Yes! You can use AI to fill out Form 8822, Change of Address

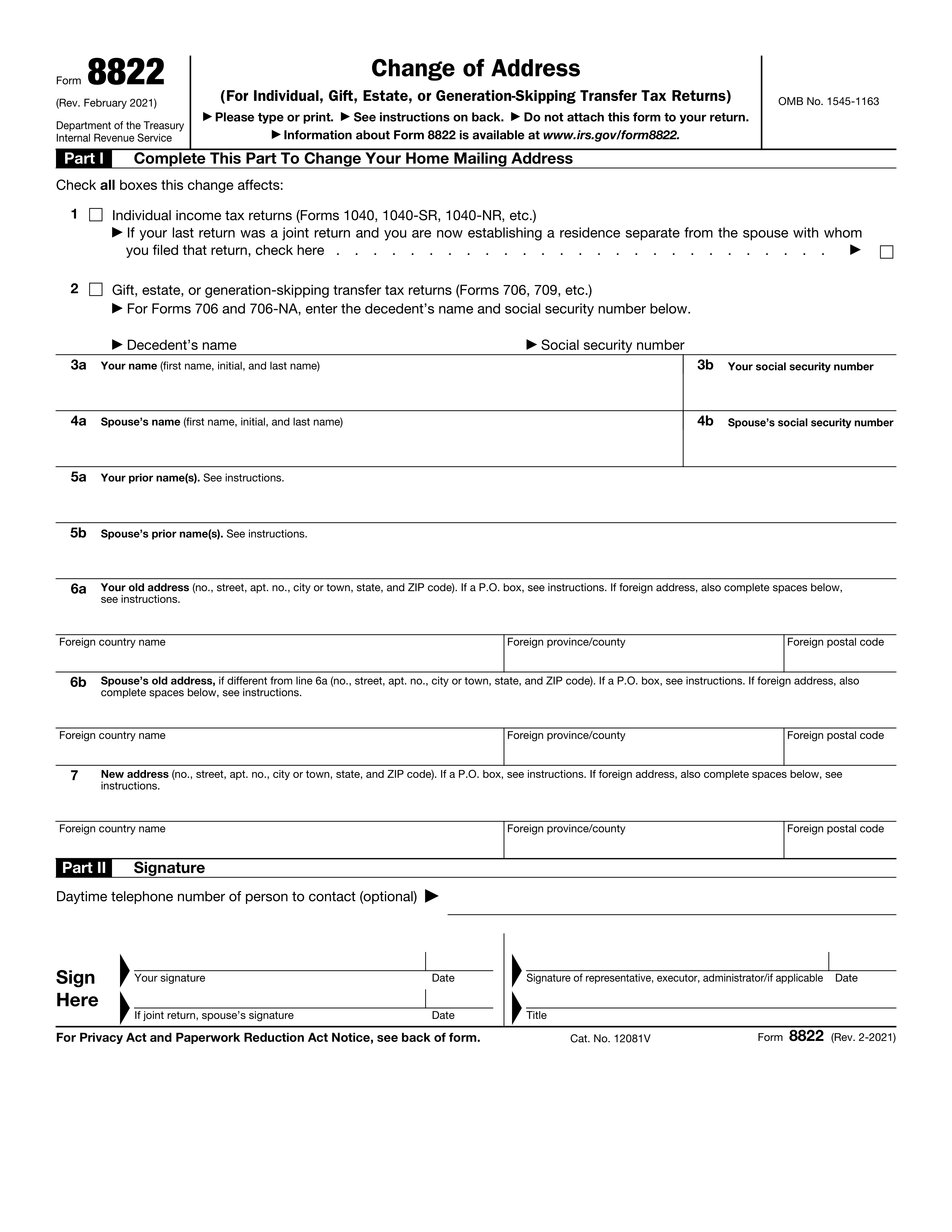

Form 8822, Change of Address, is used to inform the Internal Revenue Service about changes to your home mailing address. This form is important to ensure that you receive all necessary tax documents and communications from the IRS at your new address.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8822 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8822, Change of Address |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 25 |

| Number of pages: | 2 |

| Version: | 2021 |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8822 Online for Free in 2026

Are you looking to fill out a FORM 8822 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8822 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8822 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8822.

- 2 Enter your personal information in the required fields.

- 3 Provide your old and new addresses accurately.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8822 Form?

Speed

Complete your Form 8822 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8822 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8822

Form 8822 is used to notify the Internal Revenue Service (IRS) of a change of address for individual income tax returns, as well as gift, estate, or generation-skipping transfer tax returns.

Individuals who have changed their home mailing address should complete Part I of Form 8822. They should check all the boxes that apply to their situation, including boxes for individual income tax returns and gift, estate, or generation-skipping transfer tax returns.

Part I of Form 8822 requires the taxpayer's name, social security number, spouse's name and social security number, prior names, old address, and new address. For foreign addresses, additional information is required.

