Fill out Form GST524, Ontario Rebate Schedule with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills RC7524-ON-FILL-25E forms, ensuring each field is accurate.

#1 AI PDF Filling Software of 2026

3 out of 4 customers say they prepare their GST524 forms in 37 seconds or less

Secure platform for your PDF forms and personal information

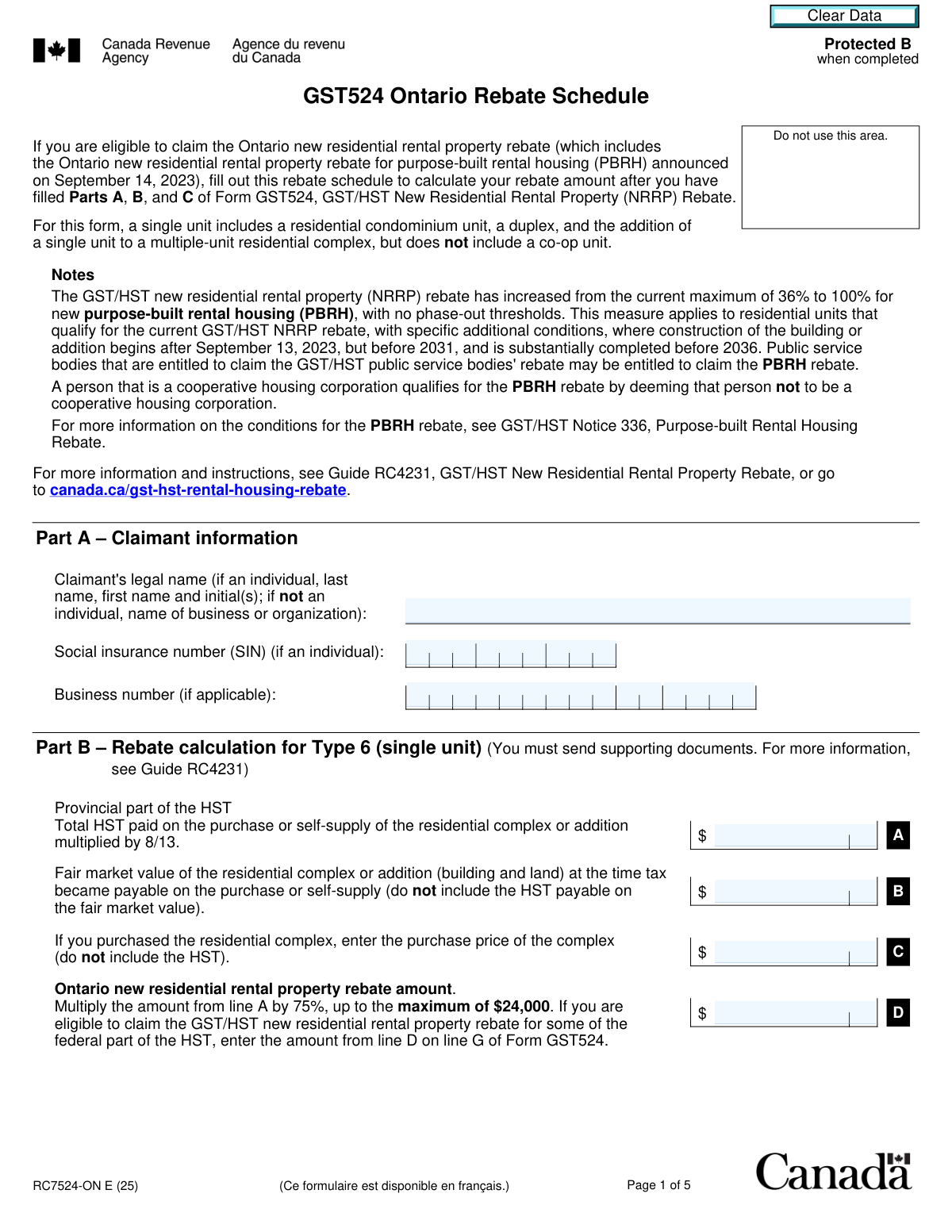

| Form name: | Form GST524, Ontario Rebate Schedule |

| Number of pages: | 5 |

Instafill Demo: filling out a legal form in seconds

Compliance GST524

Validation Checks by Instafill.ai

1

Verifies that the claimant meets the eligibility criteria for the Ontario new residential rental property rebate.

