Fill out gambling tax forms

with AI.

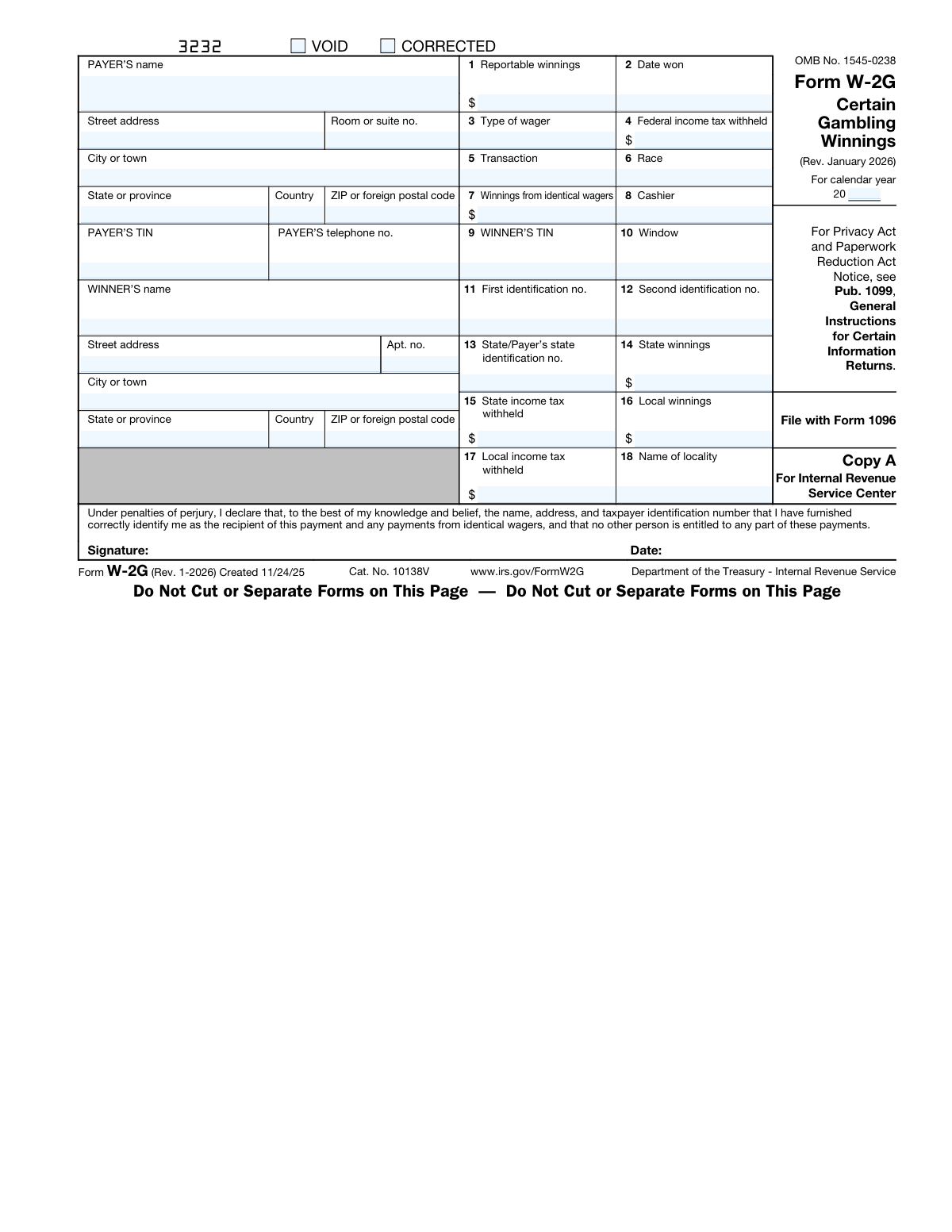

Gambling tax forms are IRS documents used to report winnings from casinos, lotteries, horse racing, poker tournaments, and other wagering activities. These forms serve a critical function in the tax system: they ensure that gambling income — which is fully taxable under federal law — is properly documented and reported to both the IRS and the winner. Whether winnings are paid out in cash, prizes, or other forms of compensation, payers are required by law to report amounts that meet certain thresholds, and winners must account for that income on their federal tax returns.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About gambling tax forms

The most common form in this category is the W-2G, which casinos, racetracks, lotteries, and similar payers issue when a winner's payout meets IRS reporting requirements. Individuals who receive a W-2G need to understand how it affects their tax liability, what withholding has already been applied, and how to reconcile it with their Form 1040. Tax professionals, gaming operators, and individual filers alike regularly work with these documents during tax season.

Because these forms involve precise financial figures and taxpayer identification details, accuracy is essential. Tools like Instafill.ai use AI to fill out gambling tax forms in under 30 seconds, reducing the risk of errors and making the process significantly faster for both payers and recipients.

Forms in This Category

| Form Name | Pages | |

|---|---|---|

| 1. | Form W-2G, Certain Gambling Winnings (Rev. January 2026) | 7 |

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds