Fill out Form 1099-NEC, Nonemployee Compensation with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills F1099NEC forms, ensuring each field is accurate.

#1 AI PDF Filling Software of 2026

3 out of 4 customers say they prepare their Form 1099-NEC forms in 37 seconds or less

Secure platform for your PDF forms and personal information

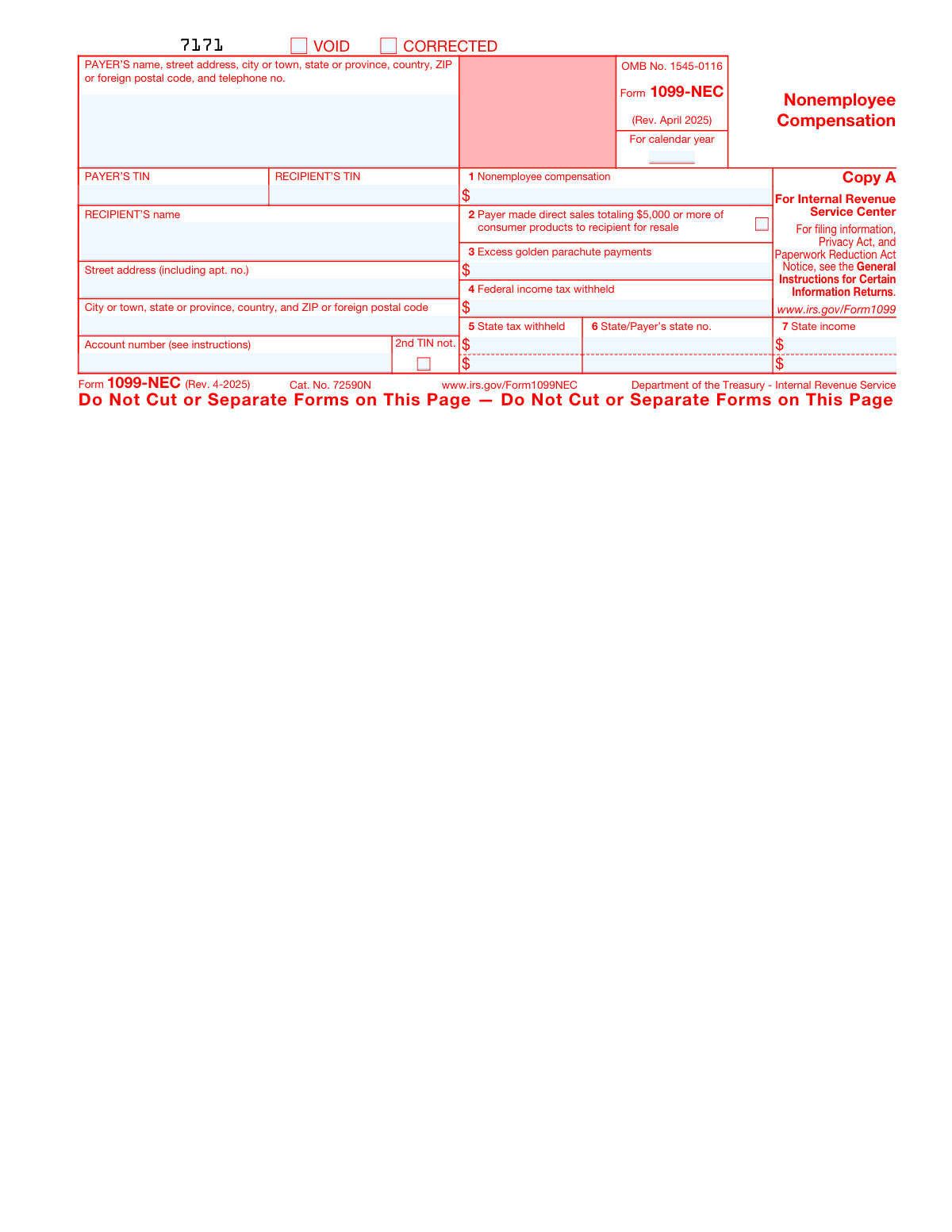

| Form name: | Form 1099-NEC, Nonemployee Compensation |

| Number of pages: | 6 |

Instafill Demo: filling out a legal form in seconds

Compliance Form 1099-NEC

Validation Checks by Instafill.ai

1

Verifies that the correct official IRS version of Form 1099-NEC is being used and not a downloaded copy.

