Yes! You can use AI to fill out Form DE-111, Petition for Probate

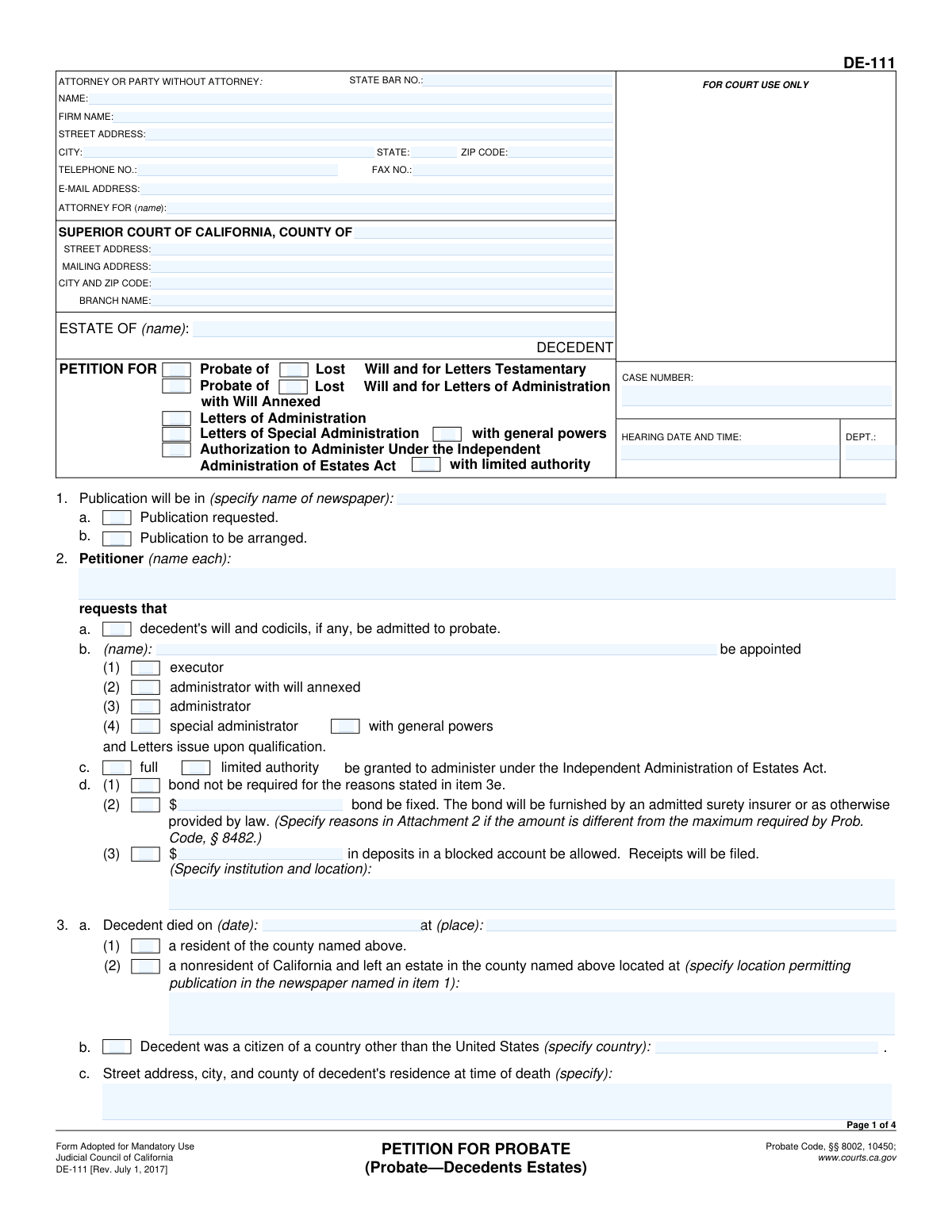

Form DE-111, officially known as the Petition for Probate, is a legal document used in California to initiate the probate process for a deceased person's estate. It requests the court to appoint a personal representative (executor or administrator) and to administer the estate, including the probate of the will if one exists. This form is crucial for legally transferring the decedent's assets to the rightful heirs or beneficiaries.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out DE-111 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form DE-111, Petition for Probate |

| Form issued by: | Judicial Council of California |

| Number of fields: | 177 |

| Number of pages: | 4 |

| Version: | 2017 |

| Language: | English |

| Categories: | probate forms, NY legal forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out DE-111 Online for Free in 2026

