Yes! You can use AI to fill out National Integrity Life Insurance Company Ownership Change Request Form (NI-77-0039-2505)

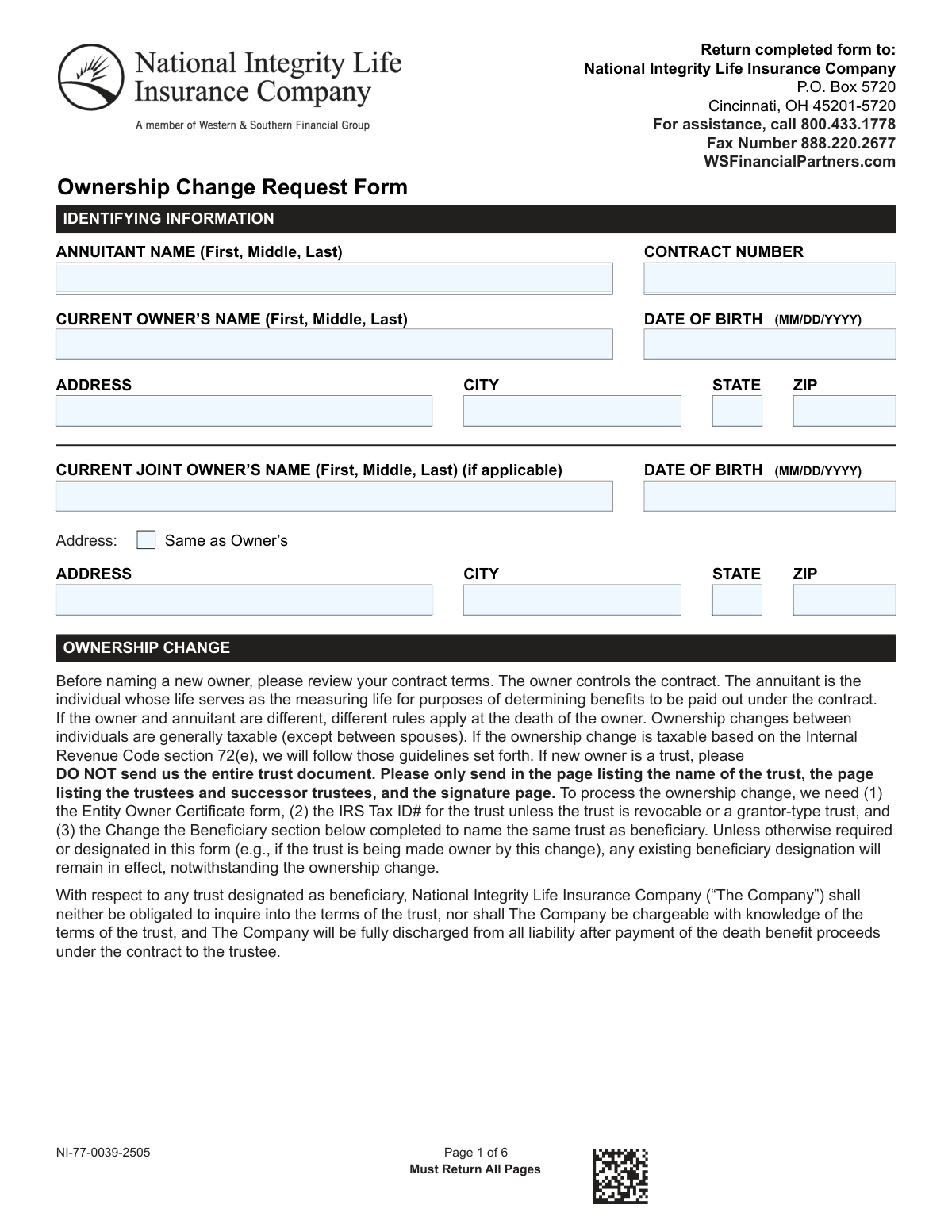

The National Integrity Life Insurance Company Ownership Change Request Form is a multi-page request used to transfer or update ownership of an annuity contract, including adding, changing, or removing a joint owner. It also includes sections to update beneficiary designations (annuitant-driven and owner-driven contracts), address special rules for trust ownership changes and potential taxability under IRC Section 72(e), and capture spousal consent where required. The form is important because the contract owner controls the annuity and ownership changes can affect taxes, death benefit handling, and who has legal rights to the contract. Proper signatures and supporting documents (e.g., death certificate, power of attorney, trust pages) are required to process the change.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out NI-77-0039-2505 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | National Integrity Life Insurance Company Ownership Change Request Form (NI-77-0039-2505) |

