Yes! You can use AI to fill out Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form (with Attending Physician’s Statement, HIPAA Authorization to Obtain Information, and Electronic Funds Transaction Authorization)

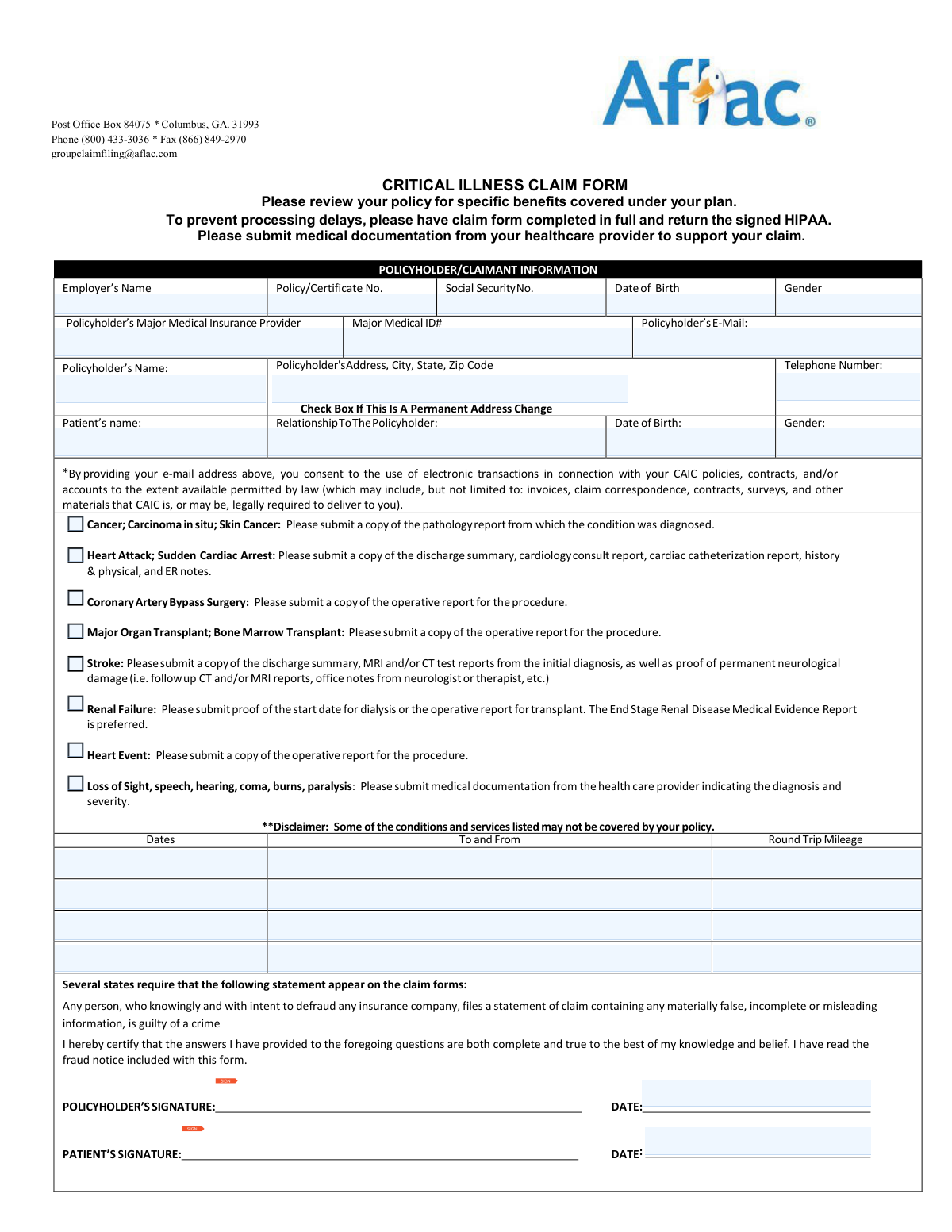

This is the official claim packet used by Continental American Insurance Company (CAIC), an Aflac Group insurer, for filing a Critical Illness insurance claim. It collects policyholder and patient details, the qualifying diagnosis/event information, and an Attending Physician’s Statement to medically substantiate the claim. The packet also includes a HIPAA Authorization allowing CAIC/Aflac to obtain medical records needed to evaluate eligibility and benefits, plus an optional Electronic Funds Transaction (direct deposit) form to receive payments. Completing all sections and attaching the correct supporting records helps prevent processing delays and reduces the risk of denial for insufficient documentation.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out CAIC Critical Illness Claim Form using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form (with Attending Physician’s Statement, HIPAA Authorization to Obtain Information, and Electronic Funds Transaction Authorization) |

