Fill out Form GST524, GST/HST New Residential Rental Property Rebate with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills GST524-FILL-25E forms, ensuring each field is accurate.

#1 AI PDF Filling Software of 2026

3 out of 4 customers say they prepare their GST524 forms in 37 seconds or less

Secure platform for your PDF forms and personal information

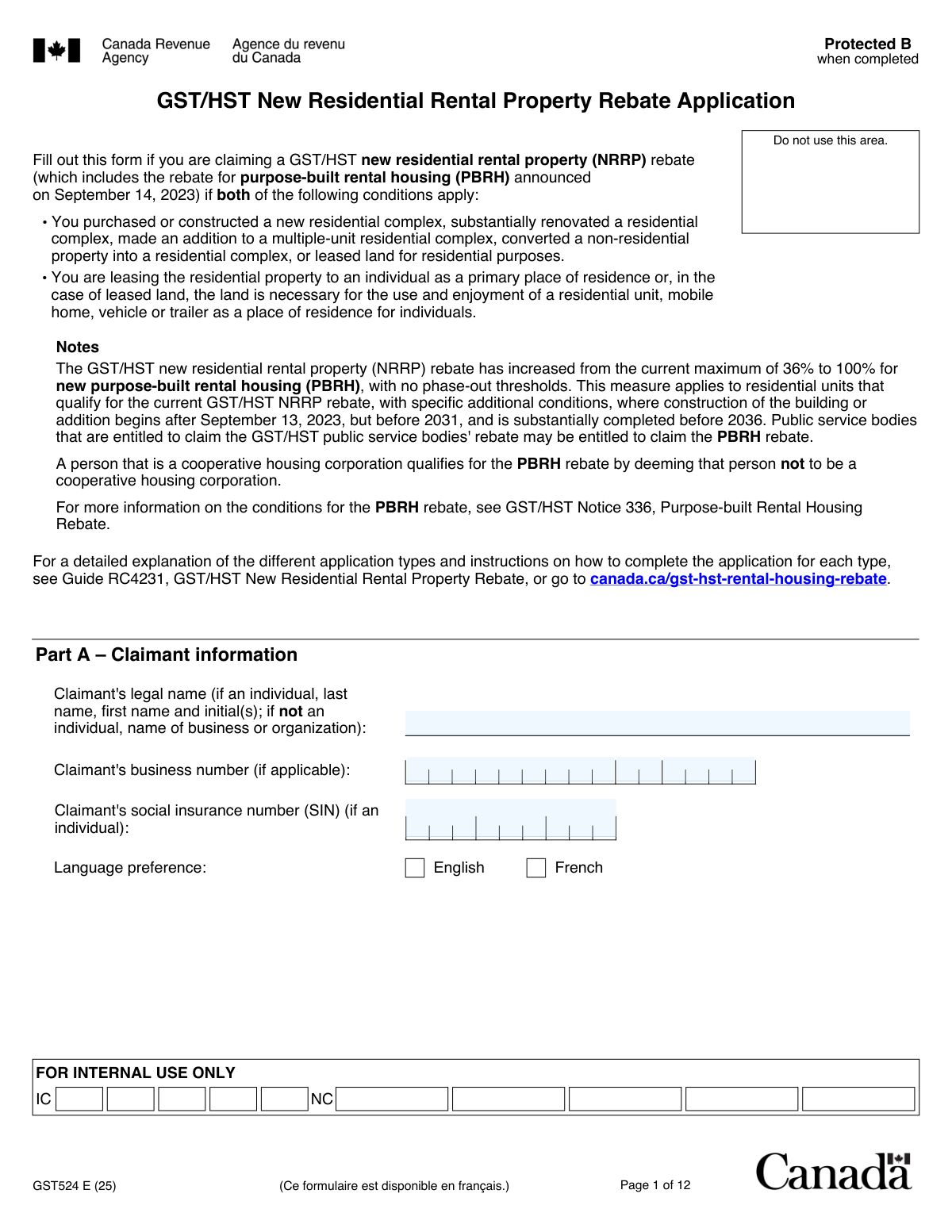

| Form name: | Form GST524, GST/HST New Residential Rental Property Rebate |

| Number of pages: | 12 |

Instafill Demo: filling out a legal form in seconds

Compliance GST524

Validation Checks by Instafill.ai

1

Eligibility Criteria Check

This validation check ensures that the claimant meets the eligibility criteria for the GST/HST NRRP rebate. It confirms that the property in question was either purchased, constructed, substantially renovated, or converted specifically for residential use. By verifying these conditions, the software helps to prevent ineligible claims from being submitted. This step is crucial in maintaining compliance with the rebate program's requirements.

2

Legal Name and Business Number Verification

This check verifies that the legal name or business name is accurately filled in Part A of the form. It also ensures that the correct business number and social insurance number are provided where applicable. By confirming these details, the software helps to avoid discrepancies that could lead to processing delays or rejections. Accurate identification is essential for the proper administration of the rebate.

3

Mailing Address Completeness Check

This validation confirms that the claimant's mailing address is complete and correctly formatted. It checks for the inclusion of the unit number, street number, street name, city, province or territory, and postal code. Ensuring that this information is accurate helps to facilitate effective communication and correspondence regarding the rebate application. Incomplete addresses could result in significant delays in processing.

4

Contact Person Information Check

This check verifies that the contact person's name and telephone number are provided in the mailing address section. By ensuring that this information is included, the software facilitates direct communication if any issues arise during the processing of the application. This step is important for maintaining a clear line of contact between the claimant and the processing authority. Missing contact information could hinder the resolution of any queries related to the application.

5

Leased Property Address Verification

This validation ensures that the address of the leased property is correctly entered in Part B of the form. It also checks for the relevant date when tax became payable and the legal description of the property. By confirming these details, the software helps to ensure that all necessary information is accurately captured for the rebate application. Incorrect property details could lead to complications in the processing of the claim.

