Fill out Belastingdienst forms

with AI.

Belastingdienst forms are essential for managing tax obligations and legal compliance within the Netherlands. This category encompasses a wide range of documentation required by the Dutch Tax Authority to handle everything from corporate tax structures to specific fiscal requests. These forms serve as the formal communication channel between taxpayers and the government, ensuring that entities and individuals can accurately report their financial status, claim relevant exemptions, and maintain their standing under Dutch tax law.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About Belastingdienst forms

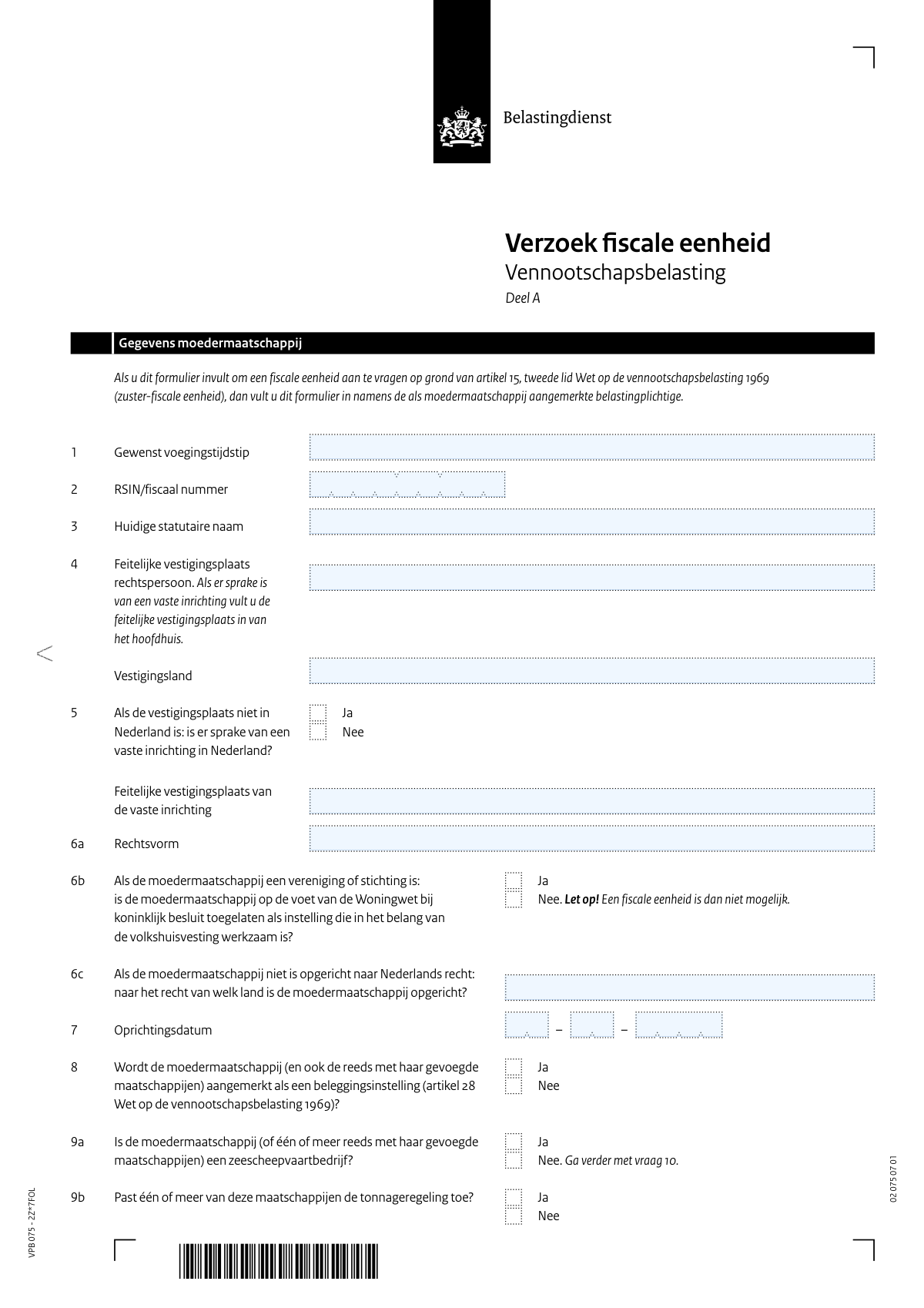

Typically, these forms are utilized by entrepreneurs, tax advisors, and financial controllers who need to formalize specific tax arrangements. For example, businesses looking to consolidate their tax reporting might require forms like the VPB 075 to request a fiscal unity (fiscale eenheid) for corporate income tax. Whether you are managing corporate tax (Vennootschapsbelasting), adjusting VAT details, or handling international fiscal qualifications, these documents are the necessary tools for navigating the complexities of the Dutch tax system. Precision is vital, as these filings directly impact tax assessments and legal liabilities.