| Number of pages: | 8 |

| Filled form examples: | Form CAIC Critical Illness Claim Form Examples |

| Language: | English |

| Categories: | insurance forms, medical authorization forms, medical forms, Aflac forms, insurance claim forms, critical illness forms, CAIC forms, health insurance forms, VA claim forms, authorization forms, PA state forms, physician forms, insurance authorization forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out CAIC Critical Illness Claim Form Online for Free in 2026

Are you looking to fill out a CAIC CRITICAL ILLNESS CLAIM FORM form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your CAIC CRITICAL ILLNESS CLAIM FORM form in just 37 seconds or less.

Follow these steps to fill out your CAIC CRITICAL ILLNESS CLAIM FORM form online using Instafill.ai:

- 1 Confirm you have the correct administrator/form (this packet is for Aflac Group/CAIC; verify your policy/certificate number and review your policy for covered benefits).

- 2 Complete the Policyholder/Claimant Information section (employer, policy/certificate number, contact details, patient information, relationship, and any address change).

- 3 Identify the critical illness condition/event being claimed and gather the required supporting medical documentation (e.g., chart notes/admission-discharge paperwork, operative/surgical report, pathology report, imaging/ER/cardiology records, dialysis start proof, etc., as applicable).

- 4 Have the treating provider complete and sign the Attending Physician’s Statement (Page 1–2), including diagnosis dates, clinical criteria questions, restrictions/limitations, hospitalization details, and return-to-work expectations.

- 5 Complete and sign the HIPAA Authorization to Obtain Information (AGC06106_2016); ensure the correct person signs (adult dependent signs for themselves; parent/guardian signs for a minor; legal representative signs if applicable).

- 6 If you want direct deposit, complete the Electronic Funds Transaction Authorization, attach a voided check or bank direct deposit form, and sign (note: forms without signatures will not be processed; electronic signatures not accepted).

- 7 Review fraud warnings, sign and date all required signature lines (policyholder/patient/physician as applicable), then submit the packet and attachments by email to [email protected] or fax to 1-866-849-2970.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable CAIC Critical Illness Claim Form Form?

Speed

Complete your CAIC Critical Illness Claim Form in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 CAIC Critical Illness Claim Form form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form CAIC Critical Illness Claim Form

This form is used to file a Critical Illness claim with Continental American Insurance Company (CAIC), part of the Aflac family, to request benefits for covered critical illness events. You should review your policy to confirm which conditions and services are covered under your plan.

The policyholder/claimant completes the Policyholder/Claimant Information section and signs the form. Your healthcare provider must complete and sign the Attending Physician’s Statement, and you must also submit the signed HIPAA authorization to prevent delays.

Email the form and supporting documents to [email protected] or fax them to 1-866-849-2970. If you need help, you can call (800) 433-3036.

Submit medical documentation that supports the diagnosis and treatment, such as chart notes and (if applicable) admission/discharge paperwork for a hospital stay, surgical/operative reports, and pathology reports for malignant conditions. Missing documentation is a common reason claims are delayed.

You must submit the pathology report used to diagnose the condition. The physician section also asks for the date the pathological specimen(s) were obtained and whether the diagnosis was pathological or clinical.

Provide the discharge summary, cardiology consult report, cardiac catheterization report, history & physical, and ER notes. The physician may also need to attach EKGs and lab reports showing elevated cardiac enzymes, as listed on the form.

For coronary artery bypass surgery, submit the operative report for the procedure. For major organ transplant or bone marrow transplant, submit the operative report as well.

Submit the discharge summary and MRI and/or CT reports from the initial diagnosis, plus proof of permanent neurological damage (such as follow-up imaging and neurologist/therapist office notes). The form states that stroke does not include transient ischemic attacks (TIAs) or certain other conditions.

Provide proof of the dialysis start date or the operative report for a kidney transplant. The End Stage Renal Disease Medical Evidence Report is preferred, and the form asks for the date a physician recommended dialysis begin.

Benefits are payable to the policyholder unless CAIC receives written authorization to assign benefits to the provider. If you want to assign benefits, attach a signed written request (benefit assignment).

The form instructs you to return the signed HIPAA to prevent processing delays, because it allows CAIC/Aflac to obtain needed medical information. If the records are for an adult dependent (such as a spouse or a child over 18), that dependent must sign; for a minor child, a parent or legal guardian signs.

In the Policyholder/Claimant Information section, enter the new address and check the box indicating it is a permanent address change. This helps ensure claim correspondence is sent to the correct location.

Yes. The form states that by providing your email address, you consent to the use of electronic transactions and communications related to your CAIC policies and claims to the extent permitted by law.

Complete the Electronic Funds Transaction Authorization and select Start/Stop/Change, then provide the routing number, account number, and bank details. You must include a blank voided check or a direct deposit form from your financial institution, and the form must be signed (forms without signatures will not be processed).

No. The direct deposit authorization specifically states that electronic signatures are not accepted and that forms received without a signature will not be processed.

No. The direct deposit section notes that if your policy number has both letters and numbers (for example, 0Y123B45), it is administered by Aflac (not Aflac Group/CAIC), and CAIC cannot process the direct deposit request; you must use the Aflac direct deposit registration site listed on the form.

Compliance CAIC Critical Illness Claim Form

Validation Checks by Instafill.ai

1

Policy/Certificate Number Presence and Administering Entity Eligibility

Validate that a Policy/Certificate Number is provided and that it matches the eligibility rule stated on the EFT section: if the policy number contains both letters and numbers (e.g., 0Y123B45), the request must be routed to Aflac (not CAIC) and CAIC direct deposit cannot be processed. This prevents misrouting and processing delays caused by submitting to the wrong administrator. If the format indicates an Aflac-administered policy, the submission should be rejected or redirected with clear instructions and the correct link.

2

Policyholder/Claimant Required Demographics Completeness

Ensure required policyholder fields are completed: Employer’s Name, Policyholder’s Name, Policy/Certificate No., Date of Birth, Gender, Address (including City/State/ZIP), and Telephone Number. These fields are necessary to identify the insured, match coverage, and contact the claimant for missing information. If any required field is missing, the claim should be flagged as incomplete and held for follow-up before adjudication.

3

SSN Format Validation (Policyholder/Claimant)

Validate that the Social Security Number, when provided, is exactly 9 digits (optionally allowing hyphens in the ###-##-#### pattern) and is not an obviously invalid value (e.g., all zeros). SSN is used for identity matching and to reduce duplicate records. If the SSN fails validation, the system should reject the value and request correction or allow submission only if SSN is truly optional for that section.

4

Date Field Format and Realism Checks (All Dates)

Validate that all dates (DOBs, diagnosis dates, symptom onset, admitted/discharged, signature dates, expected return-to-work dates) are in a valid date format and represent real calendar dates. Also enforce realism rules (e.g., DOB not in the future; admission/discharge not before DOB; signature dates not in the future beyond a small tolerance if allowed). If invalid or unrealistic, the submission should be blocked or routed to exception handling to prevent downstream calculation and eligibility errors.

5

Policyholder vs Patient Relationship Consistency

Require Patient’s Name, Relationship to Policyholder, Patient DOB, and Patient Gender when the patient is not the policyholder, and ensure the relationship selection is present and plausible. This is critical for dependent coverage validation and for determining who must sign HIPAA (adult dependent vs minor). If relationship or patient identifiers are missing/inconsistent, the claim should be marked incomplete and the correct signer requirements should be enforced.

6

Phone Number Format Validation (Claimant and Physician)

Validate telephone numbers for the policyholder and attending physician using a consistent rule (e.g., 10 digits for US numbers, allowing common punctuation). Accurate phone numbers are essential for obtaining missing documentation and clarifying medical details. If a phone number is invalid, the system should prompt for correction and prevent submission if the phone is required for that section.

7

Email Address Format and Consent Capture

If an email address is provided (policyholder email and/or EFT email), validate it against standard email format rules and record that providing the email constitutes consent for electronic transactions as stated on the form. This ensures communications are deliverable and consent is auditable. If the email is malformed, the system should reject the email value and either require correction or allow submission without email (if optional).

