Yes! You can use AI to fill out Form 8855, Election To Treat a Qualified Revocable Trust

Form 8855, Election to Treat a Qualified Revocable Trust, allows the trustees of a qualified revocable trust and the executor of the related estate to elect for the trust to be treated as part of the estate for tax purposes. This is important for ensuring proper tax treatment and compliance during the election period.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8855 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

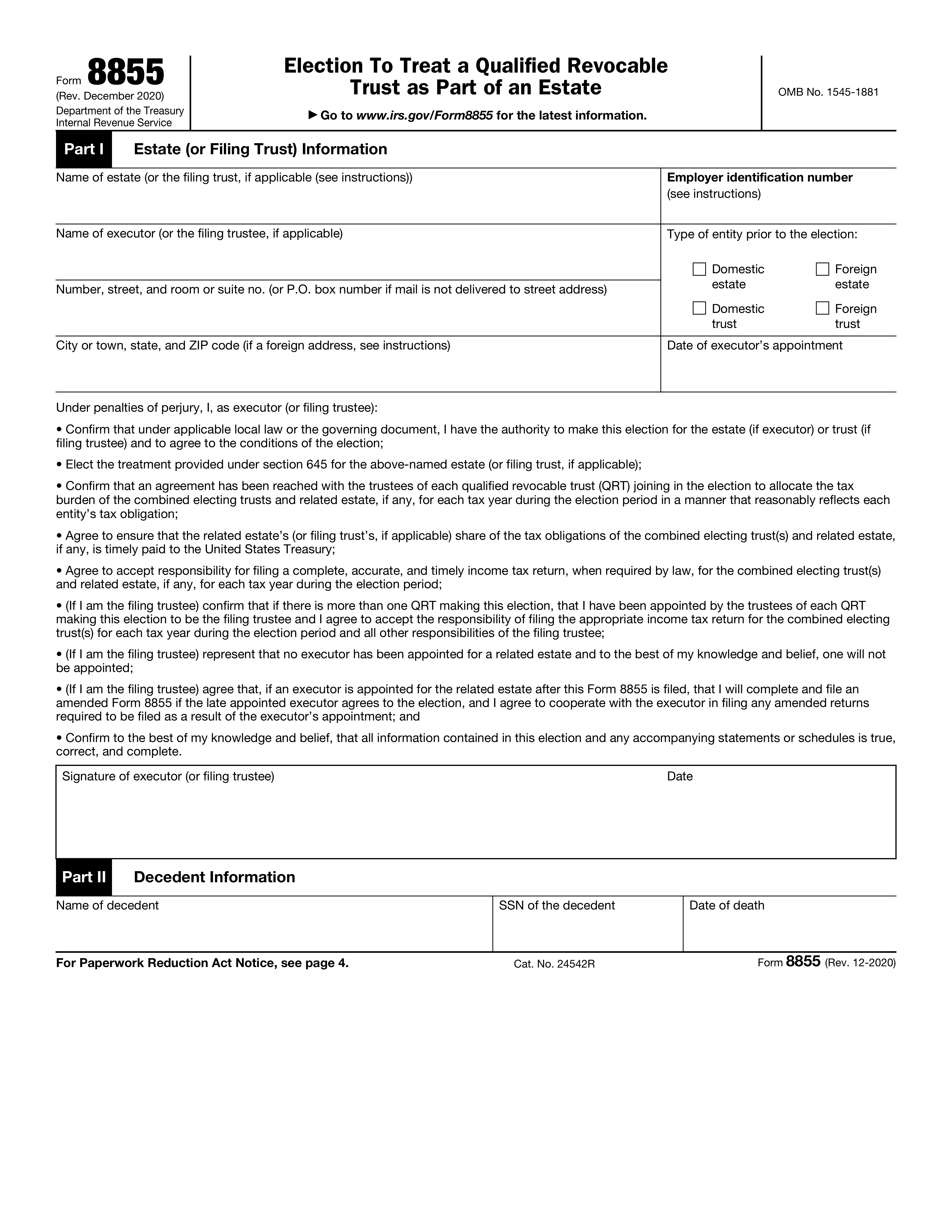

| Form name: | Form 8855, Election To Treat a Qualified Revocable Trust |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 23 |

| Number of pages: | 4 |

| Version: | 2020 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-8855 |

| Filled form examples: | Form Form 8855 Examples |

| Language: | English |

| Categories: | trust forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8855 Online for Free in 2026

Are you looking to fill out a FORM 8855 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8855 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8855 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8855.

