Yes! You can use AI to fill out Form LLC1050, Articles of Cancellation of a Virginia Limited Liability Company

Form LLC1050 is the Virginia State Corporation Commission (SCC) filing used to officially cancel (terminate) a Virginia limited liability company under § 13.1-1050 of the Code of Virginia. It records the LLC’s legal name, SCC ID, the effective date of its certificate of organization, and an affirmation that the LLC has completed winding up (paying/arranging debts and distributing remaining assets). Filing it helps ensure the state’s records reflect that the LLC is no longer active and supports proper closure of the entity’s legal and administrative obligations. Today, this form can be filled out quickly and accurately using AI-powered services like Instafill.ai, which can also convert non-fillable PDF versions into interactive fillable forms.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out LLC1050 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form LLC1050, Articles of Cancellation of a Virginia Limited Liability Company |

| Number of pages: | 2 |

| Language: | English |

| Categories: | Virginia business forms, LLC forms, business dissolution forms, Virginia LLC forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out LLC1050 Online for Free in 2026

Are you looking to fill out a LLC1050 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your LLC1050 form in just 37 seconds or less.

Follow these steps to fill out your LLC1050 form online using Instafill.ai:

- 1 Go to Instafill.ai and upload the Form LLC1050 PDF (or select it from the form library) to start an AI-guided fill session.

- 2 Enter the LLC’s exact legal name (as shown on SCC records) and the LLC’s SCC ID number; have SCC records available to avoid mismatches.

- 3 Provide the certificate of organization effective date (the date the SCC accepted the articles of organization, unless a delayed effective date/time applied).

- 4 Confirm the winding up statement is true (debts/liabilities addressed and remaining assets distributed) and add any optional “Other information” the members want to include.

- 5 Complete the signature block: authorized signer’s printed name, title (e.g., manager/member/organizer/receiver as applicable), signature, and date; add optional phone/email for faster SCC contact.

- 6 Add the correspondence name and mailing address (or leave blank to default to the registered agent/registered office) and confirm the required $25 filing fee payment method (online or check for paper filing).

- 7 Use Instafill.ai to validate required fields, export the finalized form, then file online via the SCC CIS portal or print and mail/deliver to the SCC Clerk’s Office with the $25 fee as instructed.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable LLC1050 Form?

Speed

Complete your LLC1050 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 LLC1050 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form LLC1050