To streamline your administrative workflow, all the Belastingdienst forms in this category can be filled out online at Instafill.ai. Our AI-powered platform transforms traditional, static tax documents into interactive digital experiences. By using Instafill.ai, you can quickly and accurately complete your tax paperwork, reducing the risk of manual errors and ensuring that your submissions to the Belastingdienst are professional and complete.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Navigating corporate tax requirements in the Netherlands can be complex, especially when managing multiple entities. Use this guide to determine if the available Belastingdienst form is the right choice for your current fiscal needs.

Consolidating Corporate Income Tax

Currently, the primary form in this category is the Belastingdienst VPB 075 – Verzoek fiscale eenheid Vennootschapsbelasting (Deel A – Gegevens moedermaatschappij). You should select this form if you are representing a parent company (*moedermaatschappij*) that intends to form a fiscal unity with one or more subsidiaries for corporate income tax purposes.

When to Use the VPB 075 Form

This specific document is essential for companies that want to be treated as a single taxpayer by the Dutch tax authorities. Use this form if:

- Establishing a New Unity: You are applying for a fiscal unity under Article 15 of the Corporate Income Tax Act 1969 (*Wet Vpb 1969*).

- Identifying the Parent Entity: You need to provide the core administrative data of the parent company, including the RSIN (fiscal number), legal form, and registered office.

- Complex Structures: Your request involves specific tax arrangements such as a "Papillon" fiscal unity or a "sister" fiscal unity (*zuster-fiscale eenheid*).

Key Information Required

Filling out the VPB 075 requires precise details to avoid rejection or tax corrections. Ensure you have the following information ready before you begin:

- Fiscal Qualifications: Details regarding permanent establishments in the Netherlands or specific regimes like the tonnage tax (*tonnageregeling*).

- Financial Reporting: Information on whether the entity uses a functional currency other than the Euro.

- Investment Status: Whether the company is classified as a specific type of investment institution (*beleggingsinstelling*).

By using Instafill.ai, you can quickly convert the static PDF of the VPB 075 into an interactive, AI-assisted form, ensuring that all mandatory fields for the parent company are completed accurately before submission.

Form Comparison

| Form | Purpose | Who Files It | Key Information Required | Specific Situations |

|---|---|---|---|---|

| Belastingdienst VPB 075 – Verzoek fiscale eenheid Vennootschapsbelasting (Deel A – Gegevens moedermaatschappij) | Requesting a fiscal unity for corporate income tax for a parent company. | The designated parent company or its authorized tax representative. | RSIN, fiscal number, legal form, and specific tax qualifications of the parent. | Covers sister fiscal unities, permanent establishments, and functional currency requests. |

Tips for Belastingdienst forms

Double-check the RSIN and fiscal numbers for both the parent and subsidiary companies before submitting. Incorrect identifiers are the leading cause of processing delays or immediate rejection by the Belastingdienst.

Ensure the requested start date for the fiscal unity aligns with your accounting periods and legal requirements. A fiscal unity generally cannot be requested retroactively beyond certain limits, so confirm the allowed window before finalizing your application.

Be precise when declaring the legal form and whether the entity has a permanent establishment in the Netherlands. These factors determine eligibility for specific tax regimes, such as the Papillon or sister-company fiscal unity.

If any company in the group utilizes the tonnage regime or functions as a dedicated investment institution, ensure this is noted on the form. Failing to disclose these special statuses can lead to complications in future corporate tax assessments and audits.

Many Belastingdienst forms are provided as flat PDF files that are difficult to edit directly. Use Instafill.ai to transform these static documents into interactive forms, allowing you to use AI to populate data accurately and efficiently.

After filling out the VPB 075 form, keep a digital and physical copy of the completed and signed version for your corporate records. This documentation is vital for future audits or when filing consolidated tax returns for the fiscal unity.