- 2 Enter estate or trust information.

- 3 Provide decedent and trustee details.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8855 Form?

Speed

Complete your Form 8855 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8855 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8855

Form 8855, also known as the "Election To Treat a Qualified Revocable Trust as Part of an Estate," is a tax form used to make an election to include a Qualified Revocable Trust (QRT) as part of an estate for federal estate tax purposes. This election allows the estate to use the decedent's unified credit to reduce or eliminate estate taxes on the trust's assets.

Form 8855 should be filed by the executor or the filing trustee of the QRT. It is important to note that the election can only be made on a timely filed estate tax return (Form 1041) or within two years of the decedent's death, whichever is earlier.

Part I of Form 8855 requires the identification of the decedent, the name and taxpayer identification number (TIN) of the executor or filing trustee, and the name and TIN of the trust. Additionally, it asks for the date of death and the date the election is being made.

The executor or filing trustee is responsible for making the section 645 election on behalf of the estate or trust. They must ensure that the election is made in a timely manner and that all required information is accurately reported on Form 8855. Failure to make the election or to file the form correctly may result in additional taxes and penalties.

A qualified revocable trust (QRT) is a trust that was created by the decedent during their lifetime and retained the power to revoke or amend the trust. For the purpose of the section 645 election, a QRT is defined as a trust that was in existence on the decedent's date of death and that was a grantor trust for federal income tax purposes. The trust must also meet certain other requirements, such as not being a complex trust or a grantor retained annuity trust.

An electing trust is a qualified revocable trust that has elected to be included in the estate of the person who established the trust for federal estate tax purposes. This election allows the trust to be treated as part of the estate for tax purposes, which can have implications for estate tax liability and the filing of estate tax returns. The trust must meet certain requirements to be considered an electing trust, including being a trust that could have been included in the decedent's estate if the decedent had not made the election.

The election period for an electing trust is generally within nine months after the decedent's death. However, if the decedent was a nonresident alien at the time of death, the election period may be longer. The election can be made by filing Form 8855, Application for Portability of Estate and Gift Tax Exemption, with the Internal Revenue Service (IRS).

The applicable date for determining the estate tax liability for an electing trust is the date of the decedent's death. This means that the value of the trust's assets at the time of the decedent's death is used to determine the estate tax liability, even if the trust continues to exist and grow after the decedent's death. The decedent's unified credit or exemption amount can be used to offset the estate tax liability.

Form 8855 must be filed with the IRS within the election period, which is generally nine months after the decedent's death. The form should be sent to the address listed on the instructions for Form 8855, which is currently the Austin Service Center of the IRS. It is important to note that late filings or incorrect filings may result in penalties.

Form 8855 must be signed by the executor or administrator of the decedent's estate. False statements on the form may result in penalties, including fines and even criminal charges. It is important to ensure that all information provided on the form is accurate and complete to avoid any potential penalties.

When an executor is appointed after a valid Section 622(c)(3) or (4) election has been made, the election can be amended by filing Form 8855, Application for Taxpayer Identification Number for Estate and Trusts, with the Internal Revenue Service (IRS). The amended election must be filed within 60 days after the appointment of the executor or alternate payee. It is recommended to consult with a tax professional to ensure proper completion and filing of the form.

Section 645 of the Internal Revenue Code allows an estate or trust to elect to be taxed as a grantor trust for income tax purposes. This election, also known as the grantor trust election, causes the income of the trust to be included in the income of the grantor or transferor for income tax purposes. The grantor trust election can have significant tax implications for both the estate or trust and the related estate. It is recommended to consult with a tax professional to understand the potential tax consequences of making this election.

