Yes! You can use AI to fill out Form FTB 3533, Change of Address for Individuals

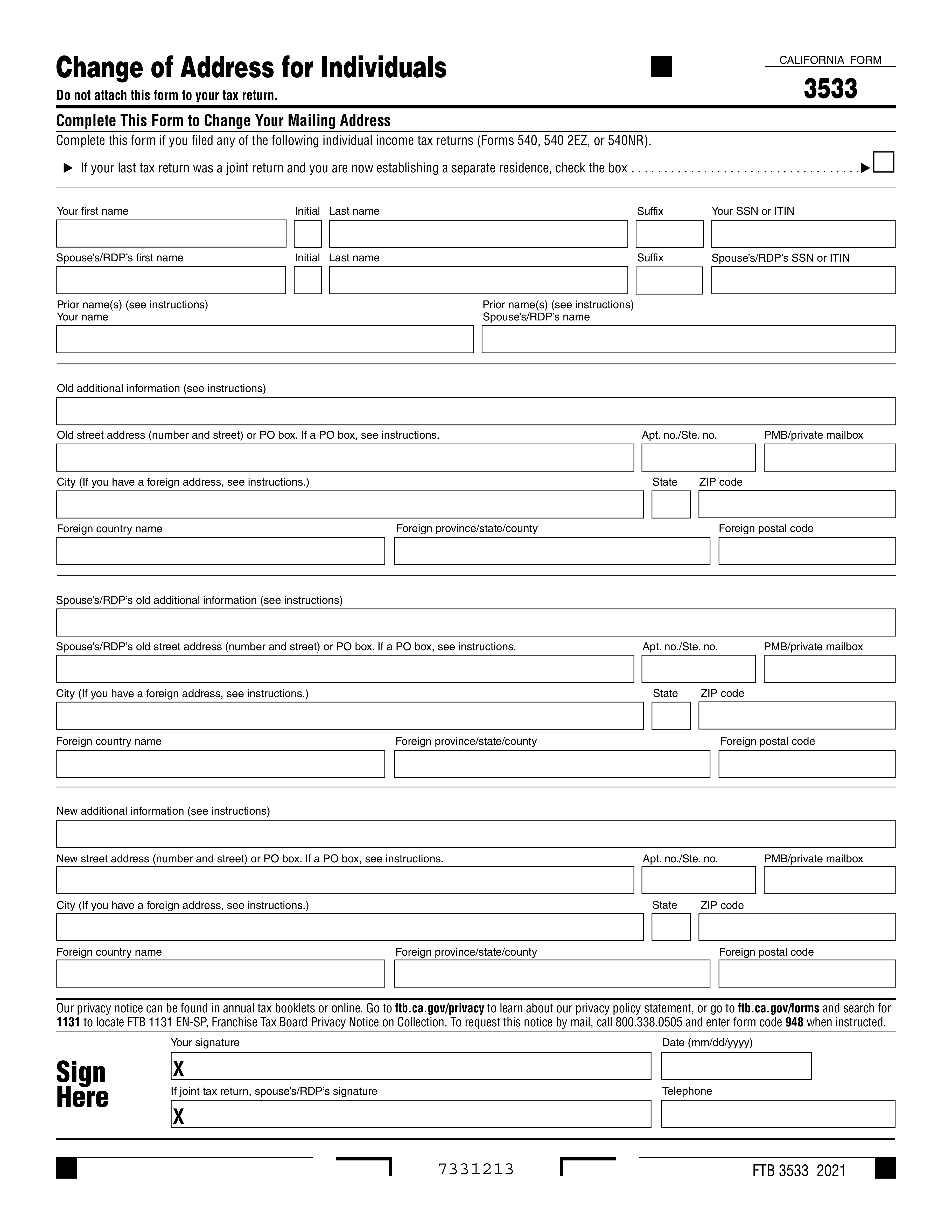

Form FTB 3533, Change of Address for Individuals, is used to notify the California Franchise Tax Board of a change in your mailing address. This form is important to ensure you receive all tax-related documents and correspondence at your new address.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out FTB 3533 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form FTB 3533, Change of Address for Individuals |

| Form issued by: | California Franchise Tax Board |

| Number of fields: | 45 |

| Number of pages: | 1 |

| Version: | 2021 |

| Instructions: | https://www.ftb.ca.gov/forms/2022/2022-3533-instructions.html |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out FTB 3533 Online for Free in 2026

Are you looking to fill out a FTB 3533 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FTB 3533 form in just 37 seconds or less.

Follow these steps to fill out your FTB 3533 form online using Instafill.ai:

- 1 Visit instafill.ai site and select FTB 3533.

- 2 Enter your old mailing address details.

- 3 Provide your new mailing address information.

- 4 Fill in your and your spouse's personal details.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable FTB 3533 Form?

Speed

Complete your FTB 3533 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 FTB 3533 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form FTB 3533

This form is used to change the mailing address for individuals who have filed California individual income tax returns (Forms 540, 540 2EZ, or 540NR).

No, do not attach this form to your tax return. Complete and submit the form separately.

You must provide your prior name(s), your old street address or PO box, apartment or suite number, private mailbox number, city, state, ZIP code, and foreign country, province/state/county, and postal code.

You must provide your new street address or PO box, apartment or suite number, private mailbox number, city, state, ZIP code, and foreign country, province/state/county, and postal code.

Check the box provided and complete the form for both yourself and your spouse or RDP.

Yes, if you have moved within California, you should file a Change of Address form to ensure that you receive any correspondence from the California Franchise Tax Board related to your tax account.

The processing time for a Change of Address form can vary, but you should allow at least 4-6 weeks for the California Franchise Tax Board to update your address in their records. If you have not received a confirmation of your address change within this timeframe, you may contact the California Franchise Tax Board for assistance.

No, the Change of Address for Individuals form is only used to change your mailing address. If you need to update your email address or phone number, you should contact the California Franchise Tax Board directly to make those changes.

The purpose of providing prior names and Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) on the Change of Address for Individuals form is to ensure proper identification and to maintain accurate records with the Franchise Tax Board (FTB).

The privacy notice at the end of the Change of Address for Individuals form informs taxpayers about the Franchise Tax Board's privacy policy and their rights under California law. It is essential to read and understand the privacy notice to protect personal information.

To request a copy of the privacy notice for the Change of Address for Individuals form by mail, call the FTB at 800.338.0505 and enter form code 948 when instructed.

If you fail to provide a change of address on the Change of Address for Individuals form, you may not receive important tax-related correspondence from the FTB. This could result in penalties or missed deadlines, which could negatively impact your tax situation.

No, the Change of Address for Individuals form is only for changing your mailing address. If you need to update your email address, you should contact the FTB directly at 800.338.0505 or visit their website for further instructions.

Yes, both you and your spouse/RDP, if applicable, must sign the form.

Provide the complete foreign address, including country, province/state/county, and postal code.

Include the PO box number in the respective sections and provide the city, state, and ZIP code.

Include all names and suffixes in the respective sections.

No, this form does not require any additional documents unless otherwise specified by the agency or institution requesting the address change.

No, once signed, the form should not be altered in any way. If you need to make corrections, you must submit a new form.

The time it takes for the address change to take effect varies depending on the agency or institution processing the request. You should contact them directly for more information.

Compliance FTB 3533

Validation Checks by Instafill.ai

1

Ensures that all personal names (first, middle, last) are entered and correctly formatted according to the instructions.

The AI ensures that the first, middle, and last names are provided in the respective fields and adhere to the formatting guidelines specified in the form instructions. It checks for any missing name components and validates the correct capitalization and order of the names. The AI also looks for any extraneous characters or symbols that are not typically part of a personal name and flags them for review.

2

Confirms that the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is provided and valid.

The AI confirms the presence of a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated field. It performs a validation check to ensure that the number provided follows the standard format and contains the correct number of digits. The AI also checks for common errors, such as sequences of the same digit or other invalid combinations, to ensure the SSN or ITIN is potentially valid.

3

Verifies that the new address is complete, including all necessary details for mailing purposes.

The AI verifies that the new address field is fully completed, including the street address, city, state, and ZIP code. It checks for common address formatting issues and ensures that all necessary components for successful mail delivery are present. The AI also cross-references the address against postal databases when possible to confirm its validity and deliverability.

4

Checks for the correct inclusion of a suffix in the 'Suffix' field, if applicable, and ensures no academic, professional, or honorary suffixes are included.

The AI checks the 'Suffix' field to ensure that if a suffix is included, it is appropriate and follows the form's guidelines. It ensures that only generational suffixes (e.g., Jr., Sr., III) are used, and excludes academic, professional, or honorary suffixes (e.g., Ph.D., Esq., OBE). The AI flags any non-conforming suffixes for further review.

5

Validates that if there has been a name change, the prior last name is entered in the 'Prior name' field.

The AI validates that in cases where there has been a name change, the individual's prior last name is correctly entered in the 'Prior name' field. It ensures that this field is not left blank when a name change is indicated elsewhere on the form. The AI also checks for consistency between the 'Prior name' field and any other relevant information provided on the form.

6

Ensures the 'Additional Information' field is used only for 'In-Care-Of' names or supplemental address information.

The system ensures that the 'Additional Information' field on the Change of Address for Individuals form is utilized appropriately. It confirms that this field contains either 'In-Care-Of' names, which designate another individual authorized to receive mail on behalf of the requester, or supplemental address details that could not be included in the standard address fields. The system prevents the entry of unrelated or unnecessary information in this section to maintain the form's accuracy and relevance.

7

Confirms that if a PO box is used, the PO box number is provided instead of the street address.

The system confirms the correct usage of the PO box field when a post office box is used as a mailing address. It verifies that the requester has provided a valid PO box number and ensures that this number is used in lieu of a traditional street address. This check is crucial to prevent confusion or misdirection of mail and to comply with postal service requirements for PO box addresses.

8

Verifies the correct entry of a foreign address, ensuring it follows the country's addressing format and includes all necessary components.

The system verifies the accuracy and completeness of a foreign address entered on the Change of Address for Individuals form. It checks that the address adheres to the specific format and conventions of the country in question, including the correct sequence and presence of elements such as street names, locality, postal codes, and country names. This validation is essential for ensuring that international mail reaches the intended recipient without delay or complication.

9

Checks that the form is signed by the individual requesting the change of address.

The system checks for the presence of a signature from the individual requesting the change of address. It ensures that the signature field is not left blank, as a signature is a mandatory requirement for processing the form. This validation step is critical for confirming the identity and intent of the person initiating the request, thereby providing authorization for the change.

10

Ensures that if there is a spouse/RDP also requesting a change of address, their signature is present on the form.

The system ensures that if a spouse or Registered Domestic Partner (RDP) is also requesting a change of address, their signature is included on the form alongside the primary requester's signature. This check is vital for validating the consent and joint request of both parties, which is necessary when the address change affects multiple individuals listed on the same form.

11

Addressed Correctly to Franchise Tax Board

Ensures that the Change of Address form for Individuals is correctly addressed to the Franchise Tax Board, including the accurate PO Box number in Sacramento, CA. This validation check is crucial to ensure that the form reaches the intended destination without any delays. It also confirms that the address provided on the form matches the official records and guidelines provided by the Franchise Tax Board.

12

Instructions for Forwarding Mail

Verifies that the form includes clear instructions for forwarding mail with the post office, especially in cases where a refund is expected and the individual has moved after filing their tax return. This check is important to prevent any misplacement of sensitive documents or checks that may be sent to the previous address. It also ensures that the individual's instructions are in compliance with postal service guidelines.

