Yes! You can use AI to fill out Form SSA-2-BK, Application for Spouse's Benefits

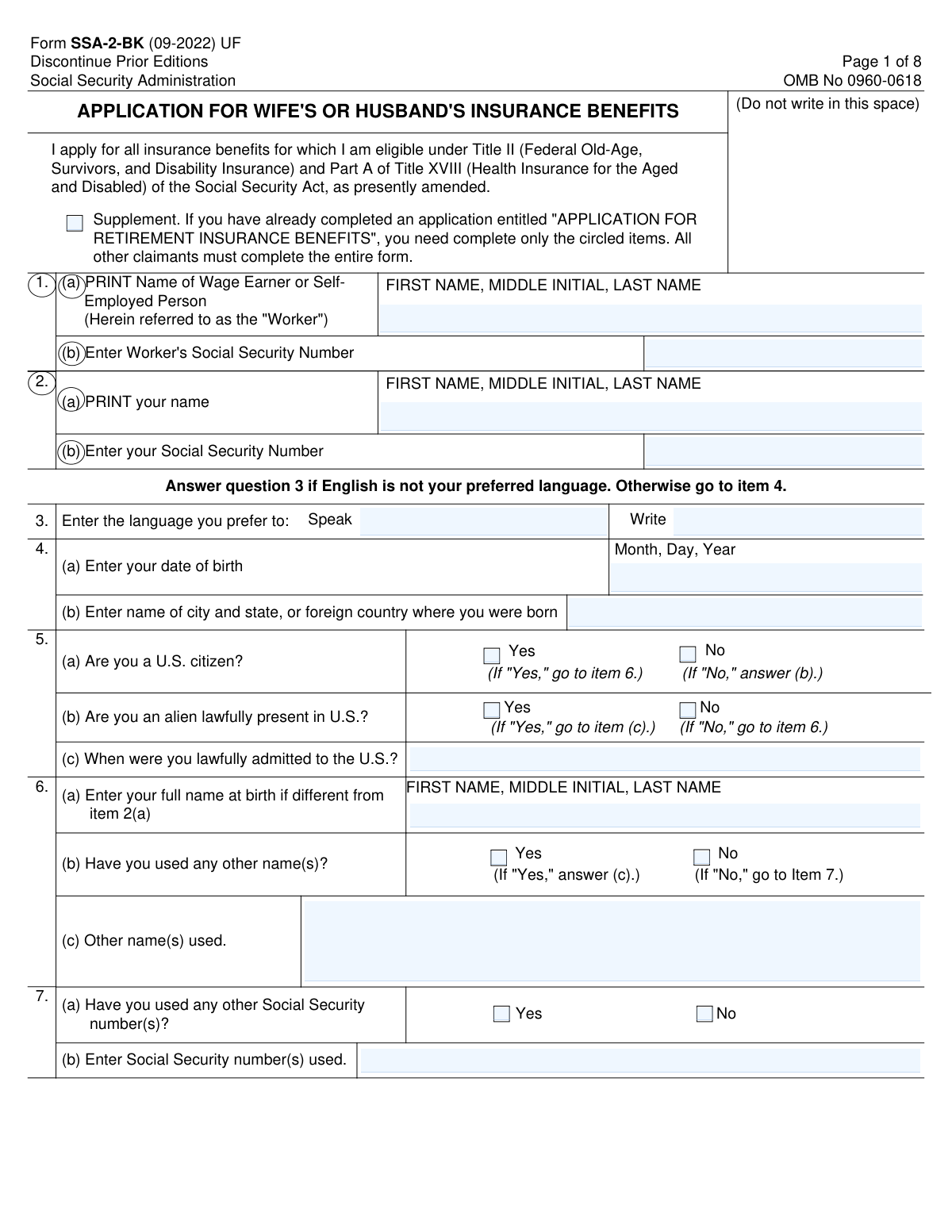

Form SSA-2, Application for Wife's or Husband's Insurance Benefits, is used to apply for Social Security benefits based on a spouse's work record. It is important to fill out this form accurately to ensure eligibility for benefits.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SSA-2-BK using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SSA-2-BK, Application for Spouse's Benefits |

| Form issued by: | Social Security Administration |

| Number of fields: | 189 |

| Number of pages: | 8 |

| Version: | 2022 |

| Language: | English |

| Categories: | insurance forms, benefit forms, SSA forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out SSA-2-BK Online for Free in 2026

Are you looking to fill out a SSA-2-BK form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SSA-2-BK form in just 37 seconds or less.