| Number of pages: | 6 |

| Filled form examples: | Form NI-77-0039-2505 Examples |

| Language: | English |

| Categories: | insurance forms, beneficiary forms, life insurance forms, insurance request forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out NI-77-0039-2505 Online for Free in 2026

Are you looking to fill out a NI-77-0039-2505 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your NI-77-0039-2505 form in just 37 seconds or less.

Follow these steps to fill out your NI-77-0039-2505 form online using Instafill.ai:

- 1 Enter identifying information: annuitant name, current owner/joint owner, contract number, dates of birth, and current mailing address.

- 2 Select the ownership change request type (change owner, add/change joint owner, or remove joint owner) and complete the new owner/new joint owner details (name, SSN/TIN, DOB, address, phone, and relationship).

- 3 If the new owner is a trust, choose the applicable IRC 72(e) tax certification checkbox and prepare required supporting items (Entity Owner Certificate, trust Tax ID if applicable, and only the specified trust pages).

- 4 Complete the beneficiary change section(s) as applicable (annuitant-driven and/or owner-driven), listing primary/contingent beneficiaries and allocation percentages, and ensure trust/entity beneficiary requirements are met when relevant.

- 5 If required (ERISA or certain community property states), complete the spousal consent section with spouse’s printed name, signature, and date.

- 6 Review the certification/authorization and backup withholding statements, then obtain all required signatures and printed names (new owner, new joint owner if applicable, prior owner, prior joint owner if applicable).

- 7 Submit all pages of the completed form and any required attachments (e.g., death certificate, POA/letters of office, trust pages) to National Integrity Life Insurance Company via mail or fax as instructed on the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable NI-77-0039-2505 Form?

Speed

Complete your NI-77-0039-2505 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 NI-77-0039-2505 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form NI-77-0039-2505

This form is used to request a change to the owner of an annuity contract, including adding/changing a joint owner or removing a joint owner. It can also be used to update beneficiary designations as part of the ownership change.

The current (prior) owner must sign, and the new owner must also sign. If there is a joint owner being added/changed/removed, the applicable joint owner(s) must sign as well.

Yes. The form states “Must Return All Pages,” so you should submit all pages (1–6) to avoid processing delays.

Mail the completed form to National Integrity Life Insurance Company, P.O. Box 5720, Cincinnati, OH 45201-5720. You may also fax it to 888.220.2677.

You’ll generally need the contract number, identifying information for the current owner and new owner (name, address, date of birth, and SSN/TIN), and signatures from the required parties. Additional documents may be required for special situations (e.g., death certificate, power of attorney).

The owner controls the contract, while the annuitant is the measuring life used to determine benefits under the contract. If the owner and annuitant are different, different rules may apply at the owner’s death, so beneficiary sections may need special attention.

In the Ownership Change section, select one option: “Change the owner,” “Add or Change the joint owner,” or “Remove the joint owner.” Then complete the new owner/joint owner fields that apply.

You must submit a certified death certificate along with this form before the ownership change can be completed. This requirement is specifically stated in the form instructions.

Yes, but you must include documentation showing your authority to act (such as the power of attorney document, letters of office, or similar legal paperwork). Without this, the request may be rejected or delayed.

Do not send the entire trust document; only send the page naming the trust, the page listing trustees and successor trustees, and the signature page. The form also indicates the company needs an Entity Owner Certificate form, the trust’s IRS Tax ID (unless revocable or grantor-type), and the beneficiary section completed to name the same trust as beneficiary.

Not always—unless otherwise required, existing beneficiary designations generally remain in effect. However, if a trust or entity is (or becomes) the owner, the form notes that the trust/entity must remain the beneficiary, and you may need to update the beneficiary section accordingly.

