Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships Completed Form Examples and Samples

Form 8865 Example – U.S. Person with Foreign Partnership

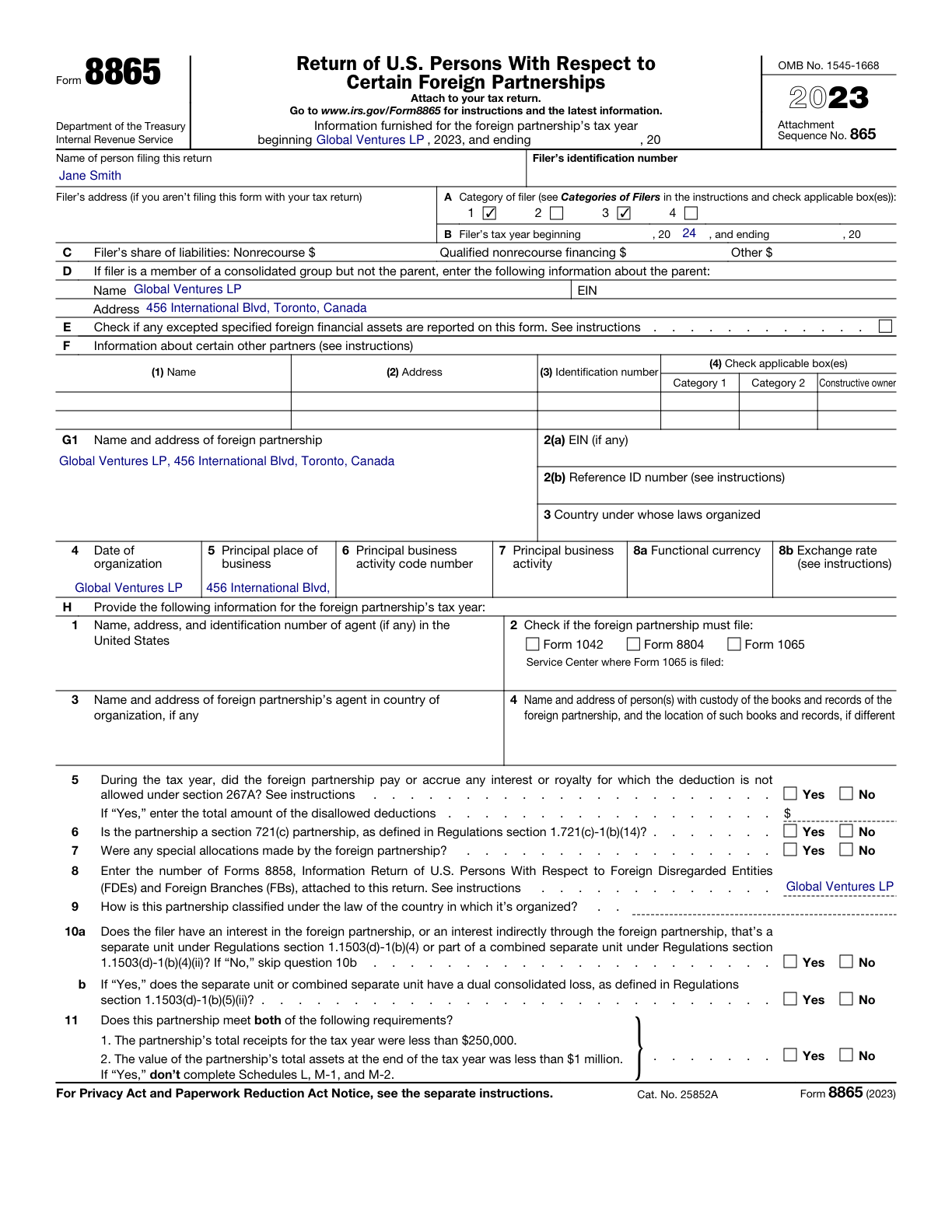

How this form was filled:

This example illustrates the completion of Form 8865 by a U.S. person who holds a 25% interest in a foreign partnership named Global Ventures LP. The form details include ownership percentage, financial data from the partnership, and reportable transactions for tax year 2024.

Information used to fill out the document:

- Partner’s Name: Jane Smith

- Partnership Name: Global Ventures LP

- Partnership Tax Year: 2024

- Ownership Percentage: 25%

- Date of Acquisition: 01/15/2024

- Partnership Address: 456 International Blvd, Toronto, Canada

- Income Reported: $200,000

- Deductions: $50,000

- Capital Account Start: $100,000

- Reportable Transactions: Yes

- Signature: Jane Smith

- Date: 03/10/2025

What this filled form sample shows:

- Accurate representation of ownership percentage and partnership details

- Complete financial data including income and deductions

- Specification of reportable transactions

- Detailed partner's capital account activities

- Properly filled signature and date

Form specifications and details:

| Use Case: | U.S. person holding a 25% interest in a foreign partnership |