Follow these steps to fill out your SSA-2-BK form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form SSA-2.

- 2 Enter worker's and your personal information.

- 3 Provide details about your marriage and any previous names.

- 4 Complete questions regarding your work history and earnings.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SSA-2-BK Form?

Speed

Complete your SSA-2-BK in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SSA-2-BK form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SSA-2-BK

The Application for Wife's or Husband's Insurance Benefits form (SSA-2-BK) is used to apply for Social Security benefits based on the earnings record of a worker. The form is used when the applicant is the wife or husband of the worker and is eligible for benefits under Title II of the Social Security Act.

The 'Worker' section of the form requires the name and Social Security number of the worker. This information is used to establish the worker's earnings record and to determine the applicant's eligibility for benefits.

Question 3 on the form is used to determine the applicant's preferred language for speaking and writing. This information is used to ensure effective communication between the applicant and the Social Security Administration.

The 'Personal Information' section of the form requires the applicant's name, Social Security number, date of birth, and place of birth. This information is used to establish the applicant's identity and to determine their eligibility for benefits.

Question 6 on the form is used to determine the applicant's citizenship or immigration status. This information is used to determine their eligibility for Social Security benefits.

Yes, the Application for Wife's or Husband's Insurance Benefits form (SSA-2-BK) is available online on the Social Security Administration's website. You can also request a form to be mailed to you by calling the Social Security Administration at 1-800-772-1213 or visiting your local Social Security office.

After the Application for Wife's or Husband's Insurance Benefits form (SSA-2-BK) is submitted, the Social Security Administration will review the application and determine if the applicant is eligible for benefits. If the application is approved, the applicant will begin receiving benefits. If additional information is needed, the Social Security Administration will contact the applicant.

Question 7 on the application for Wife's or Husband's Insurance Benefits is used to determine if the applicant has had any previous marriages. This information is important because it may affect the applicant's eligibility for benefits based on a previous marriage. If the applicant has been married more than once, they may be required to provide additional information about their previous marriages and any dependent children or ex-spouses.

Question 12 on the application for Wife's or Husband's Insurance Benefits is used to gather information about the applicant's marriage to the worker. This information is important because it is used to determine if the applicant is eligible for benefits based on the worker's earnings record. The applicant will be required to provide the date of marriage and the state where the marriage was performed.

Question 13 on the application for Wife's or Husband's Insurance Benefits is used to determine if an unmarried child or dependent grandchild of the worker has lived with the applicant during the past 13 months. This information is important because it is used to determine if the applicant is eligible for benefits based on the child's or grandchild's relationship to the worker. The applicant will be required to provide the child's or grandchild's name, date of birth, and Social Security number.

Question 14 on the application for Wife's or Husband's Insurance Benefits is used to gather information about the applicant's employment history. This information is important because it is used to determine if the applicant has earned enough Social Security credits to be eligible for benefits. The applicant will be required to provide the name and address of their employer, the start and end dates of their employment, and the total amount of wages they earned during that time.

Question 15 on the application for Wife's or Husband's Insurance Benefits is used to determine the applicant's total earnings for the past year. This information is important because it is used to determine if the applicant has earned enough Social Security credits to be eligible for benefits. The applicant will be required to provide the total amount of wages, salaries, and other earnings they received during the past year, as well as any net self-employment income.

Question 16 on the form, 'Expected Total Earnings for the Current Year', is used to determine the applicant's expected total earnings for the current year. This information is essential as it is used to determine if the applicant will earn enough Social Security credits to be eligible for benefits in the future.

Question 18 on the form, 'Desired Effective Date of Benefits', is used to determine when the applicant wants their benefits to begin. This information is crucial as it is used to determine the amount of benefits the applicant will receive.

Question 19 on the form, 'Do You Want to Enroll in Medicare Part B?', is used to determine if the applicant wants to enroll in Medicare Part B. This information is essential as it is used to determine if the applicant will be enrolled in Medicare Part B and if they will be responsible for paying the monthly premium.

Question 20 on the form, 'Do You Want to File for Supplemental Security Income?', is used to determine if the applicant wants to file for Supplemental Security Income. This information is crucial as it is used to determine if the applicant is eligible for Supplemental Security Income and if they will receive additional benefits.