Complete the Annuitant’s Beneficiary section for annuitant-driven contracts (death benefit paid upon annuitant’s death). If the owner and annuitant are different, also complete the Owner’s Beneficiary section for owner-driven contracts so the correct party takes control upon the owner’s death.

For each beneficiary, provide the requested details and mark whether they are Primary or Contingent, then enter an allocation percentage. If you need more beneficiaries than the form allows, submit a separate written request with the same required information, signed and dated by the new owner.

Spousal consent may be required if you name someone other than your spouse as a primary beneficiary on contracts subject to ERISA spousal consent rules, or if the owner resides/has resided in AZ, CA, ID, LA, NM, NV, TX, WA, or WI and the spouse is not the sole primary beneficiary. In those cases, the spouse should sign the Spousal Consent section.

The certification confirms your tax identification number and whether you are subject to IRS backup withholding. Check the box only if you are NOT subject to backup withholding; if the IRS has notified you that you are subject to backup withholding, follow the form’s instruction to cross out the relevant certification item.

Compliance NI-77-0039-2505

Validation Checks by Instafill.ai

1

All pages present and correct form version

Verify the submission includes all 6 pages and that the form identifier/version (NI-77-0039-2505) is consistent across pages. This matters because missing pages often contain required elections, beneficiary details, or signatures that determine processing and legal authorization. If any page is missing or the version is inconsistent, the request should be rejected as incomplete and returned for resubmission.

2

Contract number required and format validated

Ensure the contract number is provided and matches the expected contract number format (e.g., length, allowed characters) and/or exists in the administration system. The contract number is the primary key used to locate the policy/annuity and apply changes to the correct record. If invalid or not found, processing must stop to prevent misapplication of ownership/beneficiary changes.

3

Identifying information completeness for current parties

Confirm required identifying fields are completed for the annuitant and current owner (full name, date of birth, and address fields as presented on the form). This is important for identity matching, fraud prevention, and ensuring the correct contract parties are being referenced. If required identifying information is missing, the submission should be marked deficient and not processed until corrected.

4

Date of birth format and plausibility checks

Validate all DOB fields (annuitant, current joint owner if applicable, new owner, new joint owner, beneficiaries) are in MM/DD/YYYY format and represent a real calendar date. Also check plausibility (e.g., not in the future, not unreasonably old/young for an adult owner) and consistency with system-of-record when available. If a DOB fails validation, the record cannot be reliably identified and the form should be pended for correction.

5

Ownership change election selection (exactly one) and required downstream fields

Ensure exactly one ownership action is selected: Change the owner, Add/Change the joint owner, or Remove the joint owner. The selected action determines which sections are mandatory (e.g., new owner details for “Change the owner,” new joint owner details for “Add/Change,” and prior joint owner signature requirements for “Remove”). If none or multiple are selected, or required dependent fields are missing, the request should be rejected as ambiguous.

6

Qualified plan/IRA rollover election consistency

If the “From Qualified Plan Direct Rollover to Traditional IRA/Roth IRA” or “Designate a participant owner of a nontransferable qualified plan distributed annuity” option is selected, validate that the selection is complete and consistent with the contract type and administrative rules. This matters because qualified plan ownership and rollover handling have strict tax reporting and ownership constraints. If the election is incomplete or incompatible, the request should be pended and routed for specialized review.

7

New owner and new joint owner identity fields required and validated

When a new owner or new joint owner is being added/changed, require full legal name, SSN/TIN indicator, SSN/TIN value, DOB, address, relationship to current owner, and phone number. These fields are needed for tax reporting (1099), identity verification, and suitability/administrative contact. If any required identity field is missing or invalid, the ownership change should not be processed.

8

SSN/TIN format validation and TIN indicator logic

Validate SSN/TIN values are 9 digits (with or without hyphens) and reject clearly invalid patterns (e.g., all zeros) per internal rules; also ensure the “Check if TIN” box is consistent with the entity type (e.g., trust/entity owners should generally be TIN unless explicitly revocable/grantor-type per instructions). Correct tax identification is critical for IRS reporting and backup withholding determinations. If SSN/TIN is missing, malformed, or inconsistent with the indicated owner type, the submission should be pended for correction and potential tax review.