To obtain a new EIN for a Qualified Revocable Trust (QRT) following the decedent's death, the person responsible for administering the trust must file Form SS-4, Application for Employer Identification Number, with the IRS. The form can be filed online, by fax, or by mail. It is recommended to consult with a tax professional or the IRS to ensure proper completion and filing of the form.

Form 8855 and related documents, including supporting documentation, must be kept by the estate or trust for a period of at least three years from the due date of the return or the date the election was made, whichever is later. It is recommended to consult with a tax professional or the IRS for specific recordkeeping requirements.

The estimated time required to complete and file Form 8855, Application for Taxpayer Identification Number for Estate and Trusts, depends on the complexity of the estate or trust and the availability of necessary information. Generally, it can take between 30 minutes to several hours to complete the form. It is recommended to allow sufficient time to gather all required information and consult with a tax professional to ensure proper completion and filing of the form.

The Internal Revenue Service (IRS) provides detailed instructions and reporting requirements for Form 8855, Election To Treat a Qualified Revocable Trust as Part of an Estate or Trust, in Publication 590, Individual Retirement Arrangements (IRAs). You can access this publication on the IRS website (irs.gov) or by calling the IRS at 1-800-TAX-FORM (1-800-829-3676). Additionally, the IRS website offers an Interactive Tax Assistant tool to help guide you through the process of determining whether you need to file Form 8855. It is recommended that you consult with a tax professional or attorney for specific advice regarding your individual situation.

The Paperwork Reduction Act (PRA) is a federal law that requires federal agencies to obtain approval from the Office of Management and Budget (OMB) before collecting certain information from the public. Form 8855 is subject to the PRA, and the IRS includes the PRA notice on the form to inform taxpayers that their responses are being collected in accordance with the PRA. The notice includes the OMB control number, which is used to identify the form for PRA purposes. The IRS uses the information collected on Form 8855 to administer and enforce the tax laws related to trusts and estates. It is important for taxpayers to provide accurate and complete information on the form to ensure proper processing and avoid potential delays or penalties.

Compliance Form 8855

Validation Checks by Instafill.ai

1

Ensures that the name of the estate or the filing trust is correctly entered in Part I.

The software ensures that the name of the estate or the trust making the election is accurately captured in Part I of the form. It checks for any typographical errors, ensures consistency with official documents, and confirms that the name matches the legal designation of the entity. This validation is crucial for the proper identification of the estate or trust in question.

2

Confirms that the Employer Identification Number (EIN) for the estate or trust is provided in Part I.

The software confirms that the Employer Identification Number (EIN) for the estate or trust is correctly provided in Part I. It verifies that the EIN is in the proper format, consisting of nine digits with a hyphen (e.g., 12-3456789), and checks against a database to ensure that the number is valid and registered with the IRS. This step is essential for tax identification purposes.

3

Verifies that the name of the executor or the filing trustee is listed in Part I.

The software verifies that the name of the executor or the trustee responsible for filing the form is listed in Part I. It checks for the correct spelling of the individual's name, cross-references it with related documents to ensure accuracy, and confirms that the title or position held by the individual is appropriately indicated. This information is vital for establishing who is authorized to act on behalf of the estate or trust.

4

Checks that the address details in Part I are complete, including number, street, room or suite number, or P.O. box number, and that city, state, and ZIP code are correct.

The software checks that the address details provided in Part I are complete and accurate. It ensures that the number, street, room or suite number, or P.O. box number are entered, and that the city, state, and ZIP code are correct. For foreign addresses, the software also ensures compliance with the specific instructions for foreign addresses. This validation is important for maintaining accurate records and ensuring that any correspondence reaches the correct location.

5

Determines that the correct type of entity prior to the election is indicated in Part I.

The software determines that the correct type of entity prior to making the election is indicated in Part I. It checks that the entity is properly classified according to the options provided on the form, such as a trust or estate, and that this classification aligns with legal and tax records. This is essential for the form to reflect the entity's status accurately and to ensure that the election is processed correctly.

6

Validates that the date of the executor's appointment is entered in Part I.

The system ensures that the date of the executor's appointment is accurately entered in Part I of the form. This check is crucial as it establishes the timeline of the executor's authority. The AI verifies the format of the date to ensure it adheres to the required standards and cross-references it with the date of death to maintain consistency. Any discrepancies or omissions in the date entry are flagged for correction to maintain the integrity of the election process.

