Fill out critical illness forms

with AI.

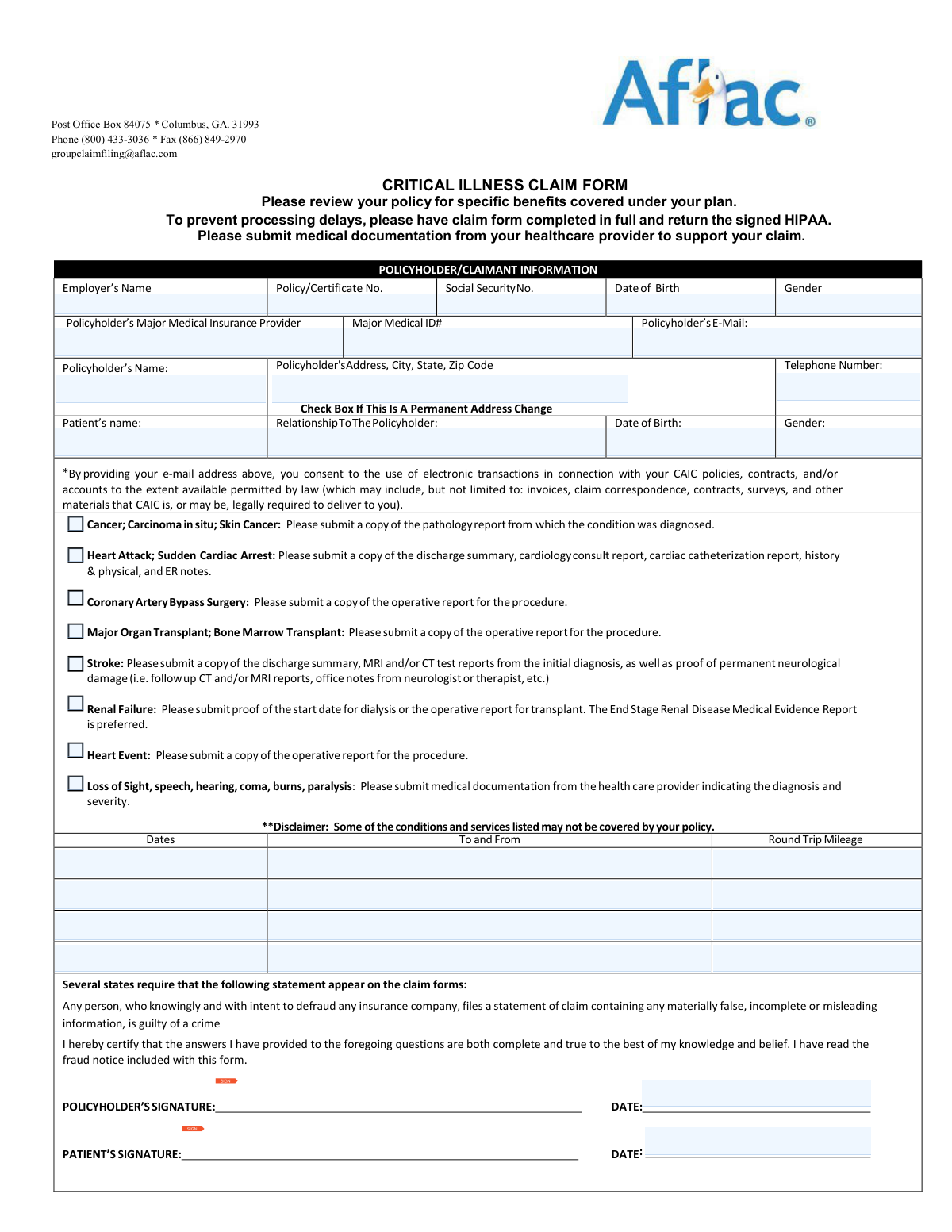

Critical illness forms are essential documents required to initiate a claim after a major medical diagnosis. These forms serve as the bridge between a policyholder’s medical event—such as a heart attack, stroke, or cancer—and the financial benefits provided by their insurance coverage. Because critical illnesses often result in high out-of-pocket medical costs and potential loss of income, submitting these forms accurately is a vital step in securing the support needed for recovery and long-term care.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About critical illness forms

Typically, these forms are completed by policyholders or their designated representatives in collaboration with healthcare providers. For instance, common claim packets like those from Continental American Insurance Company (CAIC) or Aflac Group require detailed patient information, an Attending Physician’s Statement to verify the diagnosis, and HIPAA authorizations to allow for the review of medical records. Ensuring that every section is completed correctly is crucial, as missing information or insufficient medical documentation can lead to significant delays in processing or even a denial of benefits.

Managing the paperwork involved in a medical claim can be overwhelming during an already stressful time. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, handling sensitive data accurately and securely to streamline the submission process. By automating the data entry, patients and their families can focus more on health and recovery rather than administrative hurdles.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

If you are looking to file a claim for a critical illness benefit, it is essential to ensure you have the correct documentation required by your insurance provider. Currently, this category features a comprehensive packet tailored for specific group policies.

Identifying Your Provider

The primary form available here is the Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form. You should use this form if your supplemental health coverage is provided through CAIC, which is a subsidiary of Aflac that typically handles group insurance plans offered through employers. If your policy is an individual policy directly through Aflac (not a group plan), double-check your policy documents to ensure this is the correct filing route.

What is Included in the Packet?

Filing a critical illness claim involves more than just a single page. This document is a multi-part packet designed to streamline the approval process. It includes:

- The Main Claim Form: Captures policyholder details and the specific diagnosis or qualifying event.

- Attending Physician’s Statement (APS): This section must be completed by your healthcare provider to medically substantiate the claim with specific clinical data.

- HIPAA Authorization: A necessary legal release that allows CAIC/Aflac to access the medical records required to verify your eligibility and benefits.

- Electronic Funds Transaction (EFT) Authorization: An optional but recommended form that allows you to receive your benefit payments via direct deposit for faster access to funds.

Tips for a Successful Filing

To avoid processing delays, ensure that all sections of the Aflac Group Critical Illness Claim Form are filled out completely. Missing signatures on the HIPAA authorization or incomplete physician statements are the most common reasons for claim denials or requests for additional information. Before submitting, gather all relevant pathology reports, hospital discharge summaries, or diagnostic test results to attach to your digital submission via Instafill.ai to ensure a comprehensive evidence file.

Form Comparison

| Form | Purpose | Key Components | Who Completes It |

|---|---|---|---|

| Continental American Insurance Company (CAIC) / Aflac Group Critical Illness Claim Form (with Attending Physician’s Statement, HIPAA Authorization to Obtain Information, and Electronic Funds Transaction Authorization) | Initiates a claim for benefits following a diagnosis of a covered critical illness. | Includes claim details, Physician’s Statement, HIPAA Authorization, and optional direct deposit setup. | The policyholder provides personal information while the Attending Physician substantiates the medical diagnosis. |

Tips for critical illness forms

To avoid claim delays, collect all relevant pathology reports, hospital discharge summaries, and diagnostic test results before you start. Having these documents ready ensures that the information you enter matches the official medical records required by the insurer.

The Attending Physician’s Statement is a vital part of the critical illness claim process. Contact your doctor’s office in advance to confirm they have the necessary details to complete their section accurately, as missing signatures or incomplete medical codes are common reasons for processing pauses.

The insurer cannot process your claim without a valid HIPAA Authorization to access your medical history. Make sure this form is signed and dated correctly; otherwise, the insurance company will be unable to verify your diagnosis with your healthcare providers.

AI-powered tools like Instafill.ai can complete these complex forms in under 30 seconds with high accuracy. Your sensitive medical and personal data stays secure during the process, making it a reliable and time-saving solution for managing multiple claim documents.