6

Verifies that the type of claimant and type of construction are selected correctly in Part C

This validation check ensures that the type of claimant and type of construction are accurately selected in Part C of the form. It confirms that the construction start date and substantial completion date are provided if applicable, which is crucial for determining eligibility for the rebate. The AI software cross-references these selections with the guidelines to ensure compliance. By doing so, it minimizes the risk of errors that could lead to delays in processing the rebate.

7

Confirms that the rebate calculation in Part D is completed accurately

This validation check verifies that the rebate calculation in Part D is completed accurately based on the type of application, whether it is Type 6 or Type 7. It ensures that all necessary calculations are provided and that they align with the specified criteria for each application type. The AI software meticulously reviews the calculations to prevent any discrepancies that could affect the rebate amount. This thorough verification process helps maintain the integrity of the application and supports timely approvals.

8

Ensures that Part E is filled out correctly for Type 9A and Type 9B

This validation check ensures that Part E is filled out correctly for Type 9A and Type 9B applications. It verifies that all calculations based on the fair market value of the land are included if applicable, which is essential for accurate rebate processing. The AI software checks for completeness and correctness in this section to avoid potential issues during the review process. By confirming these details, it enhances the likelihood of a successful application outcome.

9

Verifies that the certification section in Part F is signed and dated

This validation check verifies that the certification section in Part F is signed and dated by the claimant or an authorized representative. It ensures that the name provided matches the information on file, which is critical for validating the authenticity of the application. The AI software cross-references the signature with existing records to confirm legitimacy. This step is vital in preventing fraudulent claims and ensuring that only eligible applicants receive the rebate.

10

Checks that all required supporting documents are attached

This validation check ensures that all required supporting documents are attached to the application. It verifies the inclusion of purchase and sale agreements, rental or lease agreements, and any applicable provincial rebate schedules. The AI software systematically reviews the documentation to ensure completeness, which is essential for the processing of the rebate. By confirming that all necessary documents are present, it helps streamline the review process and reduces the likelihood of delays.

