Yes! You can use AI to fill out Record of Advice and Needs Analysis (Non-Life Insurance — Personal and Commercial Lines)

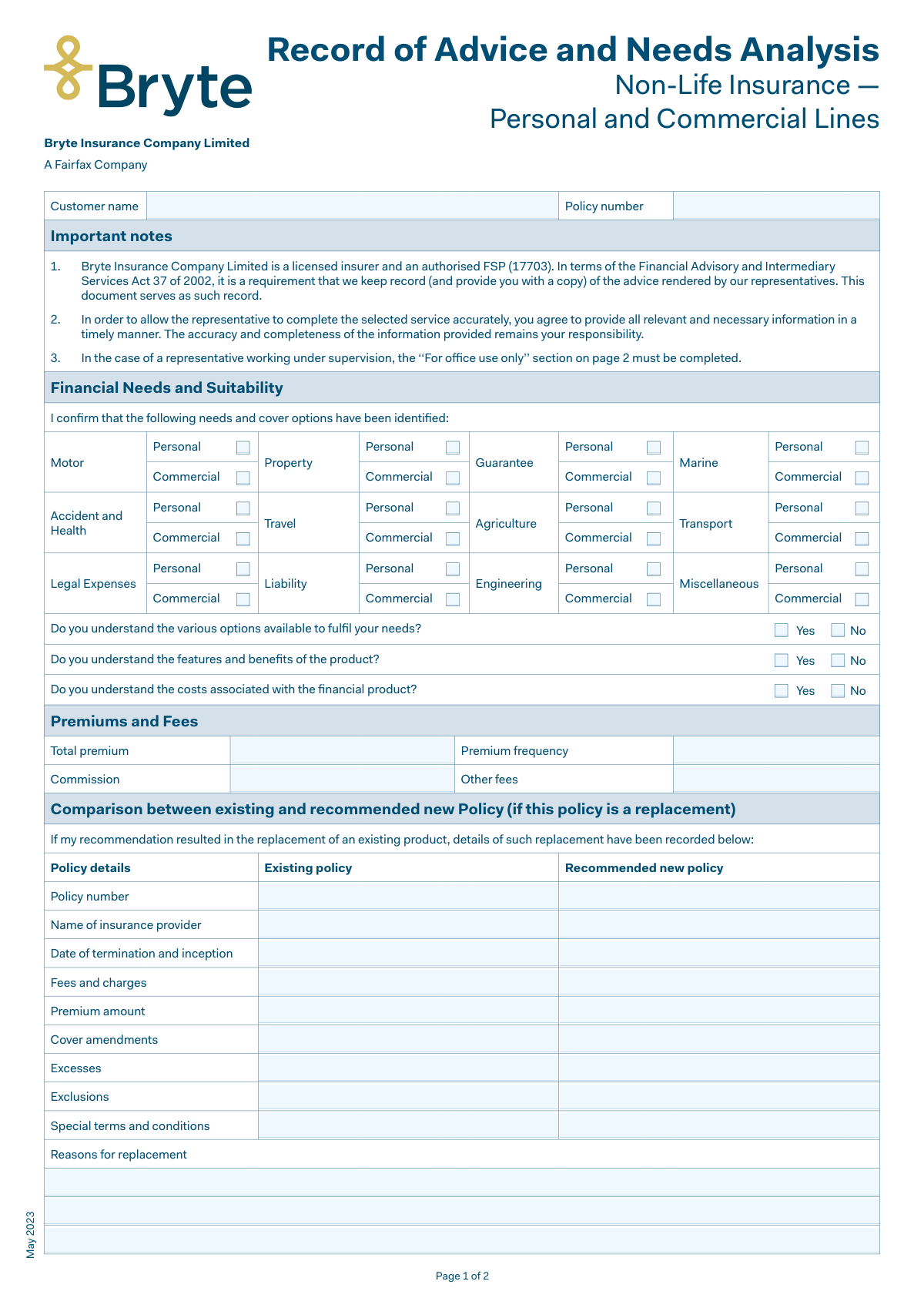

This is an official Record of Advice and Needs Analysis used by Bryte Insurance Company Limited to capture the customer’s insurance needs, the cover options discussed, and the advisor’s recommendations for non-life insurance (personal and commercial lines). It supports compliance with South Africa’s FAIS Act by creating a written record of advice that must be retained and provided to the customer. The form also records premiums/fees, any replacement of an existing policy, and includes customer declarations, signatures, and (where applicable) supervisor evaluation for representatives working under supervision.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Record of Advice (Bryte) May 2023 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Record of Advice and Needs Analysis (Non-Life Insurance — Personal and Commercial Lines) |

| Number of pages: | 2 |

| Filled form examples: | Form Record of Advice (Bryte) May 2023 Examples |

| Language: | English |

| Categories: | insurance forms, life insurance forms, commercial forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Record of Advice (Bryte) May 2023 Online for Free in 2026

Are you looking to fill out a RECORD OF ADVICE (BRYTE) MAY 2023 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your RECORD OF ADVICE (BRYTE) MAY 2023 form in just 37 seconds or less.

