Form 3949-A, Information Referral Completed Form Examples and Samples

Explore completed examples of Form 3949-A, showcasing detailed guides on reporting tax fraud. Understand how to correctly fill out the form with scenarios like self-employed contractor income fraud and employer payroll falsification.

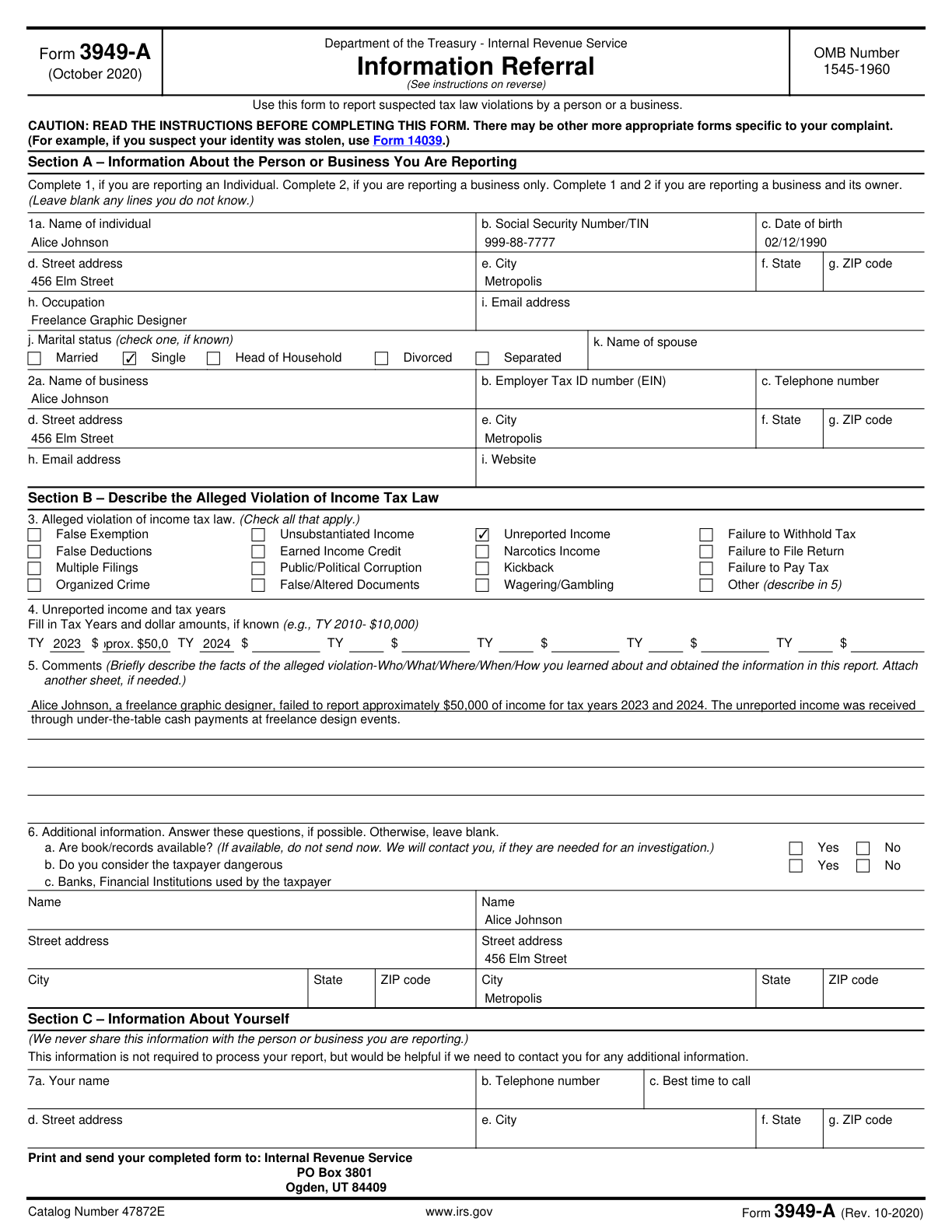

Form 3949-A Example – Reporting Tax Fraud by a Self-Employed Contractor

How this form was filled:

This example demonstrates how to fill out Form 3949-A to report income tax fraud by a self-employed contractor. The form includes all necessary identification details, specific tax violations, and an explanation of the fraudulent activity.

Information used to fill out the document:

- Name of Person or Business You Are Reporting: Alice Johnson

- Taxpayer Identification Number (if known): 999-88-7777

- Address: 456 Elm Street, Metropolis, USA

- Date of Birth: 02/12/1990

- Marital Status: Single

- Occupation: Freelance Graphic Designer

- Description of Violation: Unreported income

- Tax Years: 2023, 2024

- Estimated Dollar Amount: Approx. $50,000

- Additional Information: Operating under-the-table cash payments at freelance design events.

