Yes! You can use AI to fill out Form CA-17, Duty Status Report

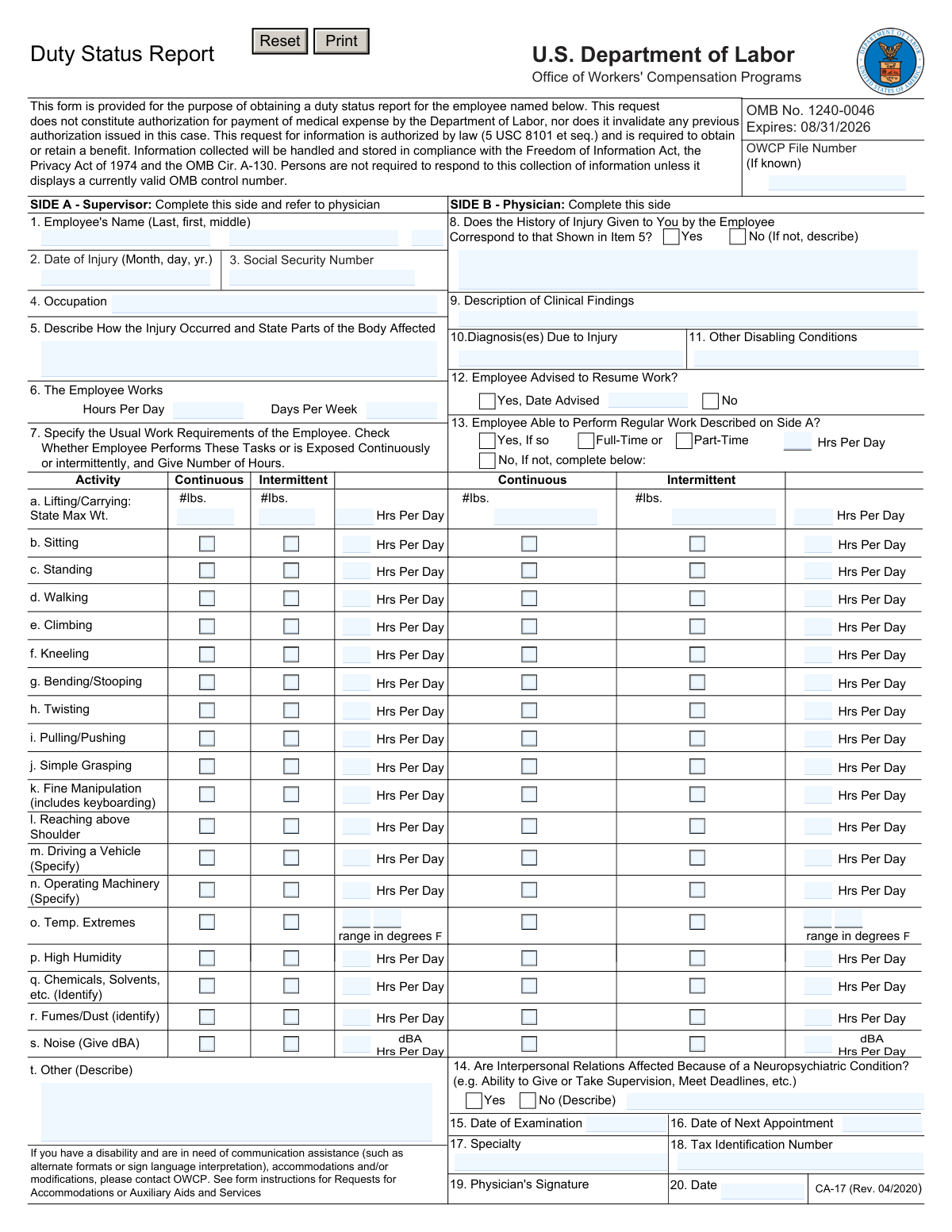

Form CA-17, Duty Status Report, is used to collect information about an employee's work status following an injury. It helps determine their ability to return to work and is crucial for processing workers' compensation claims.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out CA-17 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form CA-17, Duty Status Report |

| Form issued by: | U.S. Department of Labor |

| Number of fields: | 161 |

| Number of pages: | 3 |

| Version: | Rev. 04/2020 |

| Filled form examples: | Form CA-17 Examples |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out CA-17 Online for Free in 2026

Are you looking to fill out a CA-17 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your CA-17 form in just 37 seconds or less.

Follow these steps to fill out your CA-17 form online using Instafill.ai:

- 1 Visit instafill.ai site and select CA-17.

- 2 Enter employee's name and injury details.

- 3 Complete work requirements and physician sections.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable CA-17 Form?

Speed

Complete your CA-17 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 CA-17 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form CA-17

The Duty Status Report (CA-17) form is a document used to obtain a duty status report for an employee who has been injured. It is required by law and is utilized to determine eligibility for and the amount of benefits payable under the Federal Employees' Compensation Act.

Side A of the Duty Status Report (CA-17) form should be completed by the supervisor or employer of the injured employee.

Side B of the Duty Status Report (CA-17) form should be completed by the treating physician or healthcare provider of the injured employee.

Side A of the Duty Status Report (CA-17) form requires the following information about the injured employee: name, social security number, occupation, and work requirements. Additionally, it requires information about the injury itself, such as how it occurred and which body parts were affected.

Side B of the Duty Status Report (CA-17) form requires clinical findings and diagnoses from the treating physician, as well as information about any other disabling conditions the employee may have.

The OMB control number for the Duty Status Report (CA-17) form is 1240-0046.

Yes, the completion of the Duty Status Report (CA-17) form is mandatory to obtain or retain a benefit under the Federal Employees' Compensation Act.

Knowingly providing false or misleading information on the Duty Status Report (CA-17) form may subject the person certifying the information to criminal prosecution.

The completed Duty Status Report (CA-17) form should be sent to the Office of Workers' Compensation Programs, along with a copy for the employing agency.

Individuals with disabilities have the right to receive help from the OWCP in the form of communication assistance, accommodations, and modifications to aid them in the claims process. This may include alternate formats, sign language interpretation, or other adjustments or changes to accommodate their disability.

The physician should return the completed Duty Status Report (CA-17) form to the employing agency within 2 days to prevent interruption of the employee's income.

The Duty Status Report (CA-17) form is used by physicians to report their duty status to their employing agency for compensation purposes under the Federal Employees' Compensation Act.

The Duty Status Report (CA-17) form requires the physician to provide their name, social security number, date of injury or death, nature of injury or cause of death, and the dates of their absence from work due to the injury or death.

The Privacy Act Statement for the Duty Status Report (CA-17) form notifies individuals that their personal information will be collected, used, and disclosed in accordance with the Federal Employees' Compensation Act and other relevant laws.

The Public Burden Statement for the Duty Status Report (CA-17) form estimates the public reporting burden for this collection of information and provides instructions for submitting comments regarding the burden estimate.

Yes, the Duty Status Report (CA-17) form is mandatory for physicians to file with their employing agency in order to receive compensation benefits under the Federal Employees' Compensation Act.

Compliance CA-17

Validation Checks by Instafill.ai

1

Ensures that the employee's full name is entered correctly on Side A in the format: last, first, middle.

This validation check ensures that the employee's full name is captured accurately on Side A of the Duty Status Report. It verifies that the name is entered in the prescribed format, which is the last name followed by a comma, the first name, and then the middle name or initial if applicable. The check is crucial for maintaining consistent records and ensuring that the employee's identity is correctly represented in official documents.

2

Confirms that the date of injury is provided on Side A in the correct format: month, day, year.

This validation check confirms that the date of injury is clearly stated on Side A of the Duty Status Report. It validates that the date is provided in the correct format, specifically month followed by day and year, ensuring that there is no ambiguity regarding the timeline of the injury. This is essential for tracking the incident accurately and is important for any follow-up actions or claims processing.

3

Verifies that the employee's Social Security Number is filled in accurately on Side A.

This validation check verifies that the employee's Social Security Number (SSN) is filled in accurately on Side A of the Duty Status Report. It checks that the SSN is complete and formatted correctly, typically as a nine-digit number without spaces or dashes. This information is critical for identification purposes and must be handled with care to protect the employee's privacy and security.

4

Checks that the employee's occupation is specified on Side A.

This validation check ensures that the employee's occupation is clearly specified on Side A of the Duty Status Report. It checks that the occupation field is not left blank and that the description provided is adequate to understand the nature of the employee's job. This information can be relevant when assessing the injury and its impact on the employee's ability to perform their work duties.

5

Validates the description of how the injury occurred and the parts of the body affected on Side A.

