Fill out Dutch tax forms

with AI.

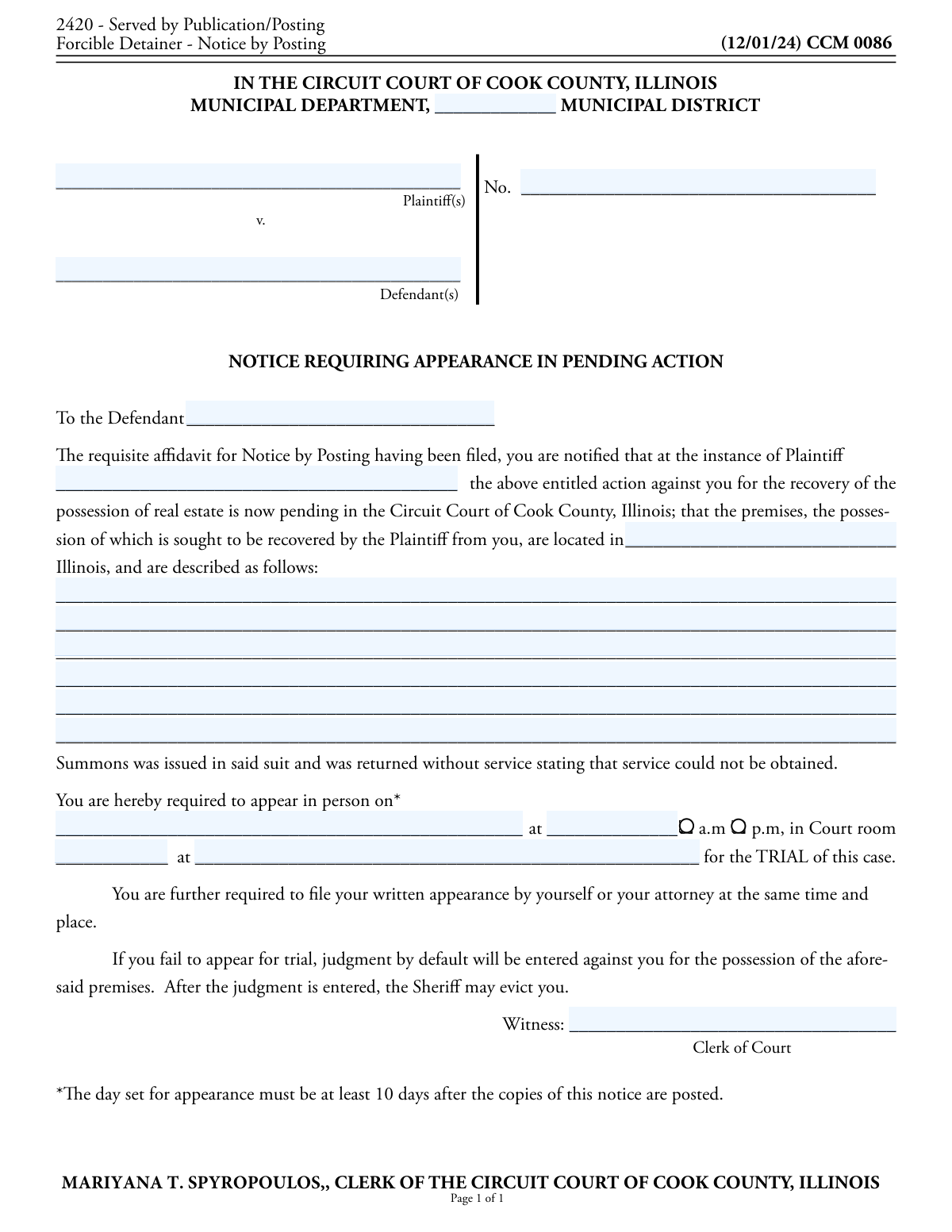

Navigating the landscape of Dutch tax forms is a critical task for any business operating within the Netherlands. These documents, ranging from corporate income tax filings to specific structural requests, serve as the formal communication channel between a company and the Belastingdienst. Properly managing these business tax forms ensures that a company remains compliant with local regulations while correctly applying for specific fiscal statuses that can impact the overall tax burden of a corporate group.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About Dutch tax forms

Corporate tax forms are typically required by financial officers, tax advisors, and business owners during key milestones, such as forming a fiscal unity or reporting annual profits. For instance, forms like the VPB 075 are used to establish a fiscal unity for corporate income tax, requiring detailed information about parent companies, subsidiaries, and specific legal structures. Given the complexity of Dutch tax law, providing accurate data regarding RSIN numbers and fiscal qualifications is essential to prevent administrative setbacks or potential audits.

Completing these technical documents manually can be a tedious process prone to human error. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, ensuring that data is handled accurately and securely. This allows tax professionals and business leaders to focus on strategy rather than paperwork, transforming a complex regulatory requirement into a quick and efficient digital process.

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Navigating Dutch business tax forms requires precision, especially when managing corporate structures. If you are looking to streamline the tax filing process for a group of companies, choosing the correct documentation for a "Fiscal Unity" is the most important step.

Consolidating Corporate Income Tax

In this category, the primary document is the Belastingdienst VPB 075 – Verzoek fiscale eenheid Vennootschapsbelasting (Deel A – Gegevens moedermaatschappij). You should select this form if your goal is to have multiple entities treated as a single taxpayer for corporate income tax (CIT) purposes.

This specific form is intended for:

- Parent Companies: As "Deel A" (Part A), this form is specifically for the parent company (moedermaatschappij) to provide its core details, including RSIN, legal form, and place of establishment.

- New Fiscal Unities: Use this when first requesting that subsidiaries be linked to the parent for tax consolidation.

- Complex Dutch Structures: It is the correct choice for specialized requests, such as those involving "Papillon" structures or sister-fiscal unities under Article 15 of the Wet Vpb 1969.

When to Use This Form

Choosing the VPB 075 is necessary when your tax strategy involves offsetting losses between different companies within your group or simplifying the overall CIT return process. It is particularly relevant if your company deals with specific fiscal qualifications such as:

- The tonnage tax regime (tonnageregeling) for shipping.

- Operating as a specialized investment institution.

- Utilizing a functional currency other than the Euro for tax reporting.

Because the Dutch tax authorities (Belastingdienst) require exact data to approve a fiscal unity, using Instafill.ai can help you accurately complete the VPB 075. Our AI tools help interpret the technical Dutch terminology and ensure that even non-interactive PDFs are filled out with the necessary precision to avoid delays or rejection of your fiscal unity request.

Form Comparison

| Form | Purpose | Who Files It | Key Information Required |

|---|---|---|---|

| Belastingdienst VPB 075 – Verzoek fiscale eenheid Vennootschapsbelasting (Deel A – Gegevens moedermaatschappij) | Requesting a consolidated tax group (fiscale eenheid) for corporate income tax purposes. | The parent company or an authorized representative acting on its behalf. | Includes RSIN, legal form, and details on special tax regimes or qualifications. |

Tips for Dutch tax forms

Always double-check the RSIN (Legal Entities and Partnerships Identification Number) for the parent company. Providing an incorrect fiscal number is a common mistake that leads to immediate rejection of the request by the Dutch Tax Authorities (Belastingdienst).

Before filling out corporate tax forms, ensure the entities involved meet the 95% ownership threshold and share the same financial year. Misunderstanding the requirements for a 'fiscale eenheid' can result in significant administrative work to undo incorrect filings.

AI-powered tools like Instafill.ai can complete these complex Dutch tax forms in under 30 seconds with high accuracy. Your data stays secure during the process, making it a highly efficient solution for businesses managing multiple corporate tax documents.

If your company uses a functional currency other than the Euro, such as USD or GBP, ensure this is clearly indicated on the form. Failing to mark the 'functionele valuta' section correctly can lead to inconsistencies in your annual corporate tax returns.

