Fill out business credit forms

with AI.

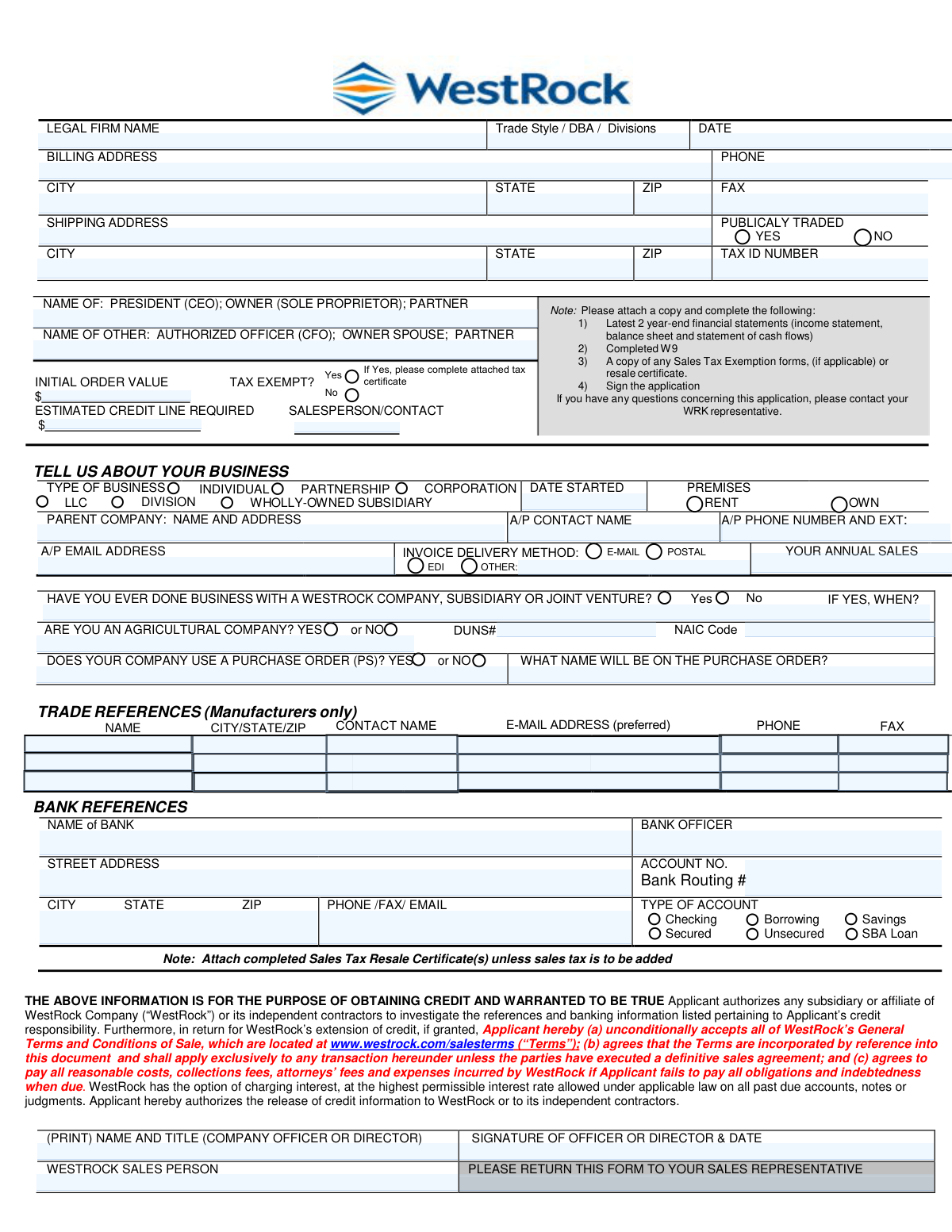

Business credit forms are the paperwork backbone of commercial trade relationships. They allow companies to establish credit accounts with suppliers and vendors, document their financial standing, and — where applicable — claim exemptions from sales tax on qualifying purchases. These forms serve a dual purpose: they help sellers assess the creditworthiness of potential customers, and they provide the legal documentation needed to support tax-exempt or resale transactions across multiple states. Getting them right matters, because errors or missing information can delay credit approvals, trigger audits, or result in unexpected tax liabilities.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About business credit forms

Businesses that regularly purchase goods for resale, manufacturers sourcing raw materials, and companies expanding their supplier network are among the most common users of these forms. A document like the WestRock Credit Application paired with a Multijurisdiction Sales & Use Tax Exemption/Resale Certificate is a good example — it covers everything from ownership details and bank references to state-by-state resale registration numbers, all in one packet. Whether you're a small retailer opening a new vendor account or a larger operation managing multi-state tax compliance, having accurate, complete documentation protects your business on both the credit and tax fronts.

Filling out these forms carefully is important, but it doesn't have to be time-consuming — tools like Instafill.ai use AI to complete forms like these in under 30 seconds, handling the details accurately and securely so you can focus on running your business.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds