Yes! You can use AI to fill out Form CA-7, Claim for Compensation

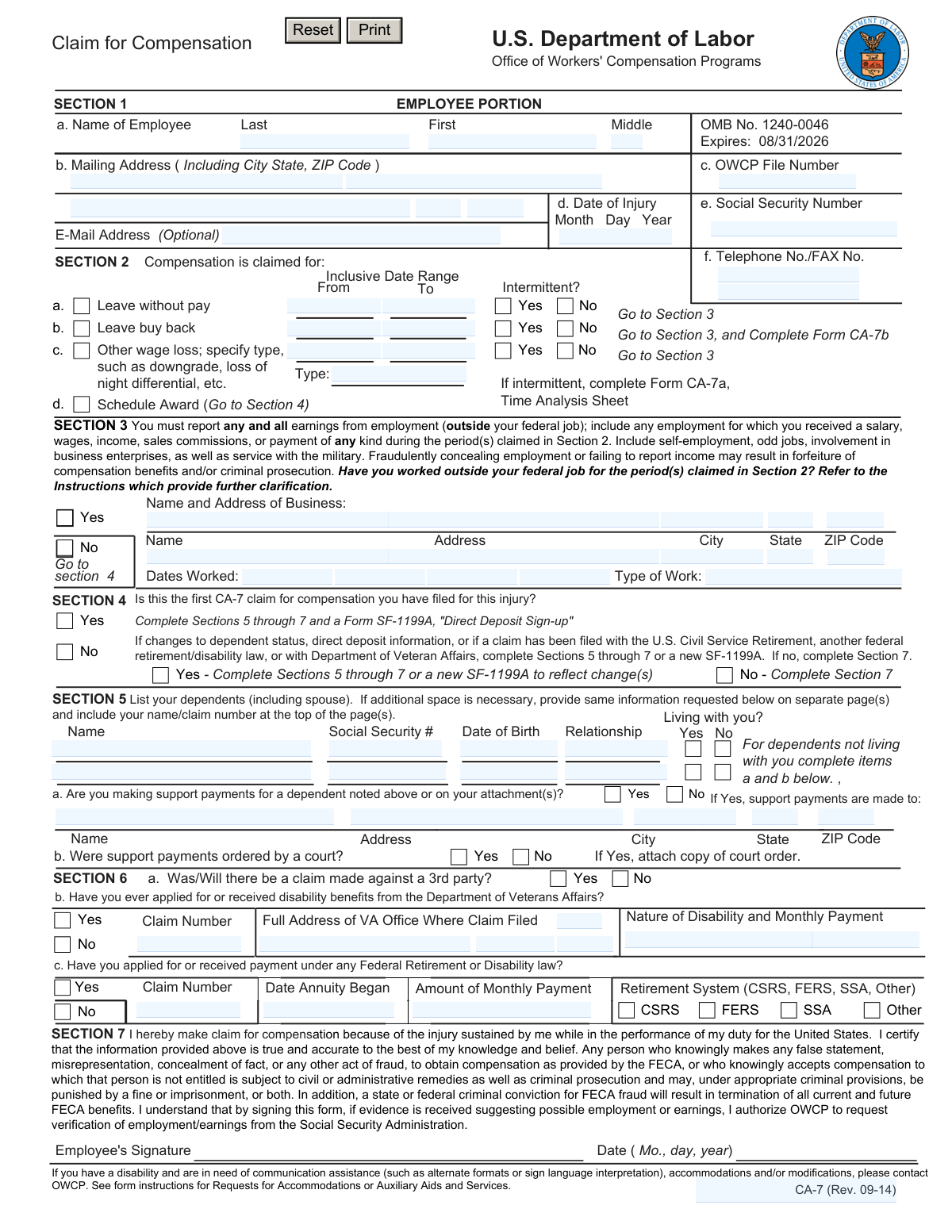

Form CA-7, Claim for Compensation, is used by federal employees to request compensation for injuries sustained while performing their duties. This form is crucial for ensuring that employees receive the benefits they are entitled to under the Federal Employees' Compensation Act (FECA).

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out CA-7 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form CA-7, Claim for Compensation |

| Form issued by: | U.S. Department of Labor |

| Number of fields: | 203 |

| Number of pages: | 4 |

| Version: | Rev. 09-14 |

| Filled form examples: | Form CA-7 Examples |

| Language: | English |

| Categories: | VA claim forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out CA-7 Online for Free in 2026

Are you looking to fill out a CA-7 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your CA-7 form in just 37 seconds or less.

Follow these steps to fill out your CA-7 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form CA-7.

- 2 Enter employee's personal information.

- 3 Provide details about the injury and compensation claim.