9

Address completeness and USPS-style field validation

Validate that address, city, state, and ZIP are present where required and that state is a valid two-letter code and ZIP is 5 digits (or ZIP+4 if allowed). Also validate “Address: Same as Owner’s” is only used when an owner address is present and clearly identified. Accurate addresses are required for regulatory notices, tax forms, and identity verification. If address fields are incomplete or invalid, the form should be returned for completion.

10

Phone number format validation

Ensure phone numbers (new owner, new joint owner, beneficiaries) include area code and contain 10 digits (allowing common punctuation). Phone numbers are needed for follow-up on deficiencies and for time-sensitive ownership/beneficiary confirmations. If phone numbers are missing where required or not in a valid format, the submission should be pended and the customer contacted for correction.

11

Trust-related tax certification selection when trust involved

If the new owner or beneficiary is a trust (or the TIN indicator/entity naming suggests a trust), validate that one of the two trust taxation certification checkboxes is selected; otherwise default treatment is taxable per the form. This is important because it drives tax reporting and customer disclosures under IRC 72(e). If trust involvement is detected and the certification is missing/unclear, the request should be flagged for tax review and the customer notified of the default taxable treatment.

12

Required supporting documents for representative signatures and deceased prior owner

If the form is signed by an attorney-in-fact/guardian/representative, require attachment indicators and receipt of POA/letters of office or equivalent authority documentation. If the request references a previous owner’s death, require a certified death certificate before processing. These documents establish legal authority to act and are necessary to prevent unauthorized changes. If required documents are not provided, the request must be rejected or pended until documentation is received.

13

Beneficiary entry completeness and beneficiary type validation

For each beneficiary line used, validate required fields are present: name, SSN/TIN (and TIN indicator if applicable), DOB, address, relationship, phone, beneficiary type (Primary or Contingent), and allocation percentage. This ensures the designation is administrable and reduces disputes at claim time. If any beneficiary entry is partially completed or has an invalid type, that entry should be rejected and the overall beneficiary change pended for correction.

14

Beneficiary allocation totals and primary/contingent rules

Validate allocation percentages are numeric, within 0–100, and that totals equal 100% within each beneficiary class (all Primary beneficiaries total 100%; all Contingent beneficiaries total 100% if any contingent are listed). This matters because ambiguous allocations can cause claim delays and legal disputes. If totals do not equal 100% or allocations are missing, the beneficiary change should be rejected and returned for correction.

15

Trust/entity owner must remain beneficiary rule enforcement

If the contract is owned by a trust or entity (or is being changed to a trust/entity owner), validate that the beneficiary designation names the same trust/entity as beneficiary as instructed on the form. This is important to maintain compliance with contract provisions and administrative requirements stated in the form. If the trust/entity is not maintained as beneficiary when required, the submission should be pended and corrected before processing.

16

Signature and date completeness for all required signers

Validate that signatures and dates are present for the new owner, prior owner, and any joint owners as applicable to the selected ownership action (e.g., new joint owner signature if added; prior joint owner signature if currently on contract and required). Signatures are the legal authorization for ownership and beneficiary changes and are required for auditability. If any required signature or date is missing, the request must not be processed and should be returned for completion.

17

Spousal consent requirement determination and completion

Determine whether spousal consent is required based on the form’s rules (ERISA spousal consent requirements and/or owner residence in AZ, CA, ID, LA, NM, NV, TX, WA, WI) and whether the spouse is not the sole primary beneficiary. If required, validate spouse printed name, spouse signature, and date are completed. If spousal consent is required but missing, the beneficiary change (and potentially the ownership change if it affects beneficiary rights) should be rejected to avoid statutory noncompliance and future claim disputes.

Common Mistakes in Completing NI-77-0039-2505

People often use an account number from a statement, a different policy number, or omit the contract number entirely because they assume the insurer can “look it up” by name. This can delay processing or cause the request to be applied to the wrong contract if the owner has multiple contracts. Always copy the contract number exactly as shown on the annuity contract or most recent statement and double-check all digits/letters.