What this filled form sample shows:

- Detailed identification of taxpayer involved in potential fraud

- Clear explanation of the violation with specific tax years

- Estimation of unreported income amount

- Additional context and details regarding the fraudulent activity

Form specifications and details:

| Use Case: | Reporting tax fraud by self-employed contractor |

| Form: | Form 3949-A, Information Referral |

| Reporting Method: | Anonymous |

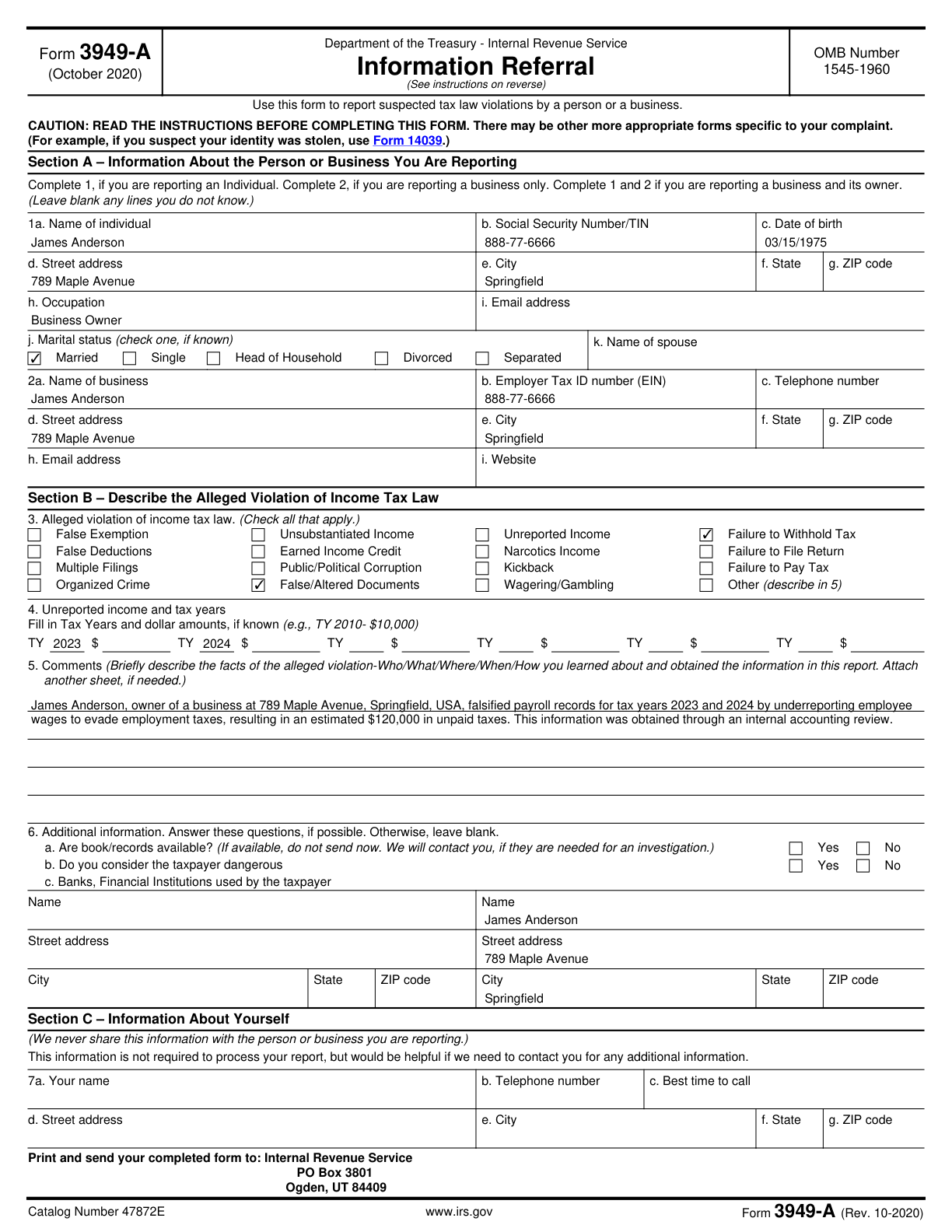

Form 3949-A Example – Reporting an Employer for Falsifying Payroll Records

How this form was filled:

This example demonstrates how to fill out Form 3949-A to report tax fraud by an employer who falsifies payroll records. It covers the necessary details, including the description of the fraudulent activities and estimated monetary discrepancies.

Information used to fill out the document:

- Name of Person or Business You Are Reporting: James Anderson

- Taxpayer Identification Number (if known): 888-77-6666

- Address: 789 Maple Avenue, Springfield, USA

- Date of Birth: 03/15/1975

- Marital Status: Married

- Occupation: Business Owner

- Description of Violation: Falsifying payroll records

- Tax Years: 2023, 2024

- Estimated Dollar Amount: Approx. $120,000

- Additional Information: Underreporting employee wages to reduce employment taxes.

What this filled form sample shows:

- Identification of the employer involved in potential payroll fraud

- Specific description of falsifying payroll records

- Estimation of monetary discrepancies resulting from the violation

- Detailed context regarding the fraudulent practices

Form specifications and details:

| Use Case: | Reporting payroll falsification by an employer |

| Form: | Form 3949-A, Information Referral |

| Reporting Method: | Anonymous |