Fill out Aflac forms

with AI.

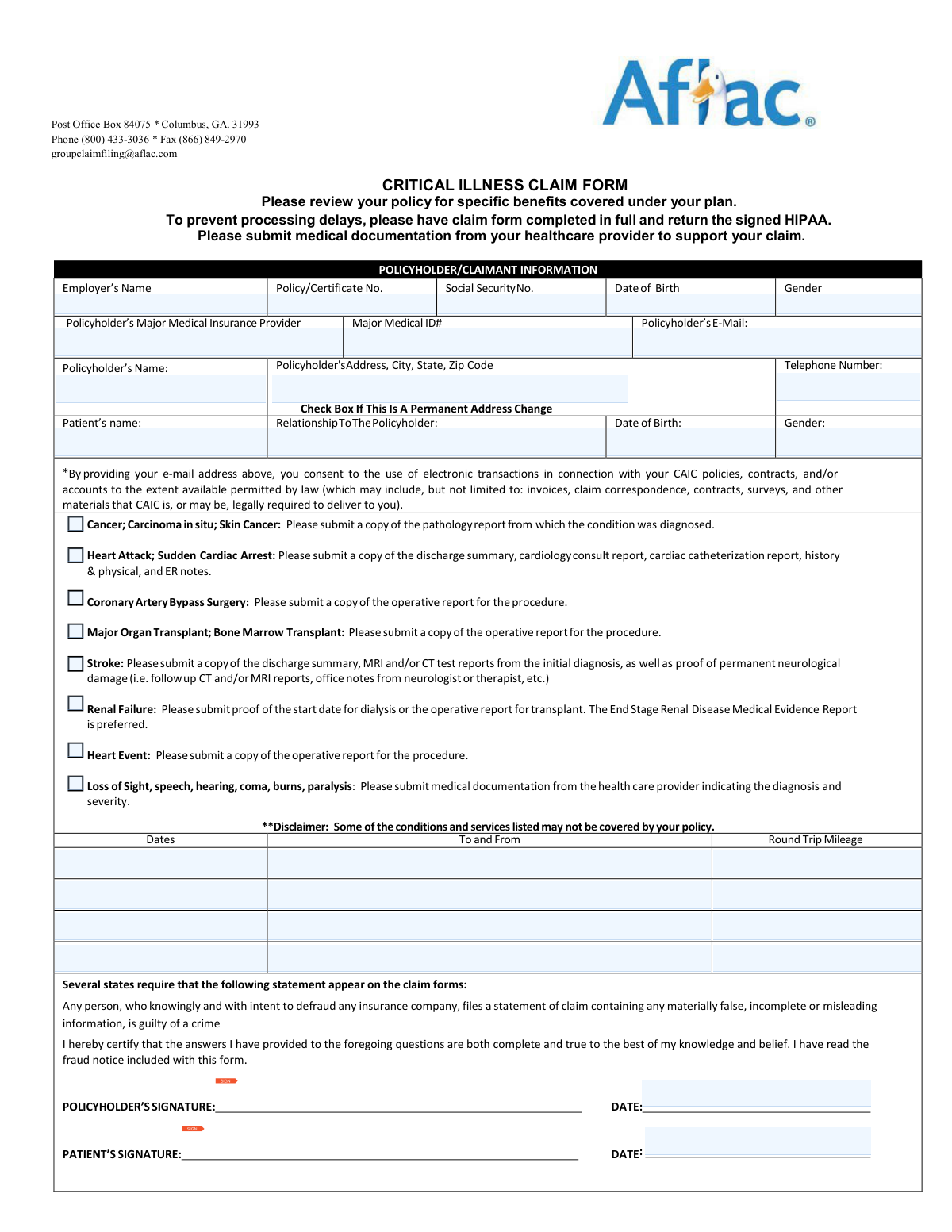

Aflac forms are essential for policyholders looking to access benefits during challenging medical situations. These forms cover a range of supplemental insurance needs, from critical illness to accident claims, often processed through subsidiaries like the Continental American Insurance Company (CAIC). Filing these documents accurately is the primary way for individuals to receive financial support that helps cover out-of-pocket medical expenses, lost wages, or specialized treatments that standard health insurance might not fully address.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About Aflac forms