This form distinguishes between the annuitant (measuring life) and the owner (controls the contract), but many people enter the same person in all fields or swap them unintentionally. That can lead to an ownership change that doesn’t match the intent and may create unexpected death-benefit or tax outcomes. Before filling in names, confirm who is currently the owner vs. annuitant on the contract and complete only the joint owner section if a joint owner actually exists.

Applicants sometimes fill in the “New Owner” information but forget to check whether they are changing the owner, adding/changing a joint owner, or removing a joint owner. When the checkbox selection is missing or inconsistent with the data entered, the insurer may reject the request or contact you for clarification. Check exactly one option that matches your intent and ensure the rest of the page supports that selection (e.g., don’t complete joint owner fields if you’re removing a joint owner).

A common error is entering an SSN in a TIN field for an entity/trust, transposing digits, or failing to check the “Check if TIN” box when the number is not an SSN. This can trigger tax reporting issues, identity verification failures, and processing delays. Verify the number against official documents, enter all digits with no missing characters, and mark the TIN checkbox whenever the owner/beneficiary is not an individual using an SSN.

The form requires MM/DD/YYYY, but people often write DD/MM/YYYY, omit the year, or use shorthand like 1/2/80. Incorrect DOBs can cause administrative rework, mismatched records, and delays—especially when multiple parties have similar names. Always use two-digit month/day and four-digit year (e.g., 03/07/1975) for every person listed (owner, joint owner, annuitant, beneficiaries).

Applicants frequently omit apartment/unit numbers, ZIP+4, or the city/state, or they check “Same as Owner’s” while also writing a different address elsewhere. Inconsistent address information can lead to returned mail, failed identity checks, and follow-up requests. Provide a complete mailing address for each party, and only use “Same as Owner’s” when it is truly identical—otherwise write the full address clearly.

When the new owner is a trust, people often send the full trust document (which the form explicitly says not to do) or fail to include the specific pages required (trust name page, trustee/successor trustee page, and signature page). They also commonly forget the Entity Owner Certificate and the trust’s IRS Tax ID (when required), which stops processing. Follow the instructions exactly: submit only the requested trust pages, include the Entity Owner Certificate, provide the trust TIN unless it’s revocable/grantor-type as applicable, and complete the beneficiary section to name the trust when required.

In trust-related ownership changes, many people skip the Section 72(e) certification because they don’t know which option applies. The form states that if neither box is checked, the company will treat the change as taxable and report any gain as taxable to the IRS. To avoid unintended tax reporting, consult a tax advisor if needed and check the correct box before submitting.

People often complete the annuitant-driven beneficiary section when the contract is owner-driven (or vice versa), or they forget to mark Primary vs. Contingent and leave allocation percentages blank. This can result in default assumptions (e.g., all primary), unclear payout instructions, or a request for correction. Confirm whether the contract is annuitant-driven or owner-driven, clearly label each beneficiary as Primary or Contingent, and ensure primary allocations total 100% (and contingent allocations total 100% if used).

Married owners frequently name a non-spouse beneficiary (or split benefits) without obtaining the spouse’s signature where required (ERISA plans or owners residing/previously residing in listed community property states). Missing spousal consent can cause the change to be rejected, delayed, or later challenged. If you are married and your spouse is not the sole primary beneficiary, review the spousal consent rules on the form and obtain the spouse’s signature and date where applicable.

When the request is due to a prior owner’s death or is signed by an attorney-in-fact/guardian, people often forget to include the certified death certificate or the legal authority documents. Without these, the insurer typically cannot legally process the ownership change and will suspend the request. Include a certified death certificate when applicable and attach the power of attorney, letters of office, or other proof of authority whenever someone signs on another person’s behalf.

A frequent issue is missing one or more required signatures (new owner, prior owner, joint owners if applicable), forgetting to date signatures, or having signatures that don’t match the printed names. People also overlook the backup withholding certification instructions, including the requirement to cross out item (2) if currently subject to backup withholding. To avoid rejection, ensure every required party signs and dates in the correct lines, print names clearly, and follow the backup withholding instructions exactly based on your IRS status.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out NI-77-0039-2505 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills national-integrity-life-insurance-company-ownershi forms, ensuring each field is accurate.