Compliance SSA-2-BK

Validation Checks by Instafill.ai

1

Completeness of Required Sections

The AI ensures that all mandatory fields in the 'Application for Wife's or Husband's Insurance Benefits' are duly completed. It pays special attention to sections that are conditional, such as those that need to be filled out if the applicant has previously submitted an 'APPLICATION FOR RETIREMENT INSURANCE BENEFITS'. The AI checks for any circled items to ensure they are not overlooked and are appropriately addressed.

2

Accuracy of Personal Information

The AI confirms that all personal information provided on the form, including Social Security numbers and dates of birth, is accurate and corresponds with the details on official documents. It cross-references the entered data with existing records to ensure consistency and prevent any discrepancies that could lead to delays or issues in processing the application.

3

Marital Status and Spouse Details

The AI verifies that the marital status is clearly indicated and that all pertinent details regarding the spouse are correctly provided. It checks for the inclusion of necessary supporting documentation that substantiates the marital relationship, such as marriage certificates or other legal documents, to ensure the eligibility criteria for the insurance benefits are met.

4

Employment History and Earnings Record

The AI scrutinizes the employment history and earnings record sections to ensure they are thoroughly detailed. Where applicable, it checks for the completeness and accuracy of the employment information provided, including dates of employment and earnings, as this information is crucial for determining benefit amounts.

5

Applicant's Signature and Date

The AI validates that the applicant has signed and dated the form. It confirms the presence of a signature and the date, which serves as an attestation to the authenticity and accuracy of the information provided. The AI also checks that the date of signing is logical and recent, which is important for the timeliness of the application process.

6

Confirms that the 'Remarks' section or additional sheets are used if more space is needed for any answers, ensuring clarity and completeness.

The AI ensures that if the provided space in the 'Remarks' section of the Application for Wife's or Husband's Insurance Benefits is insufficient, additional sheets are utilized. It confirms that all answers are clear and complete, facilitating a thorough understanding of the applicant's situation. The AI checks for continuity between the form and any additional documents, maintaining the integrity of the information provided. It also prompts the user to reference these additional sheets in the 'Remarks' section to guide reviewers to the supplementary information.

7

Ensures that the contact information provided is current and correct, allowing for efficient communication regarding the application.

The AI verifies the accuracy of the contact information provided on the Application for Wife's or Husband's Insurance Benefits. It ensures that the phone numbers, email addresses, and mailing addresses are up-to-date and entered correctly to prevent any communication delays. The AI cross-references the contact information with available databases when possible to confirm its validity. It also alerts the applicant to review and confirm their contact details before submission.

8

Verifies that any changes that may affect the claim are reported as instructed on page 8 of the form.

The AI checks the Application for Wife's or Husband's Insurance Benefits to ensure that the applicant has acknowledged and reported any changes that could impact their claim, as detailed on page 8 of the form. It verifies that the necessary sections are completed to reflect these changes. The AI also provides a reminder to the applicant to review the instructions on page 8 to ensure compliance with reporting requirements. It may highlight or flag sections that are commonly affected by changes to prompt a thorough review by the applicant.

9

Checks for the presence of any attachments that may be required to support the application, such as marriage certificates or divorce decrees.

The AI inspects the Application for Wife's or Husband's Insurance Benefits to confirm that all required supporting documents, like marriage certificates or divorce decrees, are attached. It ensures that these attachments are referenced appropriately within the application and are complete and legible. The AI may also provide a checklist of common attachments to assist the applicant in gathering the necessary documents. It alerts the user if any expected attachments are missing, based on the information provided in the form.

10

Validates that the form is submitted to the correct local Social Security office for processing.

The AI validates that the Application for Wife's or Husband's Insurance Benefits is directed to the appropriate local Social Security office for processing. It may use the applicant's zip code or other location data to determine the correct office. The AI ensures that the address and any other submission details are accurate to prevent misrouting. It also provides the applicant with the address and contact information of the correct office, based on the provided location data.

11

Ensures that a copy of the completed form is kept by the applicant for their records.

The software ensures that after the form is completed, a copy is automatically saved or prompted to be saved for the applicant's personal records. This step is crucial for maintaining a personal archive and for future reference, should any disputes or questions arise regarding the application. The system may also provide an option to print or securely store the completed form electronically. This validation is in place to protect the applicant's interests and to provide proof of submission.

12

Confirms that the instructions for assistance from the Social Security Administration are clear and accessible to the applicant.