Follow these steps to fill out your RECORD OF ADVICE (BRYTE) MAY 2023 form online using Instafill.ai:

- 1 Enter customer and policy identifiers (customer name and policy number) and confirm the document date/version if required by your process.

- 2 Complete the Financial Needs and Suitability section by selecting the relevant insurance categories (e.g., motor, property, liability, travel, etc.) for personal and/or commercial lines.

- 3 Answer the understanding confirmations (options available, product features/benefits, and costs) by selecting Yes/No for each question.

- 4 Fill in Premiums and Fees details, including total premium, premium frequency, commission, and any other fees.

- 5 If the recommendation replaces an existing policy, complete the comparison table (existing vs recommended policy) including provider, policy numbers, termination/inception dates, premiums, fees, amendments, excesses, exclusions, special terms, and reasons for replacement.

- 6 Complete the Customer Acknowledgement and Declaration section, ensure the advisor has discussed the listed items (benefits/disadvantages, exclusions, excesses, claims/cancellation procedures, insured amounts, etc.), then enter the signing date and collect client and representative signatures.

- 7 If applicable, complete Non-acceptance of Advice and/or the “For office use only” supervisor evaluation (recommendations, date, supervisor signature) for representatives acting under supervision.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Record of Advice (Bryte) May 2023 Form?

Speed

Complete your Record of Advice (Bryte) May 2023 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Record of Advice (Bryte) May 2023 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Record of Advice (Bryte) May 2023

It documents the insurance advice and recommendations your Bryte representative/financial advisor provided to you. It also serves as the required record of advice under the Financial Advisory and Intermediary Services Act (FAIS).

The representative completes the advice and recommendation details, and the client (or an authorised signatory) signs the acknowledgement and declaration. If the representative is working under supervision, a supervisor must also complete the “For office use only” section on page 2.

Not necessarily—your advisor typically completes the form based on the information you provide. You are responsible for ensuring the information you give is accurate and complete.

Have your customer details, policy number (if available), and details of your insurance needs (e.g., motor, property, liability, travel, etc.) ready. If replacing an existing policy, you should also have the current policy details, premiums, cover terms, and insurer information.

It’s the section where the advisor records which types of cover were identified as relevant to your needs (personal and/or commercial lines). It also confirms whether you understand the options, product features/benefits, and associated costs.

Answer “Yes” only if the advisor has explained the options, what the product covers, and what it costs (including premiums and fees) and you understand it. If anything is unclear, answer “No” and ask for clarification before signing.

This section captures the total premium, how often it’s paid (premium frequency), and any commission and other fees. Ask your advisor to explain each amount and what it relates to before you sign.

It must be completed if the recommendation results in replacing an existing insurance product. The form records both the existing and recommended policy details, including premiums, fees, cover changes, excesses, exclusions, and reasons for replacement.

It refers to when the old policy will end (termination) and when the new policy will start (inception). These dates help prevent gaps or overlaps in cover.

Material non-disclosure means leaving out important information that could affect the insurer’s decision or the suitability of the product. The form notes that incomplete or incorrect information can lead to inappropriate recommendations and may affect cover or claims.

You confirm the record accurately reflects the advice you received and that you had the opportunity to ask questions. You also confirm the recommendations are based on information you disclosed and verified.

The form lists key items such as benefits and disadvantages, exclusions, excesses, cancellation procedure, insured amounts, items covered, the principle of average, how insured amounts are calculated, and the claims procedure.

You can complete the “Non-acceptance of Advice” section to confirm you chose not to follow the recommendation or you proceeded with a different transaction. You’ll still sign to acknowledge the advice was given, even if you don’t accept it.

It is a supervisor evaluation used when a representative is acting under supervision. The supervisor confirms whether the advice is appropriate and may add recommendations to rectify the advice if needed.

The form does not specify submission channels or processing times; your advisor or Bryte office will provide the correct method (e.g., email or internal submission) and timelines. Ask your representative where to send it and when you can expect confirmation or policy changes to take effect.

