Yes! You can use AI to fill out REV-181 (CM), Application for Tax Clearance Certificate (Pennsylvania Department of Revenue)

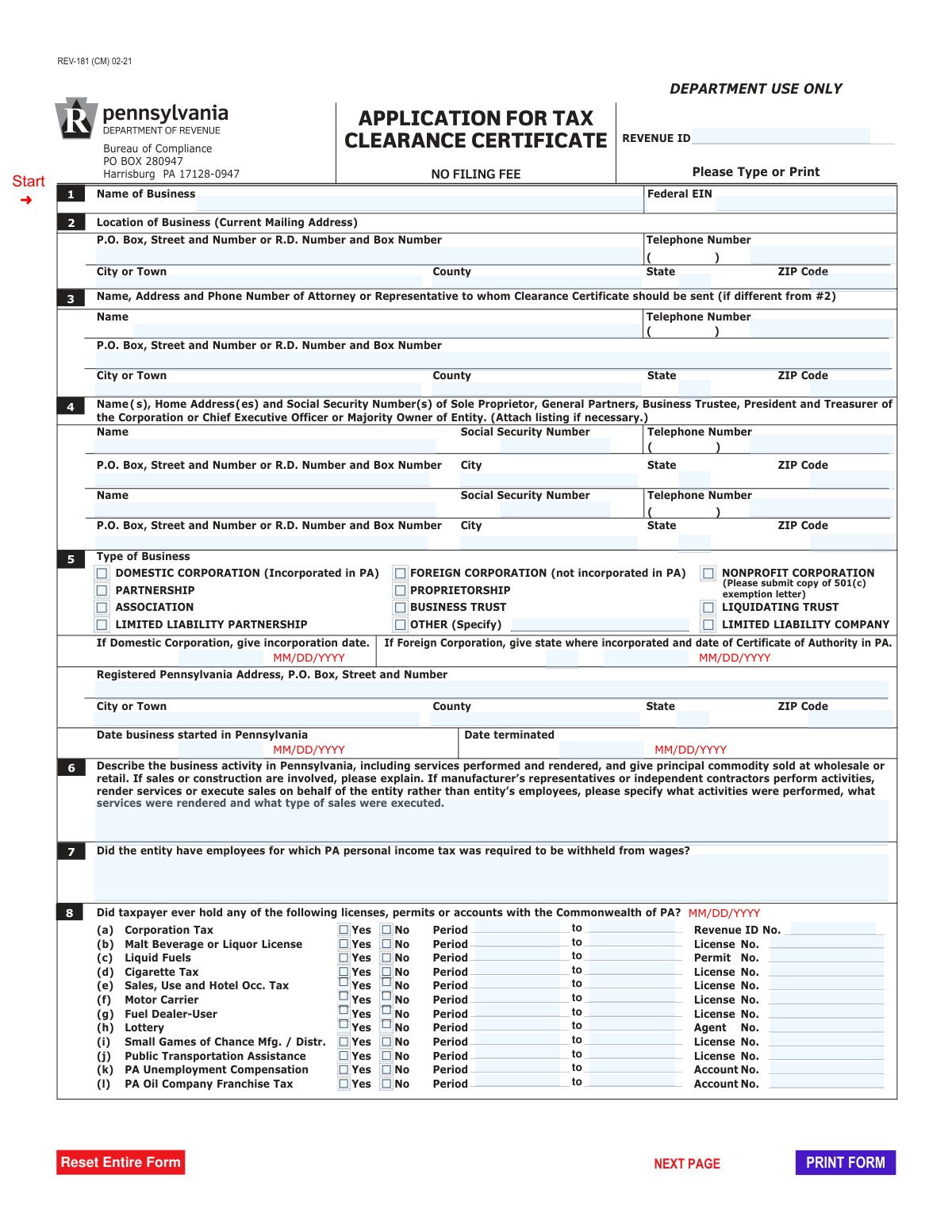

REV-181 (CM) is Pennsylvania’s application used by a business entity to obtain a Tax Clearance Certificate, often required before dissolving a corporation/association, withdrawing a foreign corporation, completing certain mergers, or completing a bulk sale transaction. The form collects identifying information, responsible party details, business activity history, tax account/license history, and real estate ownership/transfer information to confirm the entity has satisfied Pennsylvania tax obligations. It is important because the clearance certificate is frequently a prerequisite for legal/administrative actions with the PA Department of State or for closing transactions (e.g., bulk sales) without successor liability issues. The application also serves as a request for clearances from both the PA Department of Revenue and the PA Department of Labor & Industry (Unemployment Compensation Tax Services).