Typically, these documents are required by individuals who have enrolled in group or voluntary insurance plans through their employer. You might need to access these forms following a significant health event, such as a major diagnosis or an injury requiring hospitalization. Because insurance claims often require detailed medical substantiation—including Attending Physician’s Statements and HIPAA authorizations—they demand a high level of precision to ensure that the insurance company can evaluate eligibility and process payments without administrative delays.

Managing the paperwork involved in insurance claims can be overwhelming when you are focused on recovery. Tools like Instafill.ai use AI to fill these Aflac forms in under 30 seconds, accurately mapping your data to the required fields while maintaining high security and privacy standards. This approach simplifies the process of completing complex claim packets, helping you submit your documentation correctly and efficiently so you can focus on your health.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Navigating insurance paperwork can be overwhelming, especially when dealing with a health crisis. To ensure your claim is processed quickly and accurately, it is essential to use the specific documentation required by your policy type.

Determining If You Need the CAIC Form

The Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form is specifically designed for policyholders covered under an Aflac Group plan, which is typically provided through an employer. If your insurance card or policy documents reference "CAIC" or "Aflac Group" rather than an individual Aflac plan, this is the correct document to initiate your claim for a covered illness.

Why Use This Comprehensive Packet?

Instead of searching for individual documents, this packet combines several critical requirements into one workflow. You should choose this form if you need to complete any of the following:

- The Primary Claim Statement: To report the qualifying diagnosis or medical event to the insurer.

- Attending Physician’s Statement (APS): To provide the medical substantiation required for the claim to be approved.

- HIPAA Authorization: To legally allow CAIC/Aflac to obtain medical records from your doctors to evaluate your eligibility.

- Electronic Funds Transaction (EFT) Authorization: To opt for direct deposit, ensuring you receive your benefits faster than a traditional paper check.

Tips for a Smooth Filing Process

Before you begin the Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form, have your policy number and your physician's contact information ready. Because this form is a multi-part packet, completing all sections—including the optional EFT authorization—is the most efficient way to prevent processing delays or denials due to insufficient documentation.

Form Comparison

| Form | Purpose | Key Requirements | Included Documents |

|---|---|---|---|

| Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form (with Attending Physician’s Statement, HIPAA Authorization to Obtain Information, and Electronic Funds Transaction Authorization) | To request insurance benefits following a covered critical illness diagnosis. | Requires a medical diagnosis substantiated by an Attending Physician's Statement. | Includes HIPAA authorization, EFT direct deposit form, and physician statement sections. |

Tips for Aflac forms

The most common cause for claim delays is an incomplete Attending Physician’s Statement (APS). Before submitting, double-check that your doctor has signed the form and provided the specific diagnosis codes and clinical evidence required by CAIC to substantiate the claim.

Aflac Group claim packets often include multiple signature lines, particularly for HIPAA authorization and EFT enrollment. If you miss a signature on the HIPAA form, the insurer cannot legally verify your medical records, which will immediately put your claim on hold.

Filling out complex insurance packets manually can be tedious and prone to errors. AI-powered tools like Instafill.ai can complete these forms in under 30 seconds with high accuracy, ensuring your data stays secure during the process while saving you significant time and effort.

Beyond the basic claim form, you should include pathology reports, diagnostic test results, or hospital discharge summaries. Providing this evidence upfront helps the claims examiner validate the 'Critical Illness' criteria without having to wait for your provider to respond to inquiries.

To receive your benefits as quickly as possible, be sure to complete the Electronic Funds Transaction Authorization section. This allows Aflac to deposit approved claim payments directly into your bank account, bypassing the delays associated with physical mail and paper checks.