Compliance Record of Advice (Bryte) May 2023

Validation Checks by Instafill.ai

1

Customer Name Presence and Format

Validates that the Customer name field is completed and contains a plausible full name (e.g., at least two alphabetic tokens, not only initials or symbols). This is important because the record of advice must be attributable to a specific client for compliance and audit purposes. If validation fails, the submission should be rejected or routed for manual review with a prompt to capture the client’s full legal name.

2

Policy Number Required and Pattern Validation

Ensures the Policy number is provided and matches the insurer’s expected policy number format (e.g., alphanumeric length constraints, no illegal characters, no whitespace-only values). Policy number accuracy is critical for linking the advice record to the correct policy and for downstream servicing. If validation fails, block submission and request correction, or validate against a policy database if available.

3

Financial Needs and Suitability Selection Completeness

Checks that at least one needs/cover category is selected (e.g., Motor, Property, Liability, etc.) and that the selection is not contradictory (e.g., both Personal and Commercial selected for the same line if the form design intends a single choice). This confirms the advice scope and prevents empty or ambiguous records. If validation fails, require the advisor to select applicable cover types or clarify the intended scope.

4

Understanding Questions Must Have Exactly One Answer Each

Validates that each of the three understanding questions (options available, features/benefits, costs) has exactly one of Yes/No selected, not both and not blank. These acknowledgements are key to demonstrating that disclosures were made and understood. If validation fails, prevent completion until each question has a single, explicit response.

5

Premium and Fees Numeric and Currency Validation

Ensures Total premium, Commission, and Other fees (if provided) are valid monetary amounts (numeric, non-negative, reasonable precision such as two decimals, and within configured maximum thresholds). This prevents calculation errors and ensures the client’s cost disclosure is accurate. If validation fails, flag the field(s) and require correction before submission.

6

Premium Frequency Required and Allowed Values

Checks that Premium frequency is completed and matches an allowed set (e.g., Monthly, Quarterly, Bi-annual, Annual) as configured by the business. Frequency is required to interpret the total premium correctly and to avoid misleading disclosures. If validation fails, require selection from the approved list and disallow free-text values that cannot be standardized.

7

Replacement Policy Section Trigger and Conditional Requirements

Validates that the 'Comparison between existing and recommended new Policy' section is completed only when the advice results in a replacement, and that it is not partially filled without a clear replacement indication. Replacement advice is a regulated area and requires complete comparative details when applicable. If validation fails, either require completion of all mandatory replacement fields or clear the section if replacement is not applicable.

8

Replacement Comparison Field Pair Completeness (Existing vs New)

When replacement is applicable, ensures each comparison row has both an Existing policy value and a Recommended new policy value (e.g., provider name, premium amount, excesses, exclusions, special terms). This prevents one-sided comparisons that could misrepresent the impact of switching. If validation fails, prompt the user to complete missing counterpart values or mark the item as 'No change' explicitly where supported.

9

Replacement Dates: Termination and Inception Format and Logic

Validates that 'Date of termination and inception' is captured in a valid date format and that the inception date is not earlier than the termination date (or conforms to allowed overlap rules, if any). Correct sequencing is important to avoid gaps in cover or double insurance. If validation fails, block submission and request corrected dates or an explanation/override with approval.

10

Replacement Reasons Mandatory When Replacement Occurs

Ensures 'Reasons for replacement' is completed with meaningful text when a replacement is recorded (e.g., minimum character count, not placeholder text like 'N/A' unless allowed). This supports Treating Customers Fairly principles and provides an audit trail for why a change was recommended. If validation fails, require a substantive reason before allowing submission.

11

Customer Declaration Date Completeness and Validity

Checks that the signature date line is fully completed (day, month, and year) and that the resulting date is a real calendar date. Dating the declaration is essential for evidencing when the client acknowledged the advice and disclosures. If validation fails, prevent finalization and request a complete, valid date.

12

Signature Presence and Role Consistency

Validates that required signatures are present: client signature and representative signature for standard acceptance, and that the correct signature block is used (e.g., non-acceptance signature only when non-acceptance is selected). Signatures are critical for enforceability and compliance recordkeeping. If validation fails, the form should be rejected or routed for re-signing with clear instructions on which signature is missing or inconsistent.

13

Representative Name Required and Supervision Indicator Validation

Ensures the Representative name is completed and, if the representative is working under supervision, that this is clearly indicated as required by the form. This supports accountability and regulatory supervision requirements. If validation fails, require the representative’s full name and a clear supervision status before submission.

14

Office Use Only Section Required When Under Supervision

If the representative is marked as working under supervision, validates that the 'For office use only' supervisor evaluation is completed, including the supervisor’s decision (satisfied/not satisfied), recommendations (if not satisfied), date, and supervisor signature. This is explicitly required by the form notes and is a key compliance control. If validation fails, block submission until the supervisor section is fully completed.