7

Confirms that the executor or filing trustee has signed and dated Part I

The system confirms that Part I of the form has been duly signed and dated by the executor or filing trustee. This validation is essential as it signifies the executor or trustee's acknowledgment of their role and agreement to the conditions of the election. The AI checks for the presence of a signature and date, ensuring that both are present and properly executed. It also verifies that the date of signing is after the date of the executor's appointment and not in the future, which is a critical step in authenticating the document.

8

Ensures that the name of the decedent is correctly entered in Part II.

The system ensures that the name of the decedent is correctly entered in Part II of the form. This check is fundamental as it identifies the subject of the trust and the estate. The AI examines the name for any typographical errors and compares it against other official documents to ensure accuracy. It also checks for the completeness of the name, including any middle names or suffixes, to prevent any potential legal issues or confusion during the processing of the election.

9

Verifies that the Social Security Number (SSN) of the decedent is provided in Part II.

The system verifies that the Social Security Number (SSN) of the decedent is provided in Part II. This validation is critical for tax identification purposes and to ensure that the estate is correctly associated with the decedent. The AI checks the SSN format for compliance with the standard 9-digit structure and validates it against government records for accuracy. Any incorrect or missing SSN entries are highlighted for immediate rectification to avoid delays in the election process.

10

Checks that the date of death of the decedent is correctly filled in Part II.

The system checks that the date of death of the decedent is correctly filled in Part II. This information is vital as it marks the commencement of the estate and trust administration. The AI validates the date format, ensuring it follows the prescribed format and is logically consistent with the date of the executor's appointment. It also confirms that the date of death precedes the signing date of the form, as this is a logical necessity for the validity of the document.

11

Ensures that the name of the trust is correctly entered in Part III.

The AI ensures that the name of the trust is accurately captured in Part III of the form. It cross-references the trust name with official documents to prevent any discrepancies. The AI also checks for proper formatting and spelling to ensure that the trust name reflects the legal designation. This validation is crucial for the identification of the trust in question and to maintain consistency across legal documents.

12

Confirms that the Employer Identification Number (EIN) for the trust is provided in Part III.

The AI confirms that the Employer Identification Number (EIN) for the trust is provided in Part III. It validates the EIN against the IRS database to ensure it is a legitimate and current number associated with the trust. The AI also checks the format of the EIN to ensure it follows the standard IRS format. This step is essential for tax identification purposes and to comply with federal regulations.

13

Verifies that the name of the trustee is listed in Part III.

The AI verifies that the name of the trustee is correctly listed in Part III. It checks the trustee's name for accuracy and proper formatting, and compares it against the trust agreement to ensure the listed individual is authorized to act on behalf of the trust. This verification is important to establish the legal authority of the trustee in relation to the trust.

14

Checks that the address details for the trust in Part III are complete and accurate.

The AI checks that the address details for the trust provided in Part III are complete and accurate. It validates the address against postal service records to ensure deliverability and correctness. The AI also ensures that all necessary components of the address, such as street name, number, city, state, and ZIP code, are present and properly formatted. Accurate address information is vital for any official correspondence related to the trust.

15

Confirms that the trustee has signed and dated Part III, thereby confirming authority and agreement to the conditions of the election.

The AI confirms that Part III has been signed and dated by the trustee, thereby validating the trustee's authority and agreement to the conditions of the election. It checks the signature against known samples to authenticate the signatory and verifies the date for recency and format consistency. This confirmation is critical to ensure that the election is legally binding and has been made by an individual with the authority to do so.

Common Mistakes in Completing Form 8855

When completing Form Election To Treat a Qualified Revocable Trust as Part of an Estate, it is essential to provide the correct name of the estate or trust in both Part I and Part III. Incorrect or incomplete names may lead to processing delays or rejections. To avoid this mistake, double-check the name of the estate or trust as it appears on the legal documents. If the name has changed, ensure that the new name is used consistently throughout the form.