11

Confirms that the completed form and supporting documents are sent to the appropriate tax center based on the mailing address and GST/HST registration status.

This validation check ensures that the completed Form GST524 and all necessary supporting documents are directed to the correct tax center. It verifies that the mailing address provided aligns with the GST/HST registration status of the claimant. By confirming this, the software helps to prevent any delays in processing the application due to misdirected submissions. This step is crucial for ensuring that the application is handled efficiently and in accordance with tax regulations.

12

Ensures that the application is mailed by the deadline if reporting the rebate on an electronically filed return.

This validation check verifies that the application for the GST/HST New Residential Rental Property Rebate is submitted within the required timeframe. It confirms that if the rebate is being reported on an electronically filed return, the application is mailed by the specified deadline. This is essential to ensure compliance with tax regulations and to avoid any potential penalties or disqualification from receiving the rebate. The software assists users in tracking these deadlines to facilitate timely submissions.

13

Verifies that the claimant has referred to Guide RC4231 for further assistance if needed.

This validation check ensures that the claimant is aware of the resources available for assistance by verifying that they have referred to Guide RC4231. It confirms that the claimant has access to detailed information and guidance regarding the application process. By encouraging users to consult this guide, the software helps to clarify any uncertainties and improve the accuracy of the application. This step is vital for enhancing the claimant's understanding of the requirements and procedures involved.

14

Confirms that the contact information for CRA is noted for any inquiries regarding the application process.

This validation check verifies that the contact information for the Canada Revenue Agency (CRA) is included in the application. It ensures that claimants have the necessary details to reach out for assistance or clarification regarding their application process. By confirming this information is noted, the software helps to facilitate communication between the claimant and the CRA, which is essential for resolving any issues that may arise. This step is important for providing support and ensuring a smooth application experience.

Common Mistakes in Completing GST524

Failing to verify eligibility criteria can lead to unnecessary delays or rejections of the application. It is crucial to thoroughly review the requirements outlined for the GST/HST New Residential Rental Property Rebate before submission. To avoid this mistake, applicants should familiarize themselves with the eligibility conditions and ensure they meet all necessary qualifications. Consulting the official guidelines or seeking professional advice can also help clarify any uncertainties.

Providing an incomplete or incorrect legal name can result in processing issues or rejection of the application. It is essential to ensure that the name matches exactly with the official documents. To prevent this mistake, double-check the spelling and format of the name as it appears on legal documents. Keeping a copy of the official name handy while filling out the form can help ensure accuracy.

Omitting the business number can lead to complications in processing the application, as this number is crucial for identification purposes. Businesses must ensure that they include their registered business number on the form. To avoid this error, applicants should verify that they have their business number readily available and accurately input it into the form. Regularly updating business records can also help maintain this information.

Neglecting to provide a social insurance number (SIN) can hinder the processing of the application for individuals. The SIN is necessary for tax identification and verification purposes. To avoid this mistake, individuals should ensure they have their SIN on hand and enter it correctly on the form. It is advisable to review the form for completeness before submission to catch any missing information.

Providing an incorrect mailing address can result in important correspondence being sent to the wrong location, causing delays in communication. It is vital to ensure that the mailing address is accurate and up-to-date. To prevent this mistake, applicants should verify their address against official documents and ensure that all components, such as postal codes, are correct. Regularly checking and updating contact information can help maintain accuracy.

Omitting the contact person's name and phone number can lead to delays in processing the rebate application. It is essential to provide accurate contact information to ensure that any questions or clarifications can be addressed promptly. To avoid this mistake, double-check that the contact details are complete and clearly written. Including a reliable contact person can facilitate communication and expedite the processing of your application.

Providing an incorrect property address can result in the rejection of the application or delays in processing. It is crucial to ensure that the address matches the official records and is complete, including unit numbers if applicable. To prevent this error, verify the property address against official documents or municipal records before submission. Taking the time to confirm the accuracy of the address can save you from potential complications later on.