Be precise when answering questions regarding the tonnage tax regime (zeescheepvaart) or investment institution status. These special fiscal qualifications change how the Belastingdienst processes your request and affect the overall tax liability of the corporate group.

For fiscal unity requests, pay close attention to whether you are applying under standard rules or specific scenarios like sister-company or Papillon structures. Selecting the wrong legal basis under Article 15 of the VPB Act 1969 can lead to a formal denial of the application.

Frequently Asked Questions

These forms are primarily used by companies registered in the Netherlands that are subject to corporate income tax (Vennootschapsbelasting). Specifically, entities acting as a parent company use these forms to manage tax group structures or to report specific fiscal qualifications to the Belastingdienst.

A fiscal unity allows a parent company and its subsidiaries to be treated as a single taxpayer for corporate income tax purposes. This arrangement allows for the offsetting of losses between companies and simplifies the filing process by requiring only one consolidated tax return for the entire group.

You will generally need the company's RSIN (fiscaal nummer), the legal form of the entity, the official place of business, and details regarding any specific tax regimes, such as the tonnage tax or functional currency. Accurate identification numbers are essential to ensure the Belastingdienst can process the request without delays.

Yes, AI tools like Instafill.ai can fill out complex Dutch tax forms in under 30 seconds. The system accurately extracts data from your corporate source documents and places it directly into the correct fields of the PDF, significantly reducing the risk of manual entry errors.

Requests should be filed before the desired start date of the fiscal unity, although the Belastingdienst may allow for limited retroactive effect in certain cases. It is standard practice for businesses to submit these forms well in advance of a new fiscal year to ensure the consolidated status is active for the entire reporting period.

Manually completing Dutch corporate forms can take significant time due to the technical nature of the questions. However, by using AI-driven services like Instafill.ai, you can complete these documents in less than 30 seconds by automating the data extraction and placement process.

Most completed forms are sent to the Belastingdienst (the Netherlands Tax and Customs Administration). While many routine filings are handled through the online tax portal, specific applications for fiscal unities may require mailing to a central processing office or submitting via specialized software.

Providing inaccurate data can lead to the immediate rejection of the application or the retroactive cancellation of a fiscal unity. This can result in significant tax corrections, unexpected liabilities for individual subsidiaries, and potential administrative penalties from the tax authorities.

Yes, the form includes specific sections to address complex corporate arrangements under Article 15 of the Corporate Income Tax Act 1969. This includes situations where a fiscal unity is formed between sister companies or via a foreign parent company, provided they meet the Dutch residency and legal requirements.

Official forms from the Belastingdienst are almost exclusively provided in Dutch. While international firms often use English for internal records, they must translate and map their data into the Dutch fields of the official forms, a task that can be simplified using AI tools that recognize and place data regardless of the source document's language.

The tax authorities will review the request to verify that all legal requirements for the specific tax status are met. If approved, the company will receive a formal decree (beschikking) confirming the start date and the entities included in the fiscal unity.

Glossary

- Vennootschapsbelasting (VPB)

- The corporate income tax levied on the profits of companies, such as BVs and NVs, operating in the Netherlands.

- Fiscale Eenheid

- A tax arrangement known as a fiscal unity that allows a group of companies to be treated as a single taxpayer for corporate income tax purposes.

- RSIN

- A unique identification number for legal entities and partnerships in the Netherlands, used by the Tax Administration to identify businesses.

- Moedermaatschappij

- The parent company that holds the majority of shares in another company and acts as the primary entity in a fiscal unity.

- Vaste Inrichting

- A 'permanent establishment' or fixed place of business in the Netherlands through which a foreign company conducts its activities.

- Functionele Valuta

- A tax provision allowing a company to calculate its taxable profit in a currency other than the Euro, provided it meets specific accounting criteria.

- Tonnageregeling

- A specialized tax regime for the shipping industry where profit is determined based on the net tonnage of the vessels rather than actual business results.

- Papillon-fiscale eenheid

- A specific type of fiscal unity that allows a Dutch parent company to form a tax group with a Dutch subsidiary through an intermediate company located in the EU or EEA.