Yes! You can use AI to fill out Form 8975, Country-by-Country Report

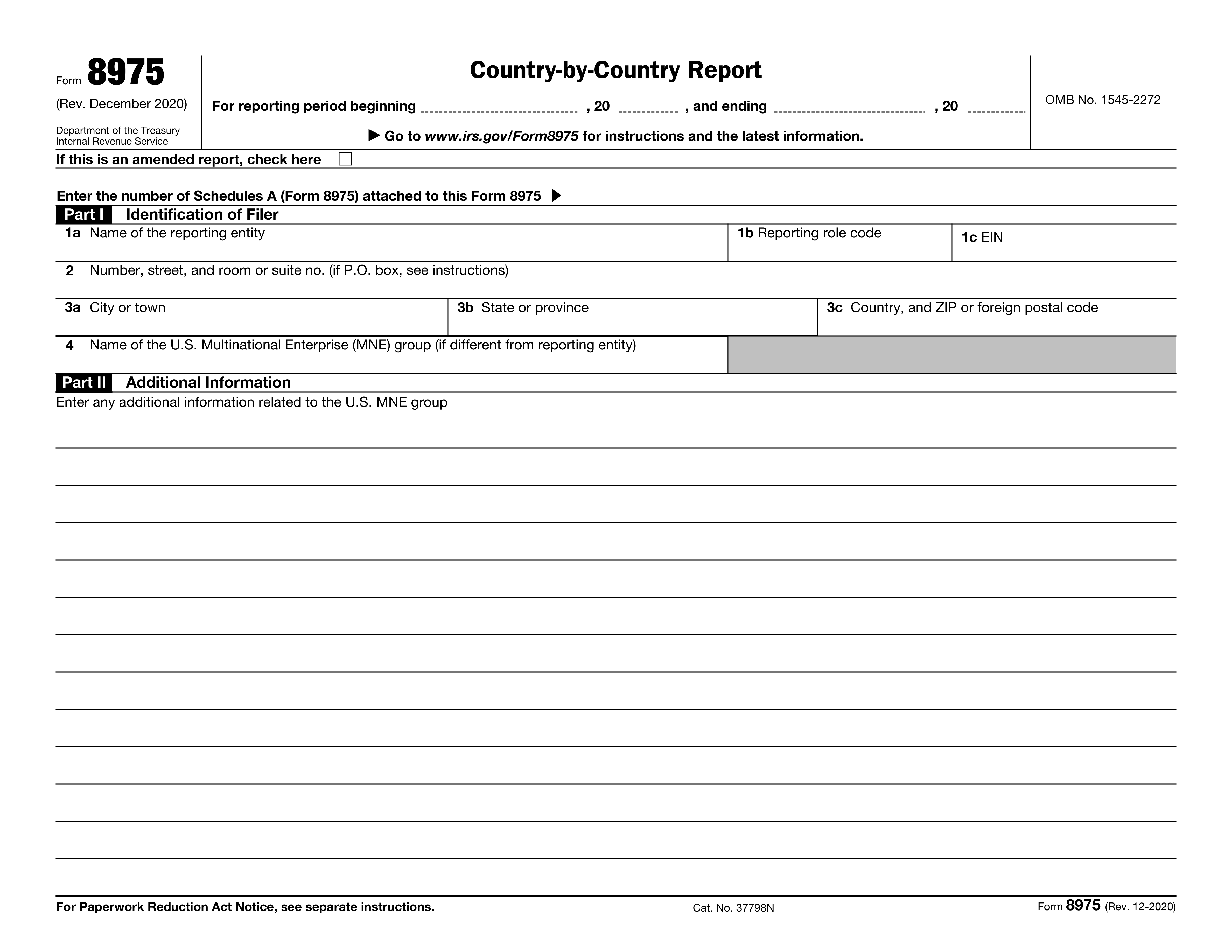

Form 8975, Country-by-Country Report, is used by U.S. multinational enterprises to report their financial information across different countries. It is important for ensuring compliance with tax regulations and for providing transparency in international operations.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8975 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8975, Country-by-Country Report |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 48 |

| Number of pages: | 2 |

| Version: | 2020 |

| Filled form examples: | Form Form 8975 Examples |

| Language: | English |

| Categories: | financial forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8975 Online for Free in 2026

Are you looking to fill out a FORM 8975 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8975 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8975 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8975.

- 2 Enter the reporting entity's name.

- 3 Fill in the EIN and address details.

- 4 Provide information about the MNE group.

- 5 Add any additional information required.

- 6 Sign and date the form electronically.