15

Supervisor Evaluation Logic and Recommendations Requirement

Validates that exactly one supervisor evaluation outcome is selected (satisfied OR not satisfied), and if 'not satisfied' is selected, that 'Recommendations' is not blank and contains actionable remediation notes. This ensures the supervision process is meaningful and auditable. If validation fails, require a single outcome selection and enforce recommendations entry when the advice is deemed inappropriate.

Common Mistakes in Completing Record of Advice (Bryte) May 2023

People often assume these details are already on file or will be filled in by the advisor, so they skip them or write an old policy number. This can cause the Record of Advice to be linked to the wrong client or policy, delaying issuance, endorsements, or claims handling. Always enter the full legal customer name and the exact policy number shown on the schedule (or clearly mark “New business / TBA” if not yet allocated).

The form lists many product lines (e.g., Motor, Property, Liability) with Personal and Commercial options, and clients frequently fail to mark the correct ones or mark both without explanation. This creates ambiguity about what advice was actually provided and can lead to incorrect cover being arranged or important sections being omitted. Only select the relevant categories and ensure the Personal/Commercial designation matches the risk (e.g., business-use vehicle should be Commercial if applicable).

The three “Do you understand…” questions (options, features/benefits, costs) are often left blank or all marked “Yes” without discussion, especially when clients feel rushed. Missing or inaccurate answers weaken the suitability record and can create disputes later if the client claims they did not understand the product. Tick the correct option for each question and ask the advisor to clarify anything unclear before signing.

Clients commonly enter a monthly premium where an annual total is expected (or vice versa), omit the premium frequency, or leave commission/other fees blank because they assume it’s “internal.” This can result in misunderstandings about affordability and total cost, and may trigger compliance follow-ups. Confirm whether the “Total premium” is monthly/annual, complete the frequency (monthly/quarterly/annual), and ensure commission and any additional fees are disclosed where required.

When a new policy replaces an existing one, people often forget to complete the comparison table (existing vs recommended) or provide only partial details (e.g., no termination/inception dates). This can lead to gaps in cover, duplicated cover, or an inability to justify the replacement decision if questioned later. If replacement is involved, complete every row: insurer name, policy numbers, dates, fees, premium, amendments, excesses, exclusions, special terms, and clear reasons for replacement.

A frequent error is writing an intended date rather than the confirmed date, mixing up termination and inception, or leaving one of them blank. The consequence can be a period with no insurance (or double insurance), which can cause claim repudiation or unnecessary cost. Use confirmed dates from the insurer(s) and double-check that the new inception date aligns with (or precedes) the old policy termination date as advised.

People often write broad statements like “better cover” or “cheaper” without specifying what changed (e.g., exclusions removed, excess reduced, sums insured corrected). This weakens the advice record and can create disputes if the client later alleges the replacement was not in their interest. Provide specific, measurable reasons (premium difference, key cover improvements, exclusions/terms changes, service issues, underwriting outcomes) and reference the exact amendments.

The declaration lists multiple items the advisor must explain (excesses, exclusions, principle of average, calculation of insured amounts, claims and cancellation procedures), but clients sometimes sign without ensuring these were actually covered. This can lead to surprises at claim stage (e.g., underinsurance and average applied, unexpected excesses, excluded events) and complaints. Before signing, ask the advisor to walk through each item and ensure you understand how it affects your specific risks.

Common issues include missing the day/month/year, using an initial instead of a full signature, signing in the wrong place, or not having the authorised person sign on behalf of a business. This can invalidate the acknowledgement or delay processing while signatures are re-collected. Ensure the document is dated fully (day, month, year), signed by the correct authorised signatory, and that all required signature blocks (client and representative) are completed.

If the client chooses not to follow the recommendation or proceeds differently, they often forget to complete and sign the Non-acceptance section. This leaves the file showing advice was given but not whether it was accepted, increasing compliance risk and potential disputes if outcomes are poor. If you are not following the recommendation, explicitly select the applicable option and sign in the Non-acceptance area.

The form notes that when a representative is working under supervision, the office-use section on page 2 must be completed, but this is frequently overlooked. Missing supervisor evaluation, recommendations, date, signature, or registration details can make the advice record non-compliant and require rework. If the representative is under supervision, ensure the supervisor evaluation is completed in full, signed, and dated before the file is finalised.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Record of Advice (Bryte) May 2023 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills record-of-advice-and-needs-analysis-non-life-insur forms, ensuring each field is accurate.