Form 8582, Passive Activity Loss Limitations Completed Form Examples and Samples

Explore a detailed example of Form 8582, Passive Activity Loss Limitations, specifically for real estate rental activities. This sample provides comprehensive guidance on reporting passive losses, including income, calculations of net losses, and handling carryover amounts. Essential for real estate investors seeking insights into completing IRS Form 8582 accurately.

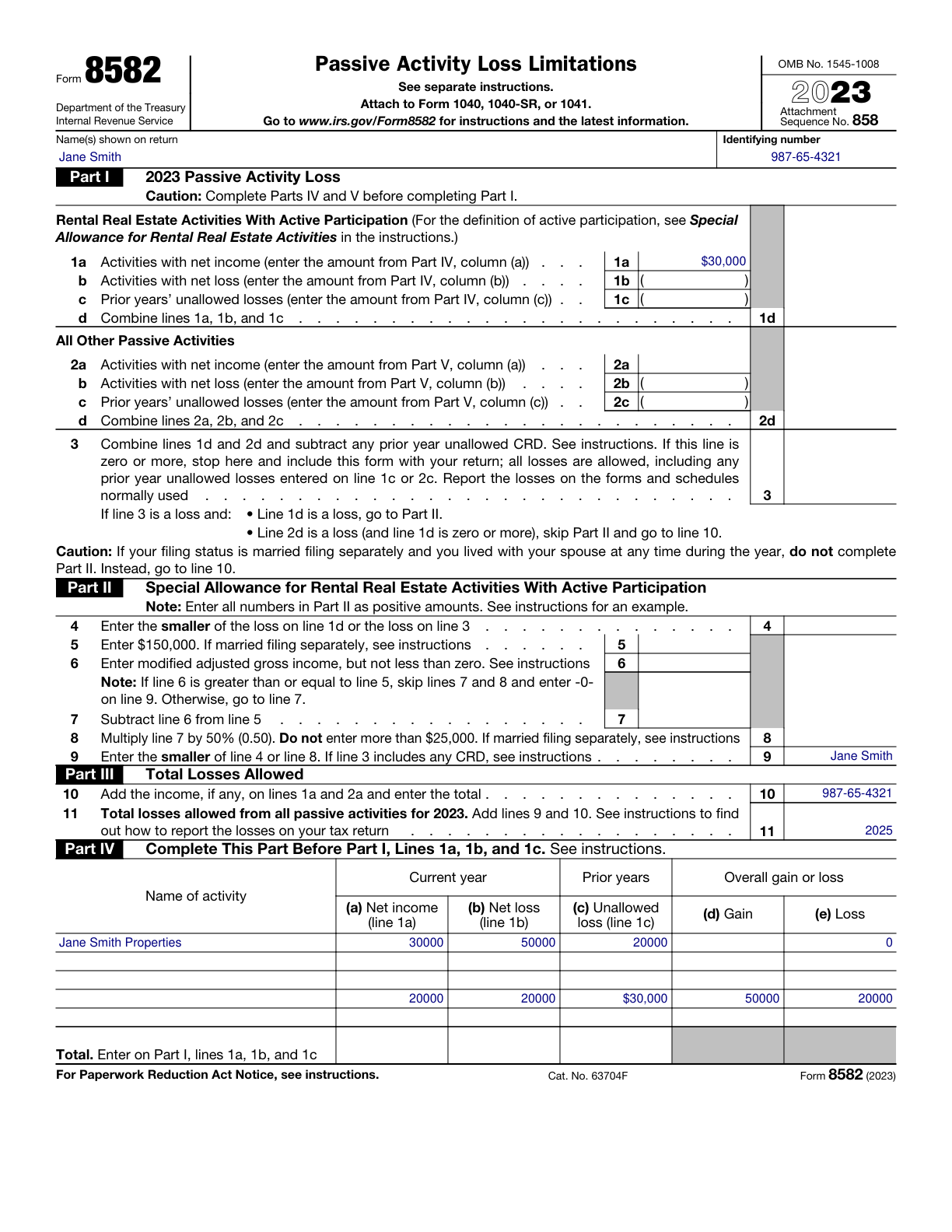

Form 8582 Example – Real Estate Rental Activity

How this form was filled:

This example demonstrates the completion of Form 8582 for a real estate rental activity indicating passive losses. The form features total passive losses and income, detailed activity description, proper calculation of net losses, carryover amounts, and allocation of unallowed losses.

Information used to fill out the document:

- Taxpayer’s Name: Jane Smith

- Taxpayer Identification Number (TIN): 987-65-4321

- Passive Activity Name: Jane Smith Properties

- Total Income from Passive Activities: $30,000

- Total Losses from Passive Activities: $50,000

- Net Passive Income: $0

- Unallowed Loss Amount: $20,000

- Carryover Losses: $20,000

- Date: 04/01/2025

What this filled form sample shows:

- Explanation of total passive income and losses from rental activities

- Accurate computation of net passive income showing zero when losses exceed income

- Clear depiction of unallowed loss amount and how to handle carryover

- Guided completion of activity-specific information for real estate investors

Form specifications and details:

| Use Case: | Real estate rental activity reporting passive losses |

| Form Year: | 2025 |