- 7 Check for accuracy and submit form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8975 Form?

Speed

Complete your Form 8975 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8975 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8975

Form 8975, also known as the Country-by-Country (CbC) Report, is a tax form required under the Base Erosion and Profit Shifting (BEPS) project of the Organisation for Economic Co-operation and Development (OECD). Its purpose is to provide tax authorities with information about reportable transactions between related entities in different countries, helping them to identify and address potential base erosion and profit shifting (BEPS) issues.

Form 8975 is generally due on the last day of the first quarter following the end of the taxpayer's fiscal year. For calendar year taxpayers, the due date is typically April 15, with extensions available. It is important to note that the specific due date may vary depending on the taxpayer's jurisdiction and local filing requirements.

U.S. taxpayers that are the ultimate parent entities of multinational enterprise (MNE) groups with annual revenue exceeding a certain threshold ($850,000 for 2021) are required to file Form 8975. In some cases, surrogate filing may be required for certain constituent entities.

Part I of Form 8975 requires the reporting entity to provide basic information about itself, including its name, address, and taxpayer identification number (TIN). It also requires the reporting entity to identify its fiscal year end and indicate whether it is a U.S. or foreign reporting entity.

A reporting role code is a code assigned to each constituent entity in a multinational enterprise group to indicate its role within the group for reporting purposes. The codes include the ultimate parent entity code (UPE), surrogate parent code (SPC), and constituent entity code (CE). These codes help tax authorities understand the hierarchical relationship between the entities in the group.

The reporting entity is the entity that is required to file the Country-by-Country Report (Form 8975). It is typically the ultimate parent entity of an MNE (Multinational Enterprise) group. The U.S. MNE group refers to the consolidated group of entities that are required to file Form 8865, Consolidated Return, under the U.S. tax provisions. The reporting entity is responsible for reporting certain information about the income and expenses of each constituent entity in each jurisdiction where the entity has a taxable presence.

The address should be entered in the format 'Street Address, City, State ZIP Code, Country'. For example, '123 Main St, Anytown, CA 12345, United States'.

In Part II of Form 8975, you are required to report certain information about each constituent entity in your MNE group. This includes the name, jurisdiction of tax residence, and the tax jurisdiction's tax identification number (if available). You may also be required to report certain information about the entity's income, expenses, and certain other items.

Yes, the country, state or province, and ZIP or foreign postal code should be entered in the format 'Country, State or Province, ZIP or Foreign Postal Code'. For example, 'United States, CA, 12345' or 'France, Paris, 75001'.

The Paperwork Reduction Act (PRA) Notice is a statement that explains the reasons for collecting the information on the form, the intended use of the information, and the estimated burden on the taxpayer. The PRA Notice for Form 8975 can be found on the instructions for the form, which can be downloaded from the IRS website (www.irs.gov) or obtained by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

Form 8975, also known as the Country-by-Country Report (CbC Report), does not have an OMB number. The OMB (Office of Management and Budget) number is a unique identifier assigned to federal forms for administrative purposes. Since the CbC Report is not a federal form, it does not require an OMB number.

The IRS does not assign a specific category number to Form 8975. Instead, it is part of the Form 1120 series, specifically Form 1120-CBC, which is filed electronically through the IRS Global Intermediator Portal.

Yes, Form 8975 can be an amended report. If there are any changes to the information previously reported, such as a change in the reporting entity or a correction to Schedule A, an amended Form 8975 must be filed. The amended report should be filed through the IRS Global Intermediator Portal as soon as possible.

Each Form 8975 can have only one Schedule A attached. Schedule A provides detailed information about the reportable transactions between the reporting entity and each of its controlled foreign corporations or controlled foreign partnerships. If a reporting entity has multiple controlled foreign entities or controlled foreign partnerships, they must each be reported on a separate Schedule A and filed as a separate attachment to the main Form 8975.

The instructions for completing Form 8975, including the latest requirements and due dates, can be found on the IRS website. Go to the IRS website (www.irs.gov) and search for 'Form 8975' or 'Country-by-Country Report'. The instructions will provide detailed guidance on how to complete the form, as well as any necessary attachments and supporting documentation. It is essential to review the instructions carefully and ensure that all required information is accurately reported.

Failure to timely file Form 8975, Country-by-Country Report (CbC Report), may result in penalties. The IRS may impose a penalty of up to $10,000 for each failure to file, with an additional penalty of up to $5,000 for each failure to provide required information, per report. Penalties may be waived if the taxpayer can demonstrate reasonable cause for the late filing.