This validation check validates the description of how the injury occurred and which parts of the body were affected, as provided on Side A of the Duty Status Report. It ensures that the narrative is complete and provides sufficient detail to understand the circumstances of the injury. This is crucial for determining the cause and extent of the injury and for any necessary workplace safety improvements or compensation claims.

6

Confirms the number of hours per day and days per week the employee works as indicated on Side A.

The AI ensures that the employee's reported work schedule is accurately captured, including the total number of hours worked each day and the number of days worked per week. It cross-references this information with the details provided on Side A of the Duty Status Report to confirm consistency. Any discrepancies between the reported schedule and the form are flagged for review. This validation is crucial for maintaining accurate employment records and may have implications for wage calculations and benefits.

7

Ensures that the usual work requirements, including the number of hours per day for each activity, are detailed on Side A.

The AI meticulously verifies that Side A of the Duty Status Report comprehensively outlines the usual work requirements. It checks that each activity mentioned includes the corresponding number of hours per day allocated to it. This validation ensures that the employee's typical workday is fully documented, providing a clear picture of their responsibilities and time commitments. The AI's attention to detail in this process helps prevent any misunderstandings or inaccuracies regarding the employee's workload.

8

Verifies that the history of injury provided by the employee corresponds with the supervisor's account on Side B.

The AI compares the injury history as reported by the employee with the account provided by the supervisor on Side B of the Duty Status Report. It looks for alignment in the details of the incident, including the date, time, nature, and circumstances of the injury. Any inconsistencies are highlighted for further investigation. This verification is essential to ensure that both the employee and the supervisor provide a harmonized narrative of the injury, which is critical for processing claims and determining workplace accommodations.

9

Checks for a complete description of clinical findings on Side B.

The AI scrutinizes Side B of the Duty Status Report to confirm that a full description of the clinical findings is present. It checks for the inclusion of all relevant medical observations and results that pertain to the employee's injury. The AI ensures that this section is not left incomplete, as the clinical findings are vital for understanding the extent of the injury and for making informed decisions regarding the employee's duty status. This check is a safeguard against incomplete medical reporting.

10

Ensures that all diagnosis(es) due to injury are listed on Side B.

The AI ensures that every diagnosis related to the employee's injury is listed on Side B of the Duty Status Report. It verifies that the diagnoses are clearly stated and that no condition has been omitted. This comprehensive listing is necessary for appropriate follow-up care, potential accommodations, and for the accurate processing of any related claims. The AI's thorough validation process supports the integrity of the employee's medical record.

11

Confirms if any other disabling conditions are noted on Side B.

The AI ensures that Side B of the Duty Status Report accurately reflects any additional disabling conditions that may affect the employee's ability to work. It meticulously scans the form to confirm that all relevant conditions are noted, and none are omitted. This check is crucial for maintaining an accurate record of the employee's health status and potential work limitations. The AI's attention to detail in this area helps prevent any oversights that could impact the employee's duty status or benefits.

12

Verifies whether the employee has been advised to resume work and the date advised if applicable on Side B.

The AI verifies the information regarding the employee's advised return to work, as stated on Side B of the Duty Status Report. It checks for a clear indication that the employee has been informed about when they can resume work, including the specific date if provided. This validation is essential to ensure that there is no ambiguity about the employee's readiness to return to duty. The AI's verification process helps in coordinating the employee's work schedule and in communicating with the employer about the expected date of return.

13

Checks if the employee's ability to perform regular work is stated on Side B, including work type and hours per day.

The AI checks Side B of the Duty Status Report to ensure that it clearly states the employee's ability to perform their regular work duties. It looks for detailed information about the type of work the employee can engage in and the number of hours per day they are capable of working. This check is vital for understanding the employee's current work capacity and for making any necessary accommodations. By validating this information, the AI assists in the management of the employee's work responsibilities and supports their recovery process.

14

Validates the inclusion of the date of examination and the date of the next appointment on Side B.

The AI validates that the Duty Status Report includes both the date of the medical examination and the date of the next scheduled appointment on Side B. This ensures that the timeline of the employee's medical care is accurately documented and that future appointments are accounted for. The inclusion of these dates is critical for tracking the employee's progress and for planning subsequent evaluations. The AI's validation of these dates aids in the continuity of care and in keeping all parties informed of the employee's treatment schedule.

15

Ensures that the medical specialty is specified and the Tax Identification Number is filled in on Side B.