This validation check ensures that the form being processed is the official IRS version of Form 1099-NEC. It confirms that users are not submitting outdated or unofficial copies that may lead to processing errors. By verifying the authenticity of the form, it helps maintain compliance with IRS regulations. This step is crucial for ensuring that all subsequent information is recorded on a valid template.

2

Ensures that the payer's full name is accurately entered in the 'PAYER’S name' section.

This validation check verifies that the payer's full name is correctly filled out in the designated section of the form. It ensures that there are no typographical errors or omissions that could lead to confusion or misidentification. By confirming the accuracy of the payer's name, it helps facilitate proper record-keeping and communication with the IRS. This step is essential for ensuring that the payment information is correctly attributed to the right entity.

3

Confirms that the payer's street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number are all filled out correctly.

This validation check ensures that all components of the payer's address are accurately completed. It verifies that the street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number are all present and correctly formatted. By confirming the completeness and accuracy of this information, it helps prevent any issues with correspondence or payment processing. This step is vital for maintaining clear communication channels with the IRS and the recipient.

4

Validates that the payer's Taxpayer Identification Number (TIN) is entered in the designated box.

This validation check confirms that the payer's Taxpayer Identification Number (TIN) is accurately entered in the specified section of the form. It ensures that the TIN is valid and corresponds to the payer's identity, which is crucial for tax reporting purposes. By validating the TIN, it helps prevent potential discrepancies that could arise during tax processing. This step is essential for ensuring compliance with IRS requirements and for the accurate reporting of nonemployee compensation.

5

Ensures that the recipient's full name is accurately entered in the 'RECIPIENT’S name' section.

This validation check verifies that the recipient's full name is correctly filled out in the designated section of the form. It ensures that there are no errors or omissions that could lead to misidentification of the recipient. By confirming the accuracy of the recipient's name, it helps facilitate proper record-keeping and communication with the IRS. This step is crucial for ensuring that the compensation is correctly attributed to the intended recipient.

6

Recipient's Address Validation

This validation check ensures that the recipient's street address, city or town, state or province, country, and ZIP or foreign postal code are all filled out correctly. It verifies that each component of the address is present and formatted according to standard postal guidelines. This is crucial for ensuring that any correspondence or payments can be accurately delivered to the recipient. By confirming the completeness and correctness of the address, it helps prevent delays or issues in processing the form.

7

Taxpayer Identification Number (TIN) Validation

This check validates that the recipient's Taxpayer Identification Number (TIN) is entered in the designated box. It confirms that the TIN is formatted correctly and matches the expected patterns for valid identification numbers. This is essential for tax reporting purposes, as an incorrect TIN can lead to complications in tax processing and potential penalties. By ensuring the TIN is accurate, it helps maintain compliance with IRS regulations.

8

Account Number Validation

This validation check verifies that the account number assigned by the payer to the recipient is entered if applicable. It ensures that the account number is correctly formatted and corresponds to the recipient's information. This is important for tracking payments and ensuring that they are credited to the correct account. By confirming the presence and accuracy of the account number, it aids in the efficient management of financial records.

9

Nonemployee Compensation Amount Validation

This check ensures that the total amount of nonemployee compensation paid to the recipient is accurately entered in Box 1. It verifies that the amount is a valid numerical entry and falls within acceptable ranges for reporting. This is critical for accurate tax reporting and for the recipient to understand their earnings. By confirming the accuracy of this amount, it helps prevent discrepancies that could lead to audits or penalties.

10

Direct Sales Validation

This validation check verifies that Box 2 is checked if the payer made direct sales totaling $5,000 or more of consumer products to the recipient for resale. It ensures that the conditions for checking this box are met and that the information is consistent with the reported sales figures. This is important for compliance with tax regulations regarding resale transactions. By confirming this detail, it helps ensure that the form accurately reflects the nature of the transactions between the payer and the recipient.

11

Confirms that any excess golden parachute payments are entered in Box 3 if applicable.

This validation check ensures that any excess golden parachute payments are accurately recorded in Box 3 of the form. It verifies that the amounts reported align with the criteria set forth for such payments. The check confirms that the user is aware of the specific conditions under which these payments must be reported. By doing so, it helps maintain compliance with tax regulations and prevents potential discrepancies.

12

Validates that any federal income tax withheld is accurately entered in Box 4.

This validation check verifies that the federal income tax withheld is correctly entered in Box 4 of the form. It ensures that the amount reported matches the actual withholding that has occurred during the tax year. The check confirms that the user has accurately calculated and reported the federal tax amounts, which is crucial for both the payer and the recipient. This process helps to prevent errors that could lead to tax liabilities or penalties.

13

Ensures that any state tax withheld is accurately entered in Box 5.

This validation check ensures that any state tax withheld is accurately reported in Box 5 of the form. It verifies that the amounts entered correspond to the actual state tax withholdings for the reporting period. The check confirms that the user has taken into account the relevant state tax regulations and has reported the correct figures. This is essential for compliance with state tax laws and for the accurate reporting of income.

14

Checks that the state number is filled in Box 6 and the state income in Box 7 if applicable.

This validation check verifies that the state number is properly filled in Box 6 and that the state income is reported in Box 7 when applicable. It ensures that the user has provided all necessary information related to state taxation. The check confirms that the entries are complete and comply with the requirements for state reporting. This helps to ensure that the form is fully compliant with state tax regulations.

15

Confirms that all entries have been double-checked for accuracy and that all required fields are filled out correctly.

This validation check confirms that all entries on the form have been thoroughly reviewed for accuracy. It ensures that all required fields are completed correctly, minimizing the risk of errors. The check verifies that the user has taken the necessary steps to ensure the integrity of the information provided. This is crucial for preventing issues during processing and for ensuring compliance with tax obligations.

Common Mistakes in Completing Form 1099-NEC

Utilizing unofficial versions of Form 1099-NEC can lead to significant issues, including the rejection of the form by the IRS. It is crucial to always download the form from the official IRS website or obtain it through authorized sources. To avoid this mistake, ensure that you are using the most current version of the form, as outdated versions may not comply with current tax regulations. Regularly check the IRS website for updates and announcements regarding tax forms.

Errors in the payer's name or address can result in processing delays and potential penalties. It is essential to double-check the spelling and accuracy of the information provided. To prevent this mistake, cross-reference the details with official documents such as the business registration or previous tax filings. Additionally, consider using a checklist to verify all entries before submission.

Failing to include the payer's Tax Identification Number (TIN) can lead to complications in tax reporting and may result in penalties. Always ensure that the TIN is accurately filled in and matches the name provided. To avoid this issue, confirm the TIN with the payer prior to completing the form. Keeping a record of the TIN in a secure location can also facilitate easier access when filling out the form.

Mistakes in the recipient's name or address can cause delays in processing and may lead to incorrect tax reporting. It is vital to verify that the recipient's information is accurate and matches their official documents. To mitigate this risk, ask the recipient to review the information before submission. Implementing a verification step in your process can help catch these errors early.

Omitting the recipient's TIN can result in the IRS rejecting the form and may lead to penalties for both the payer and the recipient. Always ensure that the TIN is included and correctly matches the recipient's name. To avoid this mistake, request the TIN from the recipient well in advance of the filing deadline. Keeping a secure and organized record of TINs can streamline the process and reduce the likelihood of errors.

Failing to include the account number can lead to confusion and misallocation of payments. It is essential to provide this information when required to ensure accurate processing. To avoid this mistake, carefully review the instructions for the form and check if an account number is necessary for your specific situation. Always double-check the completed form before submission to ensure all required fields are filled out correctly.

Entering an incorrect amount in Box 1 can result in significant tax implications for both the payer and the payee. It is crucial to ensure that the amount reported accurately reflects the total nonemployee compensation paid during the tax year. To prevent this error, verify the figures against your accounting records and any relevant documentation before completing the form. Additionally, consider having a second party review the amounts for accuracy.