Ensure that your specific CAIC or Aflac Group policy number is clearly written on every page of the submission. If pages become separated during the scanning or review process, having your identifying information on each sheet prevents your claim from being misfiled or lost.

Frequently Asked Questions

Aflac Group forms, often issued by the Continental American Insurance Company (CAIC), are used to request benefit payments for specific insurance events like critical illnesses. These forms help the insurer verify your diagnosis and determine if the event is covered under your supplemental insurance policy.

CAIC (Continental American Insurance Company) forms are typically used for group insurance policies provided through an employer. If your Aflac coverage is part of a workplace benefits package, you will likely need these specific group claim forms rather than individual policy forms.

In addition to the main claim form, you usually need an Attending Physician's Statement and a signed HIPAA Authorization to allow the insurer to review your medical records. Supporting documentation such as pathology reports, hospital discharge summaries, or diagnostic test results is often required to substantiate the diagnosis.

The Attending Physician’s Statement must be completed and signed by the healthcare provider who diagnosed or is treating the specific condition listed in the claim. It is the policyholder's responsibility to ensure the doctor receives this section and returns it to the insurance company or back to the policyholder for submission.

Yes, AI tools like Instafill.ai can fill out these forms in under 30 seconds by accurately extracting and placing data from your medical or employment documents. This helps reduce manual entry errors and ensures that all required fields are populated correctly before you submit the claim.

The HIPAA Authorization is a legal requirement that gives the insurance company permission to contact your healthcare providers and request medical records related to your claim. Without this signed document, the insurer cannot verify your medical history or process your request for benefits.

To expedite payment, you should complete the Electronic Funds Transaction (EFT) Authorization form included in the packet. This allows the company to deposit your benefit directly into your bank account rather than sending a paper check through the mail.

Manually filling out a multi-page insurance packet can take 20 to 30 minutes, but using an AI-powered filler like Instafill.ai reduces the time to less than 30 seconds. The AI automatically maps your information to the correct fields, allowing you to review and sign the document almost instantly.

If you are filing for more than one covered condition, you should check your policy to see if separate claim forms are required for each event. Generally, providing comprehensive medical documentation for all conditions at once helps the insurer evaluate the full scope of your claim.

Completed forms and supporting documents can usually be submitted via the Aflac Group online portal, by fax, or by mail to the address listed on the form. Always keep a copy of the entire submission for your personal records in case any questions arise during the review process.

Yes, if your policy includes coverage for a spouse or children, you can use these forms to file a claim on their behalf. You will need to provide the patient's information and relationship to the primary policyholder, along with the necessary medical substantiation for their condition.

Delays often occur due to missing signatures, incomplete physician statements, or failure to include the required HIPAA authorization. Ensuring that every section of the packet is filled out and that all requested medical records are attached can significantly speed up the evaluation process.

Glossary

- CAIC (Continental American Insurance Company)

- A subsidiary of Aflac that provides group insurance plans through employers rather than individual policies.

- Attending Physician’s Statement (APS)

- A critical section of the claim form that must be completed and signed by your treating doctor to medically verify your diagnosis and treatment.

- HIPAA Authorization

- A legal form that grants the insurance company permission to request and review your private medical records to evaluate your claim eligibility.

- Critical Illness

- A type of insurance coverage that provides a lump-sum payment if you are diagnosed with a specific life-altering condition covered by your policy, such as a heart attack or stroke.

- Electronic Funds Transaction (EFT)

- An optional authorization that allows Aflac to send your claim payments directly to your bank account via direct deposit instead of mailing a paper check.

- Qualifying Diagnosis

- The specific medical condition or event, as defined by your insurance policy, that triggers your eligibility to receive a benefit payout.

- Substantiate

- The act of providing supporting evidence, such as lab results, pathology reports, or doctor's notes, to prove the validity of your insurance claim.