Fill out accident insurance forms

with AI.

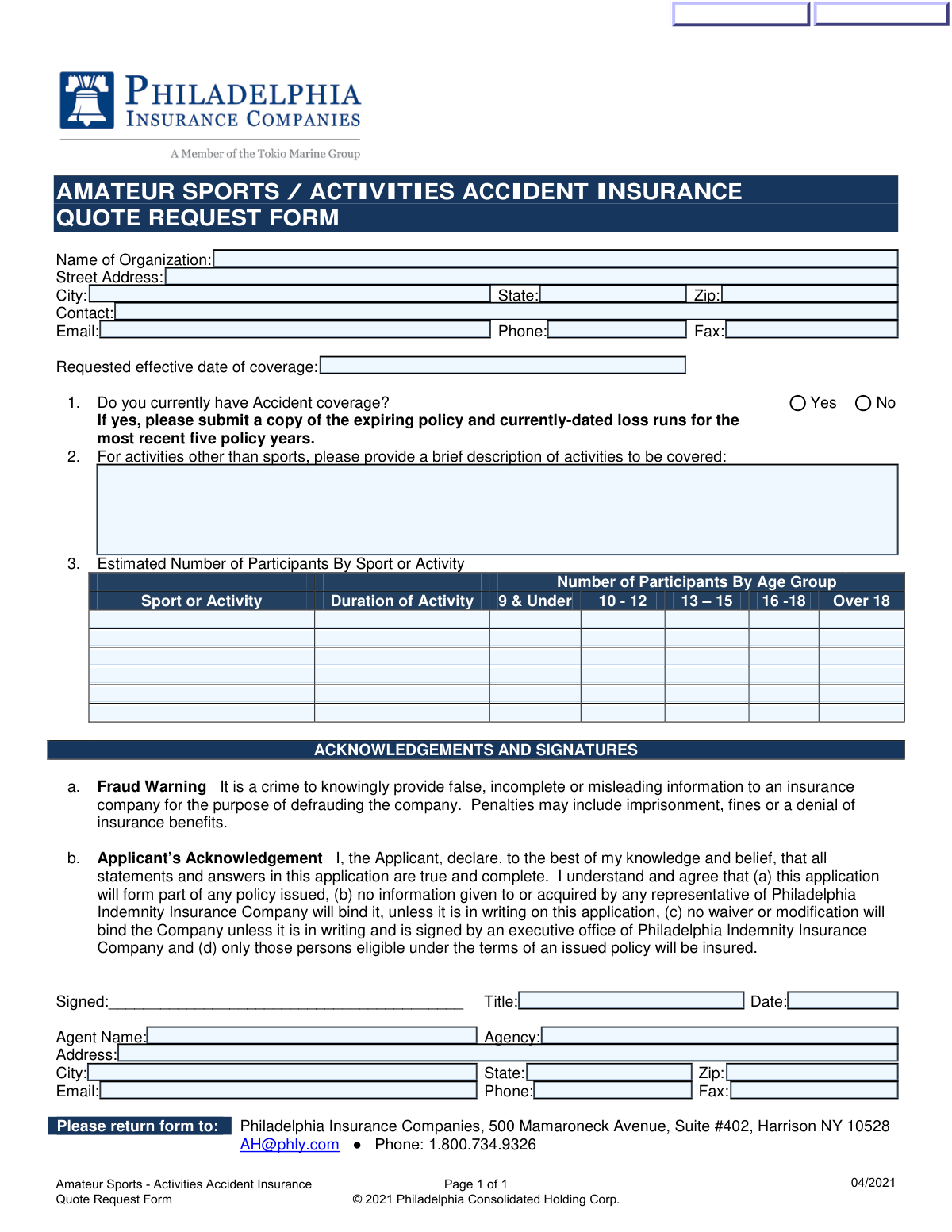

Accident insurance forms are essential documents used to secure supplemental coverage for unexpected physical injuries and medical expenses. Unlike standard health insurance, accident insurance often provides specific payouts or coverage for incidents occurring during organized activities, such as competitive sports or recreational events. These forms are critical because they allow insurance carriers to assess the level of risk associated with a particular group or activity, ensuring that participants are protected in the event of a mishap. By collecting detailed information about the nature of the activity and the number of people involved, insurers can provide accurate quotes and tailored policy terms.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About accident insurance forms

Organizations such as amateur sports leagues, youth camps, and community clubs typically require these forms when seeking a new quote or renewing their existing coverage. For example, a sports coordinator might use an accident insurance quote request form to detail the number of participants, the types of sports played, and the age groups being covered. Providing precise data is vital for obtaining a fair premium and ensuring that the policy meets the specific needs of the organization’s members and staff. These documents act as the bridge between an organization’s safety requirements and the financial protection offered by the insurer.

Managing these administrative requirements can be time-consuming, especially when dealing with complex details about participant counts and historical coverage status. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, handling the data accurately and securely to streamline the application process. This allows organizers to focus more on their events and less on manual data entry, ensuring that every field is completed correctly for the insurance company's review.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Accident insurance is a specialized field, and choosing the right form depends entirely on the nature of the organization and the activities being insured. On this page, the focus is on securing coverage for organized group activities rather than individual personal accident policies.

Identifying Your Coverage Needs

If you are an administrator, coach, or organization leader, your primary goal is likely protecting your participants from the financial burden of injuries sustained during play. The Amateur Sports / Activities Accident Insurance Quote Request Form (Philadelphia Insurance Companies) is the specific document used to initiate this process.