- 4 Complete sections regarding employment and dependents.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable CA-7 Form?

Speed

Complete your CA-7 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 CA-7 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form CA-7

The employee is required to provide their name, middle initial, OWCP File Number, mailing address, date of injury, and social security number in Section 1 of the Claim for Compensation form.

Section 2 of the Claim for Compensation form is used to report any and all earnings from employment outside of the federal job, including self-employment and military service.

Section 3 of the Claim for Compensation form is used to report the type of work, dates worked, and whether the claimant has filed a previous CA-7 claim for compensation for the same injury.

Section 4 of the Claim for Compensation form is used to provide the claimant's dependents' information, including their names, relationships, and support payments.

Sections 5 through 7 of the Claim for Compensation form are used to provide additional information related to the claim, such as disability benefits from the Department of Veterans Affairs or other federal retirement or disability laws.

Sections 8 through 15 of the Claim for Compensation form for the employing agency are used to provide information related to the employee's pay, including base wages, overtime wages, additional pay types, continuation of pay, and pay status and inclusive dates.

The Instructions section of the Claim for Compensation form provides additional information and clarification on completing the form, including explanations for certain items and exceptions.

The Employing Agency Portion of the Claim for Compensation form is used by the employing agency to provide information related to the employee's pay and employment status, including the name and address of the employer, the employee's job title, and the date of injury or illness.

CA-7 Page 2 of the Claim for Compensation form contains instructions for completing the form and information on how to file the claim with the Office of Workers' Compensation Programs, including the mailing address and filing deadlines.

The Direct Deposit Information section of the Claim for Compensation form is used to provide the claimant's bank account information for electronic funds transfer (EFT) or Direct Deposit of compensation payments, including the routing number, account number, and account type.

The Claim for Compensation form is used to apply for workers' compensation benefits in California, including medical treatment, temporary disability payments, and permanent disability payments. It requires information from both the claimant and the employing agency.

The Public Burden Statement and Privacy Act notice in the Claim for Compensation form serve two important functions. The Public Burden Statement informs the filer about the estimated time and resources required to complete the form. This information helps filers understand the reporting burden associated with the form. The Privacy Act notice explains how the personal information collected on the form will be used, disclosed, and protected. It is important for filers to read and understand both statements before completing the form.

The Office of Management and Budget (OMB) control number for the Claim for Compensation form is 1240-0046. This number is used to identify the form for regulatory and reporting purposes. It is important for filers to keep this number on file for future reference.

Compliance CA-7

Validation Checks by Instafill.ai

1

Ensures the employee's full name is entered correctly in Section 1, including First, Middle, and Last names.

The validation process ensures that the employee's full name is accurately captured in Section 1 of the Claim for Compensation form. It checks that the first name, middle initial or name, and last name are all present and spelled correctly. This step is crucial for the identification of the claimant and to avoid any discrepancies that may arise from incorrect name details. The AI cross-references this information with existing records, if available, to ensure consistency.

2

Confirms the employee's mailing address is complete with city, state, and ZIP code in Section 1.

This validation confirms that the employee's mailing address is fully and correctly entered in Section 1 of the form. It verifies that the street address, city, state, and ZIP code are provided and formatted properly. This information is essential for any correspondence related to the claim and must be accurate to prevent any delays in communication. The AI checks against postal service standards to ensure the address is valid.

3

Verifies the OWCP File Number is entered in Section 1 if known.

The AI verifies whether the Office of Workers' Compensation Programs (OWCP) File Number is included in Section 1, provided that the employee knows it. This number is critical for tracking the claim and linking it to any previous records in the OWCP system. If the number is present, the AI checks for the correct format and sequence of digits. This step helps streamline the claims process by facilitating the retrieval of existing claim information.

4

Checks the date of injury is indicated correctly in Section 1 with the format (Month, Day, Year).

The validation process checks that the date of injury is clearly indicated in Section 1 of the Claim for Compensation form. It ensures that the date is in the correct format of Month, Day, and Year, which is essential for establishing the timeline of the claim. The AI also verifies that the date is plausible and does not fall in the future or at an otherwise invalid time. Accurate dating is crucial for the processing and investigation of the claim.

5

Validates the employee's Social Security Number is provided in Section 1.

This validation step ensures that the employee's Social Security Number (SSN) is provided in Section 1 of the form. The AI validates that the SSN is in the correct format and consists of nine digits, typically formatted as XXX-XX-XXXX. It is essential that the SSN is accurate for identification purposes and for the proper administration of benefits. The AI may also perform a checksum validation to ensure the SSN is valid.

6

Confirms the employee's telephone number and optional fax number are included in Section 1.

