Judicial Council of California Form FL-150, Income and Expense Declaration Completed Form Examples and Samples

Find clear, completed examples of the Judicial Council of California Form FL-150, Income and Expense Declaration. Our detailed samples guide you through filling out the form correctly for your divorce or family law case, covering income, expenses, assets, and debts.

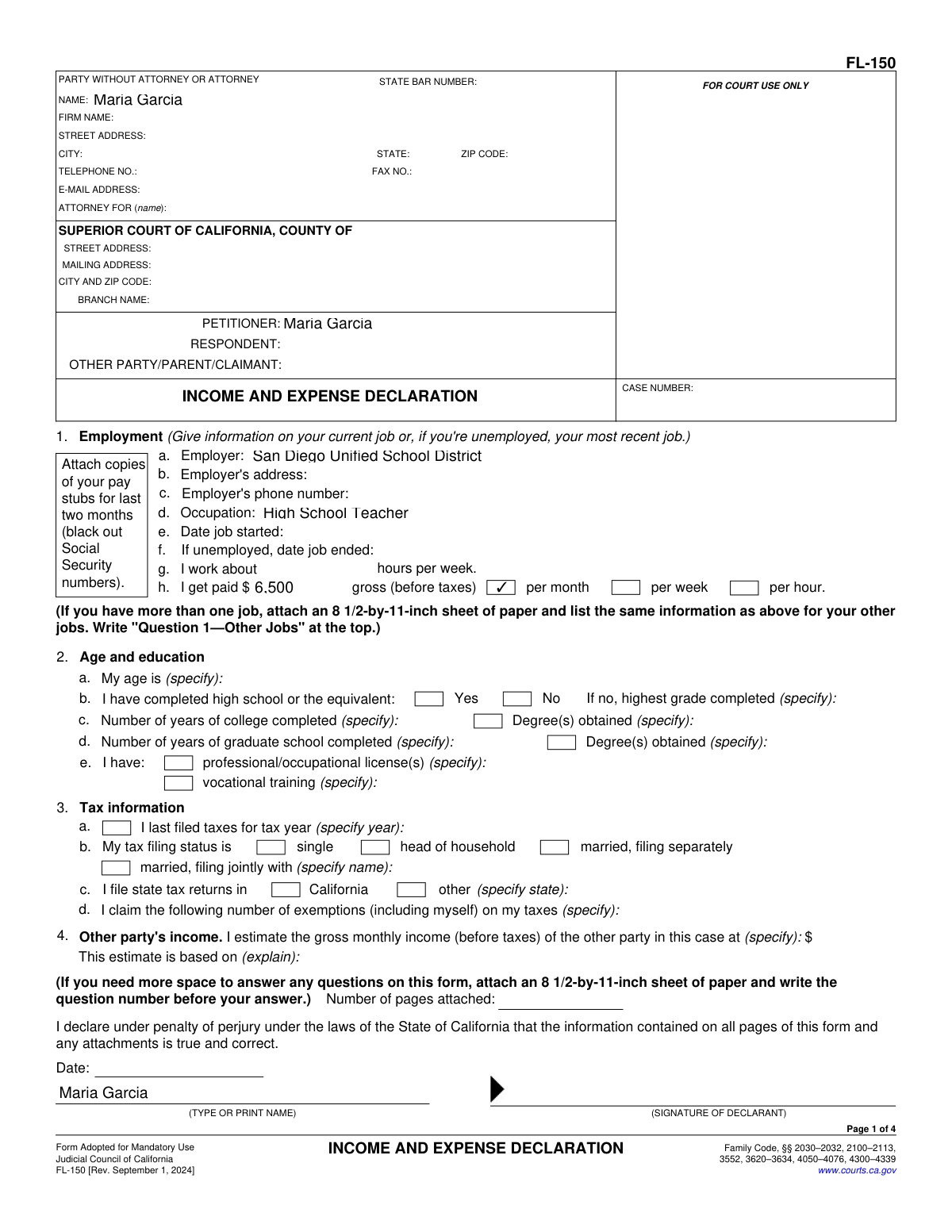

FL-150 Income and Expense Declaration Example - Employed Parent

How this form was filled:

This is an example of a completed Judicial Council of California Form FL-150 for a petitioner, Maria Garcia, who is a salaried W-2 employee (a teacher). The form details her monthly income, payroll deductions, estimated living expenses, and information about her child. It's a common scenario in a divorce or legal separation case where child and spousal support are at issue.

Information used to fill out the document:

- Petitioner's Name: Maria Garcia

- Occupation: High School Teacher

- Employer: San Diego Unified School District

- Case Type: Divorce with one child

- Filing Date: February 10, 2026

- Last Month's Gross Income (Salary): $6,500

- Total Gross Monthly Income: $6,500

- Payroll Deductions (Monthly): $1,988

- - Federal Income Tax: $750

- - State Income Tax: $350

- - Social Security/FICA: $403

- - Health Insurance Premium: $150

- - Mandatory Union Dues: $85

- - Mandatory Retirement (CalSTRS): $300

- Net Monthly Disposable Income: $4,512

- Liquid Assets (Cash & Checking): $5,000

- Monthly Expenses (Total): $4,280

- - Rent: $2,200

- - Utilities, Phone, Internet: $300

- - Food & Household Supplies: $600

- - Clothing: $150

- - Transportation (Payment, Insurance, Fuel): $730

- - Child's Extracurriculars: $200

- - Credit Card Payment: $150

- Attorney's Fees Paid: $2,500

What this filled form sample shows:

- Demonstrates how to report W-2 salary income based on recent pay stubs.

- Provides a clear breakdown of both mandatory and voluntary payroll deductions.

- Includes a realistic itemization of estimated monthly living expenses for one adult and one child.

- Accurately reports child-related costs, such as health insurance premiums and extracurricular activities.

- Shows how to declare assets and disclose information about attorney's fees.

Form specifications and details:

| Form Name: | Judicial Council of California Form FL-150, Income and Expense Declaration |

| Use Case: | Divorce/Separation with one child, filed by a W-2 salaried employee. |

| Filing Party: | Petitioner |

| Key Financials: | Based on 2025 year-end information for a 2026 court filing. |

Created: January 27, 2026 02:40 AM