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out REV-181 (CM) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | REV-181 (CM), Application for Tax Clearance Certificate (Pennsylvania Department of Revenue) |

| Number of pages: | 4 |

| Filled form examples: | Form REV-181 (CM) Examples |

| Language: | English |

| Categories: | legal service forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out REV-181 (CM) Online for Free in 2026

Are you looking to fill out a REV-181 (CM) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your REV-181 (CM) form in just 37 seconds or less.

Follow these steps to fill out your REV-181 (CM) form online using Instafill.ai:

- 1 Enter the business’s legal name, Federal EIN, current mailing address, phone number, and (if applicable) the attorney/representative contact information for where the clearance certificate should be sent.

- 2 List the responsible individuals (e.g., sole proprietor/partners/trustee/corporate officers/majority owner) with home addresses, Social Security numbers, and phone numbers; attach an additional list if needed.

- 3 Select the entity type (corporation/foreign corporation/nonprofit/partnership/LLC, etc.), provide PA registered address details, business start/termination dates in PA, and describe PA business activities (including sales/construction and use of contractors).

- 4 Answer the tax and licensing history questions (withholding/employees, prior PA tax accounts and licenses/permits, pending matters), and provide business records location and payroll/employee history as requested.

- 5 Complete the transaction/clearance purpose section by checking the reason for the certificate (dissolution, withdrawal, merger, bulk sale, contract clearance, etc.) and provide required supporting details (e.g., court date/county, sale date, settlement statement, authorization for bulk sale disclosures).

- 6 Answer the real estate and asset transfer questions; if applicable, complete Schedule A (real estate acquired/disposed within five years) and/or Schedule B (PA real estate currently owned) and attach any required agreements/explanations.

- 7 Review the certification section, ensure the signers match the responsible individuals listed earlier, sign and date, then submit the typed original to the PA Department of Revenue and send a copy to the PA Department of Labor & Industry while retaining a copy for your records.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable REV-181 (CM) Form?

Speed

Complete your REV-181 (CM) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 REV-181 (CM) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form REV-181 (CM)

This is an Application for a Tax Clearance Certificate (REV-181) used to request tax clearances from the PA Department of Revenue and the PA Department of Labor & Industry. It is commonly needed for dissolutions, withdrawals, mergers, bulk sales, and certain contract-related clearances.

Any business entity seeking a Pennsylvania Tax Clearance Certificate must complete it, including corporations (domestic or foreign), LLCs, partnerships, proprietorships, nonprofits, associations, and trusts. The form asks for entity details and responsible individuals (e.g., officers/owners/partners).

No. The form states “NO FILING FEE.”

Submit the typed original to the PA Department of Revenue, Bureau of Compliance, PO BOX 280947, Harrisburg, PA 17128-0947. You must also send one copy to PA Department of Labor & Industry, Office of Unemployment Compensation Tax Services, e-Government Unit, Labor & Industry Building, Room 916, 651 Boas St., Harrisburg, PA 17121.

The form instructs: “Please Type or Print,” and the note says to “Submit typed original.” To avoid processing issues, type it if possible and ensure all entries are legible.

You must provide the business name, Federal EIN, current mailing address, and telephone number. You’ll also provide the registered Pennsylvania address and key dates such as when the business started in Pennsylvania and (if applicable) the termination date.

The form requires names, home addresses, Social Security numbers, and phone numbers for the sole proprietor, general partners, business trustee, and/or corporate officers such as the President and Treasurer (or CEO/majority owner). If more space is needed, you can attach a separate listing.

Check the box that matches your entity type (e.g., Domestic Corporation incorporated in PA, Foreign Corporation not incorporated in PA, LLC, partnership, proprietorship, nonprofit, trust, etc.). If you select Domestic or Foreign Corporation, you must also provide the incorporation date and/or the state of incorporation and PA Certificate of Authority date.