Are you looking to fill out a DE-111 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your DE-111 form in just 37 seconds or less.

Follow these steps to fill out your DE-111 form online using Instafill.ai:

- 1 Visit instafill.ai site and select DE-111

- 2 Enter decedent's personal information

- 3 Specify type of letters requested

- 4 Detail estate's character and value

- 5 List heirs and beneficiaries

- 6 Sign and date the form electronically

- 7 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable DE-111 Form?

Speed

Complete your DE-111 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 DE-111 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form DE-111

Form DE-111, Petition for Probate, is used to initiate the probate process in court. It is a legal document that requests the court to validate the decedent's will, appoint an executor or administrator, and grant them the authority to manage the estate according to the will or state law if there is no will.

Typically, the executor named in the decedent's will or a close relative (such as a spouse, child, or parent) if there is no will can file a Petition for Probate. In some cases, a creditor or other interested party may also file the petition, depending on state laws.

To complete Form DE-111, you will need the decedent's full name, date of death, and last address; details about the will (if one exists); names and addresses of heirs and beneficiaries; an estimate of the estate's value; and information about the proposed executor or administrator. Additional documents, such as the death certificate and the original will, may also be required.

A will is considered self-proving if it includes a notarized affidavit signed by the testator and witnesses at the time the will is executed. This affidavit states that the necessary legal formalities were observed, eliminating the need for witnesses to testify in court about the will's validity after the testator's death.

The requirements for appointing an executor or administrator vary by state but generally include being at least 18 years old, of sound mind, and not a convicted felon. The court may also consider the person's relationship to the decedent and their ability to impartially and efficiently manage the estate. If the decedent left a will, the named executor is usually appointed unless there is a valid objection.

The bond requirement for a personal representative is determined by the court and is based on the value of the estate's personal property and the gross annual income of the estate. The bond serves as a financial guarantee that the personal representative will fulfill their duties faithfully. The court may waive the bond requirement if all beneficiaries agree or if the will expressly waives the bond.

The Independent Administration of Estates Act (IAEA) allows for the administration of an estate without continuous court supervision, streamlining the probate process. When filing Form DE-111, the petitioner can request independent administration, which, if granted, gives the personal representative more flexibility in managing the estate's affairs without needing court approval for every action.

If the original will is lost, you must provide evidence to the court that the will was validly executed and not revoked. This may include testimony from witnesses to the will's execution or a copy of the will. The court will then determine whether the copy can be admitted to probate. It's important to detail the circumstances of the will's loss in the Petition for Probate (Form DE-111).

To request publication in a newspaper for probate, you must file a notice of petition to administer estate with the court. Once filed, the court will provide instructions on the publication requirements, including the newspaper's qualifications and the publication duration. Typically, the notice must be published once a week for three consecutive weeks. Proof of publication must then be filed with the court.

On Form DE-111, you must list all of the decedent's heirs and beneficiaries, including their names, addresses, and relationships to the decedent. If the decedent left a will, beneficiaries are those named in the will. If there is no will, heirs are determined by state intestacy laws. It's crucial to accurately identify and list all parties to ensure proper notice and distribution of the estate.

Letters of Administration are issued by the court when a person dies without a will (intestate), authorizing an administrator to manage the estate. Letters Testamentary are issued when the deceased left a will (testate), authorizing the executor named in the will to carry out its terms. Both documents grant authority to handle the estate's affairs but differ based on the presence of a will.

