Form 8855, Election To Treat a Qualified Revocable Trust Completed Form Examples and Samples

Explore a detailed example of a completed Form 8855 for electing a Qualified Revocable Trust as part of an estate under Section 645. This guide includes executor and trustee information, election details, and ensures proper completion for tax purposes.

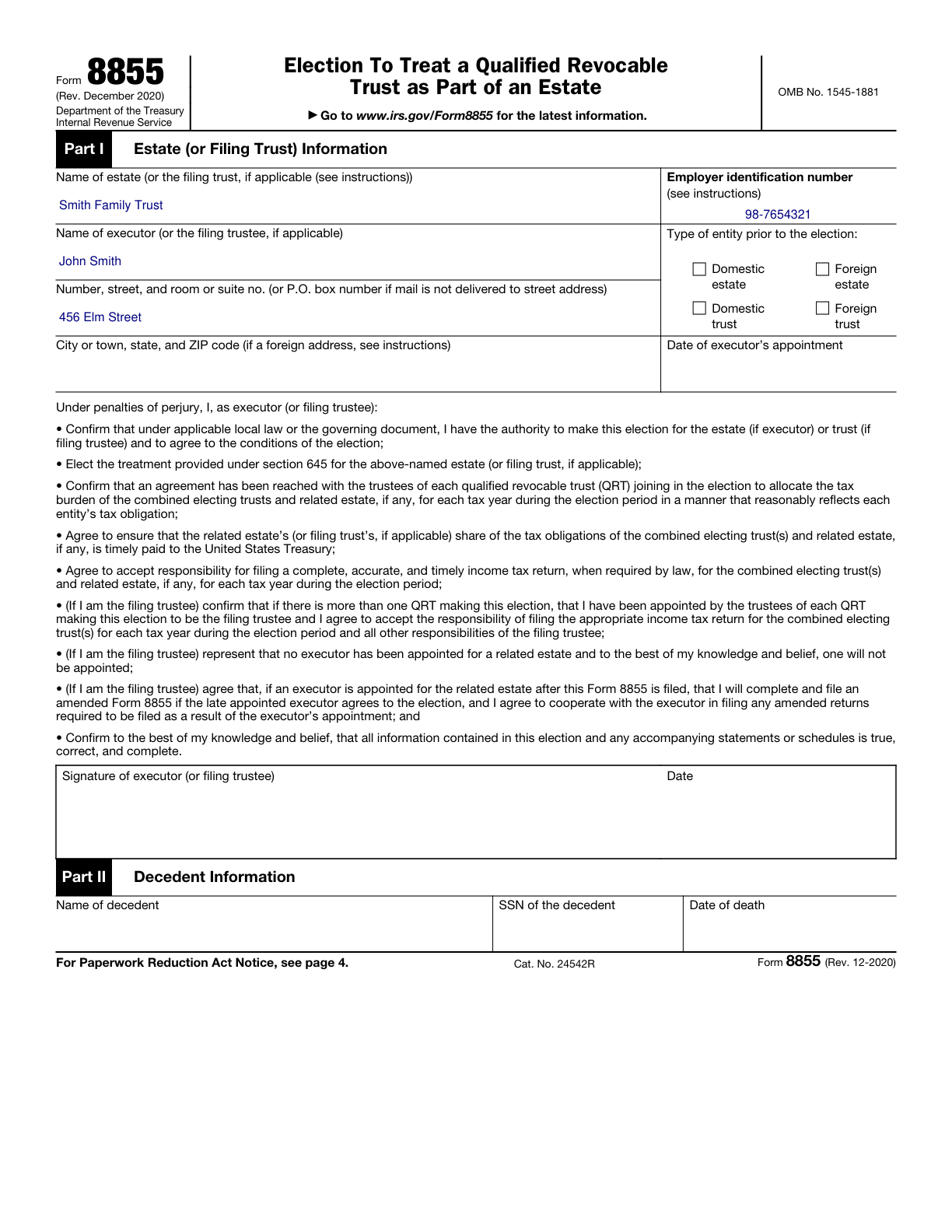

Form 8855 Example – Qualified Revocable Trust Election

How this form was filled:

In this example, the executor of the estate and trustee of the qualified revocable trust elect to treat the trust as part of the estate (under Section 645) for estate tax purposes. Key details include properly completed sections indicating election details, executor and trustee information, and a signature and date.

Information used to fill out the document:

- Executor’s Name: John Smith

- Executor’s Address: 456 Elm Street, Anytown, USA

- Trustee’s Name: Jane Doe

- Trustee’s Address: 789 Oak Avenue, Anytown, USA

- Trust Name: Smith Family Trust

- Estate’s EIN: 98-7654321

- Trust’s EIN: 99-8765432

- Election Date: 05/01/2025

- Signature: John Smith

- Date: 02/10/2025

What this filled form sample shows:

- Accurate completion of executor information and trustee details

- Correctly filled trust and estate EINs

- Valid election under Section 645 for tax purposes

- Properly formatted signature and election date

Form specifications and details:

| Use Case: | Elect to treat a qualified revocable trust as part of the estate |

| Purpose: | Achieve tax reporting consistency and benefits under Section 645 |