Describe the services performed and the principal commodity sold (wholesale or retail), and explain if sales or construction are involved. If independent contractors or manufacturer’s representatives performed activities instead of employees, specify what they did and what type of sales/services were executed.

You must answer whether PA personal income tax withholding was required from wages and provide employee and payroll totals for the last five operating years (as reported to the Social Security Administration). You also must answer questions related to PA Unemployment Compensation reporting and provide the UC account number if applicable.

Yes. The form asks whether the taxpayer ever held specific PA licenses/permits/accounts (e.g., Corporation Tax, Sales/Use/Hotel Occupancy, Liquor, Cigarette, Liquid Fuels, Motor Carrier, Lottery, UC, etc.), including the period and the relevant license/permit/account or revenue ID number.

If you are requesting a Bulk Sale Clearance Certificate under Section 1403 of the Fiscal Code, you must provide the sale date and attach a copy of the settlement statement. The form also includes a Statement of Authorization allowing the Department of Revenue to disclose tax information to the buyer or representatives for the bulk sale transfer provision.

You must answer whether the assets/activities were acquired from a predecessor and, if yes, provide the predecessor’s name, address, and acquisition date. You must also indicate whether the business will be transferred to another entity type (corporation, partnership, proprietorship, trust, association, or other) and explain if needed.

If the business held title to any real estate in the last five years, you must complete Schedule A. If the business currently holds title to real estate in PA, you must complete Schedule B; bulk sale requests may also require a list of PA properties retained (or state “none”).

The certification must be signed by individuals whose names match those listed in the responsible-party section (question 4). If more than one person is required (e.g., multiple partners or officers), ensure the appropriate individuals print their names and provide original signatures.

Compliance REV-181 (CM)

Validation Checks by Instafill.ai

1

Business Legal Name Presence and Character Validation

Validate that the “Name of Business” field is present and contains a plausible legal business name (not blank, not only punctuation, and within a reasonable length). This is important because the clearance certificate and matching to tax accounts depend on the exact legal name. If validation fails, the submission should be rejected or routed for manual review with a request for the legal name as registered.

2

Federal EIN Format and Completeness

Ensure the Federal EIN is provided when the entity type is not a sole proprietorship without employees, and validate it matches the standard EIN format (9 digits, typically displayed as NN-NNNNNNN). This prevents misidentification of the taxpayer and failed matching against Department of Revenue records. If invalid or missing when required, block submission and prompt for correction.

3

Business Telephone Number Format Validation

Validate that the business telephone number is present and conforms to a valid US phone format (10 digits, allowing parentheses/dashes/spaces) and is not an obviously invalid placeholder (e.g., 000-000-0000). A valid phone number is needed for follow-up questions and audit coordination. If validation fails, require correction before acceptance.

4

Business Mailing Address Completeness and ZIP Code Validation

Check that the current mailing address includes street/PO box, city, state, and ZIP code, and validate ZIP as 5 digits (or ZIP+4 if allowed). Address completeness is critical for mailing the clearance certificate and for jurisdictional determination. If incomplete or malformed, return an error specifying which address components are missing or invalid.

5

Attorney/Representative Delivery Section Conditional Requirements

If the applicant indicates the clearance certificate should be sent to an attorney/representative (i.e., section is filled), require name, full mailing address, and phone number, and validate the phone format. This ensures the certificate is delivered to the intended recipient and reduces misrouting. If partially completed, fail validation and require either full completion or clearing the section.

6

Responsible Party (Owners/Officers) Identity and SSN Validation

For each listed sole proprietor/partner/trustee/officer/majority owner, require name, home address, SSN, and phone number; validate SSN as 9 digits (optionally formatted as NNN-NN-NNNN) and reject known invalid patterns (e.g., all zeros in any group). These identifiers are essential for compliance checks and linking to withholding/unemployment obligations. If any required element is missing or SSN format fails, the submission should be rejected or flagged for secure correction.