Failing to include the date when the tax became payable can lead to confusion regarding the eligibility for the rebate. This date is critical for determining the timeline of the rebate application. To avoid this mistake, ensure that you have all relevant dates documented and included in the application. Keeping a record of important dates related to the property can help ensure that this information is not overlooked.

Neglecting to provide the legal description of the property can hinder the processing of the rebate application, as it is necessary for identifying the property in question. The legal description is often found in property deeds or tax documents and is essential for clarity. To avoid this mistake, always include the legal description as it appears in official documents. This attention to detail can prevent misunderstandings and ensure that your application is processed smoothly.

Incorrectly specifying the type of claimant can lead to misclassification and potential denial of the rebate. It is important to accurately identify whether you are an individual, corporation, or another type of entity. To avoid this mistake, carefully read the instructions regarding claimant types and ensure that you select the correct option. Taking the time to understand the classifications can help ensure that your application is processed correctly and efficiently.

Selecting the wrong construction type can lead to significant delays in processing your rebate application. It is crucial to carefully review the definitions and categories of construction types provided in the form instructions. To avoid this mistake, ensure that you fully understand the criteria for each construction type before making your selection. Double-check your choice against the project details to confirm accuracy.

Omitting the construction start and completion dates can result in your application being deemed incomplete, which may delay the rebate process. It is essential to provide accurate and specific dates to establish the timeline of your project. To prevent this error, maintain thorough records of your construction timeline and verify that all dates are correctly entered on the form. Review the form carefully to ensure that no fields are left blank.

Mistakes in calculating the rebate for Type 6 or Type 7 properties can lead to incorrect rebate amounts being claimed, which may require you to amend your application later. To avoid calculation errors, utilize a calculator or spreadsheet to ensure that all figures are accurate and that you are following the correct formulas as outlined in the instructions. It is advisable to have a second person review your calculations for additional accuracy. Always keep a copy of your calculations for your records.

Failing to include the necessary supporting documents can result in your application being rejected or delayed. Each type of rebate has specific documentation requirements that must be met to substantiate your claim. To avoid this issue, create a checklist of all required documents and ensure that you have included them with your application before submission. It is also beneficial to keep copies of all submitted documents for your records.

Neglecting to sign and date the certification section can lead to your application being considered invalid. This section is crucial as it confirms that the information provided is accurate and complete. To prevent this oversight, make it a habit to review the entire form for completeness, including signatures, before submission. Consider setting a reminder to check for signatures on all forms you submit.

It is crucial that the name provided on the certification matches the official records exactly. Discrepancies can lead to delays or rejection of the application. To avoid this mistake, double-check the spelling and format of your name against official documents such as your identification or tax records. Ensuring consistency across all submitted documents will facilitate a smoother processing of your rebate application.

Submitting your application without the necessary supporting documents, such as lease agreements, can result in processing delays or denial of the rebate. It is essential to review the list of required documents carefully and ensure that all are included with your application. To prevent this issue, create a checklist of all required documents before submission and verify that each item is attached. This proactive approach will help ensure that your application is complete and meets all requirements.

Failing to mail your application by the specified deadline can lead to automatic disqualification from receiving the rebate. It is important to be aware of the submission timeline and plan accordingly to avoid last-minute issues. To mitigate this risk, mark the deadline on your calendar and consider sending your application well in advance. Additionally, using a reliable mailing service with tracking can provide peace of mind that your application has been sent on time.

Addressing your application to the wrong tax center can result in delays or misplacement of your submission. It is vital to verify the correct address for the tax center designated for your application type. To avoid this mistake, consult the official guidelines or website for the most current address information before mailing your application. Taking the time to ensure the correct address is used will help ensure that your application reaches the appropriate office without unnecessary complications.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out GST524 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills gst524-fill-25e forms, ensuring each field is accurate.