8

Signature Presence and Wet-Signature Requirement Enforcement

Verify that required signatures and dates are present for the claim certification (policyholder signature/date and patient signature/date where applicable), the attending physician signature/date, HIPAA authorization signature/date, and EFT authorization signature/date if EFT is requested. The EFT section explicitly states forms received without signature will not be processed and electronic signatures are not accepted, so the system should enforce a non-electronic signature requirement where applicable (e.g., captured as ink signature image). If signatures are missing or flagged as electronic-only, the submission should be rejected and returned for proper execution.

9

HIPAA Authorization Correct Signer Logic (Adult Dependent/Minor/Representative)

Validate that the HIPAA authorization is signed by the correct party: the individual subject to disclosure must sign if an adult dependent (spouse/child over 18), and a natural parent/legal guardian must sign for a minor child; if a legal representative signs, printed name, signature, legal relationship, and date must be completed. This is required to legally obtain medical records and avoid privacy violations. If signer logic fails, the claim should be suspended and medical record requests should not be initiated until corrected.

10

Attending Physician Statement Minimum Completeness

Ensure the physician section includes patient name, DOB, diagnosis (including complications), symptom onset date, and whether prior advice/treatment occurred (Yes/No with 'When' if Yes). These elements are necessary to establish the condition, timing, and potential pre-existing considerations. If missing, the claim should be pended for physician completion and not adjudicated.

11

Condition-Specific Documentation Requirement Validation

When a condition is indicated/answered 'Yes' (e.g., cancer, heart attack, stroke, renal failure, bypass surgery, transplant), validate that the corresponding required attachments are present as listed (e.g., pathology report for malignant conditions; operative report for bypass/transplant; discharge summary and imaging for stroke; dialysis start proof for renal failure; EKGs and lab reports for myocardial infarction criteria). This prevents avoidable delays and ensures the claim meets policy definitions. If required documentation is missing, the system should generate a targeted missing-items request and place the claim in a documentation-pending status.

12

Myocardial Infarction Criteria Logical Consistency

If the claim is for myocardial infarction, validate that the physician’s answers to the required criteria are internally consistent (e.g., if the condition meets all criteria = Yes, then EKG findings, enzyme elevation, and diagnostic confirmation should not be marked No). This ensures the claim aligns with the policy definition and reduces adjudication disputes. If inconsistent, the system should flag for medical review and request clarification from the provider.

13

Hospitalization and Confinement Date Logic

If hospitalization/skilled nursing facility is marked Yes, require hospital address and both admission and discharge dates, and validate that discharge is on/after admission. Hospital stay details are often tied to benefit triggers and required chart notes. If dates are missing or illogical, the claim should be pended and the user prompted to correct the timeline.

14

Work Status and Return-to-Duty Date Consistency

If the patient is marked unable to perform job duties = Yes, require the disability date range and a description of specific job duties affected, plus restrictions/limitations quantified (hours, weight, etc.). If expected partial/full duty return dates are provided, validate that partial duty date is not after full duty date and that both are not before the disability start date. If inconsistencies exist or required details are missing, the claim should be flagged for follow-up because benefit duration and eligibility may depend on these fields.

15

EFT (Direct Deposit) Selection and Banking Field Validation

If Start/Stop/Change direct deposit is selected, require account type (checking/savings), 9-digit routing number, account number, financial institution name, and the policy/certificate holder identifiers on the EFT form. Validate routing number length and checksum (ABA validation) and ensure account number meets basic length/character rules (digits only unless explicitly allowed). If banking data is invalid or incomplete, the EFT request should be rejected (while allowing the claim to proceed via check if permitted) and a request for corrected banking details and the required voided check/direct deposit form should be issued.

16

Duplicate Identity and Cross-Form Consistency (Names/DOB/Certificate #)

Validate that key identifiers match across sections: policyholder name/DOB/certificate number should be consistent between the claim form, HIPAA authorization, and EFT authorization (if provided), and patient identifiers should match between claimant and physician statements. Cross-form mismatches are a common cause of misapplied payments and record linkage errors. If mismatches are detected, the submission should be routed to manual review and the claimant contacted to confirm correct identifiers before processing.