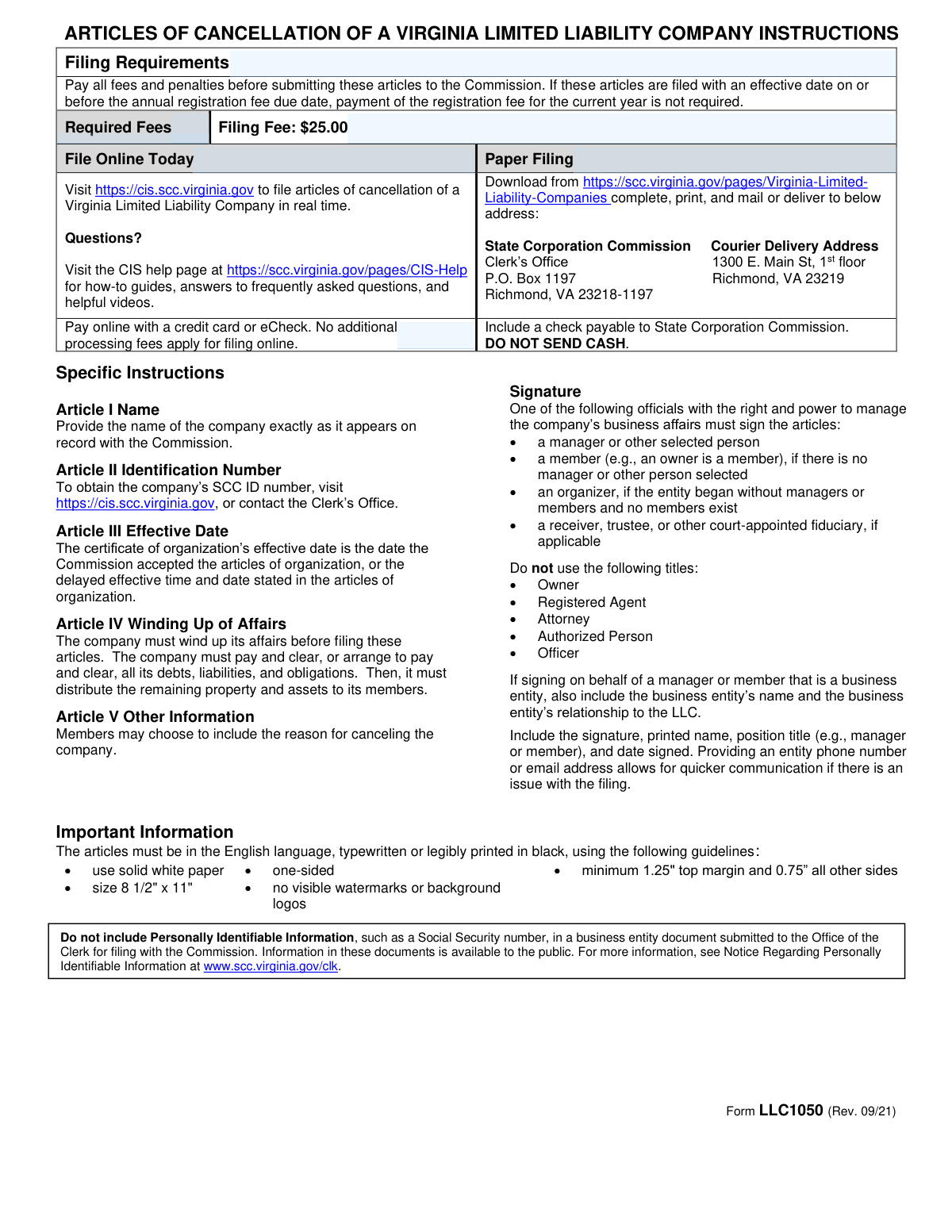

Form LLC1050 is used to officially cancel (terminate) a Virginia limited liability company with the Virginia State Corporation Commission (SCC). Filing it ends the LLC’s existence on the SCC’s records after the effective date of cancellation.

An authorized person with the right and power to manage the LLC’s business affairs must sign and file the form. This is typically a manager, or a member if the LLC has no manager, and in special cases an organizer or court-appointed fiduciary.

The required filing fee is $25. If you file online, you can pay by credit card or eCheck with no additional processing fees.

Not always. If the Articles of Cancellation are filed with an effective date on or before the annual registration fee due date, the registration fee for the current year is not required.

Yes—Article IV requires that the LLC has already completed winding up before filing. This means paying or arranging to pay all debts and obligations, then distributing remaining assets to members.

Enter the LLC’s name exactly as it appears on record with the Virginia SCC, including punctuation and designators (such as “LLC”). Using a different version of the name can delay processing.

You can look up the SCC ID number on the SCC’s CIS website at https://cis.scc.virginia.gov. You can also contact the Clerk’s Office if you cannot locate it online.

Enter the effective date of the LLC’s certificate of organization—either the date the SCC accepted the articles of organization or the delayed effective date/time stated in the original formation filing. This is not the date you are canceling the LLC.

Article V is optional. Members may include additional details such as the reason for canceling, but it is not required to complete the cancellation.

The signer must be a manager, a member (if no manager), an organizer (in limited situations), or a receiver/trustee/court-appointed fiduciary if applicable. Do not use titles like Owner, Registered Agent, Attorney, Authorized Person, or Officer.

