Fill out LLC tax forms

with AI.

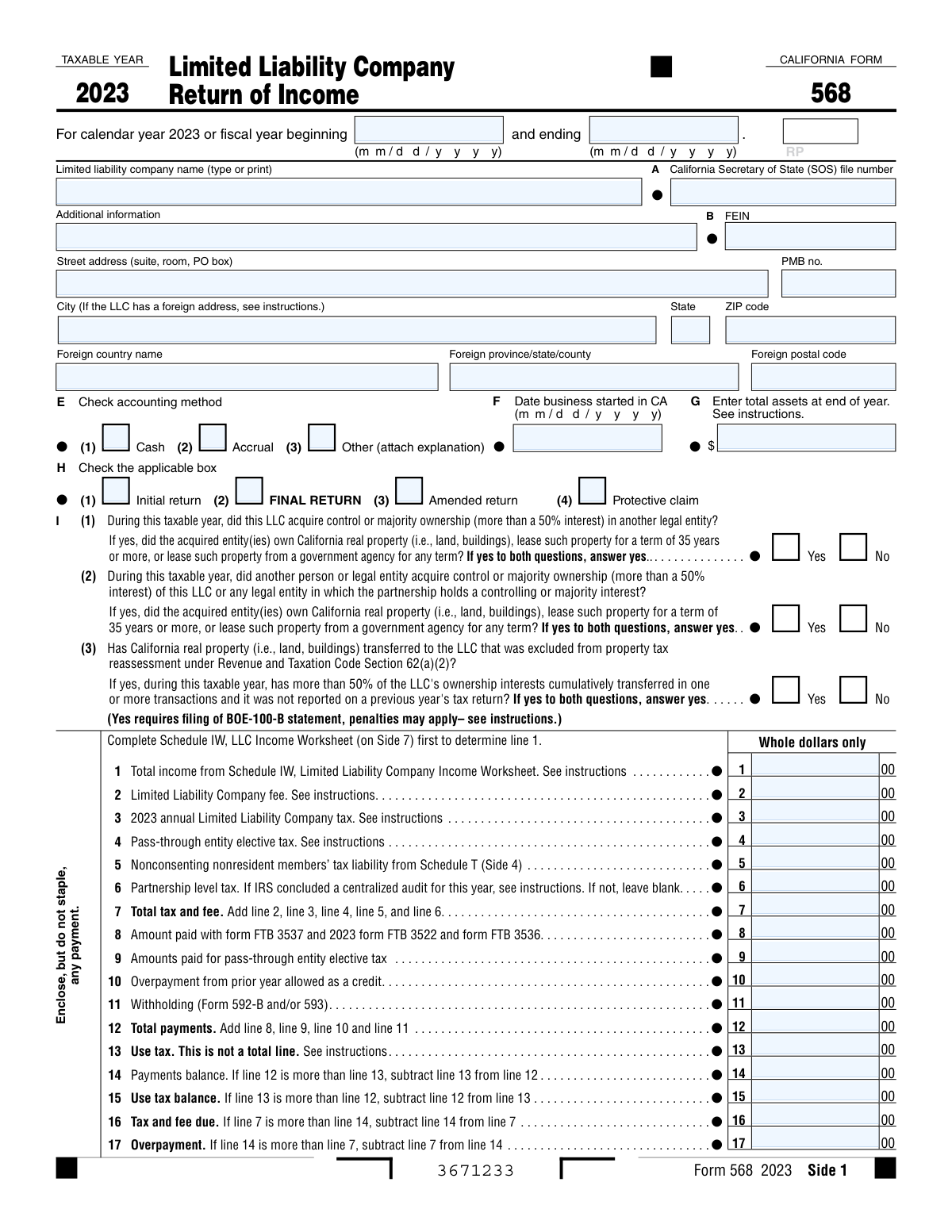

LLC tax forms are the federal and state filings that limited liability companies use to report income, calculate taxes owed, and stay compliant with tax authorities. For LLCs operating in California, this process involves navigating both federal requirements and California-specific rules administered by the Franchise Tax Board (FTB). California imposes its own LLC tax structure — including the annual $800 minimum franchise tax and an LLC fee based on total California income — which makes state-level filing a distinct and important obligation separate from any federal return.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About LLC tax forms

Anyone who owns or manages an LLC registered in California, or conducting business within the state, will likely need to deal with California's LLC tax requirements. This includes single-member LLCs, multi-member LLCs, and even out-of-state LLCs with California-sourced income. The primary form for this purpose is California Form 568, which covers income reporting, California adjustments, member allocations, nonresident withholding, and several supporting schedules. Filing it accurately matters — errors can trigger penalties or misallocate tax obligations among members.

Because these forms involve multiple schedules and precise calculations, getting the details right can be time-consuming. Tools like Instafill.ai use AI to help fill out forms like Form 568 in under 30 seconds, handling the data accurately and securely so you can focus on reviewing rather than manually entering information.

Forms in This Category

| Form Name | Pages | |

|---|---|---|

| 1. | California Form 568 (2023), Limited Liability Company Return of Income | 7 |

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds