Form SS-8, Determination of Worker Status Completed Form Examples and Samples

Explore a comprehensive filled example of Form SS-8 for a freelance graphic designer. This example provides insight into accurately completing the form to determine IRS worker status, covering elements like service descriptions, financial arrangements, and the nature of relationships with hiring firms.

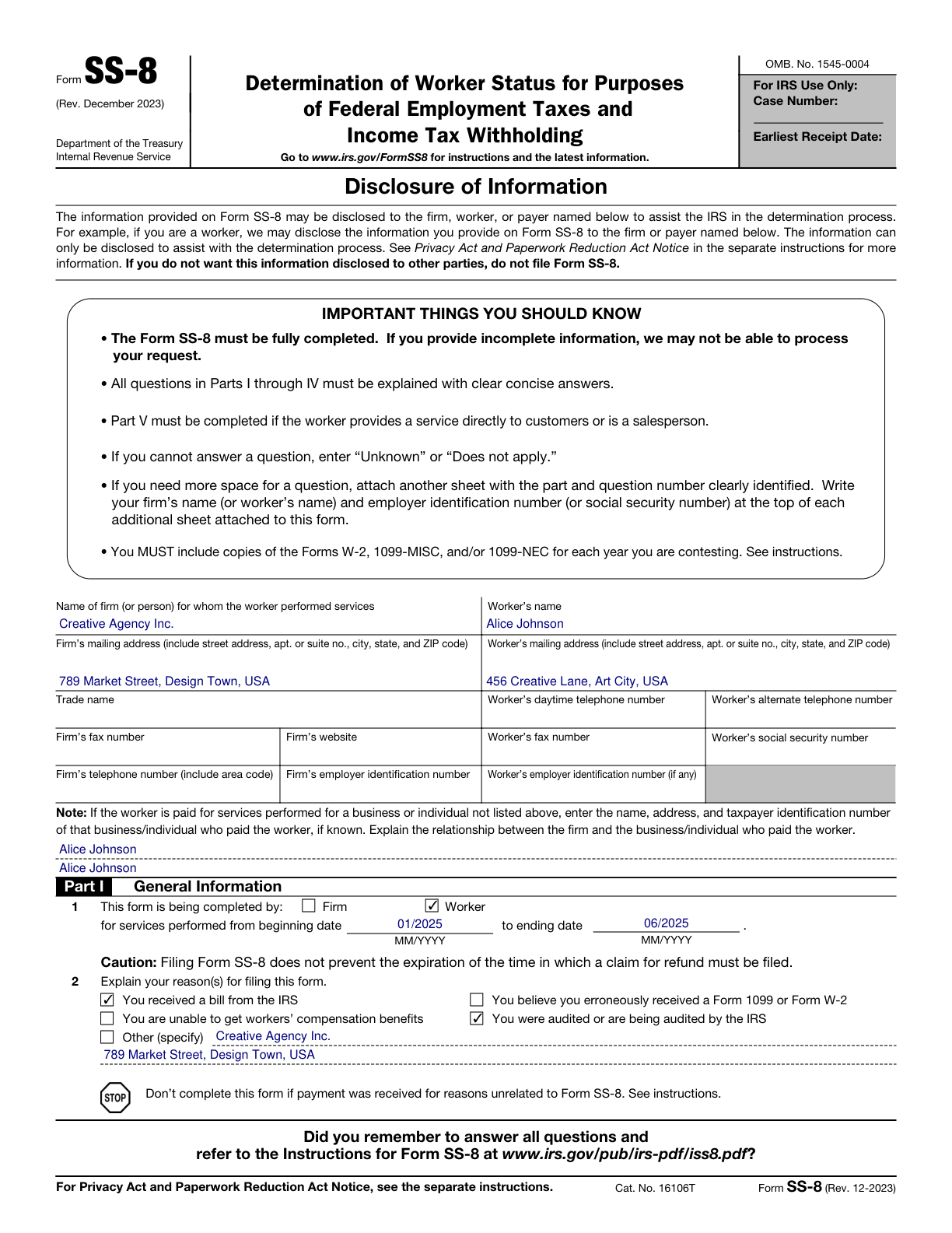

SS-8 Example – Freelance Graphic Designer

How this form was filled:

A freelancer submits Form SS-8 to determine worker status for tax purposes. The form includes detailed descriptions of work performed, degree of control by the hiring firm, and nature of relationship with the firm. Accurate information is provided about payment methods, services offered, and decision-making independence.

Information used to fill out the document:

- Worker's Name: Alice Johnson

- Business Name: Alice Johnson Designs

- Worker's Address: 456 Creative Lane, Art City, USA

- Filing Year: 2025

- Service Description: Freelance graphic design services

- Service Period: 01/2025 - 06/2025

- Hiring Firm: Creative Agency Inc.

- Firm's Address: 789 Market Street, Design Town, USA

- Payment Method: Hourly at $50/hour

- Control Level: Minimal control by hiring firm; creative autonomy

- Relationship Nature: Temporary project-based engagement

- Worker's Signature: Alice Johnson

- Date: 03/15/2025

What this filled form sample shows:

- Comprehensive service description detailing graphic design tasks

- Accurate service period aligned with the tax year

- Payment method clearly specified as hourly rate

- Indication of minimal control by hiring firm, highlighting independence

- Clear definition of relationship nature as project-based

Form specifications and details:

| Use Case: | Freelance graphic designer determining worker status |

| Purpose: | Clarify freelancer vs. employee status for tax purposes |