Entering an incorrect or incomplete Employer Identification Number (EIN) in Part I or Part III can cause significant issues. The EIN is a unique identifier for the estate or trust, and any discrepancies may result in processing delays or rejections. To prevent this mistake, ensure that the EIN is entered accurately and completely, including any hyphens or other special characters. If the EIN is not known, contact the IRS or the person responsible for obtaining the EIN for the estate or trust.

Signing and dating the form by the executor or filing trustee in Part I or Part III is a critical step in completing Form Election To Treat a Qualified Revocable Trust as Part of an Estate. Failure to do so may result in processing delays or rejections. To avoid this mistake, ensure that the person signing the form has the necessary authority and that they sign and date the form in the designated areas. Keep in mind that the form may need to be signed and dated by multiple parties, depending on the specific circumstances of the estate or trust.

Providing complete address details in Part I or Part III is essential to ensure that the IRS can contact the estate or trust regarding any issues or questions related to the form. Incomplete address details may result in processing delays or rejections. To prevent this mistake, ensure that the address is entered in its entirety, including the street address, city, state, and zip code. If the estate or trust has multiple addresses, ensure that the correct address is used for the specific purpose of the form.

Indicating the incorrect type of entity in Part I can lead to significant issues when completing Form Election To Treat a Qualified Revocable Trust as Part of an Estate. The form requires the estate or trust to be identified as a specific type of entity, such as a grantor trust or an exempt organization. Failure to indicate the correct type of entity may result in processing delays or rejections. To prevent this mistake, ensure that the estate or trust is identified correctly based on its legal structure and tax status. Consult with a tax professional or legal advisor if necessary to confirm the correct entity type.

One of the most critical sections of the Election To Treat a Qualified Revocable Trust as Part of an Estate form is Part II, which requires the decedent's correct name, Social Security Number (SSN), and date of death. Failure to enter the correct information in this section may result in processing delays or even rejection of the form. To avoid this mistake, double-check all the information entered in Part II against the decedent's death certificate and other relevant documents. Additionally, ensure that all fields are completed in their entirety to prevent any potential errors or omissions.

Another common mistake when filing the Election To Treat a Qualified Revocable Trust as Part of an Estate form is missing the filing deadline, including extensions. The form must be filed within nine months after the decedent's death to be eligible for processing. Failure to meet this deadline may result in the loss of potential tax benefits and additional penalties. To avoid this mistake, mark the deadline on your calendar and ensure that the form is submitted well before the due date to allow for any potential processing delays or mailing time.

It is essential to send the completed Election To Treat a Qualified Revocable Trust as Part of an Estate form to the correct IRS Service Center to ensure timely processing. Failure to do so may result in processing delays or even rejection of the form. To avoid this mistake, refer to the instructions on the form or consult the IRS website for the correct address and mailing instructions for the form.

Other sections of the Election To Treat a Qualified Revocable Trust as Part of an Estate form, such as Part III and Part IV, also require careful completion to prevent potential errors or omissions. For instance, failure to provide complete and accurate information regarding the trust and its assets may result in processing delays or even rejection of the form. To avoid this mistake, ensure that all sections of the form are completed in their entirety and that all information is accurate and consistent with other relevant documents.

Upon the death of the grantor of a QRT, the trust becomes part of the decedent's estate and requires a new EIN. Failing to obtain and provide this new EIN on the Election To Treat a Qualified Revocable Trust as Part of an Estate form can result in processing delays or rejections. To avoid this mistake, ensure that you apply for a new EIN from the IRS as soon as possible after the grantor's death and provide it on the form when filing. It is essential to understand that the QRT's EIN is different from the decedent's Social Security Number or the EIN of the grantor's estate.

Form 8855, Tax Information for Withholding and Reporting (Foreign), is required to be filed by the withholding agent when making distributions from the estate or trust to a nonresident alien. If a new executor or trustee is appointed, it is essential to file an amended Form 8855 within 90 days of the appointment to reflect the new appointee's information. Failing to do so can result in penalties and processing delays. To avoid this mistake, ensure that you file an amended Form 8855 as soon as possible after the appointment of a new executor or trustee.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8855 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8855 forms, ensuring each field is accurate.