If signing on behalf of a manager or member that is a business entity, include the business entity’s name and its relationship to the LLC. This helps the SCC confirm the signer’s authority.

You can file online in real time through the SCC CIS site at https://cis.scc.virginia.gov, or you can print and mail/deliver the form to the SCC Clerk’s Office in Richmond. If filing by paper, include a check payable to the State Corporation Commission and do not send cash.

If you provide a correspondence name and mailing address on the form, the SCC will send correspondence there. If you leave it blank, correspondence will be sent to the registered agent at the registered office.

No. Do not include personally identifiable information (such as a Social Security number) because documents filed with the SCC are publicly available.

Yes—AI tools can help reduce errors and save time by auto-filling fields from your information; services like Instafill.ai use AI to accurately populate form fields. If your PDF is flat/non-fillable, Instafill.ai can convert it into an interactive fillable form and then help you complete it online.

Compliance LLC1050

Validation Checks by Instafill.ai

1

Validates required filing fee acknowledgement and amount equals $25.00

Checks that the filer has indicated the required filing fee is included/paid and that the entered fee amount matches the statutory filing fee of 25.00. This prevents underpayment/overpayment issues that can delay acceptance or require follow-up. If the amount is missing, non-numeric, or not exactly $25.00 (unless the system explicitly supports fee overrides), the submission should be rejected or routed to an exception workflow.

2

Ensures online filing selection and online payment amount are logically consistent

If 'File Online Today' is marked 'Yes', the system should require an online payment amount and validate it equals $25.00; if 'No', the online payment amount must be blank. This avoids contradictory submissions (e.g., claiming online filing but providing no payment, or providing an online payment amount while selecting paper filing). If inconsistent, the system should prompt the user to correct the selection or clear the conflicting payment field.

3

Validates paper filing selection is not in conflict with online filing selection

Checks that the 'Paper Filing Selection' indicator is not simultaneously selected in a way that conflicts with 'File Online Today'. The form instructions present online vs. paper as alternative channels, and conflicting selections can cause misrouting and processing delays. If both are selected (or both are blank when one is required by the workflow), the submission should be flagged for correction before acceptance.

4

Validates Article I LLC name is present and formatted as a legal entity name

Ensures the LLC name field is not blank and contains a plausible legal name (e.g., not only punctuation/whitespace, and within reasonable length limits). This is critical because the cancellation must be applied to the correct entity and the name is a primary identifier used by staff and systems. If missing or clearly invalid, the filing should be rejected as incomplete.

5

Cross-checks LLC name against SCC records for exact match (when SCC ID is provided)

When an SCC ID number is provided, validate that the entered LLC name matches the name on record exactly (including punctuation such as commas, periods, and 'LLC' designator). The instructions explicitly require the name exactly as it appears on record, and mismatches can lead to cancellation of the wrong entity or rejection by the clerk. If the name does not match SCC records, the system should block submission and instruct the filer to correct the name or SCC ID.

6

Validates Article II SCC ID number presence and numeric format

Checks that the SCC ID number is provided (required) and conforms to the expected SCC ID format (typically digits only, with a defined length if applicable in the system). This identifier is essential for unambiguous entity identification and automated record matching. If missing, contains letters/special characters, or fails length/format rules, the submission should be rejected or returned for correction.

7

Validates Article III certificate effective date is a valid date and not in the future

Ensures the certificate effective date is present and parses as a real calendar date (e.g., MM/DD/YYYY) and is not later than the current date. A future effective date for an already-issued certificate is logically inconsistent and suggests data entry error. If invalid or future-dated, the system should require correction before filing proceeds.

8

Cross-validates certificate effective date against SCC record for the provided SCC ID

When SCC integration is available, verify the entered certificate effective date matches the Commission’s recorded effective date for that LLC. This reduces errors and helps ensure the cancellation is tied to the correct entity record. If the date does not match SCC records, the submission should be flagged and the filer prompted to confirm/correct the SCC ID or date.

9

Requires affirmative confirmation of Article IV winding up completion

Validates that the filer has explicitly affirmed the LLC has completed winding up of its affairs (e.g., a required checkbox/attestation captured by the system). The form states winding up must be completed before filing, and this attestation is a key legal statement supporting the cancellation. If the attestation is missing or negative, the system should prevent submission and instruct the filer to complete winding up before filing.

10

Validates signature is present and not a placeholder value

Ensures the signature field is completed and does not contain obvious placeholders such as 'N/A', 'None', or a single character. A valid signature is required to certify the statements and authorize the filing. If missing or clearly invalid, the filing should be rejected as unsigned.

11

Validates date signed is present, valid, and not after submission date

Checks that the date signed is provided, is a valid date, and is not later than the submission/receipt date (and optionally not unreasonably old per business rules). This supports auditability and ensures the certification timing is credible. If invalid or future-dated, the system should block submission until corrected.

12

Validates printed name is present and appears to be a person’s name

Ensures the printed name is provided and contains alphabetic characters (not only numbers/symbols), within reasonable length limits. The printed name is needed to identify who signed and to support follow-up if questions arise. If missing or clearly invalid, the submission should be rejected or returned for completion.

13

Validates title is present and restricted to allowed signer roles (and disallows prohibited titles)

Checks that the title field is completed and matches an allowed role (manager, member, organizer, receiver, trustee, or other court-appointed fiduciary) and does not use prohibited titles listed in the instructions (Owner, Registered Agent, Attorney, Authorized Person, Officer). This is important because only certain officials have authority to sign, and incorrect titles can invalidate the filing. If the title is missing, prohibited, or not in the allowed set, the system should require correction or additional authority documentation per policy.

14

Validates optional phone numbers use acceptable US phone format

For Telephone Number and Business Telephone Number (if provided), validate they contain 10 digits (optionally with country code +1) and allow common separators (e.g., (###) ###-####). Correct phone formatting improves the ability to contact the filer quickly if issues arise. If a phone number is provided but fails format validation, the system should prompt correction or strip invalid characters and re-validate.

15

Validates optional email addresses are syntactically valid and not obviously malformed

For Email Address and Business Email Address (if provided), validate basic email syntax (local@domain, valid characters, and a plausible domain/TLD). Accurate emails reduce processing delays by enabling rapid communication about deficiencies. If an email is present but invalid, the system should require correction or allow submission only if email is truly optional and the filer confirms no email contact.

16

Validates correspondence contact name/address completeness when any correspondence field is entered

If the filer provides a correspondence recipient, require both Correspondence Contact Name and a complete mailing address (street, city, state, ZIP) rather than partial entries. This ensures the Commission can send correspondence to the intended recipient; otherwise it defaults to the registered agent, which may not be desired. If partially completed, the system should prompt the filer to either complete both fields or clear them to use the default.

17

Detects and blocks inclusion of personally identifiable information (PII) in free-text fields

Scans Article V additional information and other open text fields for patterns resembling SSNs, full bank account numbers, or other sensitive identifiers, consistent with the form’s warning not to include PII. These filings are public records, so preventing PII reduces privacy and identity-theft risk. If suspected PII is detected, the system should block submission and instruct the filer to remove/redact the sensitive content.

Common Mistakes in Completing LLC1050

People often type the LLC name from memory, omit punctuation (commas, periods), drop “LLC,” or use a trade name instead of the exact legal name on file. The SCC can reject or delay the filing if the name does not match its records exactly. Always copy the name exactly as shown in the SCC CIS system (including spacing and suffixes). AI-powered tools like Instafill.ai can pull and format the legal name consistently to reduce mismatch errors.

A common error is confusing the SCC ID with an EIN, a local business license number, or an internal accounting ID. An incorrect or missing SCC ID can prevent the Clerk’s Office from matching the cancellation to the correct entity, causing rejection or processing delays. Verify the SCC ID in the CIS portal before submitting and double-check all digits. Instafill.ai can help validate that the ID format and length look correct and flag likely mismatches.

Filers frequently enter the date they decided to close, the date they signed the form, or the date the LLC was first used, rather than the certificate’s effective date (acceptance date or delayed effective date). Using the wrong date can trigger questions from the SCC or require correction, slowing the cancellation. Confirm the effective date in SCC records and enter it in the expected date format. Instafill.ai can help standardize date formatting and reduce accidental date swaps (e.g., MM/DD vs DD/MM).

Many filers treat cancellation as the first step and overlook that the LLC must complete winding up first (settle/arrange debts and distribute remaining assets). If the statement in Article IV is not true, the filing can create legal and financial exposure, including disputes with creditors or members. Ensure debts and obligations are paid/arranged and distributions are handled before signing and filing. If you’re unsure, document the winding-up steps and confirm internally before submitting.

A frequent rejection cause is having the wrong person sign (e.g., registered agent, attorney, “authorized person,” or “owner” listed as the title). The form requires a manager (or selected person), a member if no manager, an organizer in limited situations, or a court-appointed fiduciary when applicable, and it explicitly disallows certain titles. Use an eligible signer and list the title as “Manager,” “Member,” “Organizer,” or the appropriate fiduciary role. Instafill.ai can prompt for the correct role and prevent disallowed titles from being entered.

When the manager or member is itself a business entity, filers often sign only a person’s name without stating the business entity’s name and its relationship to the LLC. This can create ambiguity about authority and lead to follow-up requests or rejection. Clearly indicate the business entity name and how it relates (e.g., “ABC Holdings, LLC, Manager”) along with the individual’s printed name and capacity. Instafill.ai can enforce structured entry so the relationship and entity name aren’t omitted.

People sometimes sign but forget to print their name, omit the date, or leave the title blank—especially when rushing a paper filing. Missing any of these can cause the SCC to deem the submission incomplete and delay processing. Before submitting, confirm the signature, printed name, title, and date are all present and legible. Instafill.ai can run completeness checks and highlight missing required signature-block fields.

Common issues include paying the wrong amount, forgetting the $25 fee entirely, sending cash (explicitly prohibited), or making the check payable to the wrong payee. Payment problems can result in rejection or the filing being held until corrected. Pay the exact $25 filing fee, make checks payable to “State Corporation Commission,” and never send cash; if filing online, ensure the online payment amount matches the required fee. Instafill.ai can help by auto-filling the correct fee amount and reducing payment-field inconsistencies.

Filers sometimes mark that they will file online but also complete paper-filing selection fields, or they enter an online payment amount even when not filing online. These inconsistencies can create processing confusion or cause the submission to be treated as incomplete. Only complete the fields that match your chosen filing method (online vs paper) and keep the payment section consistent with that choice. Instafill.ai can guide conditional fields so only relevant sections are completed.

Some filers mistakenly include Social Security numbers or other sensitive personal data in “Other information” or correspondence sections, not realizing filings are public records. This can create privacy and identity-theft risk and may require additional steps to address. Do not include SSNs or other PII anywhere on the form; keep Article V limited to business-relevant notes (or leave it blank). Instafill.ai can help flag patterns that look like SSNs and prevent accidental inclusion.

If the correspondence section is blank, the SCC will default to sending correspondence to the registered agent, which may be outdated or not monitored during shutdown. Incomplete addresses (missing ZIP, suite number, or state) can cause missed notices and delays in resolving issues. Provide a reliable correspondence recipient and a complete mailing address to ensure you receive any questions or confirmations promptly. Instafill.ai can standardize address formatting and validate that required address components are present.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out LLC1050 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-llc1050-articles-of-cancellation-of-a-virginia-limited-liability-company forms, ensuring each field is accurate.