Common Mistakes in Completing CAIC Critical Illness Claim Form

People often skip “basic” identifiers (Employer’s Name, Policy/Certificate No., SSN, DOB, gender, address, phone) because they assume Aflac can look them up. Missing or incomplete identifiers can prevent the claim from being matched to the correct certificate and will commonly trigger follow-up requests and processing delays. To avoid this, complete every field in the Policyholder/Claimant section and double-check that the policy/certificate number and employer name match your enrollment materials.

This form collects information for both the policyholder and the patient, and many claimants accidentally enter the patient’s details in the policyholder fields (or vice versa), especially when the patient is a spouse or child. This can cause eligibility verification issues, incorrect benefit payee determination, and delays while the insurer clarifies who is covered. Avoid this by confirming who the certificate holder is, then completing the patient section separately with the correct relationship and demographics.

Claimants frequently send generic records (e.g., a single office visit note) instead of the condition-specific documents listed (pathology report for cancer, discharge summary and cath report for heart attack, MRI/CT for stroke, operative report for bypass/transplant, dialysis start proof for renal failure). When the required evidence is missing, the claim is typically pended until the right records arrive. Use the checklist on the form and submit the exact reports named for your diagnosis, ideally including admission/discharge paperwork if hospitalized.

Several sections define diagnosis dates very specifically (e.g., cancer date is when the pathological specimen was obtained; heart attack date is when all criteria were met; renal failure date is when dialysis is recommended). People often enter the first appointment date, the date they were told verbally, or the billing date, which can affect benefit eligibility and timing. To avoid issues, follow the form’s definition and have the provider confirm the correct date from the medical record.

The form states that stroke does not include TIAs or vertebrobasilar ischemia and requests neuroimaging plus proof of permanent neurological damage. Claimants often submit only an ER note or a CT report without follow-up documentation, or they file for a TIA believing it qualifies. This commonly results in denial or a request for additional records. Confirm the diagnosis meets the policy definition and include initial imaging, discharge summary, and follow-up neurologist/therapy notes documenting lasting deficits.

The Attending Physician’s Statement contains clinical criteria (EKG findings, enzyme levels, diagnostic studies, dialysis frequency, restrictions/limitations) that are often left blank or guessed by the claimant. Incomplete physician sections can stop adjudication because the insurer cannot confirm the covered event. Ensure the treating provider completes all applicable questions, attaches the requested reports, and signs/prints their name, degree, contact information, and medical ID number.

A very common delay is forgetting to sign and date the claim certification, patient signature line, physician signature, or the HIPAA authorization. The EFT form also states that forms received without signature will not be processed and that electronic signatures are not accepted. To avoid resubmission, sign in ink where required, date every signature line, and confirm the correct person signs (patient vs. policyholder vs. legal representative).

When records are for an adult dependent (spouse or child over 18), that dependent must sign the HIPAA; for a minor child, a natural parent or legal guardian must sign. People often have the policyholder sign everything, which can be invalid for releasing the dependent’s medical records. This can prevent the insurer from obtaining needed documentation and stall the claim. Verify whose records are being requested and obtain the correct signature (and legal representative details if applicable).

Claimants frequently transpose routing/account numbers, omit the account type (checking/savings), or forget the required voided check/direct deposit form. The form warns that incomplete or inaccurate information will not be processed, which can delay payment even after the claim is approved. To avoid this, copy numbers directly from a check or bank letter, include the supporting document, and confirm the routing number is 9 digits.

The EFT section includes a critical note: do not complete this form if the policy number contains both letters and numbers (e.g., 0Y123B45) because those are administered by Aflac, not Aflac Group (CAIC). People miss this and send EFT requests to the wrong administrator, resulting in rejection and lost time. Check your policy number format first; if it contains letters and numbers, use the Aflac direct deposit registration site listed on the form instead.

Because the form allows email or fax submission, claimants sometimes send only the claim pages without the supporting documentation, or they email/fax to a different Aflac address/number found online. Missing attachments or misdirected submissions lead to “no record received” situations or requests to resend documents. Use only [email protected] or fax 1-866-849-2970, and attach all required reports in the same transmission with clear file names (e.g., ‘DischargeSummary.pdf’, ‘PathologyReport.pdf’).

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out CAIC Critical Illness Claim Form with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills continental-american-insurance-company-caic-aflac forms, ensuring each field is accurate.