7

Entity Type Selection and Mutual Exclusivity

Validate that exactly one “Type of Business” option is selected (e.g., Domestic Corporation, Foreign Corporation, Partnership, LLC, etc.), and if “Other” is selected, require a non-empty specification. Entity type drives which additional fields are required and which tax clearances apply. If multiple or none are selected, fail validation and prompt the user to choose one.

8

Corporation-Specific Date/State Requirements (Domestic vs Foreign)

If Domestic Corporation is selected, require a valid incorporation date; if Foreign Corporation is selected, require the state of incorporation and a valid PA Certificate of Authority date. These fields are necessary to confirm legal standing and determine the relevant compliance period. If missing or invalid, block submission and request the required corporate details.

9

Registered Pennsylvania Address Completeness and State Consistency

Require the Registered Pennsylvania Address fields to be complete (street/PO box, city, county, state, ZIP) and validate that the state is PA. This is important because the form is for Pennsylvania tax clearance and the registered address must be within Pennsylvania for proper jurisdictional processing. If the state is not PA or the address is incomplete, fail validation and request correction.

10

Business Start/Termination Dates Format and Logical Order

Validate that “Date business started in Pennsylvania” is a valid date and, if “Date terminated” is provided, it is also a valid date and not earlier than the start date. Date logic is critical for determining filing periods, liabilities, and whether final returns are due. If dates are invalid or inconsistent, reject the submission and require corrected dates.

11

Business Activity Description Minimum Content Check

Ensure the narrative describing Pennsylvania business activity is provided and meets a minimum content threshold (e.g., not blank and not only a few generic words), especially if sales, construction, independent contractors, or manufacturer’s representatives are involved. This description affects tax type applicability (sales/use, withholding, etc.) and audit scoping. If insufficient, require additional detail before processing.

12

Yes/No Questions Must Be Explicitly Answered

For all yes/no items (e.g., employees with withholding requirement, licenses/accounts held, real estate title, termination questions, soft drink/diesel/tangible property activities, abandoned property questions), validate that exactly one of “Yes” or “No” is selected. Unanswered or double-marked responses create ambiguity and can lead to incorrect clearance decisions. If invalid, return an error identifying the specific question(s) needing a definitive response.

13

License/Permit/Account Details Required When 'Yes' Selected

For each license/permit/account line where “Yes” is selected (e.g., Sales/Use/Hotel Occupancy, UC account, Liquor license, Motor Carrier, etc.), require the associated identifier (license/permit/account/revenue ID) and the applicable period dates. This is necessary to verify account status and ensure all liabilities are cleared. If “Yes” is selected but identifiers/period are missing or malformed, fail validation and request the missing details.

14

Predecessor Acquisition Details Conditional Validation

If assets/activities were acquired from a prior entity, require predecessor name, address, and acquisition date, and validate the acquisition date format. This is important for successor liability and bulk sale/transfer compliance checks. If “Yes” is selected without complete predecessor details, block submission until completed.

15

Real Estate Schedules A/B Trigger and Completeness

If the applicant indicates real estate was held in the last five years, require Schedule A completion; if they currently hold title to PA real estate, require Schedule B completion, including property location, county, acquisition/transfer dates, and consideration/assessed value fields where applicable. Real estate holdings can affect liens, transfer taxes, and clearance issuance. If the trigger answer is “Yes” but the corresponding schedule data is missing, fail validation and request the schedule information.

16

Certification Signer Must Match Listed Responsible Individuals

Validate that the printed name(s) and signature(s) in the Certification section are present and match one of the individuals listed in the responsible party section (question 4), and that the signature date (if captured) is a valid date. This ensures the attestation is legally attributable to an authorized person and reduces fraud risk. If the signer is not listed or signatures are missing, reject the submission and require proper certification.

Common Mistakes in Completing REV-181 (CM)

People often enter a DBA/brand name rather than the exact legal entity name registered with PA (or the state of incorporation). This causes mismatches when the Department of Revenue tries to locate accounts, filings, and liabilities, which can delay or prevent issuance of the clearance certificate. Use the legal name exactly as it appears on formation documents, tax registrations, and prior PA filings; include the DBA only if the form or an attachment explicitly allows it.

