Form 8809, Application for Extension of Time Completed Form Examples and Samples

Explore a detailed example of Form 8809 for partnerships seeking a tax extension. Learn how to accurately complete the form with the partnership's EIN, contact information, and extension request details. This sample is an ideal guide for partnerships aiming to navigate the tax extension process effectively.

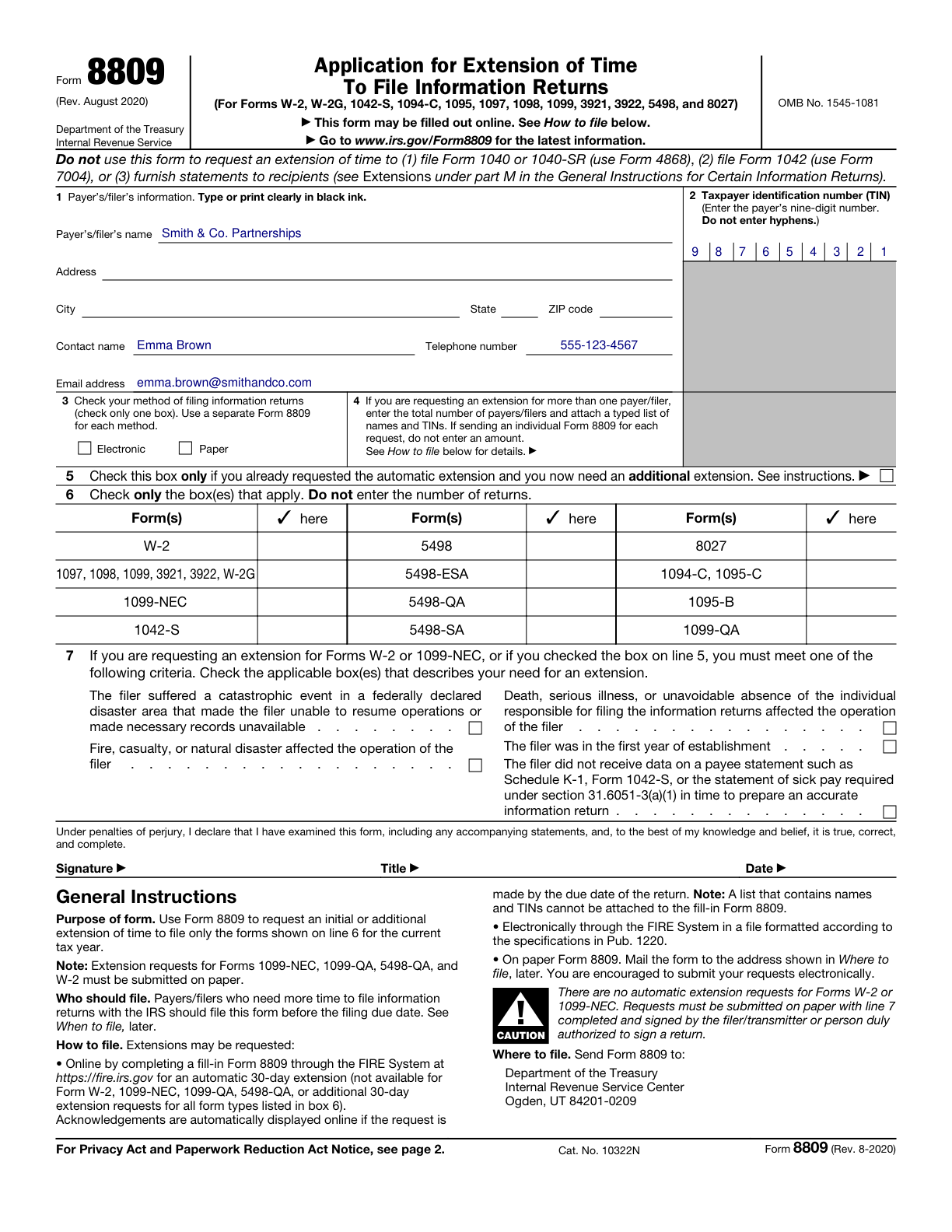

Form 8809 Example – Tax Extension for Partnerships

How this form was filled:

This example demonstrates how to properly complete Form 8809 for a partnership seeking an extension for filing. Key details include the partnership's EIN, contact information, the specific type of extension requested, and the method of form submission.

Information used to fill out the document:

- Partnership Name: Smith & Co. Partnerships

- Employer Identification Number (EIN): 98-7654321

- Contact Person Name: Emma Brown

- Contact Phone Number: 555-123-4567

- Contact Email Address: [email protected]

- Type of Extension Request: Automatic 30-day extension

- Submission Date: 03/01/2025

- Receiver’s Address: IRS, Ogden, UT 84201-0209

What this filled form sample shows:

- Correctly filled Partnership Name and EIN

- Properly listed Contact Person and Phone Number

- Specified type of extension with submission date

- Detailed contact email for further communication

Form specifications and details:

| Use Case: | Request for tax filing extension by a partnership |

| Year: | 2025 |