Penalties for failing to file or incorrectly filing Form 8975 include: (1) a failure-to-file penalty of up to $10,000 per report, (2) a failure-to-provide penalty of up to $5,000 per report, and (3) potential additional penalties for misrepresentation or substantial understatement of income. These penalties may be waived if the taxpayer can demonstrate reasonable cause for the late filing or error.

Compliance Form 8975

Validation Checks by Instafill.ai

1

Ensures that the form is being used for reporting periods beginning and ending in the specified tax year.

The validation process ensures that the Country-by-Country Report form is utilized appropriately for the correct tax year. It checks that the reporting period specified on the form aligns with the beginning and ending dates of the tax year in question. This validation is crucial to maintain the accuracy of the report and to comply with the regulatory requirements for the reporting period. Any discrepancies in the reporting period dates are flagged for correction to ensure the report's validity.

2

Confirms that the 'amended report' box is checked if the report being filed is an amendment to a previously filed report.

The validation mechanism confirms whether the 'amended report' checkbox is marked in instances where the Country-by-Country Report being submitted is intended to amend a previously filed report. This check is vital to differentiate between original submissions and amendments. It helps in maintaining the integrity of the filing process and ensures that the tax authorities are aware of the nature of the submission. Failure to correctly indicate an amended report can lead to processing errors and potential compliance issues.

3

Verifies that the correct number of Schedules A (Form 8975) is attached and the total number is accurately entered on the form.

The validation process verifies the attachment of the correct number of Schedules A (Form 8975) to the Country-by-Country Report. It cross-references the total number of schedules reported on the form with the actual schedules attached. This step is essential to ensure completeness of the information provided and to prevent any missing or extraneous documentation. The validation helps in avoiding submission errors that could arise from mismatched or incomplete schedule counts.

4

Checks that the name of the reporting entity is correctly entered in Part I, section 1a.

The validation process includes a check to ensure that the name of the reporting entity is accurately entered in Part I, section 1a of the Country-by-Country Report. This involves verifying the legal name against official records or prior filings to prevent any misidentification. Accurate entry of the reporting entity's name is critical for the proper attribution of the report to the correct entity and for the maintenance of accurate tax records.

5

Confirms that the reporting role code is provided in Part I, section 1b.

The validation process confirms that the reporting role code is properly provided in Part I, section 1b of the Country-by-Country Report. This code is essential to identify the reporting entity's role within the multinational enterprise group. The validation ensures that the code is present and corresponds to the predefined set of role codes, facilitating correct processing and interpretation of the report by tax authorities.

6

Verifies that the Employer Identification Number (EIN) is correctly entered in Part I, section 1c.

The software ensures that the Employer Identification Number (EIN) provided in Part I, section 1c, adheres to the standard EIN format. It checks for the correct number of digits and the presence of only numerical characters. The validation process includes a checksum verification to confirm the EIN's legitimacy. Additionally, the software cross-references the EIN with a database to ensure it corresponds to the reporting entity.

7

Ensures that the address of the reporting entity is complete and includes number, street, and room or suite number in Part I, section 2.

The software confirms that the address details of the reporting entity in Part I, section 2, are fully provided. It checks for the presence of a street number, street name, and room or suite number if applicable. The validation includes a format check to ensure the address conforms to local postal standards. The software may also use geolocation services to verify the accuracy of the address provided.

8

Checks for the correct entry of the city or town in Part I, section 3a.

The software verifies the correct entry of the city or town name in Part I, section 3a. It ensures that the input matches an existing city or town, considering potential spelling variations or common typos. The software may reference a geographic database to confirm the existence and spelling of the city or town. Additionally, it checks for any unusual characters or numbers that should not be present in a city or town name.

9

Confirms the state or province is accurately entered in Part I, section 3b.

The software confirms that the state or province entered in Part I, section 3b, is accurate and valid. It checks against a list of recognized state or province codes or names, ensuring that the entry corresponds to a legitimate administrative division. The validation process includes checking for correct spelling and the use of proper abbreviations where applicable. The software may also correlate the state or province with the city or town entered to ensure geographic consistency.

10

Verifies the country and ZIP or foreign postal code is correctly entered in Part I, section 3c.

The software verifies that the country name and ZIP or foreign postal code provided in Part I, section 3c, are correct. It ensures that the country name is recognized and that the postal code format is consistent with the country's postal system. The software checks for the appropriate number of characters and the inclusion of letters or numbers as required by the specific country's postal code format. Additionally, it may cross-reference the postal code with the city or town to confirm geographic alignment.

11

Checks if the name of the U.S. MNE group is different from the reporting entity and entered correctly in Part I, section 4.