The AI ensures that the medical professional's specialty is clearly specified on Side B of the Duty Status Report. Additionally, it checks that the Tax Identification Number (TIN) is correctly filled in. This information is essential for identifying the qualifications of the medical professional and for processing any related financial transactions or insurance claims. The AI's thorough validation of these details helps maintain the integrity of the report and supports proper record-keeping and billing procedures.

16

Physician's Signature and Date Presence on Side B

The validation process ensures that Side B of the Duty Status Report contains the physician's signature, confirming the authenticity of the information provided. It also verifies that the date of the signature is present and properly recorded. This check is crucial to establish the timeline of the report's completion and to maintain the integrity of the document. The absence of either the signature or the date would render Side B incomplete and potentially non-compliant with procedural requirements.

17

Supervisor Completion and Referral of Side A

This validation step checks that the supervisor has fully completed Side A of the Duty Status Report, which includes all necessary information about the employee and the duty status. It also confirms that the supervisor has appropriately referred the form to the physician for completion of Side B. This ensures a seamless transition between the supervisor's initial report and the physician's medical evaluation, maintaining the form's workflow and adherence to protocol.

18

Physician's Timely Completion and Return of Side B

The validation mechanism verifies that the physician has completed Side B of the Duty Status Report, including all required medical evaluations and recommendations. It also checks that the physician has signed and returned the form to the employing agency within the mandated 2-day period. This timely return is essential for the expeditious processing of the report and for ensuring that the employee's work status is updated in a timely manner.

19

Physician's Name and Address on Side B

This check ensures that the physician's name and address are accurately filled in on Side B of the Duty Status Report. The presence of this information is necessary for proper identification and communication with the physician. It also serves as a validation point for the authenticity of the report and for future reference if follow-up is needed. Incomplete or missing information in this section could lead to delays or complications in the processing of the report.

20

Original Report Sent to OWCP/DFELHWC-FECA

The final validation step confirms that the original Duty Status Report is sent to the Office of Workers' Compensation Programs (OWCP) Division of Federal Employees' Compensation (DFELHWC) Federal Employees' Compensation Act (FECA) at the provided address. This ensures that the report reaches the appropriate destination for official processing and archival. It is a critical step in maintaining the proper chain of custody for the document and for the subsequent actions that may be taken based on the report's findings.

21

Validates the physician's certification of the truthfulness and accuracy of the information by signing block 19.

This validation check ensures that the physician's signature is present in block 19, which is a mandatory requirement for the Duty Status Report. It verifies that the physician has certified the truthfulness and accuracy of the information provided in the report. The check also confirms that the signature is appropriately placed as per the form's layout. Additionally, it may involve cross-referencing the signature with known records to authenticate the physician's identity when necessary.

22

Checks for compliance with the Privacy Act Statement and Public Burden Statement included in the form.

This validation check scrutinizes the form to ensure that it adheres to the Privacy Act Statement and the Public Burden Statement. It confirms that the information collected is within the boundaries of what is legally permissible under these statements. The check also ensures that the form's user is aware of their rights and the intended use of the information provided. Furthermore, it may involve a review of the form's content to guarantee that no additional information is requested beyond what is authorized.

23

Ensures that any necessary accommodations for disability are communicated to OWCP as stated in the instructions.

This validation check ensures that any required accommodations for disability are clearly communicated to the Office of Workers' Compensation Programs (OWCP) as outlined in the form's instructions. It verifies that the form includes all necessary details regarding the accommodations requested. The check also ensures that the information is presented in a clear and understandable manner, facilitating the OWCP's ability to provide the appropriate support. Additionally, it may involve confirming that the accommodations are reasonable and in line with legal requirements.

24

Confirms that the form is not sent to the address provided for comments regarding the burden estimate.

This validation check confirms that the Duty Status Report is sent to the correct address and not to the one provided for comments regarding the burden estimate. It ensures that the form is directed to the appropriate department for processing. The check also involves verifying that the address fields are filled out correctly and in accordance with the form's instructions. Furthermore, it may include a review of the form's submission instructions to prevent any misdirection of the report.

Common Mistakes in Completing CA-17

One of the most common mistakes made when filling out a Duty Status Report is leaving fields incomplete or providing illegible information. This can lead to delays in processing and potential inaccuracies in the report. To avoid this mistake, ensure all required fields are fully completed and that all information is clear and legible. Double-check your entries to make sure they are complete and easy to read.

