Yes! You can use AI to fill out Form 8992, U.S. Shareholder GILTI Calculation

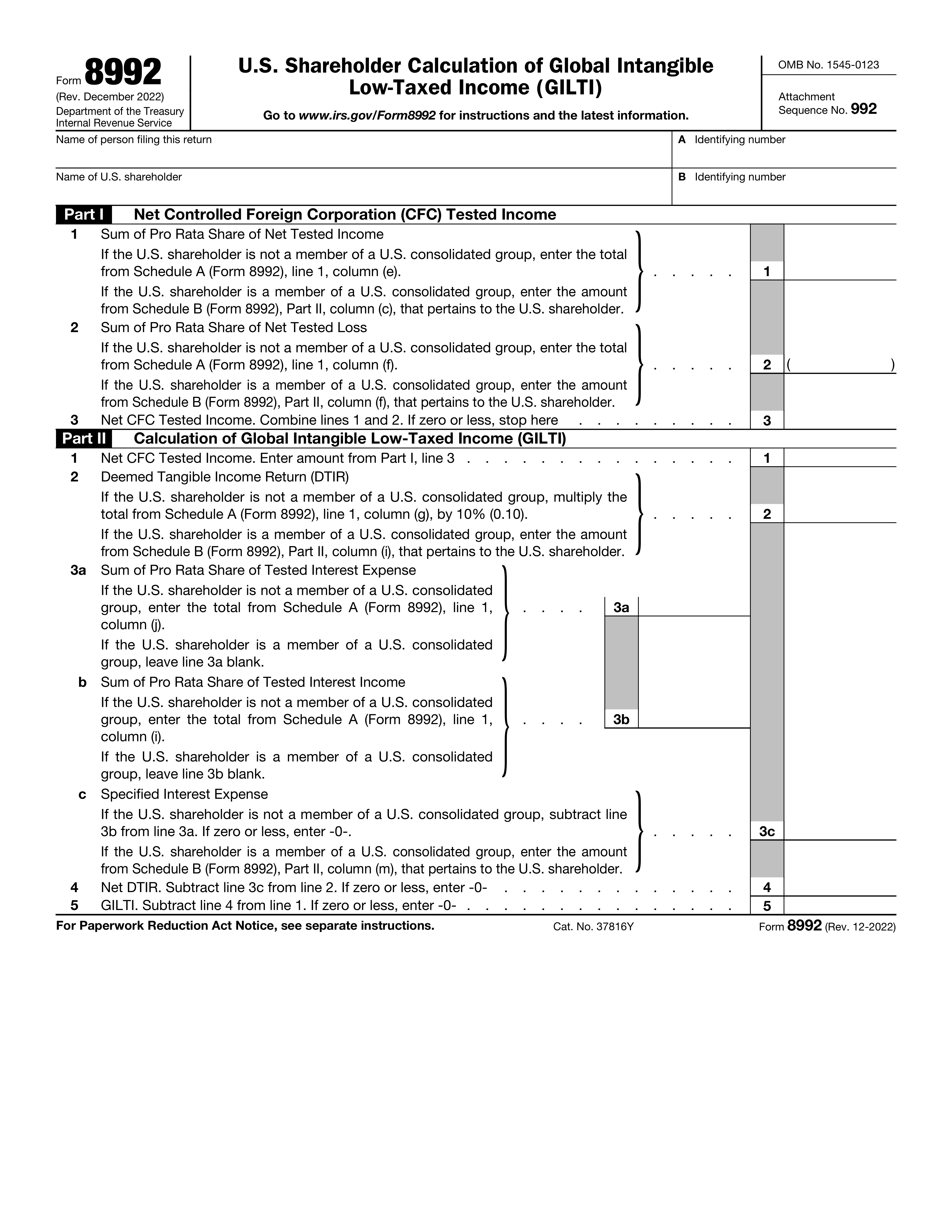

Form 8992, U.S. Shareholder Calculation of GILTI, is used to calculate the Global Intangible Low-Taxed Income for U.S. shareholders. It is important for reporting foreign income accurately and ensuring compliance with U.S. tax laws.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8992 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8992, U.S. Shareholder GILTI Calculation |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 14 |

| Number of pages: | 1 |

| Version: | 2022 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i8992.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8992 Online for Free in 2026

Are you looking to fill out a FORM 8992 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8992 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8992 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8992.