The software confirms that the instructions provided within the form for seeking assistance from the Social Security Administration are clear, concise, and easily accessible to the applicant. It checks for the presence of help links or contact information and ensures they are up-to-date and functional. The system may also highlight or provide tooltips for complex sections of the form to guide the applicant through the process. This validation is designed to facilitate a smooth application process and to minimize errors or confusion.

13

Verifies that the form is filled out in ink and is legible to prevent processing errors.

The software verifies that all entries on the form appear to be made in ink and are legible, which is essential for the form to be processed correctly by the Social Security Administration. It may use image recognition or text analysis technologies to detect handwriting and ensure clarity of the information provided. The system alerts the applicant of any fields that are unclear or unreadable and requests corrections or clarifications. This validation helps prevent processing delays or errors due to illegible submissions.

14

Checks that the form is the latest version and has not been altered in any unauthorized manner.

The software checks that the form being filled out is the most current version issued by the relevant authority and that it has not been modified in any way that is not authorized. It may cross-reference the form's version with a database of official forms and their revisions. The system alerts the user if they are using an outdated or altered form and provides a link to the latest official version. This validation ensures compliance with current regulations and standards.

15

Ensures that the applicant is aware of the implications of providing false information on the form.

The software ensures that the applicant is made aware of the legal implications of providing false information on the form. It may highlight the sections of the form where the applicant attests to the truthfulness of the information and require an explicit acknowledgment or electronic signature. The system may also provide a clear warning about the penalties for fraud or misrepresentation. This validation serves to deter dishonesty and to emphasize the seriousness of the application process.

Common Mistakes in Completing SSA-2-BK

One of the most crucial steps in completing the Application for Wife's or Husband's Insurance Benefits form is signing and dating it after all the required information has been filled out. Failure to do so may result in delays or even denial of the application. To avoid this mistake, ensure that all signatures and dates are provided in the designated areas before submitting the form.

Providing incorrect or incomplete personal information, such as a misspelled name, incorrect Social Security number, or outdated address, can lead to processing delays or even denial of the application. Double-check all personal information provided on the form to ensure its accuracy and completeness. It is also essential to use the same name and Social Security number as they appear on the insured person's records.

Failing to report changes that may affect the claim, as outlined on page 8 of the form, can result in incorrect or incomplete information being processed. It is essential to report any changes in marital status, address, or other relevant information promptly to ensure the accuracy of the application. Failure to do so may result in delays or denial of the claim.

The 'Relationship to Applicant' field must be correctly filled out to ensure the application is processed correctly. Failing to fill out this field or providing incorrect information can lead to delays or denial of the application. Be sure to select the appropriate relationship status to ensure the application is processed efficiently.

Providing incorrect Social Security numbers for the applicant or the insured person can lead to processing delays or even denial of the application. Double-check all Social Security numbers provided on the form to ensure they are accurate and complete. It is essential to use the same Social Security number as it appears on the insured person's records to avoid any confusion or delays.

The Application for Wife's or Husband's Insurance Benefits form requires accurate income information to determine eligibility and benefit amounts. Failure to provide correct income details or making calculation errors can lead to incorrect benefit amounts or even denial of benefits. To avoid this mistake, double-check all income figures before submitting the form. It is recommended to gather all necessary income documents before filling out the form to ensure accuracy.

Some sections of the form may not provide sufficient space to enter all required information. In such cases, it is essential to use the 'Remarks' section or additional sheets, if provided, to avoid leaving any necessary information blank. Failing to do so can result in incomplete or incorrect information, which may delay or even deny the processing of the application. To prevent this mistake, carefully review the form instructions and use all available space to provide complete and accurate information.

If an applicant has already submitted an Application for Retirement Insurance Benefits, they may be required to complete only specific sections of the Application for Wife's or Husband's Insurance Benefits. Ignoring these instructions and completing unnecessary sections can lead to delays or even denial of benefits. To avoid this mistake, carefully read the form instructions and complete only the sections that apply to the current application.

Once the Application for Wife's or Husband's Insurance Benefits form is completed, it must be submitted to the local Social Security office for processing. Failing to do so can result in delayed or even denied benefits. To prevent this mistake, ensure that the completed form is mailed or delivered to the appropriate Social Security office as soon as possible.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SSA-2-BK with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ssa-2-bk forms, ensuring each field is accurate.