Another common mistake is entering an incorrect Social Security Number. This can lead to delays in processing and potential issues with tax reporting. To avoid this mistake, double-check your Social Security Number entry against your Social Security card or other official documentation. If you are unsure about your number, consult your employer or the Social Security Administration.

Misrepresenting your occupation on a Duty Status Report can lead to inaccurate reporting and potential consequences. It is important to provide an accurate and truthful description of your job duties. To avoid this mistake, carefully review the instructions for completing the occupation field and provide a detailed and accurate description of your job duties.

Providing a vague or incomplete description of an injury and the body parts affected can lead to delays in processing and potential inaccuracies in the report. It is important to provide a clear and detailed description of any injuries sustained. To avoid this mistake, take the time to carefully describe the injury, including the date it occurred, the body parts affected, and the symptoms you are experiencing.

Inaccurately reporting the hours worked per day and week can lead to potential issues with pay and potential consequences. It is important to provide an accurate and truthful report of your hours worked. To avoid this mistake, carefully review the instructions for reporting hours and keep accurate records of your hours worked.

When completing the Duty Status Report form, it is essential to provide a detailed description of the work requirements for each activity listed on Side A (a-t). Failure to do so may result in incomplete or inaccurate information. To avoid this mistake, take the time to carefully consider and document the specific duties, tasks, and responsibilities associated with each activity. This information should include the frequency, duration, and any physical or environmental demands.

Another common mistake on the Duty Status Report form is the presence of discrepancies between the employee's reported history of injury and the physician's findings on Side B. These discrepancies can lead to confusion and potential misunderstandings. To prevent this issue, ensure that all information provided is accurate and consistent. Employees should report their injuries truthfully and in detail, while physicians should document their findings objectively and thoroughly. Communication between the employee and their healthcare provider is crucial to minimize discrepancies.

It is mandatory for both the supervisor and physician to sign and date the Duty Status Report form. Failure to obtain these signatures and dates may result in the form being rejected. To prevent this mistake, ensure that all necessary parties are aware of the requirement to sign and date the form and provide them with ample time to do so. Communication and organization are key to avoiding this issue.

Timely submission of the Duty Status Report form to the Employing Agency is crucial. Failure to do so may result in penalties or delays in processing. To prevent this mistake, familiarize yourself with the specified time frame for submission and ensure that the form is returned well before the deadline. Proper planning and organization can help avoid this issue.

Lastly, it is essential to include the correct address of the Employing Agency on Side A of the Duty Status Report form. Failure to do so may result in the form being misrouted or delayed. To prevent this mistake, double-check the address provided and ensure that it is accurate and complete. Clear communication with the Employing Agency can help minimize errors in this area.

The Duty Status Report is required to be submitted to the Office of Workers' Compensation Programs (OWCP) for processing. Neglecting to send a copy of the completed report to the provided OWCP address may result in delays or denial of benefits. To avoid this mistake, ensure that you send a copy of the completed report to the OWCP address as soon as possible after submission to your supervisor. It is recommended to keep a record of the date and method of submission for your records.

The Tax Identification Number (TIN) is required to be filled in on Side B of the Duty Status Report. Failing to provide this information may result in delays or denial of benefits. It is important to double-check that the TIN is entered correctly to ensure accurate processing of your report. To avoid this mistake, make sure to enter your correct TIN on Side B of the report before submitting it.

The date of the next appointment is required to be filled in on Side B of the Duty Status Report. Failing to provide this information may result in delays or denial of benefits. It is important to ensure that the date provided is accurate and reflects the date of your next scheduled appointment. To avoid this mistake, make sure to enter the correct date of your next appointment on Side B of the report before submitting it.

The medical specialty is required to be specified on Side B of the Duty Status Report. Failing to provide this information may result in delays or denial of benefits. It is important to ensure that the correct medical specialty is specified to ensure accurate processing of your report. To avoid this mistake, make sure to enter the correct medical specialty on Side B of the report before submitting it.

The Duty Status Report may include instructions for accommodations or modifications for employees with disabilities. Failing to follow these instructions may result in denial of benefits or other negative consequences. It is important to carefully review and follow all instructions related to accommodations or modifications to ensure that you are meeting your obligations under the Americans with Disabilities Act (ADA) and other relevant laws. To avoid this mistake, make sure to carefully review and follow all instructions related to accommodations or modifications for employees with disabilities.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out CA-17 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ca-17 forms, ensuring each field is accurate.