- 2 Enter your name and identifying number.

- 3 Fill in the net controlled foreign corporation tested income.

- 4 Complete the calculation of GILTI section.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8992 Form?

Speed

Complete your Form 8992 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8992 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8992

Form 8992 is used by U.S. shareholders to calculate their Global Intangible Low-Taxed Income (GILTI) for tax purposes.

U.S. shareholders are required to file Form 8992 if they have an ownership interest in a Controlled Foreign Corporation (CFC) and meet certain other conditions.

Part I of Form 8992 is used to calculate Net CFC Tested Income, while Part II is used to calculate Global Intangible Low-Taxed Income (GILTI).

Net CFC Tested Income is the sum of a U.S. shareholder's pro rata share of net tested income and net tested loss from a Controlled Foreign Corporation (CFC).

Deemed Tangible Income Return (DTIR) is the amount of income that is included in a U.S. shareholder's income as GILTI, based on a 10% return on the shareholder's net CFC tested income.

The purpose of calculating GILTI is to determine the U.S. tax liability of a U.S. shareholder with respect to their ownership in a Controlled Foreign Corporation (CFC).

A Controlled Foreign Corporation (CFC) is a foreign corporation in which U.S. shareholders own more than 50% of the total combined voting power or total value of shares.

The tax rate for GILTI is currently 10.5% for individuals and 13.125% for corporations, but these rates can change.

Form 8992 is typically due on the same date as the U.S. shareholder's income tax return, including extensions.

Specified Interest Expense refers to the interest expense that is allocated to a U.S. shareholder's pro rata share of the Controlled Foreign Corporation's (CFC) tested income. This expense is a significant component in calculating the U.S. shareholder's Global Intangible Low-Taxed Income (GILTI).

Net DTIR (Deemed Tangible Income Return) is calculated by subtracting Specified Interest Expense from the Deemed Tangible Income (DTI). DTI represents the CFC's gross tested income, minus the net tested interest and royalties, and adjusted for certain items. Net DTIR represents the net income or loss that would be attributed to a U.S. shareholder if they were considered the owner of the CFC's assets and liabilities.

GILTI, or Global Intangible Low-Taxed Income, is the amount of income that is included in a U.S. shareholder's income as a result of their ownership in a CFC. It is calculated by subtracting Net DTIR from Net CFC Tested Income. GILTI is subject to U.S. tax under the Subpart F income rules.

Form 8992, U.S. Shareholder Calculation of Subpart F Income (and Related Global High Taxed Income) and GILTI, is typically due on the same date as the U.S. shareholder's income tax filing deadline, including any extensions. It is essential to consult the IRS guidelines or consult with a tax professional for the most accurate and up-to-date information.

Part I of Form 8992 requires the U.S. shareholder to report their Net CFC Tested Income and Net CFC Tested Loss. Net CFC Tested Income represents the shareholder's pro rata share of the CFC's tested income, while Net CFC Tested Loss represents the shareholder's pro rata share of the CFC's tested loss. These figures are essential for calculating the U.S. shareholder's GILTI and determining their U.S. tax liability.

Part II of Form 8992 requires the following information for U.S. Shareholder Calculation of GILTI:\n1. Deemed Tangible Income Return (DTIR)\n2. Specified Interest Expense\n3. Net DTIR

The sequence number on Form 8992 for U.S. Shareholder Calculation of GILTI is used to identify the order in which the form is processed by the IRS.

The OMB No. for Form 8992 for U.S. Shareholder Calculation of GILTI is 1545-0123.

Instructions for completing Form 8992 for U.S. Shareholder Calculation of GILTI can be found on the IRS website (www.irs.gov/Form8992).

Compliance Form 8992

Validation Checks by Instafill.ai

1

Ensures the latest IRS guidance and form version for Form 8992, Schedule A, and Schedule B are being used as per December 2023 revision.

The software ensures that the version of Form 8992, along with its Schedules A and B, is the most current as per the December 2023 revision. It checks against the IRS database to confirm that the form aligns with the latest guidance and updates. This validation is crucial to avoid using outdated forms that may lead to incorrect calculations or non-compliance. The system alerts the user if a newer version is available and provides a link to the latest form if necessary.

2

Confirms that all sections of Form 8992 and its schedules are completed according to the step-by-step instructions provided by the IRS.