The system confirms that the employee's contact information is complete by verifying the presence of a telephone number in Section 1 of the Claim for Compensation form. It also checks for an optional fax number, ensuring that all possible means of communication are provided. This validation is crucial for maintaining clear lines of communication between the employee and the entity processing the claim. The system alerts the user if either the telephone or fax number fields are left blank, prompting for the necessary information to be filled in.

7

Ensures the type of compensation claimed is specified in Section 1 and detailed if 'other wage loss' is selected.

The system ensures that the type of compensation being claimed is clearly specified in Section 1 of the form. If the option 'other wage loss' is selected, the system prompts for additional details to be provided. This validation check is essential to understand the nature of the claim and to facilitate the appropriate processing of the compensation. The system's prompt for detail in the case of 'other wage loss' selection helps prevent incomplete submissions and potential delays in claim processing.

8

Verifies the inclusive date range for which compensation is claimed is indicated in Section 2.

The system verifies that an inclusive date range for which compensation is being claimed is properly indicated in Section 2 of the form. This check is important to establish the specific period for which the claimant is seeking compensation. The system ensures that both the start and end dates are provided and that they are formatted correctly. If the date range is missing or improperly formatted, the system alerts the user to correct the information to avoid processing delays.

9

Checks if the claim is for intermittent leave and if Form CA-7a is completed if applicable in Section 2.

The system checks if the claim includes a request for intermittent leave in Section 2 and, if so, verifies that Form CA-7a is completed as required. This validation is crucial because intermittent leave claims have additional documentation requirements. The system ensures that the claimant has provided all necessary information to support their request for intermittent leave. If Form CA-7a is not completed when required, the system prompts the user to do so to ensure the claim is processed efficiently.

10

Confirms if the claim is for a schedule award and if the form proceeds to Section 4 as indicated in Section 2.

The system confirms whether the claim is for a schedule award by reviewing the information provided in Section 2. If a schedule award is being claimed, the system ensures that the form proceeds to Section 4 as indicated. This validation check is important to ensure that the claim follows the correct procedural steps and that all relevant sections of the form are completed. The system assists in guiding the user through the form completion process, ensuring that no necessary sections are overlooked for a schedule award claim.

11

Ensures any outside employment and earnings during the claimed period(s) are reported in Section 3.

The AI ensures that Section 3 of the Claim for Compensation form is thoroughly reviewed for any outside employment and earnings that the claimant may have had during the period(s) being claimed. It verifies that all such employment and earnings are accurately reported, including the nature of the employment, the duration, and the amount earned. The AI cross-references this information with any supporting documents provided to confirm its validity. It also alerts the user if any fields related to outside employment and earnings are left incomplete or if the information provided appears inconsistent with the claim period.

12

Validates the information about dependents, claims against third parties, and other relevant details in Section 4.

The AI validates the information provided in Section 4, which encompasses details about dependents, any claims against third parties, and other relevant information that could affect the compensation claim. It checks for the completeness and accuracy of the data entered, ensuring that all required fields are filled out and that the information is consistent with legal and regulatory requirements. The AI also compares the details against any existing records to detect discrepancies and prompts the user to resolve any issues before proceeding with the claim.

13

Checks the list of dependents in Section 5 for completeness, including relationship, date of birth, and living arrangements.

The AI meticulously checks the list of dependents provided in Section 5 of the form. It ensures that each dependent's information is complete, including their full name, relationship to the claimant, date of birth, and living arrangements. The AI cross-verifies these details with any supporting documentation to ensure they match and are up-to-date. It also flags any missing or incomplete information regarding the dependents, prompting the user to provide the necessary details to support the claim.

14

Confirms the accuracy of information regarding claims against third parties and other benefits in Section 6.

The AI confirms the accuracy of the information entered in Section 6, which pertains to claims against third parties and the receipt of other benefits that may affect the compensation claim. It checks for consistency in the details provided, such as the nature of the third-party claims, the status of those claims, and any other benefits the claimant may be receiving. The AI ensures that this information is accurately reflected and that it does not conflict with the claimant's current compensation claim. It also highlights any potential issues that could arise from incorrect or incomplete entries in this section.

15

Verifies the form is signed and dated in Section 7 to certify the claim for compensation.

The AI verifies that Section 7 of the Claim for Compensation form is properly signed and dated by the claimant. It checks the signature against known samples, if available, to confirm authenticity and ensures that the date of signing is current and falls within acceptable timeframes for the claim submission. The AI also ensures that the signature and date fields are not left blank, as an unsigned or undated form may be considered invalid and could delay the processing of the claim. It alerts the user to provide a signature and date if either is missing.