13

Online or Phone-based Address Change Option

Checks for the availability of an online or phone-based address change option and ensures that the Change of Address form is only filed if those options were not utilized. This validation step is essential to avoid duplicate submissions and to encourage the use of more efficient electronic services when available, thereby streamlining the address change process for the individual.

14

Legibility and Accuracy of Fields

Ensures that all fields on the Change of Address form for Individuals are filled out legibly and accurately to prevent processing delays. This validation check confirms that the information provided is readable and free of errors, which is critical for the timely update of the individual's address in the Franchise Tax Board's records.

15

Current Version and Unaltered Form

Validates that the Change of Address form for Individuals is the current version and has not been altered in any way that would invalidate it. This check is important to ensure that the form complies with the latest requirements and that all necessary fields are present. It also prevents the submission of outdated or modified forms that could lead to processing issues.

Common Mistakes in Completing FTB 3533

One of the most common mistakes when filling out the Change of Address for Individuals form is failing to provide all required information in the correct fields. This form asks for specific details such as name, old address, new address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). It is essential to double-check that all fields are accurately filled out to ensure the form's validity. To avoid this mistake, take your time to read each field carefully and provide all the necessary information.

Another common mistake is entering an incorrect SSN or ITIN. This information is crucial for the IRS to process the form correctly. Double-checking the SSN or ITIN before submitting the form is essential. If you are unsure of your number, contact the Social Security Administration or the IRS for assistance. It is also important to note that providing a false SSN or ITIN is considered tax fraud and can result in severe penalties.

If you have a suffix such as Jr., Sr., or III, it is essential to fill out the 'Suffix' field on the Change of Address for Individuals form. Leaving this field blank can cause confusion and delay the processing of your form. To avoid this mistake, make sure to include any applicable suffixes when filling out the form.

If your name has changed, it is essential to include your prior last name on the Change of Address for Individuals form. Failing to do so can cause delays in processing your form or even result in it being returned. To avoid this mistake, make sure to include all previous last names in the appropriate field on the form.

The 'Additional Information' field on the Change of Address for Individuals form is intended for 'In-Care-Of' names or supplemental address information. Using this field for other purposes can cause delays in processing your form or even result in it being returned. To avoid this mistake, make sure to use the appropriate fields for the correct information and only use the 'Additional Information' field for the intended purpose.

When completing the Change of Address for Individuals form, it is essential to provide the correct mailing address. However, if you have a PO box number, it is crucial to include that information instead of a street address. Failing to do so may result in delays in receiving important correspondence from the Franchise Tax Board. To avoid this mistake, double-check the form instructions and ensure that you provide the appropriate mailing address based on your situation.

The Change of Address for Individuals form requires a signature from the individual making the address change. Failing to sign the form or providing an invalid signature may result in delays or rejection of the form. To avoid this mistake, ensure that you sign the form with a valid signature and that all required signatures are present. If you are unable to sign the form physically, you may be able to provide an electronic signature in accordance with the form instructions.

Once the Change of Address for Individuals form is completed, it must be mailed to the Franchise Tax Board. Failing to mail the form to the correct address may result in delays or the form being returned. To avoid this mistake, double-check the form instructions and ensure that you mail the completed form to the correct address. It is also recommended to use certified mail with a return receipt to ensure that you have proof of delivery.

If you are expecting a refund and fail to notify the post office of your change of address, you may not receive the refund check. To avoid this mistake, ensure that you notify the post office of your new address as soon as possible. You can do this by filling out a change of address form at your local post office or online through the USPS website.

In today's digital age, it is common to change your address online through various platforms such as the USPS website or your financial institutions. However, it is essential to note that changing your address online does not automatically update your tax records. To ensure that your tax records are up-to-date, it is recommended that you still file form FTB 3533 with the Franchise Tax Board to officially change your address for tax purposes.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out FTB 3533 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 3533 forms, ensuring each field is accurate.