The software confirms that every section of Form 8992 and its accompanying schedules are filled out in accordance with the detailed instructions from the IRS. It cross-references each entry with the official step-by-step guidelines to ensure accuracy and completeness. The system highlights any sections that are incomplete or deviate from the instructions, prompting the user to review and correct the information before submission. This check is designed to minimize errors and omissions that could lead to processing delays or penalties.

3

Verifies that the 'What's New' and 'Reminders' sections have been reviewed for any updates or changes affecting the filing.

The software verifies that the user has acknowledged and reviewed the 'What's New' and 'Reminders' sections of the form, which may contain critical updates or changes that affect the current filing. It ensures that these sections have been considered and that any relevant changes are incorporated into the form. The system prompts the user to confirm their review of these sections, helping to maintain compliance with the latest tax regulations and avoiding potential oversights.

4

Checks eligibility for a deduction under section 250 and refers to Form 8993 if applicable.

The software checks the eligibility criteria for a deduction under section 250 and determines whether the user should also complete Form 8993. It analyzes the data entered in Form 8992 to identify if the deduction is applicable and guides the user to the relevant sections of Form 8993 if necessary. This validation ensures that users take advantage of all available deductions, thereby potentially reducing their taxable income and ensuring compliance with tax laws.

5

Confirms that domestic partnerships have completed Schedule K-2 (Form 1065), Part VI, and Schedule K-3 (Form 1065), Part VI, in lieu of Form 8992.

The software confirms that domestic partnerships, which are required to complete Schedule K-2 (Form 1065), Part VI, and Schedule K-3 (Form 1065), Part VI, have done so correctly instead of using Form 8992. It ensures that these schedules are properly filled out and that all necessary information is provided. The system alerts the user if it detects that the required schedules are missing or incomplete, thereby helping partnerships to meet their specific filing obligations.

6

Attachment and Timely Filing

Ensures that the U.S. Shareholder Calculation of GILTI form is properly attached to the taxpayer's income tax return. It verifies that the form is filed by the due date, including any extensions that may apply. This check is crucial to avoid any penalties associated with late submissions. The system also confirms that all necessary schedules and documentation are included with the form upon submission.

7

Consolidated Filing for U.S. Groups

Verifies that a single consolidated Form 8992 is filed for all members of a U.S. consolidated group. This check is important to ensure that the group's income tax return is complete and accurate. It also confirms that the consolidation complies with the relevant tax regulations and that the form reflects the combined GILTI calculation for the entire group.

8

S Corporation Compliance

Confirms that S corporations electing entity treatment have properly attached Form 8992 and Schedule A to their Form 1120-S. This validation ensures that the S corporation's GILTI calculation is correctly reported and that the election for entity treatment is clearly indicated. It also checks for the completeness and accuracy of the information provided on the schedules.

9

Penalty Compliance

Checks for compliance with penalties under sections 6038(b) and (c) for failure to report required information. This validation is essential to ensure that the taxpayer is aware of and adheres to the reporting requirements. It helps to prevent the imposition of penalties by verifying that all necessary information is reported on Form 8992 and its related schedules.

10

Correction Procedures

Ensures that a corrected Form 8992 is submitted with an amended tax return and marked 'Corrected' if any corrections are needed after the initial filing. This check is important for maintaining the accuracy of tax records and for ensuring that the taxpayer's obligations are fulfilled. It also guides the taxpayer on the proper procedure for making corrections to previously filed information.

11

Verifies that a statement identifying the changes is attached to the corrected Form 8992

The AI ensures that when a corrected Form 8992 is submitted, it is accompanied by a detailed statement that identifies all the changes made to the form. This includes any amendments to the income, deductions, credits, or any other information that affects the calculation of the Global Intangible Low-Taxed Income (GILTI). The AI checks for the presence of this statement and confirms that it is properly attached to the form, ensuring compliance with the filing requirements.

12

Checks if a treaty-based return position applies and ensures Form 8833 is filed if necessary

The AI examines the taxpayer's situation to determine if a treaty-based return position is applicable. If the taxpayer is taking a position that a U.S. tax treaty overrules or modifies any provision of the Internal Revenue Code, the AI ensures that Form 8833, Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is completed and filed alongside Form 8992. This validation is crucial for maintaining transparency and adhering to the disclosure requirements mandated by the IRS.