Common Mistakes in Completing CA-7

The Claim for Compensation form requires the full legal name of the claimant to be provided in Section 1-a. Failure to include the middle name or initial, or providing a nickname instead of the legal name, can result in processing delays or potential rejection of the claim. To avoid this mistake, ensure that the name provided is the same as the one on file with the Office of Workers' Compensation Programs (OWCP).

Section 1-b of the Claim for Compensation form requires the claimant to provide a valid mailing address for correspondence. Incorrect or incomplete addresses can cause delays in processing and communication between the claimant and the OWCP. To prevent this mistake, double-check the address for accuracy and completeness, including the street address, city, state, and zip code.

The OWCP File Number is a critical piece of information required in Section 1-c of the Claim for Compensation form. Failing to provide this number can result in significant processing delays or even rejection of the claim. To avoid this mistake, ensure that the OWCP File Number is obtained from the employer or the insurance carrier and is included in the application.

Section 1-d of the Claim for Compensation form requires the claimant to provide the exact date of the work-related injury or illness. Incorrect or incomplete dates can lead to processing delays or potential rejection of the claim. To prevent this mistake, double-check the date of injury or illness against any available documentation, such as medical records or reports from the employer, and ensure that it is entered correctly on the form.

Section 1-e of the Claim for Compensation form requires the claimant to provide their Social Security Number. Failure to include this information can result in processing delays or potential rejection of the claim. To avoid this mistake, ensure that the Social Security Number is provided accurately and in its entirety. If there are concerns about privacy or security, the form can be mailed or handed in person to the OWCP instead of being submitted online.

Failure to specify the type of compensation being claimed in Section 1-g of the Claim for Compensation form can lead to processing delays or potential rejection of the claim. To avoid this mistake, ensure you clearly indicate the nature of the compensation, such as wages, commissions, bonuses, or other forms of remuneration, in the provided space. Double-check your entry for accuracy to ensure a smooth processing of your claim.

Providing an incorrect or incomplete date range in Section 2-a of the Claim for Compensation form can result in errors in calculating the amount of compensation owed. To prevent this mistake, carefully review the instructions and ensure that you enter the accurate start and end dates for the period of employment or leave. If you are unsure about the correct dates, consult your employer or the HR department for clarification.

Neglecting to indicate that your claim is for intermittent leave in Section 2-b of the Claim for Compensation form can result in incorrect processing of your claim. To avoid this mistake, make sure to check the appropriate box if your leave was taken intermittently, and provide the necessary supporting documentation, such as medical certificates or leave records. This will ensure that your claim is processed correctly and efficiently.

Failing to report outside employment and earnings in Section 3 of the Claim for Compensation form can result in underpayment or overpayment of your compensation. To prevent this mistake, accurately report all sources of income, including wages, salaries, commissions, and other forms of compensation, from all employers during the claimed period. This will help ensure that your compensation is calculated correctly and that you receive the full amount you are entitled to.

If your claim is for intermittent leave, it is essential to complete and submit Form CA-7a along with your Claim for Compensation form. Failing to do so can result in processing delays or potential rejection of your claim. To avoid this mistake, make sure to obtain and complete the Form CA-7a as instructed, and submit it along with your Claim for Compensation form to the appropriate agency or employer. This will help ensure that your intermittent leave claim is processed correctly and efficiently.

Failure to include accurate and complete information about dependents in Section 5 of the Claim for Compensation form can lead to delays or denial of benefits. Ensure that the full names, Social Security numbers, and relationships to the claimant are provided for each dependent. It is also essential to indicate the dependent's date of birth and whether they were or are currently receiving compensation. To avoid this mistake, carefully review the instructions and double-check the information provided for each dependent.

A common mistake when filling out the Claim for Compensation form is neglecting to sign and date the form in Section 7. This oversight can result in the form being considered incomplete and delayed or denied. To prevent this, ensure that all parties required to sign the form do so, and include the date in the designated space. It is also recommended to keep a copy of the signed form for personal records.

The Employing Agency Portion of the Claim for Compensation form requires specific and accurate information. Errors or omissions in this section can lead to processing delays or denial of benefits. Be sure to provide the correct name, address, and contact information for the employing agency. Additionally, ensure that the Employer Identification Number (EIN) is entered correctly. To avoid this mistake, double-check the information provided and consult with the employing agency if necessary.

The Claim for Compensation form (CA-7) includes specific instructions for completing each section. Ignoring or misunderstanding these instructions can result in errors and delays. Carefully review the instructions provided on the form and consult the accompanying guide if necessary. It is also recommended to ask for clarification from the California Department of Industrial Relations or a claims examiner if there is any uncertainty about how to complete a particular section.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out CA-7 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ca-7 forms, ensuring each field is accurate.