It typically takes 4 to 6 weeks for the IRS to process a change of address on Form 8822.

If a joint return was filed in the past and the spouses are now establishing separate residences, they should check the box on line 1 of Form 8822 and complete a separate Form 8822 for each spouse.

If a representative signs for the taxpayer on Form 8822, they must attach a copy of their power of attorney to the form.

Form 8822 should be filed at the address specified on the form, which depends on the taxpayer's old home mailing address.

There is no specific deadline for filing Form 8822, but it is recommended to file it as soon as possible after moving to ensure that important tax-related correspondence is received at the new address.

If a taxpayer fails to provide their current mailing address to the IRS, they may not receive important notices, such as a notice of deficiency or a notice and demand for tax. Penalties and interest will continue to accrue on the tax deficiencies.

Yes, Form 8822 is subject to the Paperwork Reduction Act. Taxpayers are not required to provide the information requested on the form unless it displays a valid OMB control number.

If the taxpayer is moving outside the United States, they should complete Part III of Form 8822 and follow the instructions for mailing the form to the appropriate address.

No, Form 8822 cannot be filed electronically. It must be filed by mailing the completed form to the appropriate address.

The estimated time required to complete and file Form 8822 is approximately 15 minutes.

If the taxpayer is a bona fide resident of Guam or the Virgin Islands, they should mail Form 8822 to the appropriate address for their territory instead of the IRS. The addresses can be found on the IRS website or by contacting the territory's tax agency.

If the taxpayer is a foreign taxpayer or has a foreign address, they should complete the additional spaces provided on Form 8822 for the foreign country name, foreign province/county, and foreign postal code. They should also indicate their foreign taxpayer identification number, if applicable.

If the taxpayer receives their mail in care of a third party, they should enter 'C/O' followed by the third party's name and street address or P.O. box on line 6b of Form 8822.

Compliance Form 8822

Validation Checks by Instafill.ai

1

Correct Tax Return Types Identification

The AI ensures that the Change of Address Form accurately reflects the tax return types that are affected by the address change. It checks that the appropriate boxes in Part I are selected, corresponding to the specific tax returns that need to be updated. This is crucial as it prevents any miscommunication with tax authorities and ensures that all relevant tax documents are sent to the new address.

2

Decedent's Information Accuracy

The AI verifies that if the change of address pertains to gift, estate, or generation-skipping transfer tax returns, the decedent's name and social security number are entered correctly. This validation is essential to maintain the integrity of the tax records and to ensure that any tax liabilities or refunds are accurately directed.

3

Taxpayer's Information Accuracy

The AI confirms that the taxpayer's name and social security number are accurately provided in fields 3a and 3b of the Change of Address Form. This step is vital for the correct processing of the form, as it ensures that the change of address is associated with the right individual and that their tax records are updated accordingly.

4

Spouse's Information Accuracy

The AI checks that if a spouse is involved, their name and social security number are correctly entered in fields 4a and 4b. This is particularly important for joint tax returns or when both individuals are affected by the change of address. The AI's validation ensures that both parties receive correspondence at the new address.

5

Prior Name Changes Verification

The AI validates that any prior name changes for the taxpayer or spouse, which may have occurred due to marriage, divorce, or other reasons, are listed in fields 5a and 5b. This helps in maintaining a consistent tax history and assists in the accurate processing of the form by the tax authorities.

6

Old Address Verification

Ensures that the old address is correctly entered in field 6a, including all relevant details such as street, city, state, and ZIP code. For foreign addresses, it verifies the inclusion of the country name, foreign province/state/county, and any applicable foreign postal code. Additionally, it confirms that the spouse's old address is accurately recorded in field 6b if it differs from the taxpayer's old address, ensuring that both parties' previous addresses are properly documented if applicable.

7

New Address Verification

Verifies that the new address is accurately entered in field 7, paying close attention to all necessary components such as street, city, state, and ZIP code. For foreign addresses, it checks for the correct entry of the country name, foreign province/state/county, and foreign postal code, if applicable. This validation is crucial to ensure that all future correspondence reaches the taxpayer at their new location without delay.

8

Daytime Telephone Number

Confirms that a daytime telephone number is provided in Part II of the form. Although this information is optional, the validation check emphasizes its importance for potential follow-up or clarification purposes. It ensures that the telephone number is in a valid format and includes the area code, facilitating easy and direct communication with the taxpayer when necessary.

9

Signature and Date Verification

Checks that the form is signed and dated by the taxpayer, ensuring the authenticity and intent to submit the change of address request. If the form pertains to a joint return, it also verifies that the spouse has signed as well. This validation is essential for the form's legal validity and to prevent any unauthorized changes to the taxpayer's address records.

10

Representative Signature Verification

Ensures that if a representative, executor, or administrator is signing the form on behalf of the taxpayer, the signature is present along with the current date and the representative's title. It also checks for the inclusion of a copy of the power of attorney, if necessary, to authorize the representative to act on the taxpayer's behalf. This validation confirms the legitimacy of the representative's authority to make the address change.