The AI ensures that the name of the U.S. Multinational Enterprise (MNE) group is accurately captured and distinctly recognized if it differs from the reporting entity's name. It meticulously verifies that the correct name is entered in Part I, section 4 of the Country-by-Country Report. This validation is crucial for maintaining the integrity of the report and ensuring that the information corresponds to the correct MNE group. The AI cross-references this data with official records to prevent any discrepancies.

12

Ensures that any additional information in Part II is relevant to the Country-by-Country Report.

The AI carefully reviews any supplementary information provided in Part II of the form to confirm its relevance to the Country-by-Country Report. It checks for the pertinence and appropriateness of the details included, ensuring they contribute meaningfully to the report's objectives. The AI's validation process includes flagging any irrelevant or extraneous information that does not support the reporting requirements. This step is essential to maintain the report's clarity and focus.

13

Verifies that additional information continues on Page 2 if more space is needed.

The AI verifies that if the space provided in Part II of the Country-by-Country Report is insufficient, any continuation of additional information is properly directed to Page 2. It ensures that there is a clear indication that more information follows and that the transition between pages is seamless and logical. This validation check is important to prevent any loss of information and to maintain the continuity and completeness of the data provided in the report.

14

Confirms that the Paperwork Reduction Act Notice has been reviewed for data privacy information.

The AI confirms that the Paperwork Reduction Act Notice, which includes important information regarding data privacy, has been reviewed and understood. It ensures that the reporting entity acknowledges the privacy implications and the requirements for data handling as stipulated by the notice. This validation is a critical step in complying with legal standards and safeguarding sensitive information contained within the report.

15

Performs a final review of the form for accuracy before submission.

Before the submission of the Country-by-Country Report, the AI performs a comprehensive final review of the entire form. It meticulously checks for accuracy, completeness, and consistency of the information entered across all sections. The AI's validation process includes cross-verifying data points and ensuring that all required fields are filled out correctly. This final review is pivotal in ensuring the report is error-free and ready for submission.

Common Mistakes in Completing Form 8975

The reporting entity name is a crucial piece of information in the Country-by-Country Report. Incorrectly entering the name may lead to misidentification of the reporting entity and potential reporting errors. To avoid this mistake, ensure that the name entered is the exact legal name as it appears in the jurisdiction where the reporting entity is registered. Double-check the spelling and capitalization of each word in the name.

The reporting role code indicates the type of reporting entity and its role in the multinational group. Entering an incorrect code may result in incorrect reporting requirements and potential penalties. To prevent this mistake, carefully review the instructions provided by the tax authority and ensure that the correct reporting role code is entered based on the entity's role in the group.

The Employer Identification Number (EIN) is a unique identifier for tax purposes in the United States. Entering an incorrect or invalid EIN may lead to reporting errors and potential penalties. To avoid this mistake, ensure that the EIN is entered correctly, including the nine-digit number and the entity's jurisdiction of registration.

The address information is essential for identifying the reporting entity's location. Incomplete or incorrect address information may lead to reporting errors and potential penalties. To prevent this mistake, ensure that the complete and accurate address is entered, including the street address, city, state or province, country, and postal or zip code.

The city, state, country, and ZIP or foreign postal code are critical components of the reporting entity's address. Failing to provide complete and accurate information in this section may result in reporting errors and potential penalties. To avoid this mistake, ensure that all required fields are filled out completely and accurately, including the city, state or province, country, and postal or zip code.

The Country-by-Country Report requires entities to indicate whether the name of the U.S. MNE group is the same as the reporting entity. Failing to make this distinction can lead to reporting errors and potential penalties. To avoid this mistake, carefully review the instructions and ensure that the correct name is used for each entity involved. It is essential to understand that the U.S. MNE group refers to the consolidated group of entities that are required to file the report, while the reporting entity is the specific entity filing the report. By providing the accurate names for both, you can ensure that your report is complete and compliant.

Part II of the Country-by-Country Report requires entities to provide detailed information about their income, taxes paid, and certain other items. Failing to provide all necessary information can result in incomplete or inaccurate reporting. To avoid this mistake, carefully review the instructions and gather all required data before filling out the form. Ensure that all fields are completed accurately and that all necessary schedules and attachments are included.

The Country-by-Country Report is a complex document that requires careful attention to detail. Failing to review the form for accuracy before submission can result in errors and potential penalties. To avoid this mistake, take the time to carefully review the form and check for any inconsistencies or errors. This includes checking calculations, ensuring that all required information is included, and verifying that the correct names and entities are used throughout the report.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8975 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8975 forms, ensuring each field is accurate.