If your group operates using a currency other than the Euro, indicate this clearly on the application. The Belastingdienst requires specific permission to file in a functional currency, which usually begins with the initial fiscal unity request.

Frequently Asked Questions

These forms are used by businesses and legal entities to manage their tax obligations in the Netherlands, such as applying for specific tax statuses or reporting corporate income. They ensure that the Dutch Tax and Customs Administration has the correct data to determine your company's tax liability accurately. Properly completing these documents is essential for maintaining compliance with Dutch fiscal laws.

Generally, the board of directors or an authorized tax representative of a Dutch legal entity, such as a B.V. or N.V., is responsible for filing these forms. In some cases, foreign companies with a permanent establishment in the Netherlands may also be required to submit specific documentation. It is important to verify which entity within a group is designated as the primary contact for the tax authorities.

A fiscal unity allows a parent company and its subsidiaries to be treated as a single taxpayer for corporate income tax purposes. This can simplify the filing process and allow the group to offset losses from one company against the profits of another. Specific forms are required to request this status or to make changes to an existing fiscal unity.

The correct form depends on your specific request, such as registering a new business, applying for a fiscal unity, or reporting changes in your corporate structure. You should review the description of each form to see if it matches your current fiscal situation or consult with a tax advisor. Many forms are categorized by tax type, such as Vennootschapsbelasting (VPB) for corporate tax.

Yes, you can use Instafill.ai to complete Belastingdienst PDF forms directly in your web browser. Our AI-powered platform helps you navigate the fields quickly and can even convert non-fillable PDF documents into interactive forms. This saves time and reduces the risk of manual entry errors before you print or submit the document.

You will typically need your company's RSIN (Legal Entities and Non-profit Organizations Identification Number), Chamber of Commerce (KVK) number, and official registered address. Additionally, you may need to provide details about the company's legal structure, fiscal year-end, and the identities of any parent or subsidiary companies involved. Having these documents ready will make the filling process much smoother.

Most paper-based forms include a specific mailing address on the last page or in the accompanying instruction manual. Some requests can also be submitted digitally through the Belastingdienst's secure portal for entrepreneurs. Always ensure you are using the most recent version of the form to avoid delays in processing by the tax office.

The vast majority of official Belastingdienst forms are provided exclusively in Dutch, as it is the official language for legal and fiscal matters in the Netherlands. If you are not fluent in Dutch, using a tool like Instafill.ai can help you identify the necessary fields more easily. For complex legal definitions, it is often recommended to seek assistance from a bilingual tax professional.

Instafill.ai uses advanced AI to guide you through the form-filling process, ensuring that you don't miss critical fields or required signatures. The platform can handle various PDF formats, making it easier to manage official documentation without needing specialized software. This ensures your submission to the Belastingdienst is legible, professional, and complete.

Providing incorrect or incomplete information can lead to the rejection of your application or even result in fiscal corrections and potential penalties. If you realize an error was made after submission, you should contact the Belastingdienst as soon as possible to file a correction. Using digital tools to double-check your entries before finalization is a highly effective way to prevent these issues.

Glossary

- Vennootschapsbelasting (VPB)

- The Dutch corporate income tax levied on the profits of companies, such as BVs and NVs, operating in the Netherlands.

- Fiscale eenheid

- A tax arrangement where a group of companies is treated as a single taxpayer, allowing them to offset losses against profits within the group.

- RSIN

- A unique identification number for legal entities and partnerships in the Netherlands, used by the Tax Administration to identify the organization.

- Moedermaatschappij

- The parent company that holds the majority of shares in another company and acts as the primary entity in a fiscal unity.

- Vaste inrichting

- A 'permanent establishment' or fixed place of business in the Netherlands through which a foreign company conducts its business activities.

- Papillon-fiscale eenheid

- A specific type of fiscal unity where two Dutch companies are linked via an intermediate company located in another EU or EEA country.

- Zuster-fiscale eenheid

- A 'sister' fiscal unity formed between two Dutch subsidiaries that share the same parent company located in an EU or EEA member state.

- Functionele valuta

- The primary currency in which a company conducts its business; companies may request to file taxes in this currency instead of Euros.

- Tonnageregeling

- A specific tax regime for shipping companies where profit is determined based on the tonnage of the vessels rather than actual business results.