This validation check ensures that the claimant satisfies all necessary eligibility requirements for the Ontario new residential rental property rebate. It confirms that the information provided aligns with the criteria set forth by the Ontario government. By cross-referencing the details submitted, the check verifies that the claimant is indeed qualified to receive the rebate. This step is crucial in preventing ineligible claims from being processed.

2

Confirms that Parts A, B, and C of Form GST524 have been completed prior to filling out the Ontario Rebate Schedule.

This validation check verifies that all relevant sections of Form GST524, specifically Parts A, B, and C, are fully completed before proceeding to the Ontario Rebate Schedule. It ensures that no critical information is missing, which could lead to processing delays or errors. By confirming the completion of these parts, the check helps maintain the integrity of the application process. This step is essential for ensuring that all necessary data is available for accurate assessment.

3

Ensures that the legal name, Social Insurance Number (SIN), and Business Number (if applicable) are accurately filled in Part A.

This validation check confirms that the legal name, Social Insurance Number (SIN), and Business Number, if applicable, are correctly entered in Part A of the form. It ensures that these identifiers match official records to prevent any discrepancies that could affect the processing of the rebate. By validating this information, the check helps to establish the identity of the claimant clearly. This step is vital for compliance and for safeguarding against fraudulent claims.

4

Calculates the total HST paid on the purchase or self-supply of the residential complex and confirms the correct multiplication by 8/13 for line A in Part B.

This validation check calculates the total Harmonized Sales Tax (HST) paid on the purchase or self-supply of the residential complex. It ensures that the calculation is accurate and confirms that the total is multiplied correctly by 8/13 for line A in Part B. This step is crucial for determining the correct amount of rebate the claimant is entitled to receive. By performing this calculation, the check helps to prevent errors that could lead to over or underpayment of the rebate.

5

Validates that the fair market value of the residential complex or addition is entered correctly on line B in Part B, excluding HST.

This validation check ensures that the fair market value of the residential complex or any additions is accurately entered on line B in Part B, excluding HST. It verifies that the value reflects the true market conditions and is consistent with supporting documentation. By validating this information, the check helps to ensure that the rebate calculation is based on accurate and fair assessments. This step is important for maintaining the integrity of the rebate process and ensuring fairness for all claimants.

6

Checks that the purchase price is accurately entered on line C in Part B, ensuring HST is not included.

This validation check ensures that the purchase price entered on line C in Part B is accurate and does not include HST. It verifies that the amount reflects the true purchase price of the property, which is crucial for calculating the correct rebate. By confirming that HST is excluded, the check helps prevent any discrepancies in the rebate calculation. This accuracy is essential for compliance with the Ontario Rebate Schedule requirements.

7

Calculates the Ontario new residential rental property rebate amount by multiplying the amount from line A by 75%, ensuring it does not exceed the maximum of $24,000 for line D in Part B.

This validation check calculates the Ontario new residential rental property rebate by taking the amount from line A and multiplying it by 75%. It ensures that the calculated rebate does not exceed the maximum allowable amount of $24,000 for line D in Part B. This check is vital for ensuring that the rebate amount is both accurate and compliant with the established limits. By performing this calculation, the software helps to streamline the rebate process and reduce errors.

8

Ensures that Part C is only completed if the purchaser is entitled to claim the Ontario new housing rebate, and verifies the accuracy of lines E through J.

This validation check ensures that Part C is only filled out if the purchaser is indeed entitled to claim the Ontario new housing rebate. It verifies the accuracy of the information provided in lines E through J, confirming that all necessary details are correctly entered. This check helps to prevent unauthorized claims and ensures that only eligible purchasers complete this section. By enforcing these conditions, the software enhances the integrity of the rebate application process.

9

Validates that the required information for a co-op unit is filled in correctly in Part D, including total floor space and fair market value.

This validation check verifies that all required information for a co-op unit is accurately filled out in Part D. It specifically checks for the total floor space and fair market value, ensuring that these critical details are correctly reported. This accuracy is essential for determining eligibility and calculating the appropriate rebate. By validating this information, the software helps to ensure compliance with the guidelines for co-op units.