13

Confirms that all required information, such as the name and identifying numbers of the CFCs, tested income, tested loss, and other relevant amounts, is accurately entered

The AI meticulously verifies that all necessary data is correctly inputted into Form 8992. This includes the names and identifying numbers of the Controlled Foreign Corporations (CFCs), as well as precise calculations of tested income, tested loss, and any other pertinent figures that contribute to the GILTI calculation. The AI's validation process ensures that the information provided is complete and accurate, which is essential for the correct computation of the taxpayer's GILTI.

14

Ensures that copies of the completed forms are kept for records and are available to be provided upon request

The AI reminds the taxpayer to retain copies of the completed Form 8992 and any related documentation. It ensures that these records are stored securely and are readily accessible if requested by the IRS or other authorities. The AI's validation process includes a check for the proper archiving of these documents, which is a critical step in maintaining compliance with record-keeping requirements.

15

Verifies that the taxpayer is aware of the Paperwork Reduction Act Notice regarding the confidentiality of tax returns and return information

The AI confirms that the taxpayer acknowledges the Paperwork Reduction Act Notice, which addresses the confidentiality, privacy, and security of tax returns and return information. The AI ensures that the taxpayer understands their rights and the protections afforded to them under this act. This validation check is important for ensuring that taxpayers are informed about the use of their tax information and the care with which it must be handled.

Common Mistakes in Completing Form 8992

Failure to attach Form 8992, U.S. Shareholder Calculation of Subpart F Income and Global Intangible Low-Taxed Income (GILTI), to the income tax return can result in significant delays in processing and potential penalties. To avoid this mistake, ensure that Form 8992 is properly completed and attached to the income tax return before filing. It is recommended to review the instructions carefully and complete all required sections to the best of your ability before attaching the form.

Providing incorrect or incomplete information about the CFCs, such as their names or identifying numbers, can lead to errors in the calculation of GILTI and Subpart F income. To prevent this mistake, double-check all information provided about the CFCs, including their names, taxpayer identification numbers, and foreign addresses. It is also recommended to maintain accurate records of these details throughout the year to ensure their accuracy when completing the form.

Calculating and reporting tested income and tested loss incorrectly can result in significant errors in the calculation of GILTI and Subpart F income. To avoid this mistake, carefully review the instructions for calculating tested income and tested loss and ensure that all required adjustments are made. It is also recommended to consult with a tax professional if you have any doubts or uncertainties regarding the calculations.

Failure to complete Schedule A, Net CFC Investment Income and Deductions, and Schedule B, Net CFC Tested Income and Loss, if applicable, can result in errors in the calculation of GILTI and Subpart F income. To prevent this mistake, carefully review the instructions and determine if these schedules are required for your situation. If so, ensure that they are completed accurately and attached to Form 8992.

Filing Form 8992 late, including extensions, can result in penalties and delays in processing. To avoid this mistake, be aware of the due date for filing Form 8992 and ensure that it is filed on time. If an extension is needed, apply for it before the due date to avoid any potential penalties.

The U.S. Shareholder Calculation of GILTI form is subject to periodic updates and changes. Failing to review these sections may result in using outdated or incorrect information. To avoid this mistake, make it a habit to check for updates and changes before filling out the form. You can also sign up for IRS email notifications or visit their website regularly to stay informed about any modifications.

The U.S. Shareholder Calculation of GILTI form requires the reporting of specific information related to foreign income and assets. Neglecting to provide this information can result in penalties. To avoid this mistake, familiarize yourself with the reporting requirements and deadlines. Make sure to gather all necessary documentation and double-check your calculations before submitting the form.

If you need to file an amended return for the U.S. Shareholder Calculation of GILTI form, it's essential to write 'Corrected' at the top of the form. Failing to do so may result in processing delays or potential confusion. To avoid this mistake, make sure to write 'Corrected' clearly and prominently at the top of the form before submitting it.

Maintaining accurate records is essential when dealing with tax-related matters. Neglecting to keep copies of completed U.S. Shareholder Calculation of GILTI forms can make it difficult to provide proof of compliance if needed. To avoid this mistake, make sure to keep copies of all completed forms in a secure location.

The Paperwork Reduction Act Notice on the U.S. Shareholder Calculation of GILTI form reminds taxpayers that they are required to keep their tax returns confidential. Ignoring this notice can result in unintended disclosures of sensitive information. To avoid this mistake, read and understand the Paperwork Reduction Act Notice before filling out the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8992 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8992 forms, ensuring each field is accurate.