Neglecting to check Box 2 when direct sales are involved can lead to incorrect tax reporting and potential penalties. This box is specifically designed to indicate that the payments are for direct sales of consumer products for resale. To avoid this oversight, familiarize yourself with the criteria for direct sales and ensure that you check the box if your payments meet these criteria. Regularly reviewing the form's instructions can help reinforce this requirement.

Mistakes in reporting excess golden parachute payments in Box 3 can lead to miscalculations of tax liabilities and potential audits. It is important to accurately report these payments to comply with tax regulations. To avoid this error, ensure that you understand what constitutes excess golden parachute payments and verify the amounts against your financial records. Consulting with a tax professional can also provide clarity on how to report these payments correctly.

Omitting the federal income tax withheld in Box 4 can result in underreporting tax liabilities, which may lead to penalties. It is essential to report any federal income tax that has been withheld from payments to ensure compliance with tax laws. To prevent this mistake, keep accurate records of any tax withheld throughout the year and double-check this information before submitting the form. Utilizing tax software or consulting with a tax advisor can also help ensure that all necessary information is included.

Failing to report state tax withheld in Box 5 can lead to discrepancies in tax filings and potential penalties. It is crucial to ensure that all applicable state taxes are accurately reported to avoid issues with state tax authorities. To prevent this mistake, review all relevant documentation and confirm the amounts withheld before submitting the form. Additionally, consulting with a tax professional can provide clarity on state tax obligations.

Omitting the state identification number in Box 6 can result in delays or complications in processing the form. This number is essential for state tax agencies to correctly identify the taxpayer and ensure proper credit for any taxes withheld. To avoid this error, double-check that the state number is included and accurate before submission. Keeping a checklist of required information can help ensure that nothing is overlooked.

Neglecting to report state income in Box 7 when applicable can lead to underreporting income and potential tax liabilities. It is important to include all relevant income to ensure compliance with state tax laws. To avoid this mistake, carefully review the income sources and ensure that all applicable amounts are reported. Utilizing tax software or consulting with a tax advisor can help ensure that all income is accurately captured.

Failing to double-check entries for accuracy can result in errors that may lead to audits or penalties. It is essential to verify all information entered on the form, including names, amounts, and identification numbers. To mitigate this risk, take the time to review the completed form thoroughly before submission. Implementing a peer review process can also help catch mistakes that may have been overlooked.

Not e-filing when required for 10 or more returns can lead to penalties and complications with the IRS. The IRS mandates e-filing for certain thresholds to streamline processing and improve accuracy. To avoid this mistake, familiarize yourself with the e-filing requirements and ensure compliance when submitting multiple forms. Setting reminders for filing deadlines can also help ensure that you meet all necessary requirements.

Failing to provide Copy B of Form 1099-NEC to the recipient can lead to issues with tax reporting for both the payer and the payee. It is essential to ensure that the recipient receives their copy in a timely manner, as they need it to report their income accurately. To avoid this mistake, establish a checklist to confirm that all necessary copies are distributed before the filing deadline. Additionally, consider using electronic delivery methods to ensure prompt receipt.

Neglecting to keep Copy C of Form 1099-NEC for your records can result in difficulties during audits or discrepancies in tax filings. This copy serves as proof of the payments made and is crucial for your financial records. To prevent this oversight, implement a systematic filing process where all copies are stored securely and easily accessible. Regularly review your records to ensure compliance and completeness.

Not filing Copy 1 of Form 1099-NEC with the state tax department can lead to penalties and complications with state tax obligations. Each state has its own requirements for filing, and overlooking this step can result in non-compliance. To avoid this mistake, familiarize yourself with your state’s filing requirements and deadlines. Setting reminders and utilizing tax software can help ensure that all necessary filings are completed on time.

Failing to keep a copy of the completed Form 1099-NEC can hinder your ability to verify payments made and may complicate future tax filings. It is important to maintain accurate records for at least three years, as this is typically the period during which the IRS can audit your returns. To avoid this issue, create a dedicated storage system for tax documents, both physical and digital, ensuring that all forms are easily retrievable when needed. Regularly back up your records to prevent loss.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 1099-NEC with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills f1099nec forms, ensuring each field is accurate.