10

Confirms that Section 1 and Section 2 of Part E are completed accurately for multiple-unit residential complexes, ensuring the total HST paid and fair market value are correct.

This validation check confirms that both Section 1 and Section 2 of Part E are completed accurately for multiple-unit residential complexes. It ensures that the total HST paid and the fair market value are reported correctly, which is crucial for the rebate calculation. By verifying these details, the check helps to maintain the accuracy of the information submitted. This validation is important for ensuring that the rebate process is handled efficiently and in accordance with regulations.

11

Checks that Section 3 of Part E includes the total number of qualifying residential units and the total rebate amount accurately.

This validation check ensures that Section 3 of Part E is filled out correctly by confirming that the total number of qualifying residential units is accurately reported. It verifies that the total rebate amount is calculated correctly based on the provided data. By cross-referencing the entries, it helps to prevent any discrepancies that could lead to processing delays. This check is crucial for ensuring that the applicant receives the correct rebate amount.

12

Ensures that Part F is completed correctly if applicable, verifying the information for land self-supply or change-in-use on lines CC through II.

This validation check confirms that Part F is completed accurately when applicable, specifically focusing on the information related to land self-supply or change-in-use. It verifies that the entries on lines CC through II are filled out correctly, ensuring compliance with the requirements. By checking these details, it helps to prevent any potential issues that could arise from incorrect reporting. This check is essential for maintaining the integrity of the application process.

13

Confirms that amounts from this form are accurately entered onto Form GST524 and Form GST525 if entitled to claim the GST/HST new residential rental property rebate.

This validation check verifies that the amounts reported on this form are accurately transferred to Form GST524 and Form GST525 when the applicant is entitled to claim the GST/HST new residential rental property rebate. It ensures that there are no errors in the amounts reported, which could affect the rebate eligibility. By cross-checking these forms, it helps to maintain consistency and accuracy in the application process. This check is vital for ensuring that applicants receive the correct benefits they are entitled to.

14

Verifies that the form is submitted to the CRA along with all required supporting documents and completed forms as instructed.

This validation check ensures that the form is submitted to the Canada Revenue Agency (CRA) along with all necessary supporting documents and completed forms as per the instructions provided. It verifies that all required materials are included to avoid any processing delays or rejections. By confirming the completeness of the submission, it helps to streamline the review process by the CRA. This check is important for ensuring that the application is processed in a timely manner.

15

Ensures that all calculations are accurate and all required fields are filled out to prevent delays in processing.

This validation check verifies that all calculations on the form are accurate and that all required fields are completed. It ensures that no information is missing, which could lead to delays in processing the application. By checking the accuracy of calculations, it helps to prevent any potential errors that could affect the outcome of the rebate claim. This check is essential for maintaining the efficiency of the processing workflow.

Common Mistakes in Completing GST524

Failing to verify eligibility for the Ontario Rebate can lead to unnecessary delays or rejections of your application. It is crucial to thoroughly review the eligibility criteria outlined in the guidelines before proceeding with the form. To avoid this mistake, take the time to read through the requirements carefully and ensure that you meet all conditions. Additionally, consider consulting with a tax professional if you are uncertain about your eligibility.

Submitting the form with incomplete sections can result in processing delays or outright rejection. Each part of the form is designed to capture specific information necessary for the rebate assessment. To prevent this issue, double-check that all required fields in Parts A, B, and C are filled out completely and accurately. It may be helpful to create a checklist of the required information to ensure nothing is overlooked.

Using an incorrect format for your legal name in Part A can lead to discrepancies in your application, potentially causing delays in processing. It is essential to use your full legal name as it appears on official documents. To avoid this mistake, refer to your identification documents when filling out this section and ensure that you follow the specified format. If you have recently changed your name, make sure to use the name that matches your current legal status.

Omitting your Social Insurance Number in Part A can hinder the processing of your rebate application, as this number is crucial for identification purposes. Ensure that you provide your SIN accurately to avoid any issues. To prevent this mistake, verify that your SIN is correct and clearly written before submission. If you do not have a SIN, be sure to follow the instructions for providing alternative identification.