When to Use This Form

This form is the correct choice if you fall into one of the following categories:

- Youth and Adult Sports Leagues: For organizations managing seasonal or year-round sports programs that require participant accident coverage.

- Camps and Clinics: For short-term events, summer camps, or specialized sports clinics where injury risk is present.

- Social and Community Clubs: For non-sporting groups that organize physical activities or community outings.

Key Information You Will Need

To complete the Amateur Sports / Activities Accident Insurance Quote Request Form accurately, you should have the following data points prepared:

- Participant Metrics: You will need estimated counts of participants, categorized by age group and the specific type of activity (e.g., contact vs. non-contact sports).

- Organizational History: Information regarding your current accident insurance status and any previous claims history.

- Effective Dates: The specific timeframe for which you need the coverage to be active.

By using this specialized quote request form, you ensure that insurers have the necessary exposure data to provide an accurate premium and appropriate coverage terms for your specific amateur activity.

Form Comparison

| Form | Purpose | Target Organization | Key Information Required |

|---|---|---|---|

| Amateur Sports / Activities Accident Insurance Quote Request Form (Philadelphia Insurance Companies) | Requesting accident insurance quotes and coverage terms for amateur athletic activities. | Sports organizations, youth clubs, and groups hosting amateur athletic events. | Participant counts by age group, specific activity types, and prior insurance history. |

Tips for accident insurance forms

Insurance premiums for sports activities are often based on the number of participants in each age group. Ensure your estimates are as accurate as possible to avoid overpaying for coverage or facing potential gaps during the policy term.

Avoid grouping different sports together if the form asks for a specific breakdown. High-impact sports carry different risks than low-impact activities, and providing specific data helps the insurer provide a more tailored and fair quote.

AI-powered tools like Instafill.ai can complete these complex accident insurance forms in under 30 seconds with high accuracy. Your data stays secure during the process, making it a major time-saver for organizations managing multiple intake forms.

Check that your requested effective date aligns with the start of your sports season or fiscal year. Requesting a date even a few days too late could leave your organization uninsured during initial practice sessions or tryouts.

Accident insurance forms require an authorized signature from an official representative of the organization. Confirm that the person signing has the legal authority to bind the organization to the terms and fraud acknowledgments listed on the document.

The form often asks for information regarding your current accident coverage status. Having your existing policy documents nearby will help you quickly provide the necessary details about your current provider and coverage limits without searching for records later.

Frequently Asked Questions

An accident insurance quote request form is used by organizations to provide insurers with the details necessary to calculate coverage terms and premiums. It gathers information about the organization, the types of activities being conducted, and the number of participants to assess potential risk. This is the first step in securing a policy that covers unexpected injuries during sports or group activities.

Typically, these forms are completed by organization directors, sports league administrators, or event coordinators who are seeking coverage for their participants. The person filling out the form should have authorization to represent the organization and access to data regarding participant counts and previous insurance history.

Yes, AI tools like Instafill.ai can be used to fill out accident insurance forms in under 30 seconds. The AI accurately extracts data from your existing documents and places it into the correct fields on the form, eliminating the need for manual data entry.

You will generally need to provide the organization's legal name, the requested effective date for coverage, and details about current accident policies. Most importantly, you must provide estimated participant counts categorized by the specific sport or activity and the age groups of the participants.

Insurers use age groups and participant counts to evaluate the level of risk associated with a specific program. Different age brackets and sports have varying statistical likelihoods of injury, so this data allows the insurance company to provide a fair and accurate pricing structure based on exposure.

While manual entry can take 10 to 15 minutes, using AI-powered services like Instafill.ai allows you to complete these forms in under 30 seconds. These tools can also convert non-fillable PDF versions into interactive digital forms, making the entire process much faster.

Completed forms are usually submitted to the specific insurance carrier or a licensed insurance agent. Many forms include agent contact sections or specific email addresses where the document should be sent to begin the underwriting process.

A quote request form is an intake document used to apply for coverage and receive a price estimate before a policy is active. In contrast, a claim form is used after an accident has occurred to request a payout or reimbursement for medical expenses under an existing policy.

Yes, most insurance documents include standardized fraud warnings that vary by state. These notices inform the applicant that providing false or misleading information on an insurance application is a crime and may lead to the denial of benefits or legal action.

While some traditional processes may request a physical signature, most modern insurers accept electronic signatures on quote request forms. Using a digital platform to fill and sign the document ensures that the application can be processed immediately without the need for printing or scanning.

Glossary

- Effective Date

- The specific calendar date and time when the insurance policy begins and coverage starts for the organization and its participants.

- AD&D (Accidental Death and Dismemberment)

- A type of coverage that pays a lump sum benefit if a covered individual dies or suffers a specific severe injury, such as the loss of a limb or sight, as a direct result of an accident.

- Underwriting

- The process an insurance company uses to evaluate the risks of an applicant to determine whether to offer coverage and what the premium should be.

- Excess Coverage

- A policy structure where the insurance pays out only after any other primary insurance, such as a participant's personal health plan, has reached its maximum limit.

- Loss Runs

- A historical report of an organization's past insurance claims, which insurers review to understand the applicant's risk profile and claim frequency.

- Exposure

- A measure of the potential for financial loss, typically determined in these forms by the number of participants and the inherent danger of the specific sports or activities listed.

- Fraud Warning

- A mandatory legal notice on insurance forms that explains the criminal and civil penalties for intentionally providing false or misleading information to an insurer.

- Blanket Coverage

- A type of insurance policy that covers all members of a group or all participants in an activity without requiring each individual to be named on the policy.