To calculate the estimated value of the decedent's estate for Form DE-111, you should include all assets owned by the decedent at the time of death, such as real estate, bank accounts, stocks, personal property, and any other valuables. Subtract any debts or liabilities. The net value is the estimated value of the estate. It's advisable to consult with a probate attorney or a financial advisor for accurate valuation.

When filing Form DE-111, required attachments typically include the original will (if one exists), a death certificate, a list of the decedent's assets and their estimated values, and any other documents that support the petition, such as a bond if the personal representative is not named in the will. Requirements may vary by jurisdiction, so it's important to check with the local probate court.

To nominate a personal representative in the Petition for Probate, you must specify the individual's name and relationship to the decedent in the appropriate section of Form DE-111. If the decedent left a will, the nominee is usually the executor named in the will. If there is no will, the court will appoint an administrator, often a close relative. The nominee must meet state eligibility requirements.

Grounds for requesting a special administrator include situations where there is an immediate need to protect the estate's assets before a personal representative is formally appointed, such as when there is a delay in probate proceedings, disputes among potential representatives, or if the estate is at risk of loss or damage. The court has discretion to appoint a special administrator based on the circumstances presented.

To indicate that the decedent was a nonresident of California on Form DE-111, you should clearly state the decedent's state or country of residence in the appropriate section of the form. This information is crucial for the probate court to determine jurisdiction and applicable laws.

Not waiving the bond for a personal representative means the representative must obtain a bond, which serves as a financial guarantee to protect the estate and its beneficiaries from potential mismanagement or fraud. The bond amount is typically set by the court and can be a significant expense. Failure to secure a bond when required can delay the probate process or result in the appointment of a different personal representative.

The Petition for Probate (Form DE-111) must be verified under penalty of perjury. This means the petitioner must sign the form in the presence of a notary public or other authorized official, who will then notarize the signature. Verification confirms that the information provided in the petition is true to the best of the petitioner's knowledge.

To file Form DE-111 with the Superior Court of California, you must complete the form accurately, attach all required documents (such as the death certificate and will, if applicable), and submit the packet to the probate court in the county where the decedent lived or owned property. Filing fees are required unless you qualify for a fee waiver. After submission, the court will review the petition and schedule a hearing if necessary.

More information about Probate Code sections referenced in Form DE-111 can be found in the California Probate Code itself, which is available online through the California Legislative Information website or at your local law library. Additionally, consulting with a probate attorney or legal aid organization can provide clarification and guidance on specific code sections.

Compliance DE-111

Validation Checks by Instafill.ai

1

Superior Court of California details

Ensures that all details related to the Superior Court of California are accurately filled in, including the county, branch name, city and zip code, street address, and mailing address. Verifies that the information is complete and matches the official records. Confirms that the court details are legible and correctly formatted. Validates that no fields related to the court details are left blank or contain incorrect information.

2

Attorney or party without an attorney details

Confirms that the name, state bar number, firm name, address, telephone number, fax number, and email address of the attorney or party without an attorney are provided. Ensures that the decedent's name is also included in this section. Verifies that all contact information is current and accurately entered. Checks that the details are complete and formatted correctly to avoid any processing delays.

3

Case number

Ensures that the case number is entered if it is known. Validates that the case number follows the correct format as per court requirements. Confirms that the field is not left blank if the case number is available. Checks for any discrepancies in the case number that might lead to processing errors.

4

Type of petition

Validates that the appropriate boxes indicating the type of petition being filed are checked. Ensures that at least one box is selected to specify the petition type. Confirms that the selection is clear and unambiguous. Checks that the selection aligns with the other information provided in the form.

5

Decedent's details

Checks that the decedent's name, date of death, place of death, and residence details are provided, including residency status in the county or California. Ensures that all fields related to the decedent are accurately and completely filled out. Verifies that the date of death is in the correct format and logically consistent. Confirms that the residence details are clear and support the petition's requirements.