Errors in calculating the Harmonized Sales Tax (HST) paid in Part B can lead to incorrect rebate amounts being claimed, which may result in adjustments or penalties. It is vital to ensure that all calculations are accurate and reflect the actual amounts paid. To avoid this mistake, take the time to review your calculations and consider using a calculator or spreadsheet to assist with accuracy. Additionally, cross-reference your calculations with receipts or invoices to ensure consistency.

Failing to include the fair market value in Part B can lead to incorrect calculations of the rebate amount. It is essential to accurately assess and report the fair market value to ensure compliance with the rebate requirements. To avoid this mistake, carefully review the instructions for determining fair market value and ensure that all necessary documentation is available. Double-check your entries before submission to confirm that this critical information is included.

Entering an incorrect purchase price in Part B can significantly affect the rebate calculation and may result in delays or rejections. It is crucial to verify that the purchase price reflects the actual amount paid for the property. To prevent this error, cross-reference the purchase price with the official purchase agreement and ensure that all figures are accurate. Taking the time to review this information can save you from potential complications later on.

Miscalculating the rebate amount in Part B can lead to receiving less than entitled or facing issues with the tax authorities. It is important to follow the calculation guidelines meticulously and ensure that all relevant figures are correctly applied. To avoid miscalculations, consider using a calculator or spreadsheet to assist with the math, and double-check your calculations against the provided formulas. Seeking assistance from a tax professional can also help ensure accuracy.

Neglecting to complete Part C when it is required can result in an incomplete application, leading to processing delays or denials. It is vital to understand the conditions under which Part C must be filled out and to provide all necessary information. To avoid this oversight, carefully read the instructions for each section of the form and assess whether Part C applies to your situation. Keeping a checklist of required sections can help ensure that nothing is overlooked.

Omitting necessary information for co-op units in Part D can lead to complications in processing your rebate application. It is essential to provide complete and accurate details specific to co-op units to ensure compliance with the rebate criteria. To avoid this mistake, familiarize yourself with the specific requirements for co-op units and ensure that all relevant information is included. Reviewing the completed form with a focus on Part D can help catch any missing details before submission.

Providing an incorrect total floor space in Part D can lead to miscalculations in the rebate amount. It is essential to measure the floor space accurately and ensure that all relevant areas are included. To avoid this mistake, double-check the measurements and verify them against the property’s official documents. Consulting with a professional if unsure about the measurements can also help ensure accuracy.

Failing to include the total HST paid in Part E can result in an incomplete application and potential delays in processing. It is crucial to gather all receipts and documentation related to HST payments before filling out this section. To prevent this error, create a checklist of all HST payments made and ensure that the total is accurately calculated and reported. Regularly reviewing the entries can also help catch any omissions before submission.

Entering an incorrect number of qualifying residential units in Part E can lead to an inaccurate rebate calculation. It is important to carefully review the criteria for qualifying units and ensure that all eligible units are counted. To avoid this mistake, maintain a clear record of all residential units and their eligibility status. Cross-referencing with property records can also help ensure that the correct number is reported.

Neglecting to complete Part F when it is applicable can result in an incomplete application and may lead to rejection. It is vital to understand the requirements for Part F and determine if it applies to your situation. To avoid this oversight, carefully read the instructions for each section of the form and assess your eligibility for Part F. Seeking clarification from a tax professional can also provide guidance on whether this part needs to be completed.

Failing to transfer amounts accurately between Form GST524 and GST525 can create discrepancies in your tax filings. It is essential to ensure that all relevant amounts are correctly carried over to maintain consistency across forms. To prevent this mistake, take the time to review each form thoroughly and double-check the transferred amounts. Utilizing a systematic approach, such as filling out one form at a time and verifying the figures, can help ensure accuracy.

Failing to include the necessary supporting documents can lead to delays in processing your application or even rejection. It is crucial to carefully review the checklist of required documents before submission. To avoid this mistake, ensure that you gather all relevant documents, such as receipts and proof of eligibility, and double-check that they are included with your submission. Keeping a checklist can help ensure that nothing is overlooked.

Inaccurate calculations can result in significant processing delays and may require you to resubmit your application. To prevent this issue, it is advisable to double-check all calculations and ensure that they align with the guidelines provided in the form instructions. Utilizing a calculator or spreadsheet can help minimize errors. Additionally, consider having a second person review your calculations to catch any mistakes before submission.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out GST524 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills rc7524-on-fill-25e forms, ensuring each field is accurate.