Privacy Act Statement and the Paperwork Reduction Act Statement. It checks that the applicant understands how their information will be used and the legal implications of the data provided. The AI ensures that the applicant's consent is clear and that they have been informed about their rights under these acts. It also verifies that the acknowledgment sections are not overlooked and are properly addressed in the application process.

26

Acknowledges the receipt for the claim

The system ensures that an acknowledgment of receipt for the retirement benefits claim has been recorded. It confirms that the applicant has been notified of the successful submission of their application. The process includes a timestamp of when the claim was received to maintain accurate records. Additionally, the system verifies that the acknowledgment complies with the necessary communication protocols as stipulated by the retirement benefits administrator.

27

Notes the changes to be reported as listed

The system meticulously scans the application for any instructions or requirements regarding changes that need to be reported by the claimant. It ensures that these notes are clearly highlighted and accessible for future reference. The system verifies that the list of reportable changes is comprehensive and aligns with the policy guidelines. Furthermore, it confirms that the applicant has been informed of how and when to report any relevant changes that may affect their retirement benefits.

Common Mistakes in Completing SSA-1-BK

One of the most crucial fields to fill accurately on the Application for Retirement Benefits form is the name section. Applicants must ensure that their name is entered exactly as it appears on their Social Security card to avoid any potential delays or denials of their application. This includes the spelling of given and surnames, as well as any middle names or initials. To prevent errors, applicants should double-check their Social Security card and carefully review their entry on the form.

Another common mistake on the Application for Retirement Benefits form is entering an incorrect Social Security number. Applicants must ensure they enter their number accurately, as any discrepancies could lead to delays or denials of their application. To prevent errors, applicants should double-check their Social Security card and carefully enter their number on the form.

Applicants must also list any other names they have used or Social Security numbers they have held in the past on the Application for Retirement Benefits form. Failure to do so could result in delays or denials of their application. Applicants should provide as much information as possible to ensure their application is processed efficiently. To prevent errors, applicants should carefully review their past records and provide all necessary information.

Another common mistake on the Application for Retirement Benefits form is entering an incorrect date of birth. Applicants must ensure they enter their date of birth accurately, as any discrepancies could lead to delays or denials of their application. To prevent errors, applicants should double-check their records and carefully enter their date of birth on the form.

Applicants must also provide the correct city and state or foreign country of birth on the Application for Retirement Benefits form. Failure to do so could result in delays or denials of their application. Applicants should ensure they provide the most accurate and complete information possible to prevent errors. To prevent errors, applicants should carefully review their records and provide all necessary information.

Applicants for Retirement Benefits who prefer a language other than English for the application process may overlook the opportunity to indicate their preference. This oversight could result in receiving the application materials in English, causing potential misunderstandings or errors. To avoid this mistake, applicants should carefully read the instructions and make sure to indicate their preferred language as soon as possible during the application process.

Applicants for Retirement Benefits must provide accurate and complete information about their U.S. citizenship or lawful presence. Failing to do so could lead to delays or denial of benefits. Applicants should double-check their information and ensure they have all necessary documentation to support their claims. It is essential to provide all relevant details, including the country of birth, immigration status, and any relevant visa or green card information.

Applicants for Retirement Benefits may overlook the importance of providing accurate and complete information about their current and previous marriages. This mistake could lead to incorrect calculations of benefits or even denial of benefits. Applicants should ensure they provide the correct names, dates, and durations of all marriages, as well as any relevant divorce or death certificates.

Applicants for Retirement Benefits may inadvertently leave out some of their children when listing dependents. This mistake could result in not receiving benefits for those children who are eligible. Applicants should carefully review the instructions and make sure to list all unmarried children under age 18, as well as those between 18 and 19 who are attending school full-time or disabled/handicapped. Providing complete and accurate information about dependents is crucial for receiving the correct benefits.

Applicants for Retirement Benefits who have self-employment income or multiple employers may overlook the importance of providing accurate and complete information about their earnings. This mistake could lead to incorrect calculations of benefits or even denial of benefits. Applicants should ensure they provide all necessary documentation, including tax returns, income statements, and W-2s or 1099s, to support their claims. Providing complete and accurate information about self-employment and employers is essential for receiving the correct benefits.

One of the most common errors made on the Application for Retirement Benefits form is failing to report total earnings accurately. This can lead to incorrect benefit calculations and potential delays in receiving payments. To avoid this mistake, ensure that all sources of income, including wages, salaries, tips, and net earnings from self-employment, are reported in their entirety. Double-check the figures to ensure their accuracy before submitting the form.

Another common mistake is failing to indicate expected earnings and exempt months correctly. This can result in over- or under-payment of benefits. Be sure to accurately report any expected earnings from employment or self-employment and indicate any months in which you expect to be exempt from receiving benefits. Double-check the figures to ensure their accuracy before submitting the form.

Choosing an incorrect start date for benefits is another common mistake made on the Application for Retirement Benefits form. This can result in delays in receiving payments or incorrect benefit calculations. Be sure to carefully review the instructions and choose the correct start date based on your retirement date and the requirements of the Social Security Administration. Double-check the figure to ensure its accuracy before submitting the form.

Failing to complete the Medicare Information section correctly is another common mistake made on the Application for Retirement Benefits form. This can result in delays in receiving Medicare coverage or incorrect coverage. Be sure to accurately report your Medicare enrollment status and provide any necessary information, such as your Medicare number and the effective date of your coverage. Double-check the figures to ensure their accuracy before submitting the form.

Failing to sign and date the form properly is a common mistake that can result in delays in processing your application. Be sure to sign and date the form in the designated areas and provide any necessary supporting documentation, such as a copy of your driver's license or other identification. Double-check the figures to ensure their accuracy before submitting the form.

When completing the Application for Retirement Benefits form, applicants may overlook providing their complete mailing address, telephone number(s), and direct deposit payment information. This oversight can lead to delays in receiving important correspondence and benefit payments. To avoid this mistake, applicants should ensure they fill out all required fields accurately and completely. Double-checking the information entered and comparing it to current records is also recommended.

Applicants for retirement benefits may overlook the importance of reviewing the Privacy Act Statement and the Paperwork Reduction Act Statement on the form. These statements outline how the Social Security Administration (SSA) will use the applicant's personal information and the amount of time required to complete the form. Failing to review these statements could result in unintended consequences or misunderstandings regarding the use of personal data. To prevent this mistake, applicants should read and understand both statements before submitting their application.

Applicants for retirement benefits may forget to report changes to their personal information, such as a new mailing address or telephone number, to the Social Security Administration (SSA) in a timely manner. This can lead to important correspondence being sent to an outdated address or missed telephone calls. To prevent this mistake, applicants should keep the SSA informed of any changes to their contact information as soon as possible.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SSA-1-BK with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ssa-1 forms, ensuring each field is accurate.