6

Verifies the correct boxes are checked to specify the type of personal representative being appointed and that all necessary details are provided.

Ensures that the form accurately identifies the type of personal representative being appointed by verifying the correct boxes are checked. Confirms that all necessary details related to the appointment are fully provided to avoid any discrepancies. Validates the completeness of the information to ensure the probate process proceeds without delays. Checks for any missing or incorrect information that could impact the appointment of the personal representative.

7

Confirms that details about the decedent's will and codicils, including dates and self-proving status, are provided if applicable.

Verifies that all relevant details about the decedent's will and any codicils are accurately documented, including execution dates. Ensures the self-proving status of the will is indicated, if applicable, to confirm its validity without additional witness testimony. Checks for the presence of any amendments or codicils to ensure the most current version of the will is presented. Validates that the information provided aligns with legal requirements for probate proceedings.

8

Ensures that bond information is indicated, including whether it is required, waived, or needs to be fixed, with reasons provided if the bond amount differs from the maximum required.

Confirms that the bond information section is completed, specifying whether a bond is required, waived, or needs adjustment. Validates the accuracy of the bond amount and ensures reasons are provided for any deviations from the maximum required amount. Checks that the bond details comply with legal standards to protect the estate's interests. Ensures clarity in the bond requirements to prevent any misunderstandings during the probate process.

9

Validates that the character and estimated value of the property of the estate, including personal property, real property, and any encumbrances, are accurately completed.

Ensures that the character and estimated value of the estate's property are thoroughly and accurately reported. Confirms the inclusion of all relevant assets, such as personal and real property, and any encumbrances affecting them. Validates the completeness and accuracy of the property details to facilitate a fair and efficient probate process. Checks for any discrepancies or omissions that could affect the estate's valuation or distribution.

10

Checks that the appropriate boxes indicating who survived the decedent are checked, with names, relationships, ages, and addresses provided.

Verifies that the sections detailing the decedent's survivors are accurately completed, including the correct boxes checked. Confirms that names, relationships, ages, and addresses of survivors are provided to establish their legal standing. Ensures the information is complete and accurate to determine rightful heirs or beneficiaries. Checks for any missing details that could complicate the probate or distribution process.

11

Confirms whether administration under the Independent Administration of Estates Act is requested.

Ensures that the form correctly indicates whether the petitioner is requesting administration under the Independent Administration of Estates Act. Verifies that this selection aligns with the legal requirements and the petitioner's intentions. Confirms that the choice is clearly marked to avoid any ambiguity. Validates that this section is completed to facilitate the proper processing of the petition.

12

Ensures all petitioners have signed the form, with the petition verified by one of them, and includes the date and printed names alongside signatures.

Verifies that every petitioner has duly signed the form, ensuring legal validity. Confirms that at least one petitioner has verified the petition, as required. Checks that each signature is accompanied by the date and the printed name for clarity. Ensures that this step is completed to prevent delays in the probate process.

13

Verifies that any attachments exceeding the space provided are noted with the number of pages attached.

Ensures that any additional information or documents that exceed the provided space are properly noted. Confirms the exact number of attached pages is specified for reference. Verifies that attachments are relevant and necessary for the petition. Validates that this notation is clear to ensure all documents are considered during review.

14

Validates that all entered information is reviewed for accuracy and completeness before submission.

Ensures that every section of the form is filled out accurately to reflect the petitioner's intentions. Confirms that no required fields are left blank, preventing potential rejections. Verifies that all information is consistent and correctly entered. Validates the form's completeness to ensure a smooth probate process.

15

Confirms the use of the current version of the form and consultation of the Probate Code for specific requirements.

Ensures that the most recent version of the form is used, complying with current legal standards. Verifies that the petitioner has consulted the Probate Code to meet all specific requirements. Confirms that any updates or changes in the form or code have been adhered to. Validates this step to avoid any legal discrepancies or processing delays.