If the claim packet includes an Electronic Funds Transaction (EFT) authorization, filling it out can significantly speed up the receipt of your benefits. Direct deposit eliminates the mailing time associated with paper checks, getting funds into your account as soon as the claim is approved.

Double-check that the date of your diagnosis falls within the active coverage period of your policy. Inconsistencies between the date reported on the form and the date listed in your medical records can lead to immediate denials or lengthy investigations.

Frequently Asked Questions

These forms are used to request a lump-sum payment from an insurance provider after being diagnosed with a serious medical condition covered by your policy. They provide the insurer with the necessary medical evidence and personal information to verify the claim and determine benefit eligibility.

Policyholders who have been diagnosed with a qualifying illness, such as cancer, heart attack, or stroke, need to complete these documents. In some cases, a beneficiary or legal representative may fill out the forms if the policyholder is incapacitated or unable to do so.

You should file as soon as possible after receiving a formal diagnosis and gathering the necessary medical documentation. Most insurance policies have a specific 'Proof of Loss' window, so submitting the forms promptly helps ensure you don't miss any contractual deadlines.

Along with the primary claim form, you typically need to include an Attending Physician’s Statement and a signed HIPAA authorization. Supporting medical records, such as pathology reports, lab results, or hospital discharge summaries, are also required to substantiate the diagnosis.

The APS is a critical document filled out by your treating doctor to confirm the specific diagnosis and the date it occurred. It provides the insurance company with the medical facts needed to determine if the condition meets the criteria defined in your insurance contract.

The HIPAA Authorization allows the insurance company to legally request and review your medical records from healthcare providers. Without this signed document, the insurer cannot verify your medical history or the details of your diagnosis, which will prevent the claim from being processed.

Yes, many claim packets include an Electronic Funds Transaction (EFT) authorization form. By providing your banking details and signing this section, you allow the insurer to deposit the benefit directly into your account, which is often faster than waiting for a check in the mail.

Submitting incomplete forms or missing signatures usually leads to significant processing delays or an administrative denial. The insurance company will typically pause the review and request the missing information, which restarts the evaluation timeline once the data is provided.

Yes, you can use AI tools to assist in completing these complex insurance documents. AI platforms like Instafill.ai can accurately extract data from your medical records or personal identification and place it into the correct fields on the PDF form automatically.

While manual entry can take a significant amount of time, AI tools like Instafill.ai can fill these forms in under 30 seconds. This technology ensures high accuracy by pulling data directly from your source documents, which helps reduce the risk of manual errors that could delay your claim.

Completed forms should be sent to the claims department of the insurance company listed on the document, such as CAIC or Aflac. Most insurers provide several submission options, including secure online portals, fax, or traditional mail.

Group forms are specifically designed for insurance policies provided through an employer or organization, while individual forms are for policies purchased independently. Group forms may require additional information about the employer and the specific group policy number.

Glossary

- Attending Physician’s Statement (APS)

- A critical section of the claim form that must be completed and signed by your treating doctor to medically verify your diagnosis and treatment history.

- Qualifying Event

- A specific medical diagnosis or health incident, such as a heart attack, stroke, or organ failure, that is explicitly covered under the terms of your critical illness policy.

- HIPAA Authorization

- A legal release form that grants the insurance company permission to request and review your private medical records from healthcare providers to process your claim.

- Electronic Funds Transfer (EFT)

- An authorization that allows the insurer to deposit your claim payout directly into your bank account rather than sending a physical check through the mail.

- CAIC

- An abbreviation for Continental American Insurance Company, the specific underwriter for many Aflac Group insurance products.

- ICD-10 Code

- A standardized medical classification system used by doctors on claim forms to identify specific diagnoses and complications.

- Lump Sum Benefit

- A one-time, fixed payment provided to the policyholder upon the diagnosis of a covered illness, which can be used for any purpose, including non-medical expenses.

- Pathology Report

- A detailed medical document from a laboratory that confirms a diagnosis, often required as supporting evidence for cancer-related critical illness claims.