11

Verifies that the form is not attached to the tax return and is sent to the correct address based on the old home mailing address.

The software ensures that the Change of Address Form is processed independently and not as an attachment to the tax return, to avoid any processing delays or errors. It verifies the old home mailing address provided on the form and cross-references it with the correct destination address to ensure the form is sent to the appropriate location for processing. This step is crucial to prevent misrouting and to facilitate a smooth address update procedure.

12

Confirms that the Privacy Act and Paperwork Reduction Act Notice have been reviewed as per the instructions.

The software confirms that the taxpayer has acknowledged and reviewed the Privacy Act and Paperwork Reduction Act Notice, which is a mandatory step before submission. It checks for an indication of review, such as a checked box or initial, as per the form's instructions. This validation is important to ensure compliance with legal requirements and to inform the taxpayer of their rights and the proper use of their information.

13

Checks that a copy of the completed form is kept for the taxpayer's records.

After the form is filled out, the software checks that a digital or physical copy of the completed Change of Address Form is saved for the taxpayer's personal records. This action is essential for maintaining a record of the request and for future reference in case of any discrepancies or issues with the address change. The software may prompt the user to confirm that a copy has been saved before allowing the form to be finalized and sent.

14

Validates that all fields are filled out completely and accurately, with no missing or inconsistent information.

The software meticulously scans each field of the Change of Address Form to validate that all required information is provided and that it is accurate and consistent with any related documents or previously submitted information. It checks for completeness, ensuring no fields are left blank, and it flags any discrepancies or inconsistencies for review. This validation is critical to prevent errors that could delay the address change process.

15

Ensures that the form is legible and that all entries are clear and easy to read.

The software ensures that all written entries on the Change of Address Form are legible and clear, facilitating easy reading and processing by postal or government officials. It assesses the clarity of the handwriting or print and may suggest enhancements or corrections if any part of the form is difficult to read. This step helps to avoid misunderstandings or data entry errors that could arise from illegible information.

Common Mistakes in Completing Form 8822

When completing the Change of Address Form, it is essential to accurately identify which tax returns are affected by the address change. Failure to check the appropriate boxes in Part I can result in delays or incorrect processing of the address change. To avoid this mistake, carefully review the instructions and ensure all applicable boxes are checked. It is also recommended to double-check the form before submitting it to ensure all necessary changes have been made.

If the taxpayer is filing the Change of Address Form on behalf of a deceased individual, it is crucial to include the decedent's name and social security number in the appropriate fields. Failure to do so can result in processing delays or incorrect information. To prevent this mistake, carefully review the instructions and ensure all required information is provided, including the decedent's name and social security number.

Fields 3a and 3b on the Change of Address Form require the taxpayer to provide their name and social security number. Failure to enter this information correctly can result in processing delays or incorrect information. To avoid this mistake, double-check the form to ensure all required information is provided accurately and completely.

If the taxpayer is married and filing jointly, it is essential to include their spouse's name and social security number on the Change of Address Form. Failure to do so can result in processing delays or incorrect information. To prevent this mistake, carefully review the instructions and ensure all required information is provided, including the spouse's name and social security number.

Fields 5a and 5b on the Change of Address Form are used to provide information about any prior name changes. Failure to complete these fields can result in processing delays or incorrect information. To avoid this mistake, carefully review the instructions and ensure all required information is provided, including any prior name changes and the dates they occurred.

Failure to enter the old address in field 6a and the new address in field 7 can lead to delays in processing the Change of Address Form. To avoid this mistake, ensure that you provide both your previous and current addresses in their respective fields. This will ensure that the taxing authority has the most up-to-date information for correspondence and record-keeping purposes.

Although providing a daytime telephone number in Part II is optional, it can be beneficial for the taxing authority to contact you regarding any issues or clarifications regarding your Change of Address Form. Failing to provide this information may result in delays or miscommunications. To avoid this mistake, consider providing a daytime telephone number if possible.

Signing and dating the Change of Address Form in the designated area is a crucial step to ensure its validity. Failure to do so may result in delays or even rejection of the form. To avoid this mistake, make sure to sign and date the form before submitting it.

Sending the Change of Address Form with your tax return instead of mailing it directly to the appropriate address can lead to processing delays. The taxing authority may not receive the form in a timely manner, which could result in incorrect correspondence or record-keeping. To avoid this mistake, mail the Change of Address Form separately to the address provided on the form.

The Privacy Act and Paperwork Reduction Act Notice on the back of the Change of Address Form contain important information regarding the collection, use, and disclosure of your personal information. Ignoring these notices can result in a lack of understanding of how your information will be handled. To avoid this mistake, read and understand the notices before filling out and submitting the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8822 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8822 forms, ensuring each field is accurate.