Applicants sometimes provide an owner’s SSN instead of the entity’s EIN, transpose digits, or omit the EIN for newer entities. An incorrect EIN can prevent the agencies from matching the application to the correct tax accounts and can trigger follow-up requests. Verify the EIN against the IRS CP 575/147C letter or prior tax returns and enter it in the correct EIN format (9 digits).

Common errors include missing suite/unit numbers, mixing a physical location with a P.O. Box incorrectly, or leaving the telephone area code blank (the form shows parentheses for area code). Incomplete contact information leads to returned mail, missed deficiency notices, and processing delays. Provide a complete current mailing address (including P.O. Box if used), city/county/state/ZIP, and a full 10-digit phone number.

The form requires names, home addresses, and Social Security numbers for specific roles (sole proprietor, general partners, trustee, president, treasurer, CEO, or majority owner). People often list only one officer, omit the treasurer, or avoid providing SSNs, which prevents proper clearance review and can result in rejection or a request for additional documentation. Cross-check your entity type and list every required person; attach an additional listing if there are more individuals than the space provided.

Applicants frequently check an incorrect entity type (e.g., LLC vs. corporation, domestic vs. foreign) or fail to provide the incorporation date or PA certificate of authority date for foreign corporations. This creates confusion about which tax accounts and legal requirements apply and can delay clearance. Confirm the entity classification from formation documents and fill in the required dates and state of incorporation exactly as recorded.

The form asks for a Registered Pennsylvania Address separately, but many people repeat the mailing address or provide an out-of-state address. If the registered PA address is wrong, it can conflict with Department of State records and complicate verification. Use the official registered office address on file in Pennsylvania (or the registered agent address, if applicable) and keep it distinct from the current mailing address.

Applicants often leave “date business started in Pennsylvania,” “date terminated,” and “Have you terminated your business activities in Pennsylvania?” inconsistent (e.g., checking “no” but providing a termination date). Inconsistencies can trigger follow-up questions and may affect which periods must be reviewed for taxes and filings. Provide exact dates (MM/DD/YYYY if possible) and ensure the yes/no answers align with the dates and any asset distribution date.

Many submissions use generic descriptions like “consulting” or “retail” and fail to explain sales vs. services, construction activities, or the use of independent contractors/manufacturer’s reps as the form requests. A vague description can lead to incorrect tax/license expectations (e.g., sales tax, withholding, contractor-related obligations) and delays while the agency clarifies. Describe what you did in PA, what you sold (principal commodity), whether it was wholesale/retail, and who performed the work (employees vs. contractors) with specific examples.

People often answer “no” to having employees without considering that PA withholding may have been required for wages paid in PA, or they confuse employees with independent contractors. Wrong answers can lead to missing withholding accounts, unpaid liabilities, or later enforcement actions that block clearance. Review payroll history for PA work locations and confirm whether PA personal income tax withholding was required; if unsure, explain the situation in the space provided or attach a statement.

For the list of PA licenses/permits/accounts (corporation tax, sales/use, UC, etc.), applicants frequently check “yes” but omit the period “from/to” and the revenue ID/license/account number. Missing identifiers make it difficult to reconcile accounts and can delay clearance while the agency searches or requests more details. If you answer “yes,” always provide the exact account/license number and the applicable period; if you don’t know it, state that and attach supporting documentation.

Applicants often answer “yes” to holding title to PA real estate in the last five years or currently, but do not attach Schedule A and/or Schedule B as instructed. Real estate holdings and transfers can affect tax clearance and require additional review, so missing schedules commonly result in an incomplete application. If you answer “yes,” complete the appropriate schedule(s) fully, include county and property location details, and attach explanations where realty transfer tax was not paid or interests were less than fee-simple.

Common issues include not including the 501(c) exemption letter for nonprofits, omitting the settlement statement for bulk sale requests, leaving the Statement of Authorization unsigned, or having the certification signed by someone not listed in the responsible individuals section. These omissions can invalidate the submission and force resubmission, significantly delaying clearance. Use a final checklist: attach required documents for your purpose, ensure original signatures are present, and make sure the certifying individuals match those listed in the responsible-party section.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out REV-181 (CM) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills rev-181-cm-application-for-tax-clearance-certifica forms, ensuring each field is accurate.