Common Mistakes in Completing DE-111

Filing the petition with incorrect or incomplete court information can lead to delays or rejection of the petition. It is crucial to verify the exact name and address of the court where the petition is being filed. Ensure all details are accurately transcribed from official sources. Double-checking this information before submission can prevent unnecessary setbacks.

Omitting attorney details or failing to indicate if a party is without an attorney can invalidate the petition. The form requires clear identification of legal representation or a declaration of self-representation. Always include the attorney's name, state bar number, and contact information if applicable. For parties without an attorney, a clear statement to that effect must be included.

An absent or incorrect case number can cause confusion and delay in processing the petition. The case number is essential for linking the petition to the correct probate case. Verify the case number with court records or previous correspondence. Accuracy in this detail ensures the petition is processed without unnecessary delays.

Selecting the wrong petition type can lead to the dismissal of the petition or the need for re-filing. Carefully review the types of petitions available and select the one that accurately reflects the nature of the request. Consulting with an attorney or reviewing the form instructions can help in making the correct selection. This attention to detail ensures the petition is processed as intended.

Incomplete information about the decedent can halt the probate process. The form requires full legal name, date of death, and last known address at a minimum. Gathering all necessary details from death certificates or other official documents before filling out the form is advisable. Completing this section thoroughly facilitates a smoother probate process.

Failing to accurately provide or completely omitting the personal representative's details can delay the probate process. It's crucial to include the full legal name, address, and contact information of the personal representative. Ensure that the representative's eligibility under state law is confirmed before submission. Double-check this section for accuracy to avoid unnecessary complications.

Incomplete information about the will and any codicils can lead to disputes or delays in probate. All relevant documents must be attached, and details such as execution dates and witness information should be accurately recorded. Review the will and codicils thoroughly to ensure all necessary information is included. This step is vital for the court to validate the documents.

Incorrect or missing bond information can result in the court requiring additional filings. The type and amount of the bond, if applicable, must be clearly stated according to state requirements. Consult with a legal professional to determine the correct bond specifications for the estate. Accurate bond information ensures the estate's administration proceeds without delay.

Omitting or inaccurately listing the estate's property can affect the distribution of assets. A comprehensive list including real estate, personal property, and financial assets must be provided. Valuations should be as accurate as possible, supported by appraisals or market analyses. Complete and precise property details facilitate a smoother probate process.

Inaccurate or missing information about survivors can lead to legal challenges and delays. The names, relationships, and addresses of all surviving heirs must be accurately documented. This includes minors and any heirs who may have a claim to the estate. Ensuring this information is correct helps prevent disputes among potential beneficiaries.

Failing to indicate whether the Independent Administration of Estates Act applies can lead to delays in the probate process. It's crucial to clearly state if the estate will be administered independently to avoid unnecessary court supervision. Review the estate's circumstances carefully to determine the applicability of the Act. Always consult with a legal professional if there's uncertainty about the estate's administration requirements.

Missing or unverified signatures on the Petition for Probate can render the form invalid. Ensure all required parties have signed the document in the presence of a notary or as otherwise required by law. Double-check the form for any signature lines that may have been overlooked. Keeping a checklist of required signatures can help prevent this oversight.

Omitting to note or include necessary attachments can stall the probate process. Each attachment should be clearly referenced in the petition and attached in the correct order. Verify that all required documents, such as the will or death certificate, are included and properly labeled. Organizing attachments before submission can ensure nothing is missed.

Submitting the Petition for Probate without a thorough review can lead to errors that may require resubmission. Take the time to review every section of the form for accuracy and completeness. Consider having a second party review the form to catch any mistakes you might have overlooked. Accuracy in the initial submission can save time and resources in the long run.

Utilizing an outdated version of the Petition for Probate can result in the rejection of the submission. Always download the most current form directly from the official court or government website before beginning the filing process. Check the form's revision date to ensure it's the latest version available. Staying informed about updates to legal forms is essential for compliance and efficiency.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out DE-111 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills de-111 forms, ensuring each field is accurate.